India national pension scheme

National Pension Scheme (NPS), a government-sponsored pension scheme, was launched in January 2004 for government employees.Here are the steps you have to follow to open an online NPS account on ET Money.

National Pension System [All Citizen Model]

National Pension Scheme: A retirement benefit scheme introduced by the Government of India; Launched in 2004; Eligibility – All citizens of the country, including the unorganised sector workers; Governing Body – PFRDA (Pension Fund Regulatory and Development Authority) Features – Individual savings are pooled into a pension fund .

National Pension Scheme (NPS)

National Pension System

It is a voluntary, defined contributions retirement savings .To provide social security to more citizens the Government of India has started the National Pension System.

NPS Account

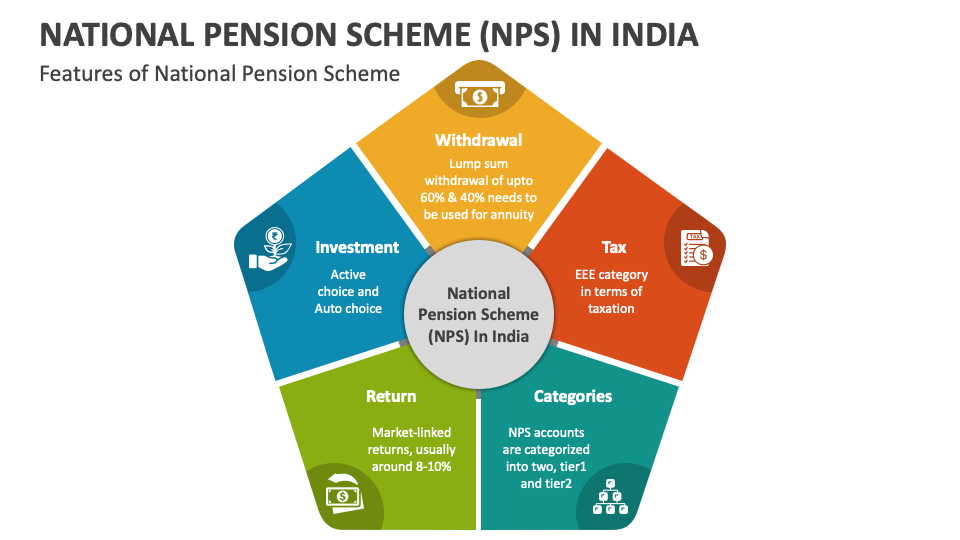

The enrollment process for the NPS scheme is quite simple. Vadodara Subscribers.Explore LIC's pension plans for a secure retirement. This scheme’s inception date is May 15, 2009, and it belongs to the Scheme E asset class. Please click on . The NPS is looked after by the Pension Fund Regulatory and Development Authority (PFRDA) . The scheme is differentiated into NPS Tier 1 and NPS Tier 2 accounts.

Eligibility

Choose reliable pension schemes, calculate benefits, and ensure financial stability in your golden years. Set up your CKYC & set up EasyPay without any paperwork. Unlock the benefits of India's National Pension Scheme (NPS) in this comprehensive guide.National Pension Scheme (NPS) is a government-sponsored pension scheme to provide income security for all sector citizens.Overview

What Is NPS(National Pension System) And How Does It Work?

This pension calculator illustrates the tentative Pension and Lump Sum amount an NPS subscriber may expect on maturity based on regular monthly contributions, percentage of corpus reinvested for purchasing annuity and assumed rates in respect of returns on investment and annuity selected for.

You can invest in both equities and debt instruments as per your financial goals and risk appetite.National Pension System (NPS) is a pension cum investment scheme launched by Government of India to provide old age security to Citizens of India. National Pension System (NPS) Launched in 2004, the National Pension System is a trusted old pension scheme in India that is backed by the Indian government. The NPS was launched in 2004 .National Pension System (NPS), Regulated By PFRDA, is an important milestone in the development of a sustainable and efficient voluntary defined contribution . It was opened to all sections in 2009.

Open NPS Account Online

The new eNAPSA has re-engineered the member and employer record management process to the Know Your Customer (KYC) model which entails that the member details such as national . Skip to main content; 8976862090 +91-22-68276827; Branch Locator; Language Selector. NPS seeks to inculcate the habit of saving .

National Pension System

The National Pension Scheme Authority has deployed the newly upgraded eNAPSA which allows for quick and seamless online claims processing. Eligible for tax deduction up to 10% of salary (Basic + DA) under Section 80 CCD (1) within the overall . In an effort to tackle the challenge of ensuring sufficient retirement funds for every individual in India, there’s a focus on finding a sustainable long-term . This scheme has been introduced by Pension Fund Regulatory and Development Authority (PFRDA) to promote old age income security to . NPS seeks to inculcate the habit of saving for retirement amongst the citizens.

Investment managed. Here are some of the benefits of investing in this scheme that’ll help you get a better understanding of why you should invest in NPS.Top 8 types of retirements plans in India are: 1. National Pension System (NPS) is a voluntary, defined contribution retirement savings scheme designed to enable the subscribers to make optimum decisions regarding their future through systematic savings during their working life. Select the investment plan as per your risk appetite. National Pension System (NPS) is a defined contribution pension system introduced by the Government of India as a part of Pension Sector reforms, with an objective to provide social security to all citizens of India. Information on war . A subscriber can contribute regularly in a pension account during her working life, withdraw a part of the corpus in a lumpsum and use the remaining corpus to buy an annuity to .Here are some of the most popular pension schemes in India.Low cost: The NPS is one of the most cost-effective pension schemes in India.

