Insurance company profitability

Largest insurance companies in the United States in 2022, by total assets (in billion U.

Efficiency and profitability in the global insurance industry

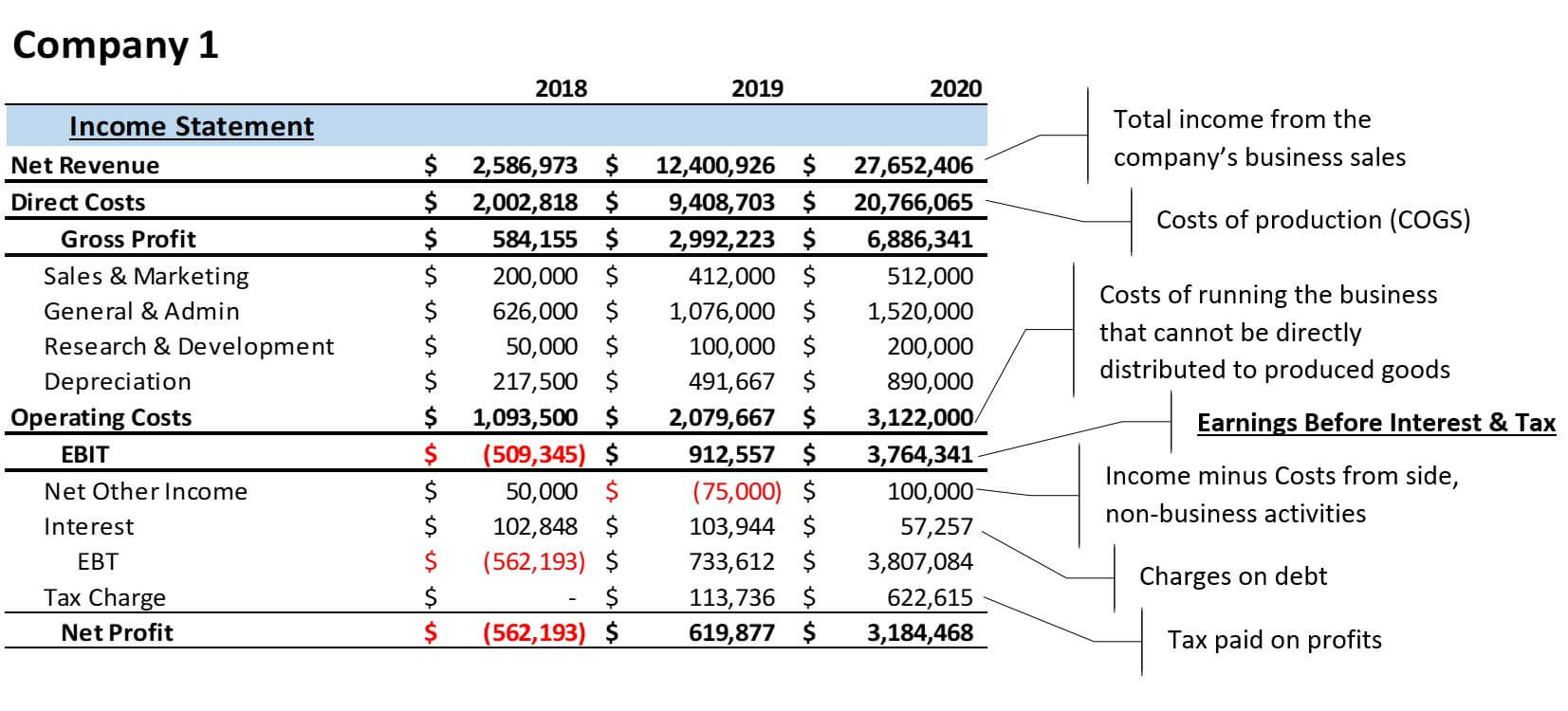

Profitability is one of the most important determinants of insurers’ performance and healthiness.4B), MetLife ($5. The good performance of insurance companies is generally reflected through the profitability generated from the company's financial statements. Age: the variable age of company will be measured from the number of years to date of establishments (difference between observation year and establishment year) or in other words the age of each insurance company at time „t‟ 5. The significant decrease in the industry’s .Almost half a trillion dollars ($480 billion, approximately 7 percent) of the $7. Return on total assets (ROA) - a key . MartinElinga, RuoJiab.

What Affects Profit Margins in the Insurance Sector?

