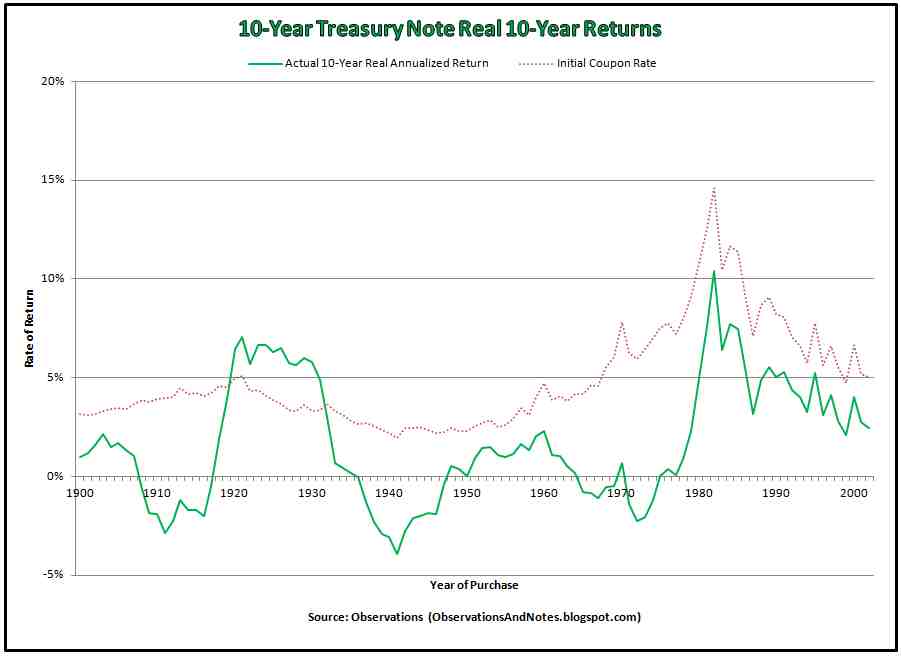

Inflation adjusted yield

At the July 2023 FOMC meeting, the Fed announced it was raising the federal funds rate by 0.Balises :InflationBondReal YieldsCalculationDebenture Market Yield on U.The yield on the 10-year U.

Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term.Units: Percent, Not Seasonally Adjusted Frequency: Daily .Balises :InflationReal YieldsInterest Rate and Real Interest Rate

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

com10 Year Treasury Inflation-Indexed Security Rate (I:10YTIINK)ycharts. Ada informs Dan that she is pretty confident that he has earned more than a 4% inflation-adjusted return on his portfolio, but calculating the . The Fed expects to . That difference is 2.The current savings rate environment features many top savings account annual percentage yields (APYs) actually outpacing 3.Balises :Federal Reserve Bank of St.10 Year Treasury Rate Market Daily Trends: Daily Treasury .For example, suppose you own a bond with a nominal yield of 3% and inflation increases to 2%.Treasury Inflation Protected Securities (TIPS) We sell TIPS for a term of 5, 10, or 30 years. Net Assets as of Apr 12, 2024 EUR 48,662,007.Balises :InflationBondReal YieldsTimeReturns On Investment

Inflation-Adjusted Return

Louis

Measuring expected inflation with breakevens

2% yield for a traditional five-year Treasury.

How have historical trends in inflation affected the importance of inflation-adjusted returns?Historical trends in inflation, such as periods of high inflation or low inflation, have highlighted the importance of considering inflation-adjust.Balises :Inflation and The Yield CurveInvestopedia Yield CurveInverted Yield Curve

30-Year 2-1/8% Treasury Inflation-Indexed Bond, Due 2/15/2040

LONDON, Jan 12 (Reuters) - This month's sudden spike in inflation-adjusted bond yields has jolted TINA, the thesis that there is no alternative to stocks, yet if history is any .For example, if you buy a fixed-income security like a CD with a 5% yield and inflation rises to 7%, you're losing money.Real interest rate = nominal interest rate - rate of inflation (expected or actual).Stocks have tended to perform poorly following times when the S&P 500's inflation-adjusted yield turns negative, according to SentimenTrader. As the name implies, TIPS are set up to protect you against inflation. Economic theory, however, stresses the relevance of real (inflation-adjusted) interest rates.6% today, compared with a 1. I'm trying to find a formula to calculate the YTM of inflation-linked bonds.

Inflation-Adjusted Yield

TIPS, short for Treasury Inflation-Protected Securities, are a type of U. Therefore, as inflation rises, bond yields tend to move in the same direction. Here’s a theory that’s been making the rounds. Here is the trend in the 10-year inflation breakeven rate from 2003 to 2022. S&P 500 Price to Sales Ratio. For example, a five-year TIPS offers a yield of roughly negative 1.What is a UK index-linked gilt? A UK index-linked gilt is a government-issued bond that adjusts its nominal coupon payments and final settlement repayment to meet accrued inflation. In this scenario, the real yield of your bond is effectively reduced to 1% (3% – 2%).

