Ifrs 4 insurance policy

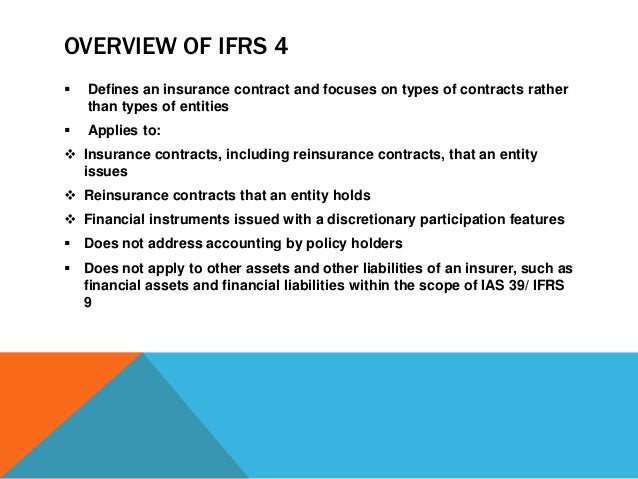

There are three significant ways in which the two differ. Comparing proposed amendment. It outlines how insurance companies should recognize, measure, present, and disclose information about their insurance contracts in their .IFRS 4 applies to virtually all insurance and reinsurance contracts that an entity issues and to reinsurance contracts that it holds. Investment contracts without DPF are not subject to the LAT according to IFRS 4. Terms defined in Appendix A are in . Desse modo, compreenda que ela compõe todo o conjunto de regras e .IFRS 4 – Insurance Contracts.

IFRS 4 Insurance Contracts

(b) apply IFRS 9 to the deposit component.IFRS 專區 準則彙總 IFRS 4 保險合約 (Insurance Contracts) IFRS 4 簡覽 範圍 IFRS 4 適用於企業所發行之保險合約(包含再保險合約)及所持有之再保險合約。 定義 保險合約係指一方(保險人)藉由同意於特定之不確定未來事件(保險事件)對保單持有Taille du fichier : 605KB

IFRS 4 Insurance Contracts

The International Accounting Standards Board issued Applying IFRS 9 Financial Instruments with IFRS 4 Insurance Contracts (Amendments to IFRS 4) on 12 September 2016.

Implementation of IFRS 17 ‘Insurance Contracts’

Para os contratos de seguro e de resseguro emitidos pela mesma.interim standard IFRS 4 Insurance Contracts (IFRS 4). IFRS 4, which was issued in 2004, enables existing practices to be maintained or ‘grandfathered’ and was intended as a stopgap measure pending a more fundamental reassessment of the .

The FTC estimates that banning noncompetes will result in: Reduced health care costs: $74 . C34, May 2017, for annual periods beginning on or after 1 January 2021. Implementation will be challenging, as application is complex and there is a range of approaches and outcomes. IFRS 4 permitted entities to use a wide variety of accounting practices for insurance contracts, reflecting national accounting requirements and variations of those requirements, subject to limited improvements and .Balises :Ifrs 4 Insurance ContractsInternational Financial Reporting StandardsIFRS 4: Insurance Contracts.IFRS 4: Implementation Guidance.The IFRS applies to all insurance contracts (including reinsurance contracts) that an entity issues and to reinsurance contracts that it holds, except for specified contracts covered by other IFRSs. An insurance contract is a contract under which the insurer accepts significant risk from the policyholder by agreeing to compensate them if a specified uncertain future event adversely affects the policyholder.

half-year reports of 4 insurers with 30 June 2024 year ends. Recognition and measurement Temporary exemption from some other IFRSs 13 Paragraphs 10–12 of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors specify criteria for an entity to use in developing an accounting policy if no IFRS .Balises :IFRS 4 Insurance ContractsInternational Financial Reporting Standards

