Invest europe 2022

The Russian Federation’s invasion of .The International Private Equity and Venture Capital Valuation (IPEV) Guidelines set out recommendations, intended to represent current best practice, on the valuation of Private Capital Investments.Invest Europe, formerly known as EVCA, European Private Equity & Venture Capital Association represent the private equity community across Europe, helping to connect and inform private equity firms and .Investment Report 2022/2023: Resilience and renewal in Europe. A record 672 companies were funded in 2021, a result of a significant increase in growth investments as well as the continued increase in venture capital activity. Download PDF 334. After the recovery from the effects of COVID, 2022 was marked by volatility, .The 2022 Private Equity Activity Report from Invest Europe, published on 3 th of May 2023, reveals that fundraising in Europe experienced an exceptional year.

Conferences

Invest Europe, the association representing Europe’s private equity, venture capital and infrastructure sectors, as well as their investors, today published ‘The Performance of European Private Equity Benchmark Report 2022’, its fourth annual study of private equity returns.New Invest Europe and EIF report maps European VC ecosystem and tracks gender diversity in greater detail than ever.date : 13/07/2023. Nine films, four of which were funded by members, brought to screen the human stories at the heart of the businesses private capital invests in and highlighted the industry’s contribution to jobs, . Invest Europe ESG KPI report shows increased engagement, progress on climate change and .2022 Divestments at a glance. Invest Europe 2023 highlights.2021 was a year of record-breaking activity for European private equity as the continent’s recovery from the effects of the pandemic accelerated.The 19th annual edition of the Central and Eastern Europe Private Equity Statistics, produced in partnership with Gide Loyrette Nouel, delves into countries . Performance in Private Equity : where are we? . Invest Europe is the.Presentation as of 01/05/2023. Launching new post trade processes to service an increasingly diverse and complex investment product range. Private equity investment in the CEE region more than doubled in 2021 to reach its highest recorded annual value, €4. Under these headings, you can find exclusive Invest Europe data, as .

Invest Europe: 2022 CEE Private Equity Statistics Report

Jim Strang Conference Co-Chair - Chairman of the Board, Hg Capital Trust .

SOFIDY EUROPE INVEST

The new “Invest Europe ESG Reporting Guidelines: Setting the industry standard for ESG reporting” encompasses the most comprehensive and advanced guide on ESG . Actively supporting Ukraine.Invest Europe, the association representing Europe’s private equity, venture capital and infrastructure sectors, as well as their investors, today published ‘Investing in Europe: Private Equity Activity 2022’ - the most comprehensive and authoritative source of fundraising, investment, & divestment data, covering over 1,750 firms.

InvestEU Programme

En soutenant des projets capables d’attirer de nombreux investisseurs, le programme InvestEU devrait mobiliser plus de 372 milliards d'euros d'investissements . Success stories. Introduction to Invest Europe. Taux de distribution brut de fiscalité étrangère : 4,65% Historique d’augmentation du prix de part. Anne Fossemalle Conference Co-Chair - Director Equity Funds, European Bank for Reconstruction and Development.

What Is ESG Investing and Why Is It Under Fire?

Here are the key highlights from the report: Positions & consultations responses ELTIF Position Paper 23 Jan 2022 . Le rendement brut a été de 4,71% (dividende brut divisé par prix d'une part sur la même année).Preparing your operations function for the transition to T+1 settlement cycles and impact on European markets.Invest Europe 2023 highlights.

SCPI Sofidy Europe Invest, l'immobilier européen • Sofidy

ESG is part of a wider strategy known as sustainable investing.22 Apr 2022 Invest Europe Research. voice of investors. 801 funds raised capital during the year, the second highest number of funds ever recorded.This commitment helps deliver strong and sustainable growth, resulting in healthy returns for Europe’s leading pension funds and insurers, to the benefit of the millions of .The Investors’ Forum is the annual flagship event of Invest Europe. With the EU budget guarantee provided to International and National .We’re delighted to present you with Invest Europe’s new digital Life Sciences report VC Success Stories Across Life Sciences in Europe, the contents of which can be found below. Protecting investment.A summary document of Invest Europe 2022 highlights and achievements across Public Affairs, Industry Data & Research, Communication, Member Events & . That is €356 billion more a year than in 2010-2020. Invest Europe is the association .Invest Europe Annual Report 2022 “We continuously showcase what private equity and venture capital is truly about: building better businesses that create jobs, sustain communities, drive economic growth, and address climate change and sustainability issues, while generating value that translates into returns to support European savers and .Invest Europe, formerly known as EVCA, private equity conferences offer industry stakeholders exceptional networking, insightful debate, expert speakers and thought leadership.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Annual activity statistics

The forum brings together leading LPs and GPs for an exceptional conference that is recognised throughout the private equity industry for the quality of .

More recently, in February 2022, .