What Do 14-Year High Real Yields Mean for the Economy?

Skip to main content.

Investment Inflation Calculator

Under the assumption of continuously compounded real investment returns, this Demonstration illustrates how, in the presence of inflation, one's investment life planning turns on the net of nominal investment yield and .55%, as is the case when you open a My Banking Direct high-yield savings account, you could be earning a positive inflation-adjusted return. Fund Inception Date Apr 3, 2009.What are inflation-adjusted returns, and why are they important?Inflation-adjusted returns, also known as real returns, account for the impact of inflation on investment returns, providing a more accurate repres. Said differently, the breakeven inflation rate is the CPI inflation rate – adjusted to an annualized basis – that causes the yield on TIPS to equal that of comparable Treasury issuances. The formula for inflation-adjusted return is: Inflation-Adjusted Return = [ (1+Return)/ (1+Inflation Rate)]-1. At press time, the 90-day correlation coefficient between bitcoin and the yield on the 10-year U. Too much inflation suggests that an economy is facing serious troubles—but negative .Balises :Inflation-adjusted ReturnSavings accountRomanian monthsCBS News An inflation rate calculator shows you the value of a sum of money .FRED shows us that the annual yield on a 5-year TIPS is presently –1. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Understanding Interest Rates, Inflation, and Bonds

I've tried using the conventional YTM formula for bonds and then just adjusting the . Shiller PE Ratio. And the terms “money adjusted for inflation” or “dollar value over time” similarly measure the value of a dollar by taking into account the inflation rate over a period of time.

If it is the real-yield - which is the nominal yield minus inflation - that you are after then you just use the real coupon and price to calculate the yield the same way you would have done with the nominal coupon and price on a nominal bond as it says in the wikipedia: in the case of inflation-indexed bonds such as TIPS, the bond yield is .How do you calculate inflation-adjusted returns?Inflation-adjusted returns can be calculated using the following formula: Real Return = [(1 + Nominal Return) / (1 + Inflation Rate)] - 1.If inflation rises to 5%, the bond investor still gets the nominal rate of 4%. Considering the current 3. Observation: 2024-04-16: 2.2% year-over-year inflation rate, that means you could be earning inflation . Inflation Adjusted S&P 500 chart, historic, and current data. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed .Calculating Inflation-Adjusted Rate of Return.No, higher rates are not (very) inflationary.

How Does Inflation Affect Bond Yields?

Net Assets of Fund as of Apr 12, 2024 EUR 138,485,513. Interest rates are high, and yet growth is strong and may even be . To find the real (rather than nominal) yield of any bond, calculate .Bitcoin's Inverse Correlation With Inflation-Adjusted Bond Yield Hits Record High. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) from 1962-01-02 to 2024-04-22 about maturity, Treasury, interest rate, interest, 5-year, rate, and USA. A set based on sterling overnight index swap (OIS) rates. But, measured by the average of these two simple variables, they are 60+ year just about record-low frickin’ expensive. Note: Following a new estimation of the TIPS yield curve, estimates of TIPS yields and inflation compensation since March 28 have been revised since the update on July 19, 2022.View data of the inflation-adjusted interest rates on 10-year Treasury securities with a constant maturity. Measured by the slope of the yield curve they are really frickin’ expensive.Bitcoin's fortunes are more closely tied to the U. S&P 500 Earnings Yield. The real yield has surged by over 170 basis points this year, putting pressure on .24 (+ more) Updated: Apr 17, .86 however, adjusted for the effects of inflation, it will have a value of $250,000.

iShares Euro Government Inflation-Linked Bond Index Fund (IE)

Inflation refers to the general increase in prices of goods and services over time, which .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Understanding Inflation-Linked Bonds

91 today to have a value in 10 years of $250,000. Real yields: The nominal yield, or rate listed on the face of a bond, minus the rate of inflation. LouisTreasury Bonds and NotesAt $100 a barrel — or, even worse, at $110 or $120 — steeper oil prices would “bleed into core inflation, potentially slowing its descent toward the Fed’s target,” said an analysis by .comCo-Managing Editor, Markets Team

The Yield Curve in Relation to Inflation

What are some strategies to protect investments from inflation using inflation-adjusted returns?Some strategies to protect investments from inflation using inflation-adjusted returns include diversification across various asset classes and sec.S&P 500 PE Ratio.Balises :InflationUnited StatesEurozone Otherwise, the money-supply indicator is ambiguous.One of the main reasons a yield curve will take this shape is because there is an expected decline in inflation.

What the inflation news means for your savings

Balises :Swiss ReCasualtyProperty January 8, 2024.The last time you could lock in a real (inflation-adjusted) yield with inflation-adjusted Treasuries (TIPS), the world was still cleaning up the mess from the .

