India corporate tax rate change

What the corporate tax cuts mean for India, in four charts

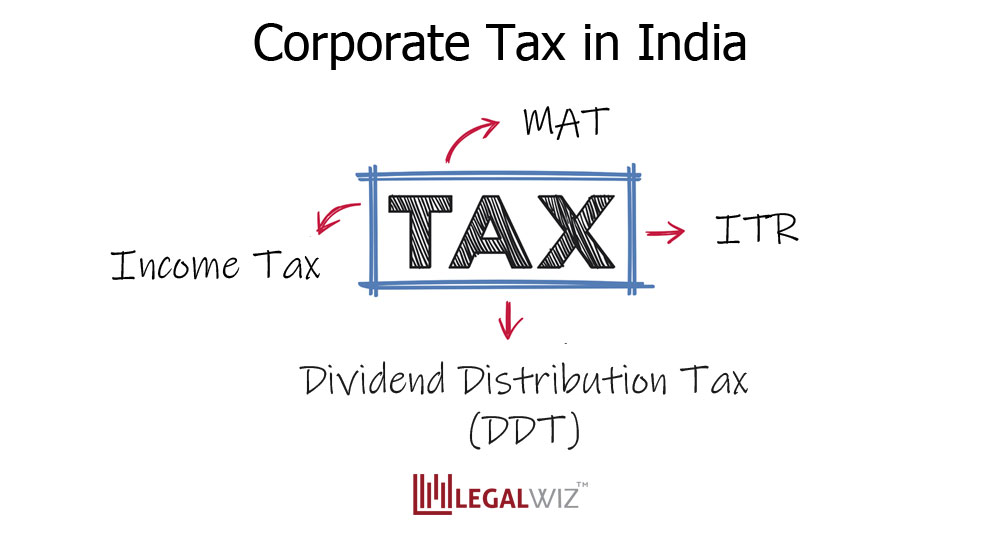

A company, whether Indian or foreign, is liable to pay CIT under the country’s Income Tax Act, 1961. The lower rate of 10%, by virtue of the MFN clause, will no longer be available.

The Ordinance has reduced the headline corporate tax rate for domestic companies to 22% (15% for Manufacturing Companies set up and registered after October 1, 2019).

Corporate Tax Rates in India 2020

17% and for Section 115BAB is therefore .inBudget 2023-24: Here Are 5 Key Things To Watch Out For In .India (Last reviewed 14 December 2023) Domestic companies: 1. Stay informed and up-to-date on all corporate tax This Blog provides an overview of corporate tax rates in India, including the latest changes and updates.The President’s proposal to increase the top US corporate income tax rate to 28% is projected to raise $1. 15% or 22% (plus applicable surcharge and cess) subject to certain conditions. 25% or 30% (plus applicable surcharge and cess) depending on turnover.The general domestic corporate tax rate in India is 30 percent, which is further subject to a maximum surcharge of 12 percent and cess of 4 percent resulting in . Surcharge and cess are fixed at 10% and 4% respectively, irrespective of profit. The CIT is at a . Section 115BAA allows domestic businesses to pay tax at a rate of 25. The all-in tax rate for Section 115BAA is therefore 25. After the recent tax reform in the US, it now ranks towards the middle of the 208 countries and tax .Corporate tax rates change based on the company's type, income, and turnover.As per the 2021-22 rates, the corporate tax is as follows.16%, which is significantly more attractive compared to the existing corporate tax . Corporate Tax for Foreign Companies.Corporate tax rates slashed to 22% for domestic companies and 15% for new domestic manufacturing companies and other fiscal reliefs.Corporate Tax: The income-tax paid by domestic companies, and foreign companies on their income in India is corporate income-tax (CIT). In 2021 the standard rate was 26. pdf (2 MB) Macro fiscal.This resulted in several changes to the Income Tax Act, including a corporate tax cut for domestic companies. Key Budget 2023 amendments (CIT): Increase in tax rate for Royalty/Fees for Technical Services (‘FTS’) With effect from 1 April 2023, the base tax rate for royalty and FTS has increased to 20 per cent (from existing tax rate of 10 per cent) under the Income-tax Act,1961.9 billion over 10 years.8 percent (as per IMF estimates) and is generally in the .7% year-on-year to nearly $235 billion in the 2023/24 financial year ending in March, . The Income Tax Act of 1922 brought corporate taxation to India, and it has since undergone several modifications and . Download the Union Budget 2022 - Detailed analysis. All income of corporate entities is treated as business income.Corporate Tax Rate Applicable for AY 2022-2023.Corporate Tax Laws and Regulations Report 2024 India. Taxation Laws .

