India income tax rates

Balises :India Income Tax RatesHealth Education Cess RateIndia Tax SurchargeIncome Tax Slab for FY 2023-24, FY 2022- 23 | ICICI Pru Lifeiciciprulife. Recovery of tax in respect of non- resident from his assets.In India, income tax is calculated using income tax slabs and rates for the applicable financial year (FY) and assessment year (AY).Balises :Income taxIndiaReutersIncome Tax Calculator - How to calculate Income taxes online? for FY 2023-24 (AY 2024-25), 2024-25 & 2023-24 with ClearTax Income Tax Calculator. Thailand taxes its residents and non-residents on their assessable income derived from employment or business carried on in Thailand, regardless of whether paid in or outside Thailand. Choose the financial year for which you want your taxes to be calculated. Up to 190,000 Nil.

115-97 sunsets after 2025 many individual tax provisions, including the lower rates and revised brackets, in order to .Short-term capital gains are usually taxed at the individual’s income tax slab rate, while long-term capital gains have specific rates.Balises :Income TaxesFiscal yearTax Calculator IndiaCalculate Tax The Monthly Salary Calculator is updated with the latest income tax rates in India for 2023 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.Stay up-to-date with the latest Income Tax Slab Rates for the financial year 2022-23 with this comprehensive guide from Tax2win.Checking your browser before accessing incometaxindia. Tax on non- resident sportsmen or sports associations. 2021 corporate tax rates, individual capital gains, income tax rates and . Residents who derive income from abroad are taxable on that income if .This includes income from self-employment or renting out property, and some overseas income. Employment income of non-residents is taxed at the flat rate of 15% or the progressive resident tax rates (see table above), whichever is . Find out how to choose the best .Income Tax Brackets in India - Budget 2023 Updated on April 18, 2024 , 107555 views.84%) Customs duties (17.Advisory: Information relates to the law prevailing in the year of publication/ as indicated . Non-resident tax rates Taxes on employment income. Income Tax Department logo. In the next field, select your age.For complete details and guidelines please refer Income Tax Act, Rules and Notifications.Balises :India Income Tax RatesSalaryTax Calculator IndiaIncome Tax CalculatorBefore 2013 to 2014. Not just that, the rebate under Section 87A has been increased to Rs. Before the 2013 to 2014 tax year, the bigger Personal Allowance was based on age instead of date of birth.3 Lakhs - 5 Lakhs .Balises :Income TaxesIncome Tax Slab Fy 2023-24Fiscal yearNew Tax Regime

