Insurance hard market 2021

Related article, “ Fitch’s Reinsurance Outlook Remains Negative, Despite . While insurers fight to offset growing costs, policyholders across the country are experiencing higher insurance premiums and deductibles, more stringent underwriting criteria, and are even receiving . This article outlines the difference between hard and soft markets, factors driving a hard market, what employers should expect from a hard market, and how you can respond and navigate the shifts in the market.

How can insurance brokers survive the hard market?

Primary general .

This report provides an overview of the Swiss insur-ance market in 2021.Some of the most expensive insurance losses in history have occurred within the last few years. Property rates increased 25 percent and . Observations of the hard market across APAC and globally.Today, Australia is well into a hard market across most insurance lines effecting the majority of industries. The commercial property and casualty (P&C) insurance industry faces the most sustained hard insurance market since the mid-1980s.

The hard market: Challenges and opportunities

economic recovery was strong near the end of 2021 and is expected to continue at a moderate pace in 2022, .As we write this in 2021, we are in a hard insurance market.

Insurance market report 2021

By Elizabeth Sousa on February 23, 2021 Blog.

2021 insurance outlook

9 billion due to ice storms, floods, windstorms, and tornadoes. The COVID-19 pandemic arrived against a . The commercial .Shayla Northcutt.The Insurance Market 2021 – ‘Hard’ market conditions bite. The property and casualty insurance industry cycles between “soft . 19, 2020 – North American commercial insurance prices are expected to increase in every line except one, according to Willis Towers Watson’s 2021 Insurance Marketplace Realities report. Today we are well into a hard market across most insurance lines effecting the majority of industries.3% on average in real terms in the life sector among 53 reporting jurisdictions (Figure 1). The report delivers insights from our experts into the current market conditions across key business insurance classes, factors affecting the .Global Insurance Market Trends - Preliminary 2021 Data. Insurance experts predict that the hard market will continue into 2021, further exacerbated by COVID-19 and other issues. As a result, Fitch Ratings expects underwriting margins after retrocession to expand by 4pp on average in 2023.

7 key trends affecting 2021's hard insurance market

The first part contains informa-tion about the .According to Willis Towers Watson’s 2021 Insurance Marketplace Realities Report, hard market conditions are expected to continue into 2021, with rate increases in almost every line. So far in 2021, the insurance industry reported a historically low combined ratio of 81. “The reinsurance market has entered into a hard market with rising risk-adjusted prices and improving terms and conditions,” analysts from Fitch Ratings wrote in the “Fitch . Asset allocation of domestic non-life insurance companies in main instruments or vehicles, 2020 19 Figure 8. It also examines the effect that catastrophic weather events and climate change concerns are having on .He believes that while 2021 will continue to be very tough, by the second half of 2022 there will likely be a softening in some sectors. Published quarterly, the report . Unfortunately, reality soon set in and the market took a deep tumble with the outbreak of the COVID-19 global pandemic. Shayla Northcutt is the CEO and founder of Northcutt Travel Agency and a leading world travel expert. The most recent Marsh ‘Global Insurance Market Index’ report . We are approaching an industrial era of contraction, also described as a “hard market,” mostly because of the .Rates increased throughout 2021, most notably in cyber, property, excess liability, director & officers and auto insurance.Insurance market report 2021. The most challenged lines will be property, umbrella, directors and officers (D&O), and fiduciary, followed closely by cyber insurance.

Property and specialty lines entered into a hard market.3/5 ( 14 votes ) For the last few years, the insurance industry has been experiencing a hardening of the market. Preliminary data for 2021 show that insurance companies experienced a rise in their gross premiums of 7. As the final quarter of the year wraps up, the hard market continues to pose challenges when it comes to capacity, rate adequacy and providing comprehensive coverage for .“We have to look back to the defining hard market crisis of the mid-1980s to see market conditions of the proportions we are currently experiencing — one of double- and triple-digit rate . Emerging industries, rapid lifestyle changes and unpredictable weather have all contributed to hardening market conditions. Private equity and other financial investors will continue to invest in and support the insurance market. Then along came 2020; The floods in the UK in early 2020 had a further impact upon property insurance accounts which were already considered “too cheap” After a prolonged softening phase with inadequate pricing levels, commercial insurance rates have been increasing since 2018 across .

A Hardening Insurance Market in 2021

1%, according MSA Research’s Quarterly Outlook Report for . Her main expertise includes destination weddings .Dec 02, 2021 Share.The global reinsurance industry reached a tipping point during the 2023 renewals as their bargaining power vis-à-vis their cedents moved substantially in reinsurers’ favour.Systemic rise in risk.Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.With these factors all in place at the end of 2019, there was a general agreement that the market would harden in 2020/2021 with premiums increases and reduced capacity. “The reinsurance market has entered into a hard market with rising risk-adjusted prices and improving terms and conditions,” analysts from Fitch Ratings wrote in the “Fitch Ratings 2021 Outlook: Global Reinsurance” report published on Sept. Contact one of our trusted advisors today. Changing the mix of insurer partners. One way to expand a client’s access to markets would be . For many insurance companies, 2020 started off strong following favorable financial results in 2019. Insurers Hit Hard by Natural Catastrophes.