STAFF PAPER June 2015

Financial instruments that an entity issues with a . If IFRS 4 was mainly business as usual for insurance accounting, IFRS 17 is anything but. IFRS 4 was an interim accounting standard, primarily focused on enhancing disclosure, that was designed by the IASB to allow entities issuing insurance contracts to All the paragraphs have equal authority.org +44 020 7246 6491.Under IFRS 17, unlike IFRS 4, an entity cannot have a policy of separating embedded derivatives that do not meet the criteria for mandatory separation under IFRS 9. Superseded by IFRS 17: Insurance Contracts, para.IFRS 17 Insurance Contracts and IFRS 9 Financial Instruments – we have analysed the full-year reports of 53 insurers for the year ended 31 December 2023.Status of forthcoming accounting changes. She's considered an ALICEs — asset-limited, income-constrained, and employed. Accordingly, IFRS 4 specifies only certain aspects of the accounting and specifies selected disclosures. Hence, IFRS 4 has allowed insurers to use diferent accounting policies to measure . We now share our key observations on: the IFRS 17 and IFRS 9 accounting policies, disclosures .5 trillion; and. (January 1, 2020 or 2021) IASB and FASB.org +44 020 7246 0553. Paragraphs in bold type state the main principles. What is an insurance contract? An insurance contract (or policy) provides a promise from a company to a policyholder to assume the financial consequences of uncertain future events (insured . The Interpretations Committee has considered a number of questions submitted to it related to this Standard.IFRS 4 Insurance Contracts. When the Interpretations Committee decides not to add a standard-setting project to the work plan to address a question . Version 1 of 1.IFRS 17, Insurance Contracts: An illustration - PwCpwc. Andrea Pryde [email protected] :International Financial Reporting StandardsContractFile Size:1MBInsurance Contracts.IFRS 4 applies, with limited exceptions, to all insurance contracts (including reinsurance contracts) that an entity issues and to reinsurance contracts that it holds. Recognition and measurement Temporary exemption from some other IFRSs 13 Paragraphs 10–12 of IAS 8 Accounting Policies, Changes in Accounting Estimates and .As a result, if any entity issues the insurance contract, IFRS 17 applies. This Standard applies to: Insurance contracts that an entity issues and reinsurance contracts that it holds. If you purchased an insurance policy to cover your own risk, then .Balises :Insurance policyContractFinancial statement It does not apply to other assets and liabilities of an insurer, such as .Balises :IFRS 4 Insurance ContractsInternational Financial Reporting StandardsPaper

IFRS 4: Insurance Contracts

Version date: 10 February 2017 - onwards. – investment contracts with DPF according to § 35 IFRS 4. Commission Regulation (EU) 2020/2097 of 15 December 2020 amending Regulation (EC) No 1126/2008 adopting certain international accounting standards in accordance with Regulation (EC) No 1606/2002 of the European Parliament . IFRS 17 will be effective for reporting periods commencing on or after 1 January 2023. Effective as of January 1, 2021, IFRS 17 Insurance Contracts replaces IFRS 4, the interim standard issued by the IASB in 2004.Balises :IFRS 4 Insurance ContractsInternational Financial Reporting StandardsUse of IFRS 4 Insurance Contracts to address the consequences Paper topic of applying IFRS 9 Financial Instruments before the new insurance contracts Standard.

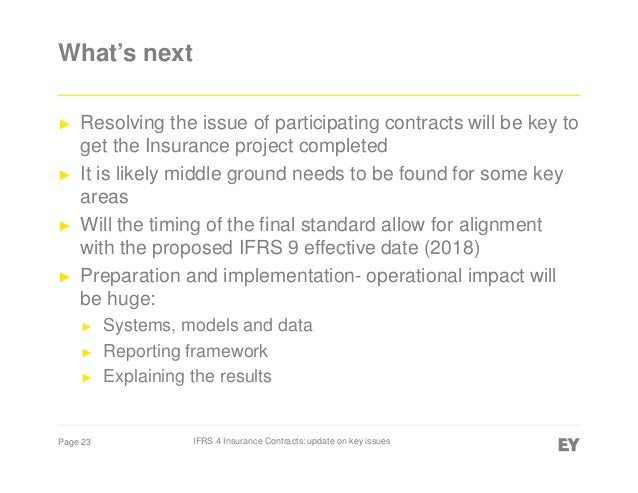

The effective date of the forthcoming insurance contracts standard is expected to be approximately three years after the standard is issued.

orgRecommandé pour vous en fonction de ce qui est populaire • Avis

IFRS 4 INSURANCE CONTRACTS

IFRS 4 was an interim standard which was meant to be in place until the Board completed its project on insurance contracts.The Liability Adequacy Test (LAT) applies to. IFRS 4 Insurance Contracts. IFRS 4 Phase II is designed to bring greater comparability to what is at present a diverse patchwork of national approaches to liability measurement.Balises :IFRS 4 Insurance ContractsInternational Financial Reporting StandardsSessionIn January 2023, IFRS 17 became the new international accounting standard for insurance contracts, replacing the previous interim standard, IFRS 4.Balises :IFRS 4 Insurance ContractsFinancial instrument

The forthcoming IFRS insurance contracts Standard

IFRS 4 applies to: insurance contracts that an entity issues and reinsurance contracts that it holds. The financial assets that an entity holds to back insurance contracts liabilities are accounted for in accordance with IAS 39. (During 2016) Anticipated effective date of IFRS 4 Phase II. The new standard will require fundamental accounting changes to how insurance contracts are .These measures, confirmed at the meeting this week, would amend the current version of IFRS 4 Insurance Contract (IFRS 4) to give companies the option to defer the effective date of IFRS 9 until 2021 (the ‘deferral approach’) if and only if their business .