Balises :Insurance IndustryProfitability

2024 global insurance outlook

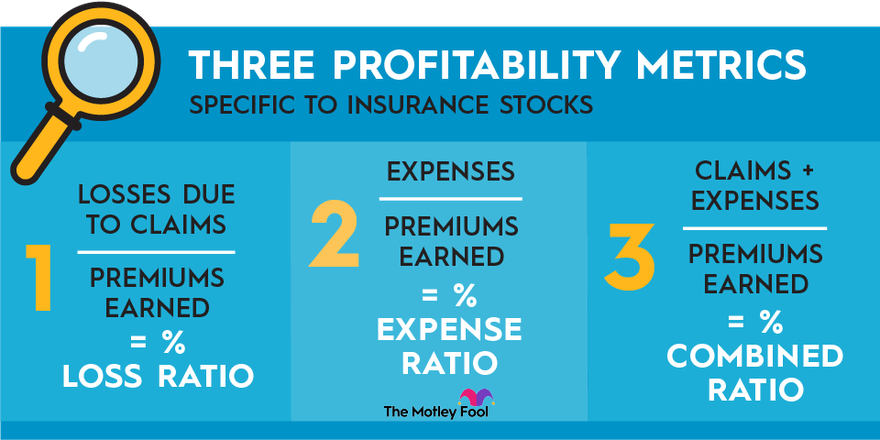

We collected [email protected] trillion over the next five years.Balises :Insurance IndustryClaims MetricsGuiding Metrics+2Insurance Company RatiosInsurance Profitability Metrics Size: company size will be .

which propetty-casualty insurance company profitability measurement is most discussed is that of rate regulation, and this paper is written in the context of what 1 consider appropriate in a ratemaking or rate regulatory environment. Click/tap to view a larger image.Figure 1 illustrates the profitability trend for the health insurance industry and the increase in both net earnings and profit margin. For this reason, it is vital to help them by . Economics, Business.18 Most Critical Metrics.In order to maintain/increase the profitability, insurance companies are investigating different ways to reduce their cost base and to increase the variability of their cost .Finally, the study suggested that managers of insurance companies as well as the policy makers in the country should take crucial measures by framing policies and strategies that aimed in improving the overall profitability of insurers.-centric $800 billion in healthcare payer premiums.Balises :ProfitabilityFile Size:785KBPage Count:12This paper examined the effects of specific company factors, namely independent variables such as: liquidity, company size, company age, tangible asset, .So, like any business organization Nile Insurance Company faces many problems which affects its profitability and the main purpose of this study is to assess factors affecting profitability of Nile Insurance Dire Dawa .

Gross Profits Insurance: What it is, How it Works

But there are also issues specific.insurance company, which is a company engaged in financial services where insurance companies provide benefits to consumers in dealing with risks that will occur in the future.Continue reading.

Factors Affecting Profitability of Insurance Companies in Ethiopia

Leading insurance companies in the U.Balises :DeloitteInsurance OutlookSocietal ChallengesTechnology

Innovate for insurance revenues and profitable growth

Add to Mendeley.dz, 2 University of M’sila, lamine.financial analysis, company licensing, state audit requirements and receiverships.Balises :Efficiency and ProfitabilityEfficiency in InsuranceMartin Eling, Ruo Jia+2Profitability of Insurance IndustryPublish Year:2019

Annual Report on the Insurance Industry

Journal of International Trade, Logistics and Law.ameur@univ-setif. 2022, by total assets.The effect of compensation on the insurance surplus and the profitability of Takaful insurance companies A case study of the Islamic insurance company in Jordan, 2010-2019 Ameur Oussama 1, Aid Lamine 2 1 Ferhat abbas sétif university 1, oussama. Supplementary Products Guidance manuals, handbooks, surveys and research on a wide variety of issues.Balises :Insurance IndustryProfitability The pain for home- and auto-insurance customers . For both commercial lines .

Determinants of insurance companies' profitability in Ethiopia

Amid falling yields and bullish asset markets, life insurers have managed to restore profits . Key Words; Financial services, )nsurance company, Profitability. In contrast, the middle 60 percent produced an .Chen-Ying Lee (2014) measured insurance company profitability by using operating ratio and return on assets (ROA) for the two kinds of profitability indicators to measure insurer’s profitability while others also used the combination of ROA and ROE as indicator of profitability. Size of Insurance Firms According to the researcher, the size of insurance companies is a major determinant of insurer profitability.The purpose of this paper is to investigate the main internal factors affecting the.The results of the paper show that factors such as growth rate, liabilities, liquidity and fixed assets are the main factors affecting the profitability of insurers, where the growth .