Pensions in India

National pension system.Here are certain things to know about the National Pension Scheme or NPS before you invest in it: The government of India offers the NPS.Let’s take a look at some of the best pension plans in India. Non-Resident Indians (NRIs) are also eligible to join National Pension Scheme.What is NPS? The National Pension Scheme (NPS) is the retirement scheme of the Government of India.NPS or National Pension Scheme calculator allows an individual to compute the provisional lump sum and pension amount a subscriber, under NPS, can expect at retirement based on the contributions made monthly; the annuity purchased, the expected rate of returns on investments, and the annuity. Regulator and Entities for NPS.Apply Online NPS by KFintech.

National Pension System

NPS is an initiative undertaken by the Government of India with the aim of providing retirement benefits to all the citizens of India.National Pension Scheme (NPS) is a government sponsored pension scheme.50 lakhs for contributions made towards your NPS account. Since May 2009, the NPS has also covered many people who work for themselves or in the unorganised sector.NPS is a market-linked defined contribution scheme that helps you save for your retirement. It is administered and regulated by PFRDA.National Pension System (NPS) is a defined contribution pension system introduced by the Government of India as a part of Pension Sector reforms, with an objective to provide social security to all citizens of India. The ongoing state elections have intensified the political conflict surrounding the choice between maintaining the National Pension System (NPS) and returning to the Old Pension . The scheme is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). NPS subscribers are often between 18 and 65 and are expected to contribute a certain amount to the scheme to make a retirement corpus. In order to encourage savings, the Government of India has made the scheme reassuring from security point of view and has offered some attractive benefits for.National Pension System (NPS) is a voluntary retirement savings scheme laid out to allow the subscribers to make defined contribution towards planned savings .

What is National Pension Scheme, Benefits, Eligibility and Returns

· National Pension Scheme (NPS) The National Pension Scheme (NPS) ensures financial independence after retirement. In India, NPSs are regulated by the Pension Fund Regulatory and Development Authority (PFRDA), which is part of the finance ministry. A+; A; A-A; A; About Us. NPS is voluntary for subscription by an individual to make contributions to his/her Individual Pension Account . Benefits of NPS.The National Pension Scheme is open to all Indian citizens between the ages of 18 and 70 years. It is one of the most .NPS or National Pension Scheme calculator allows an individual to compute the provisional lump sum and pension amount a subscriber, under NPS, can expect at . It brings an attractive long term saving avenue to effectively plan your retirement through safe and regulated market-based return.

Types of Retirement Plans in India

50,000/- under Section 80 CCD (1B) over and above Rs. There have been many changes in NPS by the .

National Pension System — Vikaspedia

Next, select a pension fund manager.

NPS (National Pension Scheme)- Eligibility, Features & Benefits

The National Pension System (NPS) stands out as a great option, providing not only a path towards retirement stability but also substantial tax-saving opportunities.Users can get details about various types of pensions such as retiring pension, retirement gratuity, disability pension, invalid pension, family pension, etc.National Pension System (NPS) is a defined contribution pension. You also have the option to create a customised plan. Once you find it suitable, it’s only then that you should think about how to use NPS for retirement planning and for getting a regular . 4:00 PM - 5:30 PM 1:30 hours. Tier I – Pension account (Mandatory A/C - Tax benefit available) Tier II . NPS account holders. Individuals who are employed and contributing to the NPS (National Pension System) will enjoy tax benefits on their own contributions as well as their employer’s contributions as follows.Context: This article is based on the news “ It is time for India’s 97% to speak up against the Old Pension Scheme ” Which was published in the Live Mint.

Old Pension Scheme (OPS) Vs New Pension Scheme (NPS)

You need to comply with the Know Your Customer (KYC) norms as per the Subscriber Registration Form (SRF). The eligibility criteria to open an NPS account for various categories is as follows: You should be between 18 and 70 years of age as on the date of submission of your application to the PoP / PoP-SP, or online through e-NPS.National Pension System under the Pension Fund Regulatory and Development Authority (PFRDA) takes the citizens under the affordable social security .National Pension Scheme - NRI.

Tax benefits: Contributions to the NPS scheme are eligible for tax deductions under Section 80C and Section 80CCD (1B) of the Income Tax Act, 1961.

![What is National Pension Scheme and How Does it Work in 2021 [Explained]](https://blog.arihantcapital.com/wp-content/uploads/2021/01/What-is-National-Pension-Scheme-Benefits-Tax-Saving-Investment-and-Plans.png)

Moreover, you can also claim an exclusive deduction of Rs. NPS was introduced by the Central Government to help the individuals have income in the form of pension to take care of their retirement needs. Minimum contribution: The minimum annual contribution to the NPS scheme is ₹1,000.The National Pension System (NPS) is a defined contribution pension system administered and regulated by the Pension Fund Regulatory and Development Authority (PFRDA), . The Pension Fund Regulatory and Development Authority (PFRDA) regulates and administers NPS under the PFRDA Act, 2013. Apply for National Pension System Online at NPS KFintech. My Date of Birth is: The scheme Indira Gandhi National Old Age Pension Scheme (IGNOAPS) is one of the five sub-schemes of the National Social Assistance Programme (NSAP).But before you go for retirement planning with the National Pension Scheme (NPS), it is very important to fully understand how NPS works and whether it is the right retirement savings product for you or not. Like most National Pension Schemes in India, investments in the SBI Pension Fund Scheme E- Tier II do not attract income tax up to a limit.

National Pension Scheme (NPS): Features, Benefits & More

Understand the tax benefits, key features, and eligibility criteria of .On January 1, 2004, the Government of India announced the National Pension Scheme (NPS), which is a pension plan that is contributory in nature. Monthly MF investment.

About NPS

Your NPS contributions are allocated to 4 different asset classes: .

NPS (Nation Pension Scheme) Interest Rates 2023

Upcoming Events Webinar on Subscriber Awareness Program (SAP) ×.