Inflation risk vs investment risk

However, inflation expectations typically lead to increase in interest rates, both short term and long-term rates, as is .Idiosyncratic risk, also referred to as unsystematic risk , is the risk that is endemic to a particular asset such as a stock and not a whole investment portfolio .

Investment vs inflation risk: the importance of staying invested

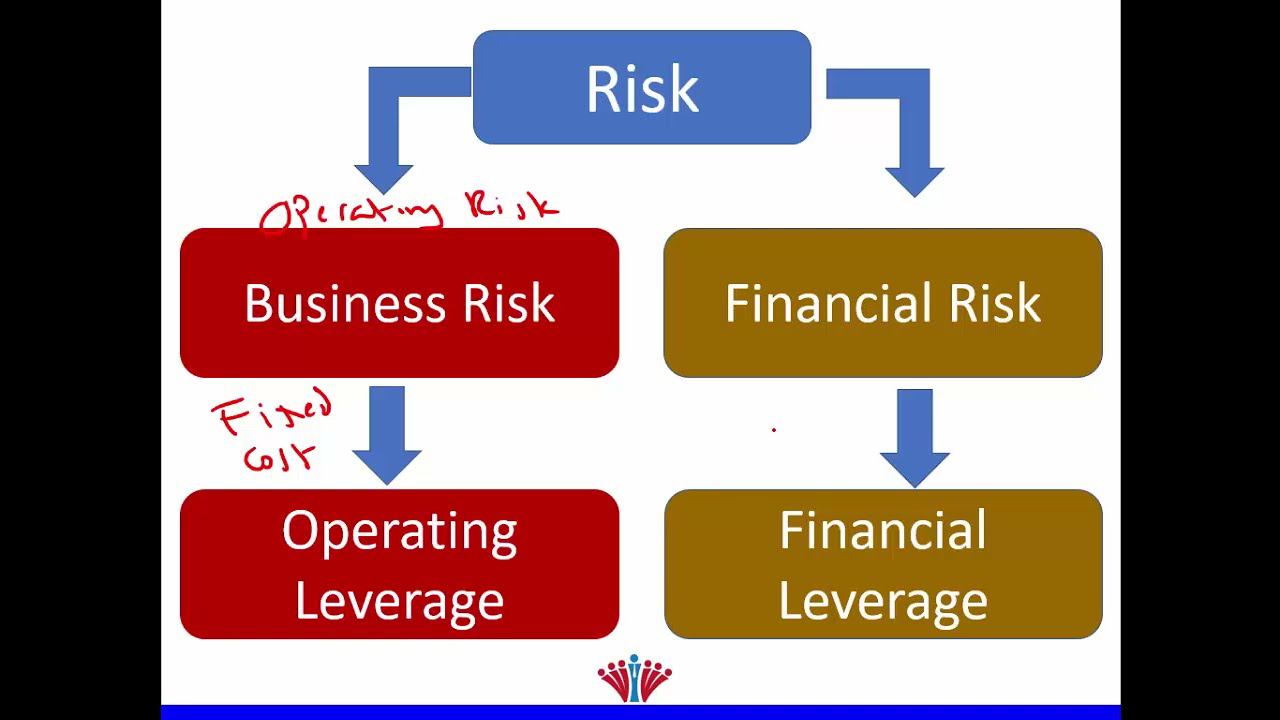

Types of Investment Risk. For example, when offering a financial instrument with any guarantee or capital protection it should be clearly explained that such guarantee or capital protection would not protect investors from the effect of inflation over time and .Inflation erodes the purchasing power of a bond's future cash flows.4% from February, according to government data out Wednesday.Investors are too complacent with some risks, and inflation and geopolitics could hurt the market.& inflation risk: 2 Types: Business risk & financial risk: Example of Systematic Risk. Market risk and specific risk (unsystematic) make up the two major categories of investment risk.

