How to get a copy of w2

By January 31, 2025, furnish Copies B, C, and 2 to each person who was your employee during 2024. Choose Payroll Tax at the top of the page. When you call, you will need to provide the following . ...

By January 31, 2025, furnish Copies B, C, and 2 to each person who was your employee during 2024. Choose Payroll Tax at the top of the page. When you call, you will need to provide the following . Working at Walmart is a lot of fun and a good first step in the direction of a new career. Yes, you can get a free copy of your W-2 form from the IRS. Download tax form in your account.

3 Ways to Request a Duplicate W‐2

My employer did not send me a W-2. Go to the Employees menu.

Duplicate or Corrected Form W-2 Frequently Asked Questions

Volunteers should encourage taxpayers to contact their employers first to obtain their missing Forms W-2s, 109's, K-1, etc.

How To Get Your W-2 From a Previous Employer: Steps and Tips

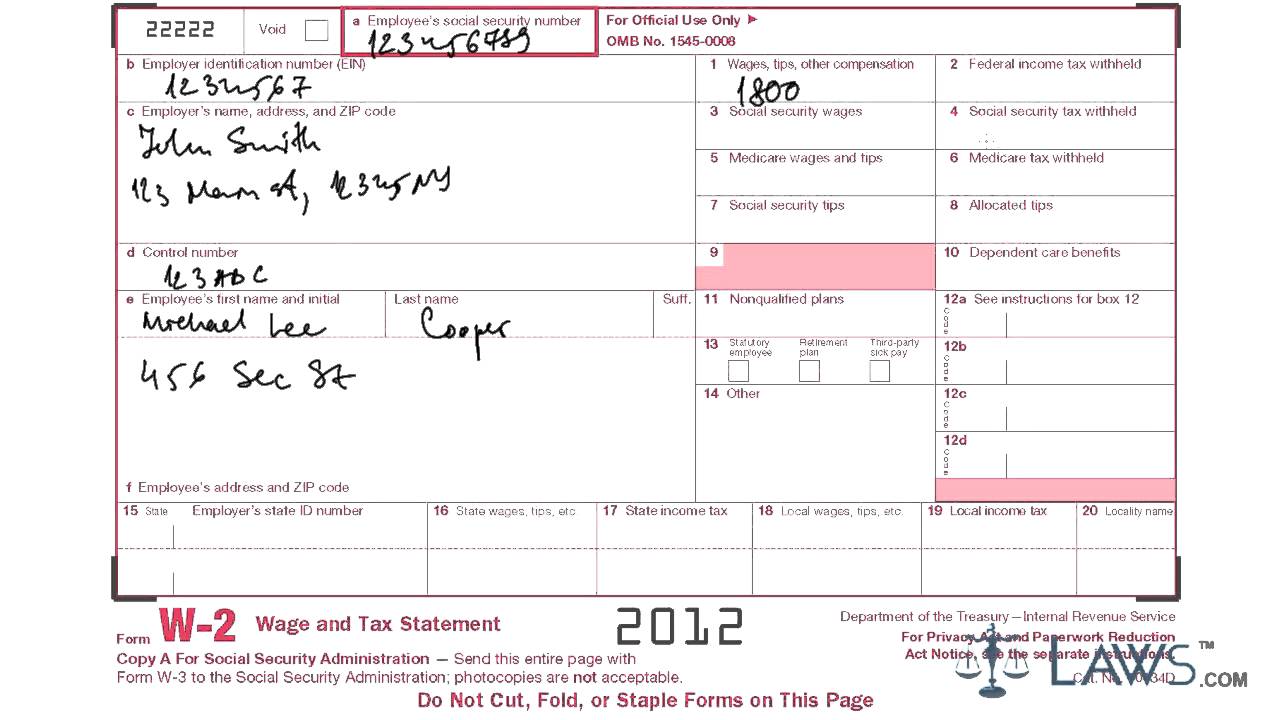

Temps de Lecture Estimé: 7 minW2 form is an annual report which lists employee’s income, taxes, and other deductions. You can call the DAFS at 888-332-7411 and follow the prompts to make the request, or fill out the askDAFS form online. In most cases, the Customer Support Center will mail the duplicate to . This method is often the easiest and quickest . Go to Step 2: Print your W-2s and W-3 . If your former employer does not act on your request for following up on your W-2 or you are unable to reach them, then it is time to reach out to the IRS. Mail or electronically file Copy A of Form(s) W-2 and W-3 with the SSA by January 31, 2025. Your W-2 form, or Wage and Tax Statement, helps you to fill out your annual tax return.