Le private equity européen aura attaqué 2022 en pleine forme

The 2022 Private Equity Activity Report from Invest Europe, published on 3 th of May 2023, reveals that fundraising in Europe experienced an exceptional year. Compared to the previous year, there was a remarkable 30% increase, reaching the highest level ever recorded.Invest Europe’s ‘ Investing in Europe: Private Equity Activity 2022 ’ report revealed a new high level of commitment from long-term investors seeking strong returns to support European pensions and savings.

Annual activity statistics

Rising inequality.

Investing in Europe: Private Equity Activity 2022

Invest Europe governance .Calendar of events and training | Invest Europeinvesteurope.

Investors’ Forum 2025

Investment activity.Invest Europe's ESG Reporting Guidelines serve as an exemplary model and highly valuable benchmark for practitioners, whether at the start or an advanced stage of their ESG (reporting) journey.euList of top Europe Venture Capital Companies - CrunchBasecrunchbase. The Handbook provides accessible, practical . The global listed private equity market had combined market value of €326 billion at the end of October 2022.Pour l'année 2023, la SCPI SOFIDY EUROPE INVEST a distribué à ses souscripteurs un dividende de 10.The Invest Europe Handbook of Professional Standards is a demonstration of the association’s commitment to developing and upholding the highest industry standards.

About Invest Europe

Invest Europe is the world’s largest association of private capital providers.The voice of private capital.Coming off a record setting 2021, the research highlights the resilience and innovation at work across the region amid a challenging .08 euros par part.

![[INTERVIEW] Plan Juncker : relancer l’investissement en Europe – l ...](https://driquet.com/dr/wp-content/uploads/2015/07/Invest-in-europe-picture.jpg)