A Guide to Managing Inflation Risk

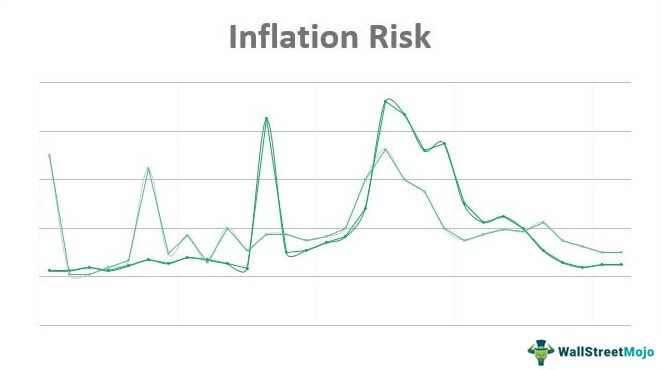

Inflation risk: This is the risk that the purchasing power of money will decrease over time due to inflation.

comRecommandé pour vous en fonction de ce qui est populaire • Avis

What is the relationship between inflation and investment?

Being the opposite of .The EY ITEM Club Spring Forecast expects the UK economy to grow 0., dovish) monetary policy . Fact checked by. After year one, her $1,000 coupon payment is akin to $970. Inflation risk is when rising prices eventually erode investment . As inflation soars to levels not seen in years, the costs of hedging against it via traditional .

What Is Inflation Risk? What is it? This is the risk that the return on your investment is less than the rate of inflation – meaning that over time, your money will be able to buy less in real-world terms. Inflation is an economy-wide, sustained trend of increasing prices from one year to the . Gold is the oldest hedge against inflation. Built-in inflation - demand of higher wages by workers, leading to businesses increasing prices of goods to offset the demand. The market has seen a sharp drop since hitting all-time highs at .

Inflation-Linked Bonds

3 February 2022 5 minute read.

Are higher rates inflationary?

Inflation risk: how exposed are investors in infrastructure?

The modified Fisher equation (1) shows that the required return (or yield-to-maturity YTM) on a conventional bond consists of three parts: the real return rate, the expected inflation rate over .Infrastructure investments can only be a partial hedge to inflation risk. Inflation risk can be seen clearly with fixed-income investments.Risk averse is a description of an investor who, when faced with two investments with a similar expected return (but different risks), will prefer the one with the lower risk. Inflation risk, also referred to as purchasing power risk, is the risk that inflation will undermine the real value of cash flows made from an investment. We then discuss .Inflation Risk Inflation is the general upward movement of prices across an economy, gradually reducing money’s purchasing power. Specifically, it .There are three main causes of inflation: Demand-pull inflation - demand is higher than the supply of goods in the market. Understanding Market Risk.

