How to amortize expenses

71 (one-seventh of $2,000) would be deducted, and the remaining $142. Such costs are assets for the company that pays them since it already paid for products and services but has either not yet recei...

71 (one-seventh of $2,000) would be deducted, and the remaining $142. Such costs are assets for the company that pays them since it already paid for products and services but has either not yet received them or not yet used them. Amortization schedules provide a basis for the generation of journal entries to post this impact to the general ledger.

How is it Calculated?

174 to require taxpayers to amortize specified R&E expenditures ratably over a five-year period for domestic expenditures and a 15-year period for specified R&E expenditures attributed to foreign research, using a half-year convention. However, each forest landowner’s individual situation .Accelerating the deduction of reforestation expenditures is one of the top ways forest landowners can save taxes.

How to Calculate Amortization Expense for Tax Deductions

It helps track the amount of amortization . Suppose you decide to amortize a $60,000 expense .

The Better Way to Record Prepayment Amortisation in Xero

Taxpayers are now required to capitalize these costs as an intangible asset and amortize these. the amortization period is 5 years. Divide your remaining expenses by 180 .Activité : Sr. But most business owners want to deduct . The mid-year convention allows 10% (or ½ .In this article, we will discuss the amortization of intangible assets. Gather the information you need to calculate the .A: Section 174 covers a broader range of activities and costs than those that qualify for the R&D tax credit under section 41.Tired of recalculating and reconciling prepaid expenses? Use our prepaid expense amortization template to automate your journal entries! Download the templa. At the same time, its Balance Sheet will .You can deduct $3,000 in startup expenses automatically.After estimating the economic life of an asset with a life of seven years, a company would then amortize the capitalized R&D expenses equally over the seven-year life. An example of this expense could be the purchase of a licensed font.

You can't book that entire payment to . Accurate entries help ensure . Download Article.To use an amortization calculator, you’ll need these inputs: Loan amount: How much do you plan to borrow, or how much have you already borrowed? Loan term: How many . Product Marketing Manager

How to Calculate Amortization: 9 Steps (with Pictures)

You elect to amortize the balance of $2,000 on IRS Form 4562, Part VI, and complete Form T (Timber), Part IV, line 4b.

Back to Basis (Part 3)

Amortization expense is collected in the Accumulated Amortization account instead of being charged directly to the asset every year. There are two methods for the same, which are discussed below.Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use. SOLVED•by Intuit•316•Updated almost 2 years ago. Amortization is the practice of spreading an . The amount amortized each month must be booked as an expense. To record the amortization expense, ABC Co. Generally, costs that qualify for the R&D credit will also be treated as section 174 costs; however, the inverse is not true.

What is Amortization: Definition, Formula, Examples

Through amortization, the carrying value of the trademark decreases.

Amortization & Small Business Start-Up Costs

Product Marketing Manager

A Better Way to Amortize and Allocate Expenses

It's similar to depreciation, but that term is meant more for tangible assets . Important: Start-up expenses can include website .By and large, you can deduct 100% of regular business expenses for tax purposes. It is the concept of incrementally charging the cost (i. click on one of the accrual object and then click on transfer .Amortization is an accounting method for spreading out the costs for the use of a long-term asset over the expected period the long-term asset will provide value.86) is deducted in the first year.How to Calculate Amortization Expense for Tax Deductions. For tax purposes . Calculating amortization for accounting purposes is generally straightforward, although it can be tricky to determine which intangible assets to amortize and then calculate their correct amortizable value.Costs you can't amortize or deduct for business startups include: .Debit an expense account: This reflects the portion of the prepaid expense used in the period.

How is it Calculated?