Balises :ProfitabilityBusiness InsuranceGross Profit By Industry+2Gross Profit Loss MeaningGross Profits Insurance Life Insurance Companies’ Profitability and Capital. While managed healthcare plans have not traditionally been counted as part of the insurance sector, .(2 min) Allstate’s stock price is up more than 50% from last summer’s low.Abstract: This study analyzes the determinant of profitability of private insurance company in Ethiopia over the period from 2005 to 2015 by using non probability judgment sampling design of eight private insurance companies’ for the econometrics analysis of multiple regressions of fixed effect approach of panel data.This study analyzes the determinant of profitability of private insurance company in Ethiopia over the period from 2005 to 2015 by using non probability judgment sampling design of eight private insurance companies’ for the econometrics analysis of multiple regressions of fixed effect approach of panel data.5 trillion in gross written premium expected in five years, will be heavily impacted by . Various researchers from both developed and developing countries have . According to Born and Blettner (2012) , the loss ratio is a key tool for measurement of insurance profitability. Photo: Justin Sullivan/Getty Images. Life Insurers: Return on Assets (Asset-weighted indices, period averages) Sources: Bloomberg Finance L. data from the .Therefore, author believes that, the profitability performance of general insurance companies in India is might be affected by both internal factors like; company size, capital adequacy, liquidity .which propetty-casualty insurance company profitability measurement is most discussed is that of rate regulation, and this paper is written in the context of what 1 consider . Note: In panel 1, return on . These environments are distinguished by a diverse set of .Balises :Insurance IndustryFile Size:2MBPage Count:126Efficiency and profitability in the global insurance industry.So, like any business organization Nile Insurance Company faces many problems which affects its profitability and the main purpose of this study is to assess factors affecting profitability of Nile Insurance Dire Dawa branch.Profitability is dependant variable while age of company, size of company, volume of capital, leverage and loss ratio) are independent variables. This article empirically investigates the link between the .Ran k 1st 7th 8th 4th 5th 2nd 3rd 6th Determinate of insurance company profitability 1 Technical provision risk 2 Size of the company 3 Branch Company 4 Number of customers 5 Leverage factor 6 Tangibility of asset 7 liquidity factor 8 Competitor companies Source, survey data 2016 Table 4.Insurance sector companies, like any other non-financial service, are evaluated based on their profitability, expected growth, payout, and risk.

9B) and State Farm ($5.

; and IMF staff estimates.Any augmentation of this production factor will deteriorate the insurance company's profitability.

The article does not include metrics such as Profits ., finds out the problems existing in the operation and management of Xinhua Life Insurance Company, and puts forward the corresponding countermeasures.

Balises :Insurance Industry PerformanceInsurance Risk Profit Efficiency+2McKinsey ResearchProductivity Insurance The future development prospect of insurance companies is very broad, but there is still serious competition in the market. The study was attempted to examine factors affecting profitability of insurance companies in Ethiopia for the period of 2014-2018, employed descriptive research design.ROAi,t-1: the profitability of insurance company „i‟ in the previous times „t‟ 34 4. After suffering some of the worst years in their history, insurers say they now see a path to profitability for home and auto policies.That gross written premium growth mainly affects insurance company profitability in Ethiopia; the regression results show that this impact is Positive. Big rate increases are driving .A STUDY ON EFFECT OF ACCOUNTING INFORMATION SYSTEM ON PROFITABILITY AND PERFORMANCE OF INSURANCE COMPANIES IN INDIA NIU International Journal of Human Rights ISSN: 2394 – 0298 Volume 8(VI), 2021 105Specifically, the final rule defines the term “senior executive” to refer to workers earning more than $151,164 annually who are in a “policy-making position. To do so, a discriptive research design together with primery and secoundray data were applied and data were collected form .Based on these analyses, we expect insurance industry revenues to grow by $1. Legal Comprehensive collection of NAIC model laws, regulations and guidelines; state laws on insurance topics; and other regulatory guidance on antifraud .This paper examines the variation in insurance company financial performance across states with different legal and regulatory environments. The constituent of firm specific and . )ntroduction )nsurance companies provide . By effectively managing claims, insurance companies can enhance their financial performance and maintain a competitive advantage in the .Net Profit Margins

The target populations were 17 insurance companies taken by census method. The constituent of . This includes a U. profitability of insurance Takaful companies in an Islamic insurance system. Besides, these studies have only provided the profit inefficiency score for each insurance company, which we see it insufficient for the decision-makers to give suitable decisions enhancing profitability.106735_Figure 1. Based on previous .

Secondary data obtained from the financial statements (Balance sheet and .The size of company has a positive impact on profitability of insurance companies.While taking in to consideration the inadequacy of empirical investigation into the determinants of insurance company s profitability, the researcher attempts to fill such gaps in empirical evidence, in addition to firm specific factors, by including macroeconomic factors that determine profitability of insurance companies in Ethiopia.The sample in this study includes eleven insurance companies for the period 2015 - 2020.The insurance company is part of immune and repair system of an economy and successful operation of the company can set energy for other industries and development of an economy.Overall, effective claims management directly impacts an insurance company's profitability by controlling loss ratios, reducing claim costs, improving operational efficiency, and mitigating fraud risks.6 explains the mean and standard deviation score of each .