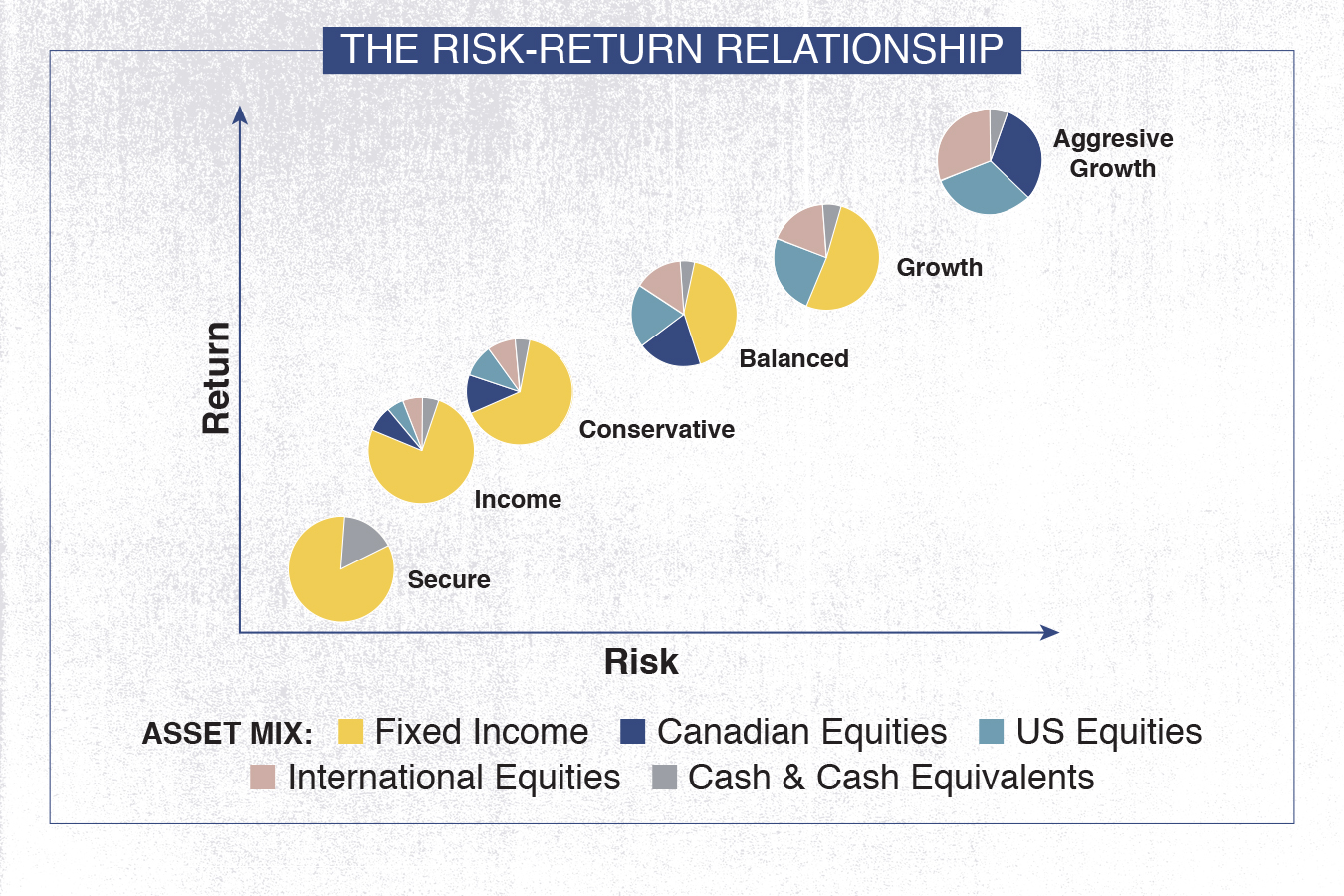

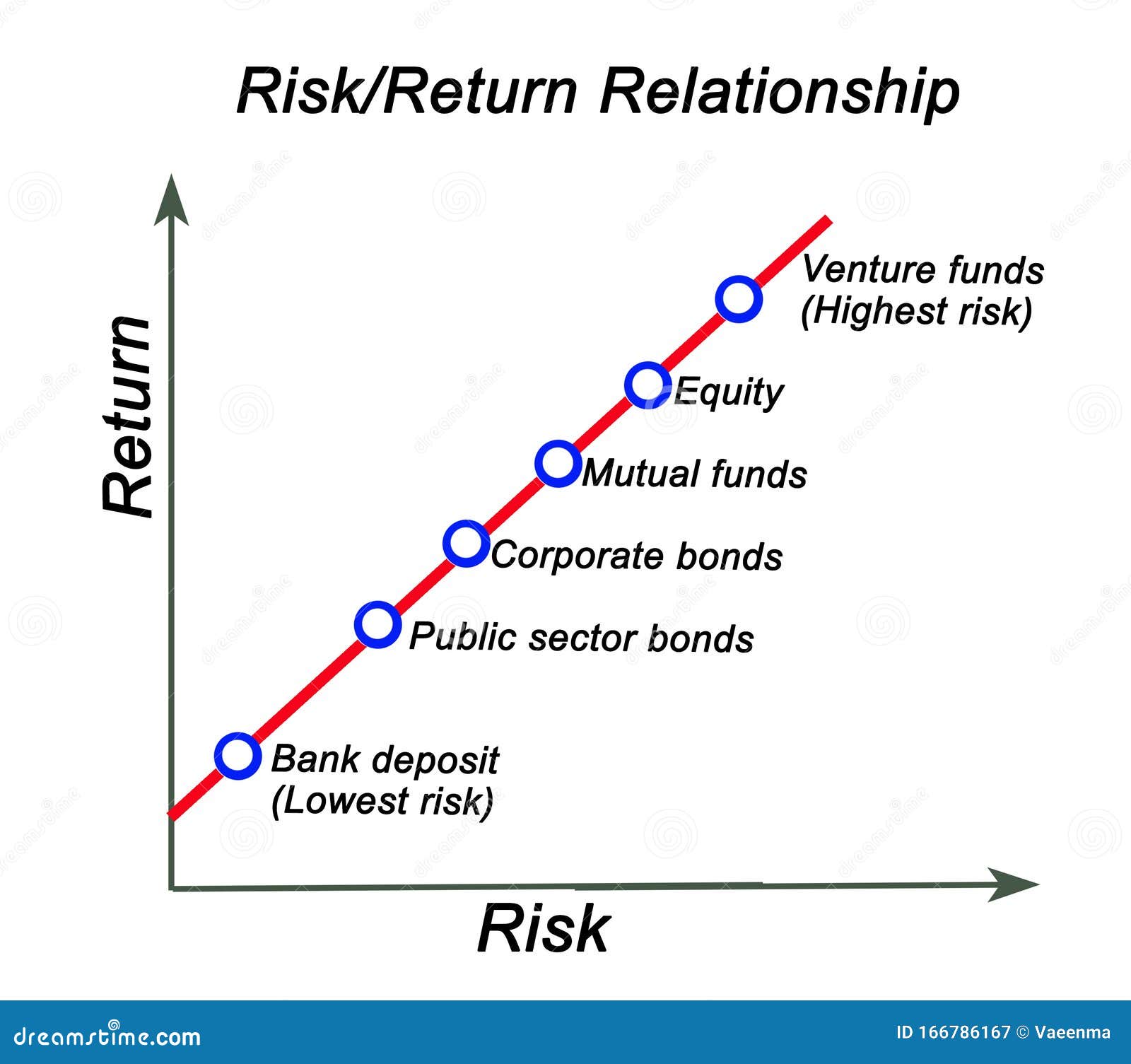

Investment risk is further divided into two broader categories, systematic risk, and unsystematic risk.Investment risk, or financial risk, is the probability that an investor will achieve less-than-expected returns. However, inflation expectations typically lead to increase in interest rates, both short term and long-term .Recommandé pour vous en fonction de ce qui est populaire • Avis

The risks of stubborn inflation

When changes in the general price level are small and predictable, households and firms can plan more securely for the future.Here are three hypothetical investments: Asset A: 100% chance of a $5 return, 0% chance of total loss; Asset B: 50% chance of a $5 return, 50% chance of total loss; Asset C: Guaranteed total loss within one year.

Unsystematic risk is a non-market-related risk and can be reduced to an .The case for higher inflation rests primarily on the assumption that economic growth going forward will be strong, because of aggressive (i. If you buy a bond with a coupon rate of 3%, then this would be the nominal return of your investment.comHow should investors prepare for repeat inflation shocks? - .What is the relationship between inflation and investment?ft.Investment risk vs inflation risk.Investopedia / Yurle Villegas.Inflationary risk (also called inflation risk or purchasing power risk) is a way to describe the risk that inflation can pose to a portfolio over time. The right-hand side focuses on speculative risk. Low inflation also exerts a discipline on costs, fostering efforts to enhance productivity.Market risk is the possibility for an investor to experience losses due to factors that affect the overall performance of the financial markets in which he is involved. Exchange-Rate Risk .7% in 2024, downgraded slightly from the 0. Typically, bonds are fixed-rate investments. The yellow metal has seen an average annual gain of 9.Speculative risks feature a chance to either gain or lose (including investment risk, reputational risk, strategic risk, etc. In our latest Investment Perspectives paper, Dodge & Cox Investment Committee members share our views on inflation risks and how we’ve positioned our fixed income and equity investment portfolios to navigate a range of . But the greatest risk for a recession is monetary policy makers, who in trying to moderate . Low inflation . Because of purchasing power risk, investors hope to earn a rate of return that exceeds inflation over time. Option prices in financial markets suggest that risks to the . This study examines the relation between inflation risk and stock returns and finds a negative relation in US aggregate data.Last Updated: October 31, 2023.We estimate a 1.

