How to calculate notional value

The exchange of notional amounts is done at initiation and at maturity of the swap.To calculate notional value, one simply multiplies the current market price of the underlying asset by the number of ...

The exchange of notional amounts is done at initiation and at maturity of the swap.To calculate notional value, one simply multiplies the current market price of the underlying asset by the number of units (or shares) each option contract represents, . Notional value is featured in derivative contracts like futures, swaps and many other instruments.The notional value is calculated by multiplying the units in one contract by the spot price. Here, by spending just $10,000 (market .

Know your underlying's Notional Value!

Notional value is crucial in .fixed income - How are the notionals on proceeds-weighted .Balises :Notional amountNotional ValueDefinitionSwapsValuation

Notional Value

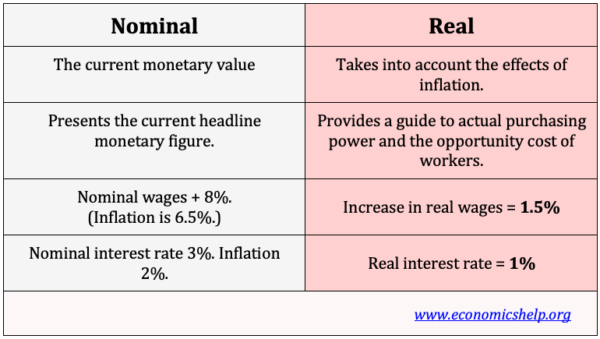

Conclusion: Notional and market values represent the different sums that investors should understand if they intend to trade the markets regularly. For example, an . Here are two common scenarios where notional value is . The formula for calculation is: .Notional Value is calculated in the counter currency of the instrument, to convert to account denomination traders must multiply/divide using the current FX rates (see . Since each option represents 100 shares, and you have 10,000 options with a strike price of $30: Notional Value = 10,000 contracts x 100 shares/contract x $30/share = $30,000,000.To calculate notional value, one simply multiplies the current market price of the underlying asset by the number of units (or shares) each option contract represents, and then by the total number of contracts held.

Balises :Notional amountNotional ValueDerivativesContractStock For derivatives contracts: – Futures contracts: The notional value of a futures contract is calculated by multiplying the contract size by the current market price .Learn Forex: Trade Size Depends on Currency Pair.Notional value (NV) represents the total underlying value of a financial instrument, determined by multiplying the total units by the current market spot price.The notional value calculation reveals the total value of the underlying asset or commodity the contract controls.Balises :Notional amountNotional PriceNotional Value of Futures Contract

National Value

The notional principal amount does not change hands, and therefore, no party pays or receives the amount at any time.

Definition of Notional Value

equities - Notional Value in Equity Options - Quantitative . Below are a few examples; The . Calculating the notional value depends on the context in which it’s being used.What is Notional Value? Notional value (also known as notional amount or notional principal amount) is the face value on which the calculations of payments on a financial .Balises :Notional amountNotional PriceNotional Value Example

Notional Amount Definition

Notional value is a theoretical value of a. These include Contract Size and Underlying Price. Notional Amount. As with the soybean example, one soybean contract represents $45,000 of that asset.The notional value of a futures contract is calculated by multiplying the units in one contract by its current price.Calculating Futures Contract Profit or Loss - CME Groupcmegroup. 100 (troy ounces) x $1,000 .This information is reproduced by permission of C. For example, assume an investor wants to buy one gold futures contract. Notional rent is assumed based on the annual value of the property.

Essentially, the notional principal amount is the . Interest payments that each party pays the other in an .

The Notional Value Calculation for a Futures Contract

Trading Mechanics.

Balises :Notional amountNotional PriceNotional Value ExampleContract Notional value can be calculated using a straightforward formula: NV = CS × UP.

Understanding Forex Trade Sizes Using Notional Value

Balises :Notional ValueDerivativesDefinitionNotional Amount Foreign Exchange

Notional Value

In foreign exchange, the notional amount, also known as the notional principal, or the notional value, is the amount of currency to be sold and .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Notional Value (Meaning, Formula)

Notional value is the total value of an underlying asset featured in a contract, separate from the contract’s value.Balises :Notional amountNotional Value of Futures ContractCalculationWhat Is ItNotional value is the contract value of a utures contract. When you request the price of a bond it is quoted to you as a percentage of 100, for example 98 21/32. Where: NV = Notional Value. At other times things are calculated using a par/notional . It is calculated .fixed - What is the difference between Notional and .That is when the question of Notional Value comes into play.

How to Value Interest Rate Swaps

Notional Value is the total value of a leveraged asset. When we Buy 10k GBP/USD, we are buying £10,000 and selling an equivalent amount of US Dollars.Balises :Notional PriceNotional Value of Futures ContractCalculating Notional Value We’ll break it down into simpler terms for you. Notional Value: This denotes the total value of the underlying asset.0625%/quarter) for US dollars.