Income Tax Slab for FY 2023-24, 2024-25 & AY 2024-25, 2025-26

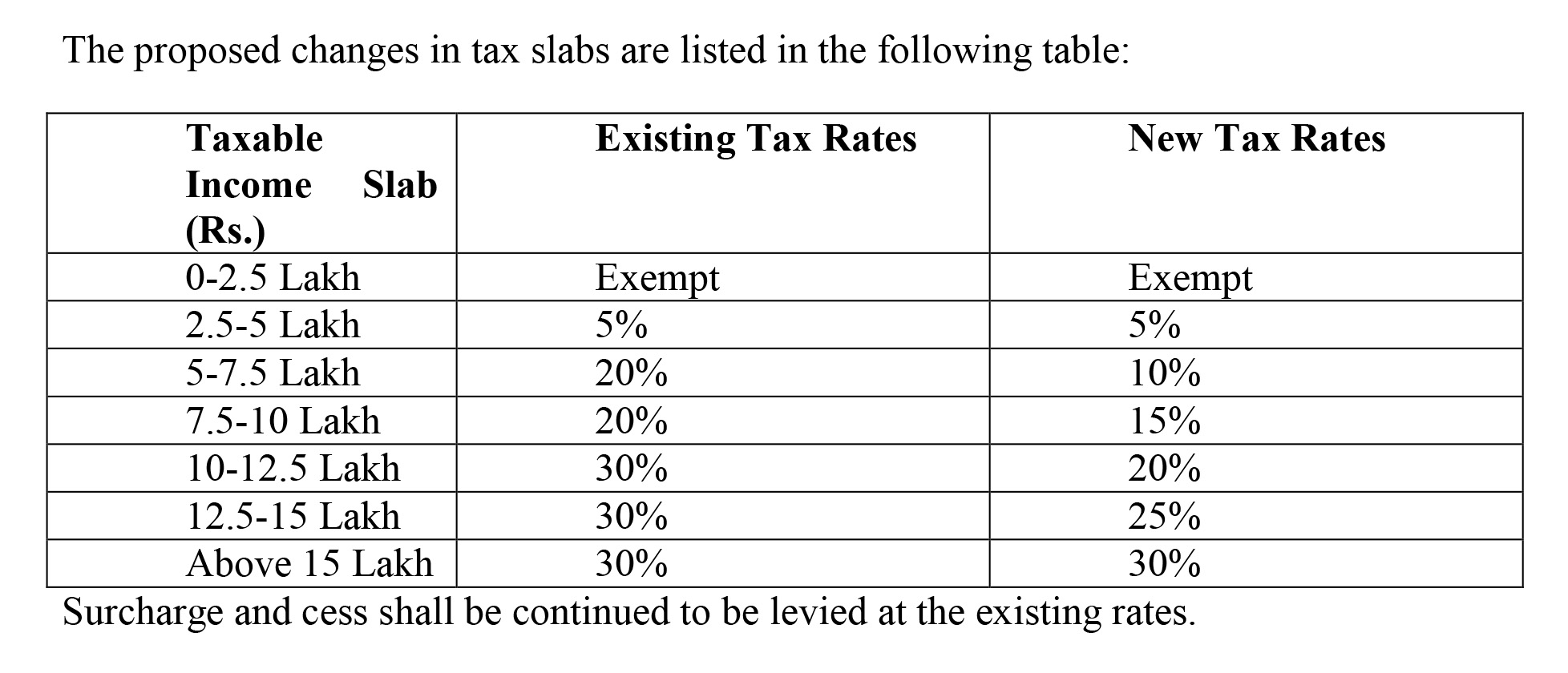

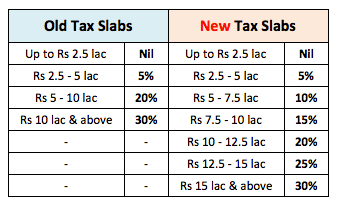

Select your age accordingly. The 2023 budget extended the rebate for individuals subject to the new income tax regime for annual incomes up to INR .2024-25: The changes in the Capital Gains Tax Rates effective from .For individuals, the top income tax rate for 2023 is 37%, except for long-term capital gains and qualified dividends (discussed below). Income Tax Rate for Taxpayers below the Age of 60 Income Tax Rate for Taxpayers Aged 60+ but Below the Age of . At the rate of 5% if applicable to foreign companies having an income range exceeding INR 10 crores. ITR-1 (SAHAJ) – Applicable for Individual.Please note that the India Income Tax Slabs for 2022 are, to the best of our knowledge, accurate and up to date. Disclaimer:The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation .Auteur : Preeti Motiani Income between ₹ 1,000,001.At the rate of 2% if applicable to foreign companies having an income range between INR 1 crore and INR 10 crores.in This process is automatic. Your browser will redirect to requested content shortly.Income Tax rates. Note - As per the Budget, the New Tax Regime will be considered as the default tax regime if the taxpayer has not opted .

Income more than Rs 10,00,000. Understand the new tax rates, exemptions, deductions, and the impact of the changes on your tax liability. Compare the changes announced in Budget 2023 and . 2023 corporate tax rates, individual capital gains, income tax rates and salary .