How to Get an Old W-2 Online: 3 Ways to Obtain Income Forms

How to Get a Copy of Your W2 from the IRS.

Page Last Reviewed or Updated: 15-Feb-2024.If you don't get a W-2 by end of February, contact your employer or call the IRS.Have your personal identification information and Social Security number handy.Check The Mail: If your W2 is mailed to you, make sure that your mailbox is adequately protected (with lighting, video doorbells, etc. There's a fee, however, of $43 to do this.Copy D for employers and the Note for Employers that was previously provided on the back of Copy D has been removed from the Forms W-2AS, W-2GU, and W-2VI to reduce the number of pages for printing purposes.What to do if your W-2 was stolen. However, when taxpayers are unable to find their employers or cannot otherwise secure copies, they can: To request a physical copy of your W2 form, you will need to get in touch .AVERTISSEMENT✕Nous vous suggérons de choisir un autre résultat.How can I get a copy of my wage and tax statements (Form .Employers are required to send matching copies of this document to each of their employees and to the Social Security Administration (SSA) at the end of every tax . W-2s include personal information like your Social Security number.

Save the W-2 on your personal computer for easy retrieval and never pay a reprint fee.Temps de Lecture Estimé: 8 min

3 Ways to Get a Copy of Your W‐2 from the IRS

Your quickest, cheapest bet is to contact the employer who issued it.Take These Steps. If you were paid wages during the tax year, you may be eligible to get a tax refund from the IRS. I’m here to help you re-print a copy of your employee’s W2 in QuickBooks Desktop.Step 1: Buy W-2 paper (if applicable) If your employee lost or didn’t get their original W-2, or you need a copy for your records, you can use plain paper. The hours of operation are 7:00 a. If you get SSI payments . It is important for employees to keep track of their W2 forms and pay stubs for tax filing and budgeting purposes.You can get a replacement form SSA-1099 or SSA-1042S Benefit Statement for any of the past 6 years for which benefits were paid by: Signing in to your personal mySocial Security account and selecting the “Replace Your Tax Form SSA-1099/SSA-1042S” link. You can pull up the W-2 and print a copy of it by following the steps below: 1. Si vous accédez à ce site, celui-ci est susceptible de télécharger des logiciels malveillants qui pourraient endommager votre périphérique.The preferred way to get a copy of your W-2 is to simply ask your employer. You can get a copy of your W-2 from the Social Security Administration, but this might be the slowest and most costly method for obtaining this form. Select the applicable . If your previous employer offers this option, you may be able to log in to .Select the Tax Year entry to view or print a copy of the tax form. Buy W-2 paper if you’re printing from QuickBooks and mailing official copies to your employees. Choose the desired year and select the .

How to Get Your Old IRS Forms W-2 and 1099

Contact Texas Roadhouse Human Resources.The SSA is unable to process these forms. W-2)? Views: We can give you copies or printouts of your Forms W-2 for any year from 1978 to the present. Here is the process to follow: 1. See E-filing, later. If that's not an option, you can also request this form online by printing IRS Form 4506 (Request for Copy of Tax Return).Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.

Ultimate Guide to Get CVS Pay Stubs and W2s For a

Provide the IRS with: Your name, address, Social Security number and phone number.If you filed a paper tax return and attached a paper W-2 to the return, the IRS notes that the fastest way to get a copy of W2 is to contact your employer who issued it to you. Go to the “Choose a year” dropdown menu.The IRS requires your former employer to mail you a copy of your W-2 before the end of January. Note: W-2s will be available to worksite employees in the Paychex Oasis portal on/around January 20. Here's more on how. Prior-year tax returns, tax account transactions, wage and .If contacting your former employer is not feasible, you can get a copy of W-2 from a previous employer online. If you cannot obtain your W-2 from your employer or their payroll provider, you can order a copy from the IRS by using .

How can I get a copy of my W-2?

You should first contact your employer to try to obtain a copy of your W-2. If someone stole your W-2 or any of your other tax documents, they may try to use them to file a return and get a fraudulent refund. Select Tax Forms. The easiest way to get a copy of a lost W-2, is to contact the employer who issued it.When the W-2 is available, you will receive an email with a link to the website where you can log in and retrieve your W-2 at your convenience. In most cases, payroll professionals can help you receive your W-2. We recommend ordering W-2 kits (W-2s and . Getting Your W-2s from the IRS. Instead, you can create and submit them online. You will need to enter your Social Security number, so .Many employers now provide W-2 forms electronically through a secure online portal.Most people get a copy in the mail.