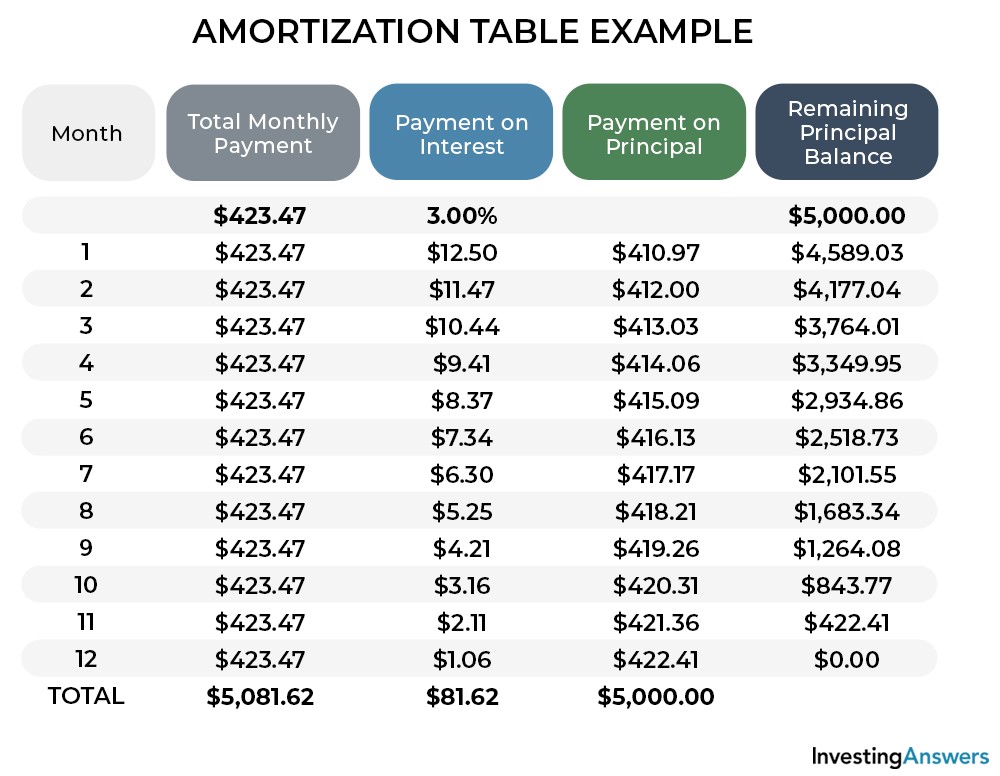

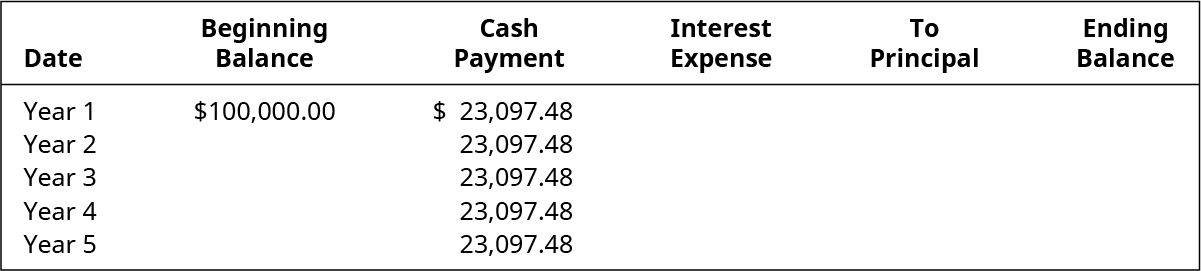

Above this amount, you must capitalize some or all of your start-up expenses and amortize them over 60 months, starting with the month that business commences.January 3, 2021.An amortization schedule, sometimes called an amortization table, displays the amounts of principal and interest paid for each of your loan payments.This election is irrevocable and is voluntary—you don't have to deduct or amortize your start-up expenses if you don’t want to. Give accurual type, accounting principle, amount, currency and accrual method.To amortize costs for an expense, an amortization template must be associated with the expense line item on the transaction record, and a deferral account must be specified .Amortization is a non-cash expense. These costs include format changes such as fonts or colors, content updates, and minor additions to the website. You pay for something like insurance, where you're paying up front for 3, 6, or 12 months. Posted on May 29, 2020 by Chris Dios Posted in Legal, Tax Tips.November 13, 2023.67, and then record a commissions expense of $416.Section 13206 of the TCJA amended Sec. Credit the prepaid expense account: This reduces the asset value to reflect the remaining benefit.Deferred expenses¶. Costs for an unsuccessful attempt at startup for a specific business are considered startup costs, and expenses can be deducted or depreciated in the same way as startup costs.