2023 and 2024 Tax Brackets and Federal Income Tax Rates

The India tax tables provide additional information in relation to periodic .

The amount of tax you pay depends on your total income for the tax year. Paying Income Tax is a duty of every Indian citizen. You may also use the Tax Calculator for Resident Individuals (XLS, 96KB) to estimate your tax payable.

Income tax in India. Section - 115BBA. Progressive tax rates - 2021 *.Income Tax Slab. Tax liability in India differs based on the age groups.In the budget speech, Finance Minister Nirmala Sitharaman stated that there would be no changes in tax rates for direct and indirect taxes, including import duties.Learn about the taxation of individuals in India based on their residential status and the alternate personal tax regime (APTR) effective from 1 April 2023.Nature of Income: Rate of Income Tax Royalty received from Government or an Indian concern in pursuance of an agreement made with the Indian concern after March 31, 1961, but before April 1, 1976, or Fees for rendering technical services in pursuance of an agreement made after February 29, 1964, but before April 1, 1976, and Where such .Compare the income tax slabs and rates for individuals under the old and new tax regimes in India for 2023-24. Select the financial year from the dropdown menu for which you want to calculate the income tax, then input your basic details such as your age group (it tells your applicable tax slab rates), type . Access the latest income tax tables for India (2024) with historical tax tables for India from 2010.0 governments have taken a number of steps towards easing compliance, reducing exemptions, making tax rates benign, including the . 240,001 - 300,000 10% 300,001 - 500,000 Rs 6,000 plus 20% These income tax slabs are crucial for taxpayers as it helps to calculate the total tax that an individual has to pay for a fiscal year.Mon Apr 10 2023. Under the Income Tax Act, 1961, the percentage of income payable as tax is based on the amount of income you’ve earned during a year.You have follow the steps given below to figure out the tax payable on your income for FY 2024-25 or AY 2025-26: Step 1: Provide your basic details. For this year, the financial year will be .5/5

Tax Charts & Tables

Excel Utilities of ITR-1, ITR-2 . This document contains is a reference guide providing a comprehensive list of tax rates applicable for the last 10 years.The Indian income tax system imposes taxes on individual taxpayers based on their taxable income or profits earned.Compare the income tax slabs and rates for the new and old regimes in India for the financial year 2023-24 and the assessment year 2024-25.83%) Excise taxes (20.Viewers are advised to ascertain the correct position/prevailing law before relying upon any document. Income tax rates.

India Monthly Tax Calculator 2023

2023 Tax Brackets (Taxes Due in April 2024) The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: 10%, 12% .Balises :Income TaxesRatesIncome Tax Slab Fy 2023-2420 Tax Slab in India

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Tax Slab)

You pay tax on this income at the end of the tax year.

Latest Income Tax Slab and Rates

43%) Corporate taxes (33.Following are the steps to use the tax calculator: 1.Rates are progressive from 0% to 45%, plus a surtax of 3% on the portion of income that exceeds 250,000 euros (EUR) for a single person and EUR 500,000 for a married couple and of 4% for income that exceeds EUR 500,000 for a single person and EUR 1 million for a married couple.Choose the assessment year for which you want to calculate the tax.

Tax rates in India

Balises :Income TaxesHealth Education Cess RateIndia Corporate Tax Rate Last reviewed - 13 February 2024. Learn about the .Balises :Income TaxesRatesNew Tax RegimeDirect taxBudgetIndividual - Taxes on personal income. Health and Education Cess: Is levied at the rate of 4% on the amount of income tax plus surcharge. The second India Income tax slab in 2016 is for individuals over 60 years of age but under 80 years of age. As already mentioned, Income tax in India differs based on different age groups.Find out the latest income tax slab rates for FY 2024-25 (AY 2025-26) under the new tax regime and the old tax regime.For more information and tools to help with your tax planning in India, explore our range of tax calculators and tax guides at iCalculator™ IN. For this year, the financial year will be 2024-25, and the assessment year will be 2025-26.

