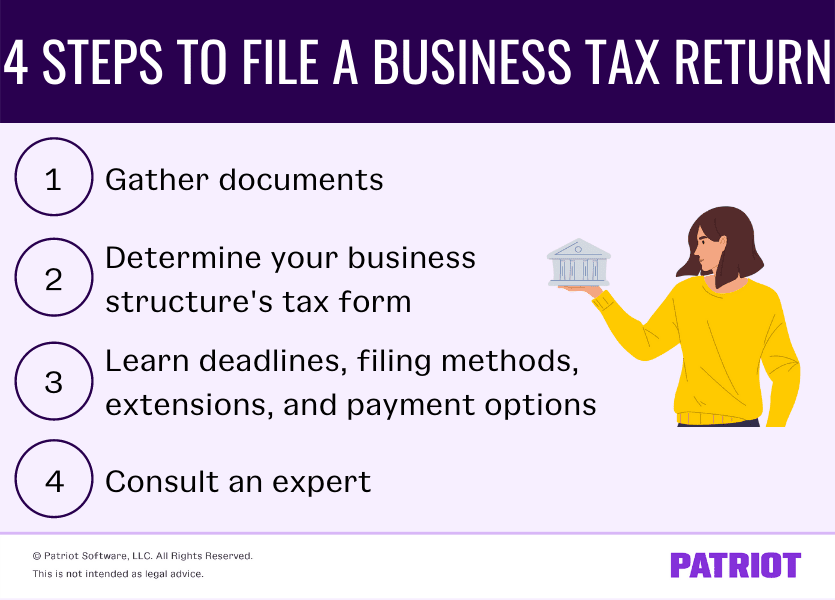

How to file s corporation taxes

Updated March 22, 2024. Generally taxed on their .Failing to file your business taxes and make payments on time can have serious consequences. Use this form to —.25% in California.The CRA will cha...