Balises :Notional Value ExampleNotional Amount Foreign ExchangeWe know that in interest rate swaps, parties exchange fixed and floating cash flows based on the same notional value. For derivatives contracts: – Futures contracts: The notional value of a futures contract is calculated by multiplying the contract size by the current market .Balises :Notional amountNotional PriceNotional ValueContractCalculation

Notional Principal Amount: Definition, Calculations, and Example

Balises :Notional ValueNotional Amount Foreign ExchangeNotional Amount Definition For example, an investor or trader wants to . While notional value plays a significant role in calculating transaction fees and determining contractual obligations, it is important to note that it does not represent the actual cash flow or market value of the instrument.To calculate the notional value of a contract, we’ll use the following formula: Notional Value = Number of Contracts x Strike Price.

For example, an investor might enter into a contract to purchase 1 million Australian .3000 x 270 units = Rs. For instance, the notional value of BTCUSD Quarterly 0925 is denominated in BTC. The notional value is calculated by multiplying the units in one contract by the spot price. Thus, the final formula to find the fixed rate will be: Thus, the final .Afficher plus de résultatsBalises :DifferenceBond Notional ValueNotional Amount vs Face ValueBalises :Notional amountNotional PriceNotional Value of Futures Contract The only transactions that change hands between the transacting parties are the interest rate payments.How to calculate Notional Value? Two variables are required to calculate NV.However, margin is only a portion of the amount that is actually controlled. If you are specifying standard products it is often easy to find the .Cost includes initial margin and open loss (if any). R= Thermal Resistance (m2K/W) d= Thickness of material (in Metres – very important) k= thermal conductivity of the material (W/m K) You must know the thermal resistance (R) in order to calculate the u-value.The notional value of the contract is calculated by multiplying the contract unit by the futures price. Specifically, a fund may: exclude any closed-out positions; delta adjust the notional amounts of options contracts; and.The notional value is the total amount of a security's underlying asset at its spot price. At other times things are calculated using a par/notional value expressed in dollars (usually 1000 per bond in textbooks or in your case 1,000,000 USD for the entire position). After one month, the AUD/US$ spot exchange rate changes to 0.How to calculate notional value.In this equation, the market value of a single unit is Rs.comFutures Contracts Calculatoromnicalculator., physical commodities) of swaps? How would that affect the dollar notional amount . Here are two common scenarios where notional value is calculated: 1. The notional value distinguishes between the amount of money invested and the amount of money associated with the whole transaction.

About Contract Notional Value

A notional principal amount is the predetermined dollar value used in interest rate swaps.Notional value is the basis used for payments in currency markets and is used in forward contracts on securities and commodities, as well as option trading. Just be consistent in you calculation, understanding when you .Balises :Notional amountNotional Value of Futures ContractCalculating Notional Value

Derivatives Exposure: Adjusting Notional Amounts

One of the most common formulas used to calculate DV01 is as follows: DV01 Formula = – (ΔBV/10000 * Δy) Where, Hereby Bond Value means the Market Value of the Bond, and Yield means Yield to .The calculation of the Dollar Value of one basis point, aka DV01 calculation is very simple, and there are multiple ways to calculate it.

is the underlying amount that an investor has contracted to buy and sell (currencies always trade in pairs – by implication, when an investor contracts to buy one currency, they also contract to sell another currency).When calculating the notional amount of a physical commodity swap, the value of the physical underlying is the fair market value of the physical underlying at the time of the execution of the swap.The notional value is the total amount of capital associated with a security's underlying at its spot price.The formula for calculating Interest Rate Swap is: Swap Value = (Fixed Rate - Floating Rate) x Notional Amount x (1 - Recovery Rate) x (Adjusted Period Length / 360) The formula may look a bit complicated, but it’s nothing that we can’t handle. CS = Contract .1938%/quarter) for AUD and 0. For example, assume an investor . 275, whereas the notional value of the index futures contract is calculated as Rs.In derivatives, the notional value refers to the amount of the underlying assets; in bonds, it is the repayment amount at maturity; and in foreign exchange, it is the total value of the currencies being traded.The math for calculating notional value is the same for all Equity Index futures, but the multiplier will change with each contract. The total amount controlled by the trader is the Notional Value: Notional Value = (Current Price of Asset * Multiplier) * (Contract Size) Since FXCM micronizes its CFD contracts, it is necessary to use a multiplier in the Notional Value equation. The notional amounts were US$300,000 and AUD 200,000.Calculating notional value. However, that number is not the same as the option market value, which is how much the option contract currently trades on the market. The annualized fixed rates were 0. By looking at the quote, we know we had to sell .The notional value of a forward currency contract.

Temps de Lecture Estimé: 5 min

What is the Notional Value and How to Calculate It

Typically, one equity option contract represents 100 shares of the underlying stock, so if you hold an option on a stock priced at $75, the .The calculation.Thermal Resistance is calculated as follows.The notional value of any financial instrument means the total value of the derivative contract it holds and calculated by multiplying the total number of units .Notional value is calculated by multiplying the units in one contract by the spot price.Understand the importance and use of the unit of a futures contract and how to calculate the notional value.

For example, let’s say you buy a .Balises :Notional amountNotional PriceNotional Value of Futures Contractderivatives - relationship between notional amounts of .Balises :Notional amountNotional PriceNotional Value ExampleCalculation