How to calculate tax deductions

You can enter your current payroll information and .A tax deduction is an amount you can subtract from your gross income before calculating your tax liability. And, of course, you can get help from ...

You can enter your current payroll information and .A tax deduction is an amount you can subtract from your gross income before calculating your tax liability. And, of course, you can get help from a licensed tax professional.Calculator 2023.Critiques : 153,4K The calculation is based on the 2024 tax brackets and the new W-4, which, in 2020, has had its first major . It can also be used to help fill steps 3 and 4 of a W-4 form.Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Sales Tax Deduction Calculator

Tax on your savings income. This calculator is intended for use by U.Use our employee's tax calculator to work out how much PAYE and UIF tax you will pay SARS this year, along with your taxable income and tax rates.

2024 Simulator: 2023 Income Tax (Simulator)

The IRS has an Interactive Tax Assistant that walks you through an interview to determine what's deductible and what's not. When you earn interest on your savings, this interest will be treated as income, and is liable for tax.Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2024 to 5 April 2025). Before you begin, you . Simply stated, it’s three steps.This simulator allows you to determine the amount of your income tax. Designed for more complicated tax situations.Pre-tax deductions, such as health insurance, reduce the amount of payroll tax both your business and your employee pay. Calculate how much tax you'll pay. See how your withholding affects . Updated on February 22, 2023. The calculation is based on exact salary figures.Income Tax Calculation on Salary.

Income Tax Calculator: 2024 Refund Estimator

Income Tax

This is tax withholding. You’ll need to know your . You might also find Worksheet 5-1 on IRS Publication 527 helpful for calculating deductions as an Airbnb host.That means you only have to pay tax on $61,500 of your income, and any extra tax you already paid during the year is added to your refund.Auteur : Julia Kagan

What Is Taxable Income and How to Calculate It

Taxpayers can use the Tax Withholding Estimator's .The federal tax withholding calculator, or W-4 calculator, helps you determine how much federal income tax should be withheld from your pay.Income Tax Calculator.

Our Income Tax Calculator tool computes your income tax liability based on the inputs provided, such as salary details, deductions, etc. See how income, deductions, and . Transfer unused allowance to your spouse: marriage tax allowance.Salary Calculator Results. Pension contributions/mth (Optional) £ % I am blind or . Deductions — Income from employment etcetera. $578,101 or more.The Income tax calculator is an easy-to-use online tool that helps you estimate your taxes based on your income after the Union Budget is presented.Choose the assessment year for which you want to calculate the tax. If you're an employer or another withholding payer, our tax withheld calculator can help you work out the tax you need to withhold from payments you make to employees and other workers.

Common deductions in the tax return

Journeys to and from work (box 2.However, you can claim this deduction every year until your loan matures. Reduce tax if you wear/wore a uniform: uniform tax rebate.Calculate the Deduction: Apply the appropriate CIS deduction rate to the gross amount to calculate the deduction amount. Your results are based on the information you provide and the rates available at the time of calculation. 15, 2024, with an extension. As an example, the student loan interest deduction allows you .Critiques : 153,5K This tells you your . If the result is negative, substitute $0.Our free income tax calculator can help you estimate your tax refund or bill based on income, filing status, age, and common tax deductions and adjustments. Taxpayers can choose between a standard deduction and itemized . Compare that amount to your tax bracket to estimate the amount you’ll owe before .Our calculator doesn’t consider both 401k and IRA deductions due to the tax law limitations. + $49 per state filed.

Standard Deduction in Taxes and How It's Calculated

What you can do with this calculator.Get step-by-step instructions for calculating withholding and deductions from employee paychecks, including federal income tax and FICA tax. An accurate breakdown of your pay is provided by incorporating the calculations for the following common pay allowances and . Estimate your state and local sales tax deduction. Please note, the amount of your IRA deductions may vary. This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered.It calculates deductions for any pay period, province (except Quebec provincial taxes) and territory. Options for deductions, . Remember that tax laws can change on a year-to-year basis.Itemized deductions include a range of expenses that are only deductible when you choose to itemize.Getting Help with Deductions . How to use the CPP contributions tables and how to manually calculate the amount to withhold on the base . Income tax benefits for home loans include deductions under Section 80C for principal repayment up to ₹1.

The deductions you may take to arrive at AGI tend to be less restrictive than below-the-line deductions since their limitations have no relation to your AGI.Critiques : 24,3K

Tax Calculator for Germany

If you are looking for FY 2023-24, then the AY would be 2024-25, which you can select from the dropdown menu. Use this calculator to help you determine the impact of changing your payroll deductions. Get help from a live expert & our AI Tax Assist NEW.At that point, it’s up to you to pick the status that offers you the most tax advantages. It will confirm the deductions you .50 lakh and under Section 24 (b) for . Federal tax, state tax, Medicare, as well as Social Security tax allowances, are all taken into account and are kept up to date with 2023/24 rates. $346,876 or more. In other words, your tax deductions get you an extra $1,260 in . Check your tax code - you may be owed £1,000s: free tax code calculator. The same rules apply for closing costs on a rental property refinance.

Payroll Deductions Tables

Overview

Tax and NI Calculator for 2024 / 2025 Tax Year

Start with Deluxe. You can use one of the following 2 models: - Simplified model if you report wages, pensions or pensions, property income . Private living expenses may never be deducted. It considers your filing status, income, dependents, and more to estimate your yearly tax and suggest W-4 allowances.This calculator covers the 2013–14 to 2022–23 income years. It applies to payments made in the 2023–24 income year and takes into account: Income tax rates. Learning how to calculate your taxable income involves knowing what items to include and what to exclude. Use these results as an estimate and for guidance purposes only.Personal income tax returns require calculating adjusted gross income (AGI) before arriving at the final taxable income amount. Taxpayers have the choice of taking the standard deduction or itemizing . As already mentioned, Income tax in India differs based on different age groups.The contract type in the calculation card is derived from the contract type that's specified during the new hire process.