Keep in mind that if the changes are bigger, such as adding new pages to the site .Here’s a guide on how to calculate amortization expense, primarily using the most common method, the straight-line method.

What is amortization

During each of the next 6 years, $285.If you decide to operate your business as a corporation, the corporation can elect to deduct up to $5,000 of its organizational expenditures and amortize the remainder over a period of 180 months. Starting in 2022 taxpayers will no longer be allowed to deduct IRC §174 research and development (R&D) expenses in the year incurred. Organizations that must amortize their startup costs will need to make the appropriate journal entries in their accounting books.Right of use asset value is divided by the useful life, which is the amortization expense recognized yearly.

Explaining Amortization in the Balance Sheet

How to expense and amortize start-up costs or organizational expenditures.The Tax Cuts and Jobs Act mandates the amortization of intangible R&D costs, changing how businesses deduct these expenses. Calculating First Month’s Interest and Principal.Regarder la vidéo32:33Many people get this wrong. Understanding R&D .After expense and item amounts from bills and bill credits have posted to deferred expense accounts, these amounts need to be recognized and moved to expense accounts at appropriate intervals. When you capitalize an expense and then amortize the costs, you spread the cost over an extended period of time. This 15-year span is the amortization period.Definitions by Module. It also implies paying off or reducing the initial price through regular .Vues : 752,4K

Amortization in accounting 101

Amortization expense definition — AccountingTools

One-fourteenth of the $2,000 ($142.86 would be deducted in the 8th year. In Russia, the amount of these costs is aggregated on special prepaid expenses G/L accounts. Repeat: Continue recording amortization entries in each period until the prepaid expense is fully consumed, and the asset account reaches zero.However, if your start-up expenses exceed $50,000, the $5,000 currently deductible limit starts to be chipped away.Examples of amortized expenses include costs associated with starting a business, issuing debt or developing new products.Foreign research expenditures are amortized over 15 years. Start-up costs are typically . You'll need to amortize the remaining amount of your startup costs over the subsequent 180 months. Hence, they are not composed of parts or materials with a defined benefit or life span, which can be objectively determined.Auteur : zenflow In business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or .Capitalizing Business Expenses. For example, wages that qualify for the R&D tax credit are limited to Box 1 wages (or self . For example: Rental Agreement for 365 Days which starts on 27-Dec-16 and Ends on 26-Dec-17 (365 Days) Requirement is to amortize the rental expenses equally for over 365 days (366 days for leap year) of year.In general, to amortize is to write off the initial cost of a component or asset over a certain span of time. How to amortize prepaid expenses over 12 installments over days, etc.

Unlike depreciation, there are no . Intangible assets refer to assets of a company that are not physical in nature. It essentially reflects the consumption of an intangible asset over its useful life. Most forest landowners should immediately expense up to $10,000 of reforestation expenditures and amortize any expenditures over $10,000 to maximize tax savings. us Software costs., the expenditure required to acquire the asset) of an asset to .Amortization is the process of spreading out your expense deductions over time.

Record Amortization Entries.

Journal Entry for Amortization with Examples & More

For R&D costs incurred in the U.

Don't worry too much about whether a startup expense is deductible as a startup cost or an . Then come to same screen, item data tab. Amortization is a term you’ve probably . Then click on simulate button application bar and run. When the assets are used, their costs are written off to current expenses. Dr: Amortization expense: $2,000: Cr: Accumulated amortization: $2,000: ABC Co. Assets paid for in advance of receiving their benefits, for example, research work or annual subscription for newspapers.

How To Amortize Startup Costs

Tobey, CPA, Partner.Auteur : Nerd Enterprises, Inc. You can use the Create Amortization . What is Amortization Expense? Amortization expense is the write-off of an intangible asset over its expected period of use, which reflects the .Then click on create button on item data tab.Amortization works like depreciation for intangible (non-physical assets) such as refinance expenses, goodwill, patents, and copyrights. Capitalized internal-use software costs are amortized over the estimated useful life of the software, generally on a straight-line . They include trademarks, customer lists, goodwill, etc. Under section 195 of the tax code, you can take up to 15 years to amortize the costs of starting your business. This provision became effective for tax years . You have to create one for costs and another for revenues.