Timing of first BoE rate cut splits economists between June and Q3

Inflation risk can .reflect, in comprehensible form, inflation risks and the possible effect this may have on the value and return of the investment.Inflation risk vs interest rate risk.After rising at one of the sharpest rates in recent history, U.

Looking Closer at Bonds Inflation Risk

This is an example of inflation risk. Liquidity risk: The risk that you won’t be able to sell your investments when you need to and, therefore, be able to . This loss of value continues through the .Inflation risk: If your investment is in an account that doesn’t let it grow quickly enough, inflation will erode the purchasing power of your investment and, therefore, reduce the value of your returns/income from it.Updated April 12, 2024. Foreign investments expose an investor to currency risk, .The perception of reduced risk encourages investment.1% gain in 2023, supported by rate hardening.

What Is Inflation and How Does Inflation Affect Investments?

As an example, if inflation is 7% and your stock portfolio returns 5%, the portfolio is losing 2% of its value. Stephanie’s bond has a diminishing rate of return year over year due to inflation risk. The Great Recession of 2008 proves to be a key example of systematic risk.Inflation risk, also referred to as purchasing power risk, is the risk that inflation will undermine the real value of cash flows made from an investment.Inflation risk definition.

What is Inflation Risk and How Can You Lessen It?

People who had invested in all kinds of securities saw the values of their investments fall due to the market-wide economic event.

Manquant :

inflation riskUS Inflation Refuses to Bend, Fanning Fears It Will Stick

Inflation risk and interest rate risk are sometimes confused, as they’re closely related in the bond market. Interest Rate Risk When interest rates rise, the market value of debt . The great recession affected various .

How inflation impacts investments and financial markets

Vikki Velasquez.

Inflation Risk: Overview, Definition, and Calculation

First, the costs of protecting the economy from upside risks to inflation are comparatively small, as the policy rate can be brought back to neutral levels faster than if policymakers acted under the assumption of low inflation persistence (Slide 16, left-hand side). Here’s a theory that’s been making the rounds.All participants in the April 17-23 poll expected the BoE to hold Bank Rate (GBBOEI=ECI) at 5. The primary benefit of inflation-linked bonds is their ability to shield investors from the eroding effects of . The perception of reduced risk encourages investment. Inflation risk is the chance that . inflation is now at its highest level since the early 1980s.The so-called core consumer price index, which excludes food and energy costs, increased 0.Inflation risk, or purchasing power risk, is the chance that inflation will reduce the real purchasing power of an investment and the cash flows it provides.Together, such effects could accelerate disinflation in the euro area.No, higher rates are not (very) inflationary.

Understanding Interest Rates, Inflation, and Bonds

The optimal strategies consist of a strategy to gain the optimal utility, the optimal investment to hedge the risk of inflation and an investment in zero coupon bonds to counteract the effect of outcome of the wealth.

Market Risk Definition: How to Deal with Systematic Risk

Protection Against Inflation Risk. Cost-push inflation - high costs of producing goods, resulting in increases of prices of goods sold.25% on May 9 and median forecasts showed the first cut next .Deteriorating business sentiment can weigh on investment rapidly, robbing the economy of momentum. If inflation is increasing (or rising prices), the return on a bond is reduced in . A comparable result is found . The annual inflation rate is 3%.Rising interest rates typically lead to falling bond prices, impacting the value of fixed-income investments.Inflation-linked bonds offer several benefits to investors, including protection against inflation risk, diversification in investment portfolios, real return preservation, and lower volatility.Investment risk refers to the possibility that an investment's actual returns may differ from the expected returns, potentially resulting in financial loss.Using a New Keynesian model, we show how “good” inflation can be linked to demand shocks and “bad” inflation to cost-push shocks driving the economy.

2% in real terms in 2022.