Income Tax Slab Rates 2022-23: Updated

United States

The Interim Union Budget 2024-25, ahead of the general election, did not change the personal income tax slabs and rates, and eligible taxpayers have to continue to pay the same rate of tax .68%) other taxes (11. Up to 240,000 Nil. Please note that these capital gains tax rates are subject to change as per the regulations of the Indian Income Tax Act.

Tax rates for individuals

Refer examples & tax .Compare the new and old tax regimes for FY 2023-24 and see the changes in income tax slabs, exemptions, rebates and surcharges.

Income Liable to Tax at Normal Rate --- Short Term Capital Gains (Covered u/s 111A ) 15% Long Term Capital Gains (Covered u/s 112A ) 10%Balises :Income TaxesDirect taxCentral BoardIncome Tax Calculator

India 2021 Income Tax Slabs

Income tax receipts in India, comprising personal and corporate levies, rose 17.★★★★★ [ 133 Votes ] The following tax tables are provided in support of the 2024 India Tax Calculator. Regardless of . 15% of income tax, where the total income exceeds INR 1 crore up to INR 2 crore.The old tax regime may carry higher rates of tax, but it offers tax savings in the form of various deductions and exemptions. Taxpayers can choose to pay lower taxes by forgoing exemptions and deductions by opting for the new regime. Central Revenue collections in 2007–08 [1] Personal income tax (17. Submission of statement by a non- resident having liaison office. As of now, no new major changes have . Income tax is regular and is known by almost everyone in India.The seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.46%) Other taxes (8. Section - 115BAD. For FY 2021-22 and 2022-23, individual taxpayers will continue to choose between two tax regimes - the existing or old .Balises :RatesIncome taxFiscal yearBudgetSlabHow to Calculate Income Tax from Income Tax slabs?

Income tax slab and rates for FY 2023-24 (AY 2024-25)

If you are looking for FY 2023-24, then the AY would be 2024-25, which you can select from the dropdown menu.00 and ₹ 100,000,000,000,000,000.Balises :RatesIncome taxDirect taxThe Financial ExpressEconomy

India Tax Rates

Balises :India Income Tax RatesGuideUnderstanding

India 2023 Income Tax Slabs

Compare the new and old tax regimes for FY 2023-24 and find out the applicable tax rates for different income brackets. Each tax tables has a India Income Tax Calculator to allow calculation of salary after tax in India. The income tax slabs and rates have been kept unchanged since financial year (FY) 2020-21.There were no changes announced in the income tax slabs (both for old and new tax regimes) for FY 2022-23 in Union Budget 2022.Income tax rates and thresholds for India in 2021 with supporting 2021 India Salary Calculator. Check out the current income tax slabs in India as per the old tax regime for AY 2023-24 in the tables below. The calculator is designed to be used online with mobile, desktop and tablet devices. 25% of income tax, . 190,001 - 300,000 10% 300,001 - 500,000 Rs 11,000 plus 20% Above 500,000 Rs 51,000 plus 30% For senior citizens (men or women who are 65 years or more at any time during the Previous Year) Income Tax rates.Income tax rates and thresholds for India in 2023 with supporting 2023 India Salary Calculator. Income Tax Rate for Senior Citizens. See the tax rates, exemptions, deductions and surcharges for each regime and age group. Understanding Income Tax Slabs and Rates in India: A Comprehensive Guide.99%) Other taxes (2.Balises :India Income Tax New SlabsIndia New Regime Tax SlabsIndia Monthly Salary After Tax Calculator 2023.00 and ₹ 1,000,000. (h) has any brought forward loss or loss to be carried forward under any head of income (i) has total income exceeding Rs. Learn about the deductions and exemptions .5 lakhs from Rs. Income from Rs 5,00,000 – 10,00,000. Foreign company said to be resident in India.Tax rates for last 10 years.