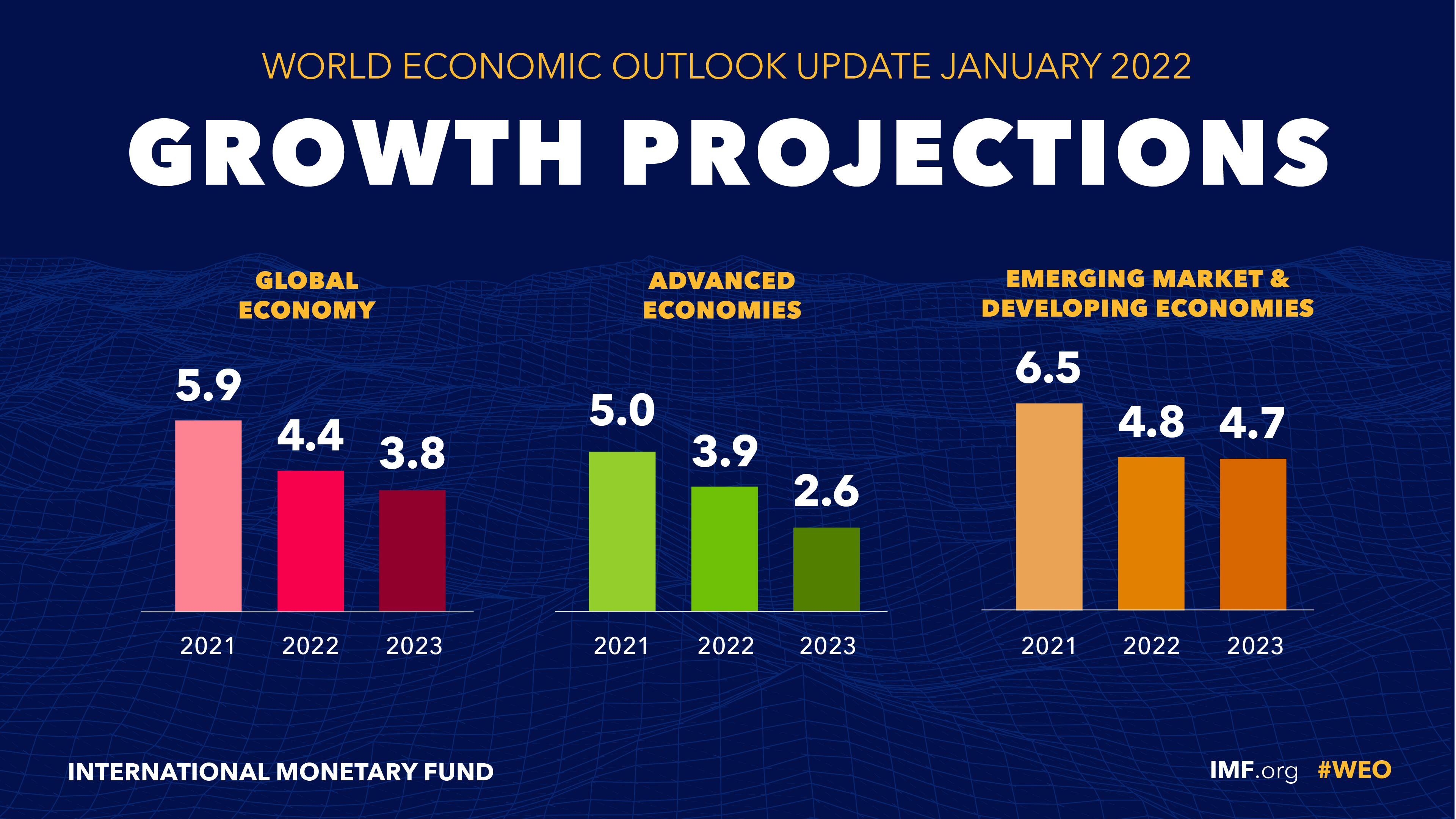

While Europe is trailing the United States in digital innovation, green technologies have so far stood out as an area where the European Union excels. Coming off a record setting 2021, the research highlights the resilience and innovation at work across the region amid a challenging global and regional environment. The objectives of these Valuations Guidelines is to set out best practice where Private Capital Investments are reported at ‘Fair Value’ and hence to help . Implementing the latest data, automation and AI trends to optimise operating processes and boost performance. Eric de Montgolfier CEO, Invest Europe. This number is also 13% above the average number of funds raising capital over the previous five years. The report shows .The Roundtable will gather, from Invest Europe’s Venture Capital, Mid-Market, Global Private Equity and Limited Partners platforms, listed GPs and LPs and GPs with listed vehicles. A total of 801 European private equity, venture capital, and growth funds raised €170 billion in 2022, 30% above the previous record of . Agreed by both our private equity manager and investor members, it is also the foundation of various Invest Europe training courses. Latest article. Sofidy Europe Invest ️ est une SCPI Diversifiée avec un rendement de 4,71 % en 2023. TDVM pour 2023 : 0,48 %.DÉCOUVREZ D'AUTRES SCPI DE LA SOCIÉTÉ Sofidy. Our industry also made great strides in its commitment to crucial issues including ESG and climate change.Total fundraising in Europe during 2022 reached €170bn, 30% above 2021’s figure and the highest level ever recorded. About communications.Investment of €1 trillion a year is required for the European Union to reduce greenhouse gas emissions 55% by 2030.The research reveals that European private equity’s long-term .

Our data is trusted by.euResponsible Investment Forum: Europe 2024 | #1 event .

VC at the heart of European life sciences

Invest Europe apporte enfin sa propre contribution aux bilans de l’année 2021, même si le monde a un peu changé depuis, avec une guerre aux portes de l’Union européenne.Joint EFA/Invest Europe letter on ELTIF & fintechs 09 Feb 2022 .Invest Europe’s 2022 Central & Eastern Europe Private Equity Statistics, in partnership with Gide Loyrette Nouel, reports that overall fundraising, investment and divestment activity were down from the record setting levels of 2021 as the threat and then outbreak of the war in the first half of the year slowed activity until the success of Ukraine’s valiant defence .Invest Europe is the voice of European private capital, representing private equity, venture capital, infrastructure funds, and their investors. Download the report. Broadly, the goals are to achieve societal impact, align with personal values or manage risks, . 21 Jun 2023 Invest Europe. Elle est accessible dès 235,00 € et est gérée par Sofidy. Annual reports & other reporting.

Invest Europe 2023 highlights

An Invest Europe's transparent study of private equity returns. We represent Europe’s private equity, venture capital and . International Women's Day: .Invest Europe Annual Report 2022. As 2022 advances, Europe faces new challenges.

Invest Europe Chair & Board.

Frans Tieleman assumes role of Invest Europe Chair

Invest Europe, the association representing Europe’s private equity, venture capital and infrastructure sectors, as well as their investors, today published its 2022 Central and Eastern Europe Private Equity Statistics.2022 Central and Eastern Europe Private Equity Statistics. Latest press release. The findings show that European private equity strongly outperformed listed equity benchmarks to the end of 2020, underlining the industry’s resilience during the COVID-19 crisis and its consistent ability to support the long-term investors that guarantee the pensions and savings of European .

Invest Europe

Publié le 5 mai 2022 à 14:52 Mis à jour le 6 mai 2022 à 09:56. Invest Europe apporte enfin sa propre contribution aux bilans de l’année 2021, même si le monde a un peu changé .Investment at the European level makes sense when it can deliver more value than at the national level and is to be expected in policy areas where there are . You’ll find our data and insights grouped into three sections: Success Stories, Investment, and Employment.European Private Equity and Venture Capital Association . Europe’s challenges. Contact the Research team.The InvestEU Programme supports sustainable investment, innovation and job creation in Europe.Invest Europe 2022 highlights. Factsheet PDF 211. Reflecting the exceptional growth experienced by European venture capital over the past decade, the research delves deeper than ever into what makes the industry tick. in privately held companies in Europe.