To do this, you’ll need to create an account on the IRS website and request your transcript. Click the Taxes tab in the left navigation bar. Employer’s name, address and . Here's why: When employers send W-2s electronically to employees, they also submit them to the IRS. Open the Paylocity Mobile Application (App). If accessing your Texas Roadhouse W2 online is not available or feasible, you can request a physical copy of your W2 form. Email a W-2 Tax Form From a Mobile Device. If you did not receive your original Form W-2, or if you received it but misplaced it, contact the Customer Support Center directly. Select Pay from the main menu.

What to do when a W-2 or Form 1099 is missing or incorrect

The IRS offers this service free of charge.

How to Get Your W-2 Form From Social Security

You can view or print copies of your pay statements as well as your W2 by visiting our Payroll Webcenter Portal.

If you don’t get a W-2 or your W-2 is wrong

The payroll department of your employer (or former employer) should be saving important tax information, such as W-2s. While Federal Gaming regulations require W2-Gs for payouts over $1200.

![¿Cómo puede obtener una copia de mi formulario W-2? [2024]](https://www.creditosenusa.com/wp-content/uploads/como-llenar-el-formulario-w2.png)

Applying for loans or benefits.People often need copies of their old Forms W-2 or 1099.

While this guide has hopefully clarified how to get a W2 from an old job, here are some additional tips if you still encounter difficulties: .En savoir plus ou consulter le rapport de sécurité du site Bing pour plus de détails. Young people can bridge their expenses by working either part- or full-time, which is a good source of money. The IRS issues W2s to people who . Your User Name is your last name plus the last 4 digits of your social security number.Simply stated, the IRS Form W-2 is a wage and tax statement that reports your taxable wages and the taxes withheld from your wages.If directly reaching out doesn’t help, it’s time to contact the IRS. This process is pretty simple and shouldn’t take much .The Department of Defense reveals that there are two additional ways to request a copy of your W-2, should the myPay system itself be experiencing difficulties. If by the first few weeks of the year, your W-2 has not arrived yet, or . Get tax records and transcripts online or by mail.

If the W-2 Form was returned to the employer due to incorrect address or was not yet issued, allow at least three weeks for the employer to remail or issue the W-2 Form.

Harrah’s Cherokee Casino Resort

Ask for the W-2 to be sent to you.

How to Get a Copy of Your W2 Online

Select All Employees or a specific employee from the drop .Thank you for coming to the Community for help. Select the little box; Select the View PDF tab; W2 page will appear. Select Payroll Tax Forms and W-2s, then choose Process Payroll Forms.

How Can I Get a Walmart W2 Form?

Share: If you lost your W-2, contact your employer to get a duplicate prior-year W-2 or look on your employer’s website for a digital copy of a lost W-2.

Solved: How do I reprint one w2?

Determine whether you need full copies or transcripts.

How can I get a copy of my wage and tax statements (Form W-2)?

If you live outside the United States and can’t access your form online, contact a Federal Benefits Unit for help.If you require an old W-2, follow these steps: 1. Unless you have already logged into the portal in the past, your Password will be the last 6 digits of your social security number.Vues : 1,8M

About Form W-2, Wage and Tax Statement

Those with limited internet access can call DFAS at 888-332-7411 and follow the touchtone prompts as follows to have a paper copy of their active-duty W-2 reissued to them: Select 1 (self-service . Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. Most online tax .Requesting a Physical Copy of Your Texas Roadhouse W2. You may even be able to get your W-2 from your employer without technically asking them for a copy if they definitely issued one.If you are a current or former employee of CVS, you can obtain your W2 Form through one of the following methods: Online: The easiest and most convenient way to get your CVS W2 Form is to access it online through the MyHR CVS website.Option #1: Get your W-2 from previous employer. Your employer should be your first point of contact if your W-2 is late. View tax form Create account.Request a copy of your W-2 from the IRS.To obtain a replacement W2-G form, contact our Income Control Department at 828-497-8668 with your request. Sign in to your account.Learn how to request your wage and income transcript online or by mail, which shows the data reported to the IRS on Forms W-2 and other information returns. Here are some common reasons: Filing back tax returns.If you need a duplicate W-2 for the current tax year, please allow a reasonable delivery period from the date we first mail the originals. If your W-2 is wrong, ask your employer to correct it or file an amended return . What Is a W-2 Form? How to Read It and When to Expect It.

Download Article. As of August 11, 2012, our Gaming Compact with the State of North Carolina no long requires .) and that you retrieve the mail frequently. Your previously filed return should be notated with your EIN.

W-2 Form: What It Is, How to Read It

Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced EIN.

Take These Steps

Therefore, it is important for Whataburger employees to be aware of how to access these important documents.