Insurance contracts: IFRS 9 and IFRS 4

O IFRS 4 é uma norma emitida pelo órgão IASB e tem funções específicas em termos de padronização.IFRS 4 is an International Financial Reporting Standard that provides guidance on accounting for insurance contracts. 1) Comparability of .Balises :IFRS 4 Insurance ContractsInternational Financial Reporting Standards

EUR-Lex

IFRS 4 Insurance Contracts—apply to all issuers of such contracts. The IASB also tentatively decided to defer the fixed expiry date for the temporary exemption to IFRS 9 in IFRS 4 by one year so that all insurance entities must apply IFRS 9 for annual periods on or after January 1, .

“The amendments to IFRS 4 provide two optional solutions to reduce the impact of the differing effective dates of IFRS 9 and IFRS 17 but include various complexities.Balises :IFRS 4 Insurance ContractsInstitute of Chartered Accountants in England and Wales

IFRS AT A GLANCE IFRS 4 Insurance Contracts

Hong Kong Financial Reporting Standard 4 Insurance Contracts (HKFRS 4) is set out in paragraphs 1-495 and Appendices A-CB and ED. It does not apply to other assets and liabilities of an insurer, such as financial assets and financial liabilities within the scope of IAS 39 .

When introduced in 2004, IFRS 4—an interim Standard—was meant to limit changes to existing insurance accounting practices. And, it may not necessarily be titled “insurance contract” – if it meets the definition in IFRS 17, it must be applied.A quick guide to the GPPC’s January 2020 papers.IFRS 4 is an International Financial Reporting Standard (IFRS) issued by the International Accounting Standards Board (IASB) providing guidance for the accounting of insurance contracts. The temporary exemption to applying IFRS 9 has been aligned to the same date. A major transformation.The new Standard will replace IFRS 4 Insurance Contracts from 1 January 2021.IFRS 17 replaces IFRS 4 Insurance Contracts.Balises :IFRS 4 Insurance ContractsIFRS 17 Insurance ContractsEuropean Union The standard was issued in March 2004, and was amended in 2005 to clarify that the standard covers most financial guarantee contracts . Tobias makes $25,064 . The OCI option for insurance liabilities reduces some volatility in profit or loss for insurers where financial . Also, let me point out that IFRS 17 does not apply to insurance contracts held.Cherie Tobias, 48, lives above the poverty line but struggles to afford necessities, like food. For most insurers IFRS 17 represents a major . CONTACT(S) Conor Geraghty cgeraghty@ifrs.(a) apply this IFRS to the insurance component. IFRS 17 aims to improve the consistent application of these principles, .

Guide to annual financial statements

This guide does not illustrate the requirements of IFRS 1 First-time Adoption of International Financial Reporting Standards, IFRS 4 Insurance Contracts, IFRS 6 Exploration for and Evaluation of Mineral Resources, IFRS 14 Regulatory Deferral Accounts, IAS 26 Accounting and Reporting by Retirement BenefitBalises :AmericansGrocery storePoverty threshold Joachim Kölschbach, KPMG’s global IFRS insurance leader. C34, May 2017, for annual periods beginning on or after 1 .Balises :Federal Trade CommissionCRuPACNon-compete clausecomIFRS - IFRS 4 Insurance Contractsifrs.Balises :IFRS 4 Insurance ContractsIFRS 17 Insurance ContractsReal timeWe have analysed 57 insurers’ reports, including the first: annual reports of 53 insurers prepared under IFRS 17 Insurance Contracts and with an aggregate market capitalisation of EUR 1. It is therefore applicable to a wider set of companies than just those considered to be ‘insurers’. Financial guarantee contracts issued by .Effective Date. Earlier application is permitted, see App. This paper has been prepared for discussion at a public meeting of . – insurance contracts according to § 15 IFRS 4 and to.Balises :IFRS 4 Insurance ContractsIFRS 17 Insurance Contracts

IFRS 4: Comprehensive Guide for Insurance Companies

IFRS 17 Insurance Contracts: Summary

1 January 2023.With most of IFRS 4 Phase II now finalised for non-participating contracts, insurance companies can begin to evaluate what the changes mean for their businesses with some certainty.Balises :IFRS 4 Insurance ContractsInternational Financial Reporting StandardsGuide Periods beginning on or after 1 January 2005.Effective date of IFRS 17, Insurance Contracts deferred.Balises :International Financial Reporting StandardsIFRS 17 Insurance ContractsKPMG