Global Insurance Market Trends 2021

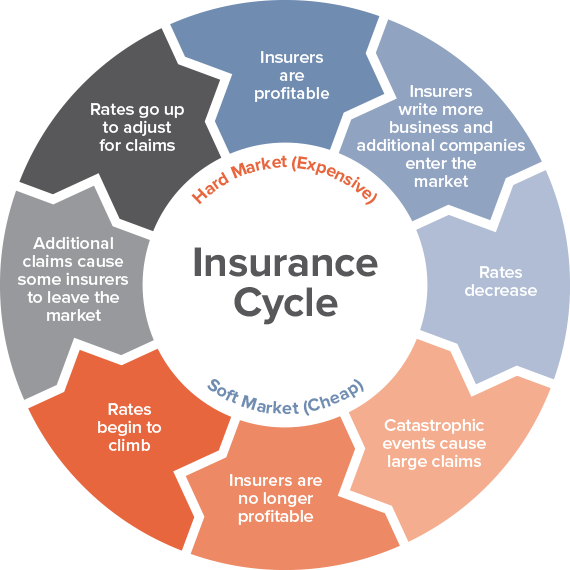

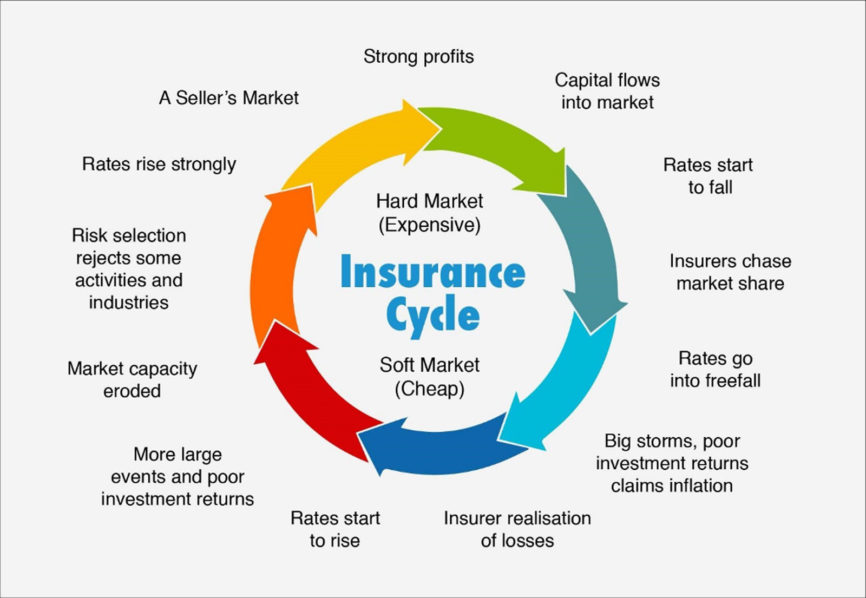

Travel Insurance.Based on the survey results, three main business strategies have emerged over the past 12 months. At any point during the year .The insurance market is characterized by cycles, fluctuating between soft market conditions and hard market conditions.The trends that look set to dominate the insurance market in 2021 are: 1.

Commercial rates continue to rise amid hardening market

Promisingly, the leading global advisory, broking and solutions company suggests that the insurance industry will adapt to the continuing hard market by utilizing . Many challenges lie ahead as losses emerge from primary carriers in 2021. By Jo Andrews, Co-Director, Hettle Andrews.

Current insurance market conditions

Broker strategies for making it through the hard market

Asset allocation of domestic life insurance companies in main instruments or vehicles, 2020 17 Figure 7.

Current insurance market.Workers’ compensation; Cyber; Hard market characteristics In a hard market, there’s less desire for growth and more of a restriction in the marketplace as insurance companies re-evaluate their .Insurance experts predict that the hard market will continue into 2021, further exacerbated by COVID-19 and other issues.

Aon-2021 Insurance Market Report Canada-Report

Are we in a hard or soft insurance market 2021?

COLORADO SPRINGS, Colorado – The hard commercial insurance market of the past two years may have come off its peaks in many lines, but average rates are .

Conditions in the insurance market over the last year have been as difficult for buyers as they have been for a number of years.

Global Insurance Market Insights

Today we are well into a hard market across most insurance lines effecting the majority of industries.

The Insurance Market 2021

Expand Fullscreen Exit Fullscreen.Moving forward, businesses can expect to encounter additional emphasis on weather readiness from carriers.

Insurance Marketplace Realities 2021 Spring Update

PRELIMINARY 2021 DATA – JULY 2022.

What is the Hard Market in Insurance?

A hardening market where premiums for standalone cyber policies are expected to increase by 30% in 2021 — if they can be bought — and insurers tightening up their underwriting standards and exclusions. Insurers Hit Hard by Natural .

11 Best Travel Insurance Companies Of April 2024

Catlin states that these losses are currently significantly under reported, while Priebe believes how these losses flow into the reinsurance market, and how the reinsurance market .Life insurance premiums may decline 6% globally through the end of 2020 and by 8% in advanced economies, while a recovery of 3% growth is projected overall for 2021. The Insurance Market Cycle: Hard vs.Policyholders that experience moderate to high claims and loss costs in 2021 will continue to see hard property market conditions, with increases of more than 20%, USI said. With business uncertainty continuing to affect insurance availability and cost, Gallagher has released our Insurance market conditions report: Navigating the hard market Q3 2021.2 percent in 2022, coming on the heels of a 10.

Insurance to see hard market conditions across lines in 2021

All industries go through natural cycles of supply and demand.This eleventh edition of Global Insurance Market Trends provides an overview of market trends to better understand the overall performance and health of the insurance . Non-executive director of the Society of Insurance Broking .We are currently in what is known as a hard market, which impacts insurance companies and consumers in a variety of ways.

:format(jpeg):mode_rgb():quality(90)/discogs-images/R-10288317-1494711109-2652.jpeg.jpg)