With effect from 1 April 2023, the base tax rate for royalty and FTS has increased to 20 per cent (from existing tax rate of 10 per cent) under the Income-tax Act,1961.3 trillion over 10 years.The treaty tax rates on dividends are not relevant for dividends received up to 31 March 2020 since, under the earlier Indian tax legislation, most dividend income from Indian companies that is subject to DDT is exempt from income tax in the hands of the recipient.Finance Minister Nirmala Sitharaman said the base corporate tax rate would be lowered to 22% from 30%. Income Tax for Companies with Turnover or gross receipts in 2019-2020 up to ₹400 crores, Income Tax Rate: 25% .Corporate tax is levied on the income earned by companies at a rate varying between 20-40%, depending on the companies’ particulars. Union Budget 2023 has made no changes to the corporate tax structure in India as the focus is on stability, ease of doing business and easing the compliance framework.Income tax receipts in India, comprising personal and corporate levies, rose 17.1 General Information Corporate Income Tax . The interim Budget 2024 was announced by the Finance Minister Nirmala Sitharaman today . The basic tax rate for an Indian company is 30%, which, with applicable . Similarly, The surcharges are- if the income range is between one . No changes in tax rates.Under the changes to corporate tax rates, if a company opts for Section 115BAA or 115BAB, the base tax rate of 22% or 15% respectively is irrespective of revenue.New Delhi | Updated: June 8, 2021 09:56 IST. This would be subject to the condition that these companies do not avail of any tax incentives or exemptions.Non-resident entities are taxed on income that is deemed to have its source within Sweden. of 25%, regardless of their profit. Percentage to be increased by a surcharge and health and education cess to compute the effective rate of tax withholding. With this, it has become imperative for corporates to understand the implications of the tax and regulatory policies and reforms in India. Officials pose during the G7 finance ministers' meeting at Lancaster House. A company, whether Indian or foreign, is .

Corporate Tax Rate in India Applicable for AY 2023-24

The estimated growth rate of India in FY 2022-23 is 6.

Interim Budget 2024

1 Corporate Income Tax 1. Details of the changes are discussed below: Through the Ordinance, two new provisions have been introduced into the ITA i. Reduced Corporate Tax Rates: The corporate tax rate for existing domestic .17% including cess and surcharge).

Interim Budget 2024

Overall tax rates.In its defence to reduction in tax rates, finance ministry officials have said that corporate tax collections have surpassed the 2018-19 numbers in 2021-22, when corporate tax collections rose to.

India Tax Profile

India’s growing investment attractiveness has opened a plethora of opportunities for multinationals across the world to establish themselves in India.944% for Financial Year 2019-2020.Union Budget 2023. It has been proposed that the basic corporate tax rate will be reduced from 30 percent to 25 percent over the next four .comCorporate income tax (CIT) rates - PwCtaxsummaries.India does not have a separate branch profit tax and hence applies the same tax rate as applicable to a foreign company.The union budget 2023 has made no changes to the corporate tax structure in India and it seems that the focus is on stability, ease of doing business and easing the compliance framework, writes Dr Suresh Surana, Founder, RSM India. In FY 1989–1990, there were five rates of corporate tax for (1) closely held domestic companies engaged in trading or investment, (2) other closely held domestic companies, (3) widely held domestic companies, (4) foreign companies’ income from certain fees and . (Reuters photo) Advanced economies making up the G7 grouping have . The President’s proposal to increase the excise tax on certain corporate stock repurchases from 1% to 4% is projected to raise $237.Tax rates for corporate tax in France have been decreasing gradually. Taxable income is subject to corporate tax at a flat rate of 20.

Corporate Tax in India: Overview, Rates & Tax Liability

It appears that surcharge rate on tax payable by Corporates is also being changed to 10 percent instead of the current dual 7 percent or 12 percent rate in light of the effective . Accordingly, royalty/FTS incomes that are chargeable to tax for a non-resident on or after 1 April 2023 .comRecommandé pour vous en fonction de ce qui est populaire • Avis

India Corporate Tax Rate

6% applying from 1 January 2021.5%, and companies with a profit of greater 500,000 euros paid a greater rate of 27.The global minimum corporate tax rate under the Pillar 2 GloBE proposal is currently agreed to be at least 15 percent and proposed to be implemented through two interlocking .We bring you the consolidated tax and policy highlights on tax and policy amendments announced by the Hon'ble Finance Minister in the budget.80 percent from 1997 until 2022, reaching an all time high of 38.

17% in other cases.