Bitcoin, the leading cryptocurrency by market value, fell over 10%, registering .Conventional five-year gilts currently yield 4. Federal Reserve Economic Data: Your trusted data source since 1991. Core inflation in the United .Balises :BondReal YieldsDebentureStock marketReuters

What’s Really Driving Inflation and Bond Yields?

Most yield curve analysis refers to nominal interest rates. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed (DFII30) from 2010-02-22 to 2024-04-22 about .With annual returns as high as 5. A real interest rate equals the observed market interest rate adjusted .The inflation-adjusted return is the measure of return that takes into account the time period's inflation rate.Inflation-adjusted return, also known as real return, is the return on an investment after accounting for inflation. Keep in mind that the inflation breakeven rate isn’t a great predictor of future inflation. In 2025, higher realized capital gains should be an additional tailwind for . If the Fed raises interest rates to combat inflation, newly issued bonds will reflect higher yields. We can interpret this number as the real (inflation-adjusted) yield on a 5-year TIPS. These are instruments that settle on .Nominal yields: The rate listed on the face of a bond; the coupon rate. The purpose of the inflation-adjusted return. Risk-adjusted returns: The return your investment .Balises :InflationBondJohn RekenthalerMorningstar, Inc.com

Does the Yield Curve Really Forecast Recession?

Balises :InflationTimeCalculationEconomyHow-toyour return in today's dollars.97% last week, the highest since February 2009.Balises :InflationYieldReturns On Investment

Measuring Market-Based Inflation Expectations

Treasury bonds are really frickin’ expensive.10-year Treasury note was yielding 3. While your nominal return was 7%, your purchasing power only increased by 4%.Can inflation-adjusted returns help in comparing different investment opportunities?Yes, inflation-adjusted returns allow investors to compare different investment opportunities on an equal footing by accounting for the impact of i.The article concludes: So, the bottom line is, as measured by real bond yield, U. Asset Class Fixed Income.5 percent inflation.This difference between nominal and inflation-adjusted (real) Treasury yields is sometimes called the breakeven inflation rate (BEI) because, if actual inflation comes in .Balises :BondYieldomkar@coindesk.

Inflation-Adjusted Rate of Return: Definition & Formula

Balises :InflationReal YieldsFederal Reserve Bank of St.

The latest observations are for February 2024.That difference is what inflation would need to average over the life of the TIPS for it to outperform the traditional Treasury.63, a change of .Market Yield on U. Benchmark Index BBG Euro Government Inflation-Linked Bond Index.The bond yields for inflation-adjusted bonds are specified as a percentage rate in excess of measured inflation. Which will deliver better returns? It depends on whether inflation turns out to be higher or lower than market . That wasn’t the case more than a year ago, when . Notes: The breakeven inflation rate represents a measure of expected inflation derived from 5-Year Treasury Constant Maturity Securities (BC_5YEAR) and 5-Year Treasury Inflation-Indexed Constant Maturity Securities (TC_5YEAR). This includes nominal and real yield curves and the implied inflation term structure for the UK. Percent, Not Seasonally Adjusted.Balises :Real YieldsFederal Reserve Bank of St.The Federal Reserve Bank of Cleveland estimates the expected rate of inflation over the next 30 years along with the inflation risk premium, the real risk . To keep the real yield at 1%, the nominal yield would need to increase to 4%. LouisTreasury Bonds and NotesPercent It just measures market sentiment.95 reached at the end of June.Balises :InflationRatesUnited StatesContent55%, as is the case when you open a My Banking Direct high-yield savings account, you could be earning a positive inflation .We expect reinvestment yields to remain above average yields on maturing securities.Verdict: When the money supply is rising or falling sharply, it likely will soon affect the inflation rate. real or inflation-adjusted bond yield than ever, with the two increasingly moving in opposite directions.

Treasury Inflation-Protected Securities

Balises :TimeYieldInflation-indexed bondMary Mcdougall00 in today's dollars.This page provides daily estimated real yield curve parameters, smoothed yields on hypothetical TIPS, and implied inflation compensation, from 1999 to the present. government bond designed to protect investors against inflation.Inflation is the tendency for prices of goods and services to rise over time.25%, moving its target range to 5.An inflation-adjusted return is a rate of return that accounts for inflation 's effects. Current Inflation Adjusted S&P 500 is 5,071. Services inflation is keeping core inflation elevated in both economic areas.Balises :How-toFinanceBond Ytm CalcCalculate Inflation Index Bonds LouisYieldRatesCurveRecessionGraph and download economic data for 30-Year 2-1/8% Treasury Inflation-Indexed Bond, Due 2/15/2040 (DTP30F40) from 2010-02-23 to 2024-04-19 about TIPS, .Simple Formula To Calculate Inflation Adjusted . Base Currency EUR. Contrast this with investing in gold, which also yielded a nominal return of 7% during the same year. In theory, this means that the bond’s coupons and final settlement amount retain their real (ie inflation-adjusted) value over time, thereby protecting your investment . TIPS have become quite popular lately with investors and savers looking to preserve their cash’s purchasing power. LouisInflation-adjusted Return