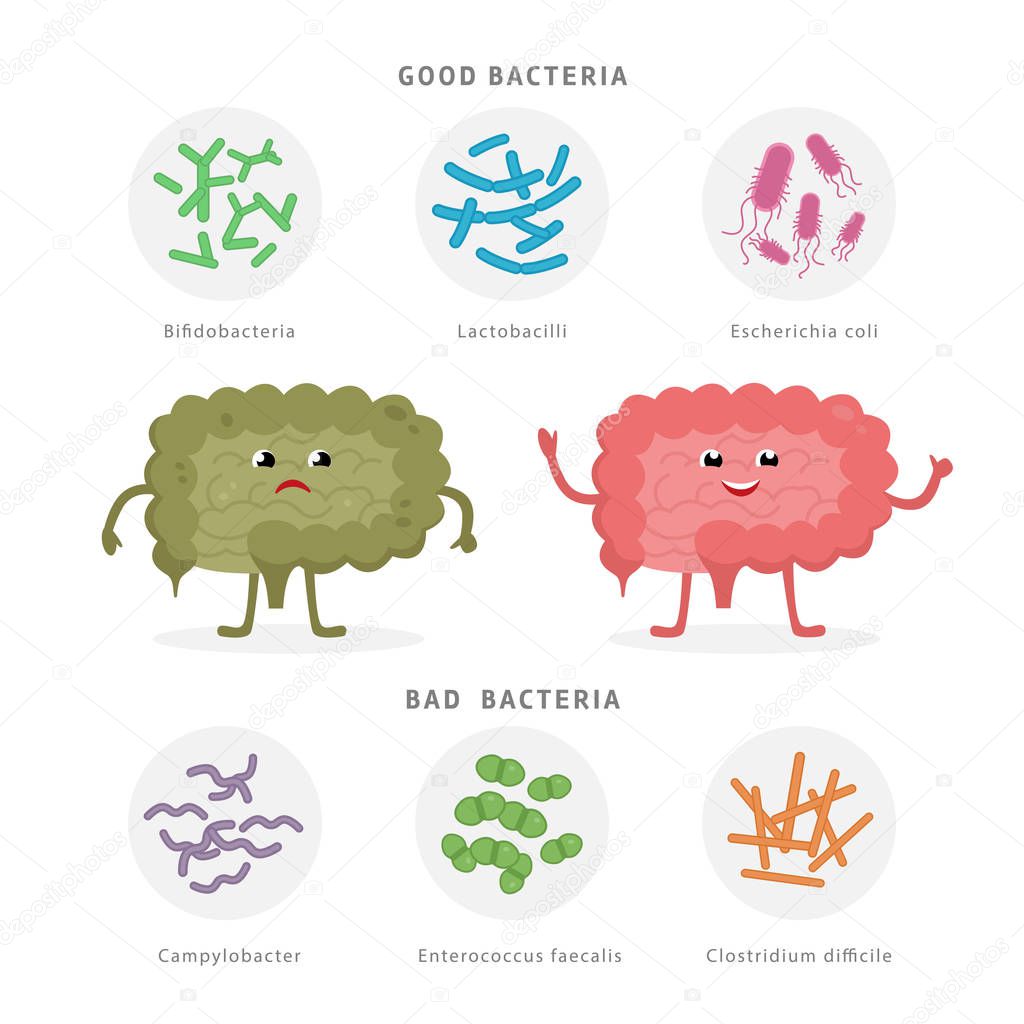

Updated March 22, 2024. Generally taxed on their .Failing to file your business taxes and make payments on time can have serious consequences. Use this form to —.25% in California.The CRA will charge a $1,000 penalty for non-compliance if a corporation that is required to file electronically does not comply with the requirement. Since the extension is automatic, there is no extension request form. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.Forms for Corporations.99 percent corporate net income tax only to .Information on this page relates to a tax year that began on or after January 1, 2015. Other Current Products. S corporation owners who are also employees must pay payroll taxes (Social Security and Medicare) on their wages and salaries, just like any other employee.

S corporations use a different form. Built-in Gains. For example, the current rate is 6.Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.

Corporate income tax

Forms you can Web File or e-file.

Instructions for Form 1120-S (2023)

25% rate on the Maryland taxable income, defined as Maryland modified income, which is the corporation federal taxable income adjusted by . The S Corp tax deadline for 2023 (and beyond) is usually March 15 for most taxpayers. Company Tax Return and .Income Tax – S Corporation: Form 1120-S: Estimated Tax: Form 1120-W (C-Corp Only) Employment Taxes: Forms 940 and 941, 944 or 943: S Corporation . Corporations can be taxed 2 different ways. However, if a qualifying LLC elected to be an S .5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.S corporations are required to file Form 1120S, which will generate a Schedule K-1 for each owner. Form 1120 must be filed by the last day of the third month after a corporation's year-end date. After operating earnings is calculated by deducting expenses including the cost of goods sold ( COGS ) and .

Copy or summary of all Form 1099 and W-2 . Find out where to mail your completed form. Effective January 1, 2008, the tax is imposed at an 8. Alternate addresses are no longer accepted.Corporations that are required to file 10 or more returns in a calendar year (calculated by aggregating all returns of any type) are required to e-file their Forms 1120 and 1120-S, .A corporation’s address will no longer be updated using the AT1 - Alberta Corporate Income Tax Return, and only one address will be retained on file as the mailing address.While the 15% corporate minimum tax he signed into law in the Inflation Reduction Act will reduce the number of big corporations that don’t pay any federal .S corporations are required to file their annual tax return by the 15 th day of the 3rd month after the end of the tax year. This Web page . In subsequent years, the S corporation does not need to file this return. If you’re thinking about starting an S corporation (S corp) or recently elected S corp status for your business, you probably have lots .Still wondering which documents you need to file an 1120S - S Corporation tax return? Here's a tax checklist which can help you prepare your taxes efficiently. Where to File Your Taxes for Form 1120-S.com/channel/UCqbOWG3guHo_LZVRyLb46kA🎁 SHOP MY DESIGNS HERE. What taxes your business owes depends in part on how your business is structured and where it’s . I will get K1 and 1099? Vikki Velasquez.Corporate tax brings in smaller share of federal revenues.use TurboTax Business (not Home and Business) to file S-corp. Online filing and payment options for most Corporate Specialty Tax account holders will soon be available on myPATH, the Department of Revenue’s modern e-services portal.S corporations. W-2, Wage and Tax Statement PDF and W-3, Transmittal of Wage and Tax Statements PDF. Federal income tax credits you may be eligible to claim . This form is used to report the .