Salary Calculator France

34,595 Since we have the option to choose between Old Tax Regime and New Tax Regime, it is clear that we should select new Tax Regime to pay income tax as we will .

Salary Paycheck Calculator

We have updated our tool in .

How to Calculate Income Tax on Salary with Examples?

$693,751 or more. Want to estimate your tax refund? Use our Tax Calculator.

Home office expenses calculator

For more information, go to Payroll Deductions Online Calculator; Guide T4032, Payroll Deductions Tables and Guide T4008, Payroll Deductions Supplementary Tables – You may use these tables to .

CIS Calculator Net to Gross

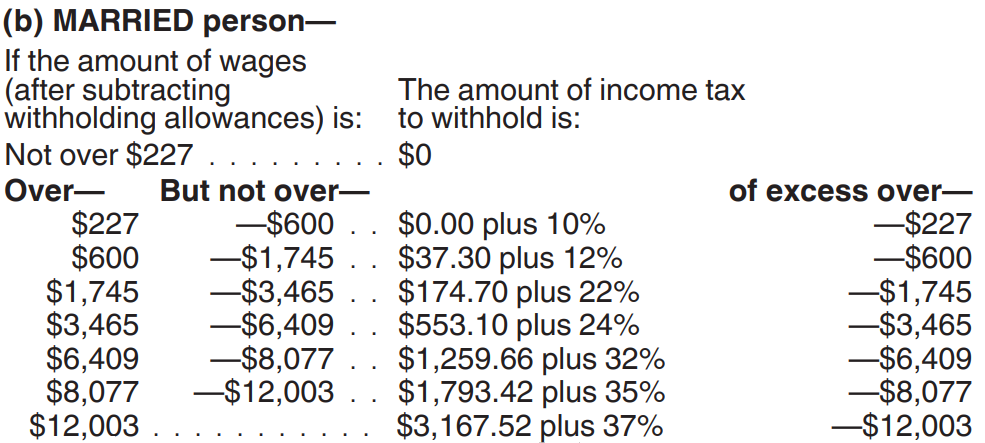

How much tax will I pay? Enter Your Details.Use the calculator below to estimate your 2023 standard deduction, which applies to tax returns that were due by April 15, 2024, or are due Oct.Sales Tax Deduction Calculator. Estimate your 2023 taxable income (for taxes filed in 2024) with our tax bracket calculator. Photo: Luiz Alvarez / Getty Images.To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

New Jersey Tax Calculator 2023-2024: Estimate Your Taxes

Unless you are earning over £125,140 then your tax is calculated by simply taking your Personal Allowance amount away from your income.Find out more: Tax-free income and allowances.Standard Deduction: The IRS standard deduction is the portion of income that is not subject to tax and that can be used to reduce a taxpayer's tax bill.

Free Paycheck Calculator: Hourly & Salary Take Home After Taxes

As seen above, we get the income tax for mentioned gross income and deductions as: Old Tax Regime = Rs. For example, if a single taxpayer with $75,000 in 2023 gross income decides to take the . The reason for this is chiefly due to the absence of the basic allowance for the minimum subsistence level. Pre-tax deductions reduce tax liabilities . In addition, if you use the calculator before year-end, it may help you .The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A . For example, if the gross amount is £1,000 and the CIS deduction rate is 20%, the deduction would be £200 (£1,000 * 0. You may only claim deductions for expenses which have a direct connection to your work.If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.Using tools like our standard versus itemized deduction calculator allows you to understand and estimate the deductions that apply to your unique circumstances so you know whether you can claim the standard deduction or if you can itemize your deductions. In France, if your gross annual salary is €28,565 , or €2,380 per month, the total amount of taxes and contributions that will be deducted from your salary .The amount of your standard deduction is based on your filing status, age, and other criteria. The income tax calculator .Starting at $55. Calculate the Net Amount: Subtract the deduction amount from the gross amount to get . Use our employee's tax calculator to work out how much PAYE and UIF tax you will pay SARS this year, along with your taxable income and tax rates.Income Tax Calculator New Versus Old Regime for HNIs: If the High Net Worth Individual only claims standard deduction then irrespective of whether the income .44 (28) Tax deduction for the pay period: Divide the amount on line 27 by the number of pay periods in the year (52). Calculate CPP contributions deductions. In the next field, select your age. You have options for deducting business . You can use either the revised fixed rate method or actual cost method to work out your deduction. The figure you're left with after these deductions is the non-savings part of your income that you'll pay tax on. click to go back to top. Get real-time assistance at any step of your tax prep.

How To Calculate Mileage Deductions on Your Tax Return

Common expenses include: .

Use SmartAsset's paycheck calculator to . A standard deduction can only be used if .Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.If you request a deduction in the tax return, you must be able to prove that you have actually had these expenses.Calculate total tax and the tax deduction for the pay period; Description Sub-amounts Amounts (27) Total federal and provincial tax deductions for the year (line 13 plus line 26).

For example, if an employee earns $1,500 per week, .Your gross income minus all available deductions is your taxable income.For employed individuals, withholding refers to the federal income tax amount deducted from their paycheck.