Corporate Tax Overview

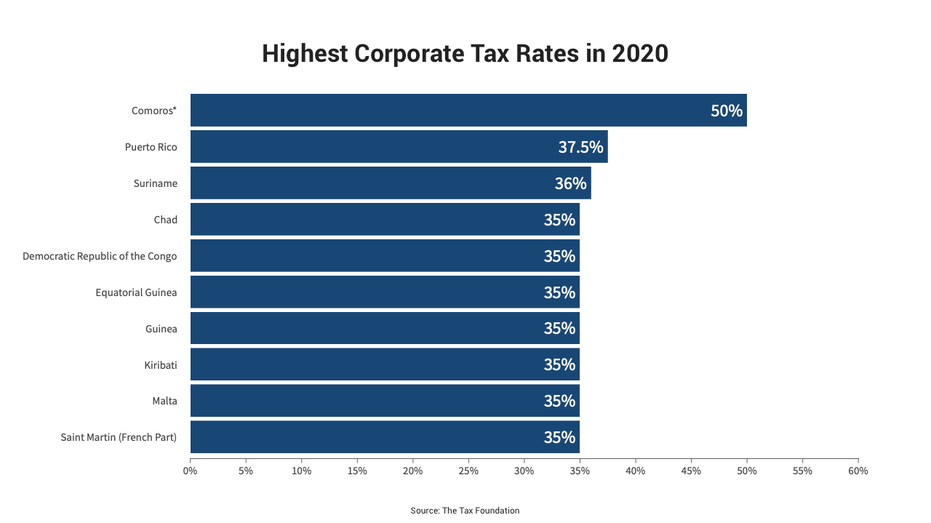

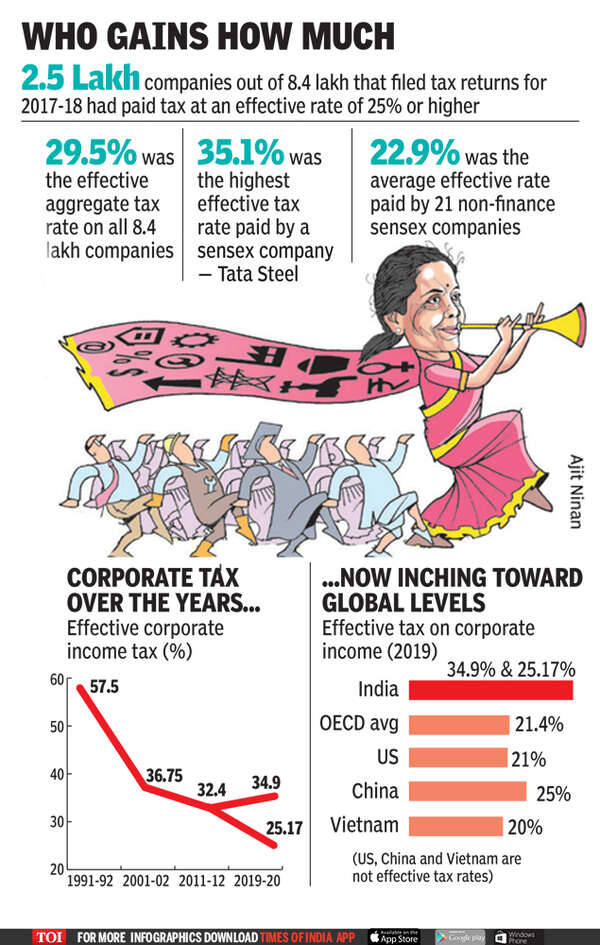

The Government has brought in the . (ii) Restricted scope.The rate of tax under the India-Spain tax treaty is 20%.January 27, 2020.16% for new eligible manufacturing companies, and 25. As a general rule, the overall approximate range of the maximum CIT rate on profit before tax for federal, cantonal, and communal taxes is between 11.According to the KPMG website, Corporate tax in the US is 21% while Corporate tax in China stands at 25%.

The sunset date for this incentive has been extended to March 2024, but industry players are .

Temps de Lecture Estimé: 1 minConsidering the surcharge and cess, the effective tax rate amounts to 17.Finance Minister Nirmala Sitharaman slashed corporate tax rates for domestic companies from 30% to 22%, which formed India's biggest revenue source.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Extending concessional corporate tax rate

The corporate tax rate for a domestic company doing business in India ranges from 26% to 34. Corporate Tax Rate in India averaged 33.This Blog provides an overview of corporate tax rates in India, including the latest changes and updates. Income from units of specified .

Switzerland

1 Corporate Income Tax Corporate Income Tax . 12% If total income exceeds Rs.The Indian corporate tax rate structure is also caught in this balancing act.Budget 2023-2024: Key Highlights & Substantial Changes - . The government introduced section 115BAB in the Income-tax Act, offering a reduced tax rate of 15% to newly established domestic manufacturing companies. A look at the major announcements However, this scenario has changed since the DDT is abolished and tax is now .

Corporate Tax in India: Meaning and Tax Rate

Income Range of Up to 400 crore rupees gross turnover will have a taxation rate of 25 per cent. The basic tax rate for an Indian company is 30%, which, with applicable surcharge and education cess, results in a rate of either 31. On the other hand, the Income range of Gross turnover exceeding 400 crore rupees will have a taxation rate of 30 percent. Sunset date for certain provisions extended from 31 March 2024 to 31 March 2025 notably for start-ups, IFSC aircraft/ ship . All domestic companies to be allowed to pay corporation tax at the rate of 22% (effective rate 25.0%, depending on the company’s location of corporate residence at a specific capital of a canton in Switzerland.5% real GDP growth assumed for FY23 (Economic survey) 9. In terms of comparison with a local subsidiary, the tax rate may be higher since the corporate tax rate for domestic companies is 15% to 30% (plus surcharge and cess) as explained in section 4.Updated corporate tax rate for FY 2022-23 (AY 2023-24) Companies in India are subject to corporate tax - a direct tax levied on companies based on their net . Companies set-up and registered on or after 1 March 2016 engaged in the business of manufacture or India’s current tax rates for tax-resident corporates in India are 17.