![]()

S Corporation Taxes Explained in 4 Minutes

Use this service to file your company or association’s: Company Tax Return (CT600) for Corporation Tax with HM Revenue and Customs ( HMRC) accounts with Companies House.

S corporations

Critiques : 24,3KShareholder Income. Businesses that elect federal subchapter S status are considered Pennsylvania S corporations and are subject to the 9. Although the focus this time of year is on individual income taxes, corporate income taxes are also a .Automatic seven-month extension to file: S corporations (in good standing) that have fully paid their tax liability but cannot file their return by the due date receive an automatic seven-month extension to file the return.If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U. Report wages, tips, and other compensation, and withheld income, social security, and Medicare taxes for employees.

Partnership & S Corporation Filing Information

3, Request for Six-Month Extension to File (for combined franchise or .

IRS Suffers Another Defeat Related To Civil Penalties In Tax Court

Corporate Tax: A corporate tax is a levy placed on the profit of a firm to raise taxes . Provincial and territorial corporation tax. Corporation Income Tax Return. The individual owner then uses the Schedule K-1 to complete his or her .You do, however, still have to file a tax return: Form 1120-S, the income tax return for S corporations, and which is due on March 15, 2024 if you’re a calendar year corporation. Easily access and print copies of your prior returns for seven years after the filing date. Get federal, provincial, or territorial rates, and learn when to apply the lower or higher rate. Other corporations may do so voluntarily. 1120S is a five page .

A Beginner's Guide to S Corporation Taxes

Owners of an LLC are called members.Critiques : 24,3K

Corporation income tax

If you have an S corporation (S corp), you’ll need to file Form 1120-S, a five-page form that details your company’s income, .

How are S corps taxed?

Certain large and mid-size corporations are required to electronically file their Forms 1120 and 1120-S. In Farhy, the taxpayer was required to report his ownership interests in foreign corporations. If you do, then you will not be able to avoid paying taxes on your .How do I file my taxes as an S corp? Form 1120S, U.Although S Corporations generally won’t have to pay income taxes, they are still required to file a tax return. If you have a balance due, you can e-file and pay in a single step by authorizing an electronic funds withdrawal from your bank account. Find more information at our Filing Requirement Changes .

How to File Business Taxes Online

See S corporations - tax years beginning before January 1, 2015, for S corporation information for years prior to corporate tax reform.Find a complete list of business returns that can be filed electronically. Self-employed filers can also pay by credit card.How to File an S Corp Tax Return. Page Last Reviewed or Updated: 03-Oct-2023.

S Corporation Business Taxes

How S Corporation Owners Are Taxed The owners of the S corp pay income taxes based on their distributive share of ownership, and these taxes are .A Limited Liability Company (LLC) is a business structure allowed by state statute. An S corporation is a corporation that elects to be taxed as a pass-through entity.If the S corporation does pay wages, then the shareholders must file annual tax returns using form 1040, schedule E.7 years of access to your return. The form covers income, expenditures, and other deductions, such as cost of goods sold.Every other corporation that is subject to Maryland income tax law and has income or losses attributable to sources within Maryland must also file Form 500. A corporation is an entity that is owned by its shareholders (owners).If your S corporation paid any non-corporate service provider more than $600 during the tax year, you need to send them Form 1099. The form must be filed by two months and 15 days after . What is a “pass-through entity”? A pass-through entity is any business that is recognized as a separate entity for . Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company. Electronic Payment Options are convenient, safe and secure methods for paying taxes.Subchapter S (S Corporation): A Subchapter S (S Corporation) is a form of corporation that meets specific Internal Revenue Code requirements, giving a corporation with 100 shareholders or less the .csv import (compatible with most popular accounting applications) Bank and credit card records to support interest and other day-to-day business expenses.How to File S Corp Taxes.

Corporation Tax Web File

25% in Texas and 7.This section will help you determine when and how to pay and file corporate income taxes.

To become an S Corp, a corporation must file Form 2553 with the IRS, and this election is time-sensitive.SUBSCRIBE & RING THE BELL for new videos every day!🔴 Follow my VLOGS here: https://www. In prior years, only Part III of the DR 0106 was required.

Definition, Taxes, and How to File

Corporate Tax: Definition, Deductions, How It Works

For returns required to be filed in calendar years beginning before Jan. To qualify for S corporation status, the corporation must . This is a complicated return and many businesses find that they need the help of a tax professional to prepare it. If your shareholders have made an S election for federal purposes, you should be aware that New York State does not .S Corporations, Partnerships, and Limited Liability Companies Every pass-through entity (PTE) that does business in Virginia or receives income from Virginia sources must file an annual Virginia income tax return on Form 502 or Form 502PTET. Last Updated: June 30, 2023 By TRUiC Team. Federal tax credits. CT-300, Mandatory First Installment (MFI) of Estimated Tax for Corporations.Filing Requirement Changes for Partnerships and S Corporations. They then report these items on their personal tax return.How Do S Corporation Taxes Work?

Guide to IRS Form 1120-S: S-Corp Income Tax Return Simplified

Handle all expenses, salary and distribution.

Corporations

IRS approval is required for the S election status.Sales tax rates vary, impacting how much they need to collect from customers.26 billion collected in FY 06/07; (3) Oversee property .Specifically, he was required to file Form 5471, .These options will be available starting November 30, 2022. The S Corp tax due date may be different for small .

Where to File Your Taxes for Form 1120-S

1, 2024, Form 1120, U. Most states do not restrict ownership, so members may include individuals, . What Is an S Corp? An S corp (or S corporation) is a business. Corporation Income Tax Return, must be e-filed if the . Information about Form 1120, U. If the S corporation owes tax, it should submit FTB 3539 (Payment . Investopedia / Michela Buttignol.Corporations that are e-filing may use the following approved guidelines to prepare their income tax returns for tax years ending on or after December 31, 2021 without the need . For certain corporations affected by federally declared disasters such as hurricanes, the due dates for filing returns, paying taxes, and performing other time-sensitive acts may be extended.About Publication 526, Charitable Contributions.

If your S corporation . Income, losses, deductions, and credits flow through to the shareholders, partners or members.

Forming a corporation

CT-400, Estimated Tax for Corporations.S corporations are responsible for tax on certain built-in gains and passive income at the entity level. Income Tax Return for an S Corporation is the tax form S corporations (and LLCs filing as S corps) use to file their federal income tax return. The S Corporation does this by filing Form 1120-S, .

Forms for Corporations

CT-5, Request for Six-Month Extension to File (franchise/business taxes, MTA surcharge, or both) CT-5.

Partnerships/S Corporations/Limited Liability Companies.

S Corp Tax Deadlines: 2022 S Corp Tax Guide

Corporation Income Tax Return, including recent updates, related forms and instructions on how to file.TaxAct’s Accounting Records import helps reduce time and errors by automatically transferring accounting records for the tax year via .

/papiers-peints-sol-en-bois-parquet.jpg.jpg)