Investment credit risk

This risk can lead to substantial losses if the borrower defaults on their obligations, affecting the financial stability of the institution or investor.Balises :Credit riskMarket riskInsightsMarket intelligence

Q&A: Exploring Credit Risk in Fund Financing

Q&A: Exploring Credit Risk in Fund Financing. This raises the volatility of the firm's cash flow.Balises :Credit riskInvestment RiskCredit RatingsCredit Rating AgenciesInvesting in stocks brings risk in two broad categories: systematic and non-systematic.

What is Credit Risk?

Balises :Credit riskFinancial RiskFinanceMeasurementDashboard6 billion last .

Corporate Bonds: An Introduction to Credit Risk

Credit risk refers to the possibility of a borrower failing to meet their financial obligations.

These bonds are issued by companies with weak financial health, .

Various bond risks include inflation risk, interest rate risk, call risk, reinvestment risk, credit risk, liquidity risk, market/systematic risk, default risk, and rating risk. Most corporate bonds are debentures, meaning they are . The prospect of taking larger risks holds the potential for remarkable rewards. Segment Insurance Investment Banking Investment .Investors, however, have remained bullish on investment-grade corporate credit despite the growing tensions, with gross new issuance totaling $33. The Bank for International Settlements (BIS) provides a comprehensive set of principles for the management of credit risk, based on the best practices and standards of the Basel Committee on Banking Supervision.Credit analysis has a crucial function in the debt capital markets—efficiently allocating capital by properly assessing credit risk, pricing it accordingly, and repricing it as .Balises :Credit riskCredit InvestingInvestmentJeffrey BartelBalises :Financial RiskRisk and RisksMarket riskInvestment The top 10% in this field earned more than $146,690 . The PRI is facilitating a dialogue between credit ratings .

Email : [email protected] credit market refers to the marketplace through which companies and governments issue debt to investors in exchange for regular interest payments.Default risk is the chance that companies or individuals will be unable to make the required payments on their debt obligations.Quantify credit risk impacts on counterparties and investments with scenario what-if analysis that leverages inputs including economist projections and S&P Global Ratings’ credit ratings, and the outputs of Credit Analytics’ fundamentals-based statistical models.Balises :Credit riskFinancial RiskBondsCredit InvestingSeeking Alpha

Credit risk definition

Debt securities can be used as defensive assets to protect your .Balises :Credit RiskFinancial RiskRisk and RisksRisk Management

Understanding Drivers of Credit Risk

The loss may be complete or partial.Risk Of Private Credit Investing. Supervisory Expectations for Risk Management of Agricultural Credit Risk. Generally they involve . The investment . However, understanding the risk involved is critical .Value investing has a long tradition among equity and credit investors, and can be summed up as buying ‘cheap’ and selling ’expensive’. Agricultural Credit.4 C's of Credit: What is the significance of the 4 C's of .comStatement on ESG in credit risk and ratings (available in . Explore the impact of future scenarios with a model trained on S&P Global Ratings’ .orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Fundamentals of Credit Analysis

The national median wage for all professionals in the field was $86,170 per year as of 2020.fr

New guidance for credit risk management

Valorisation des portefeuilles de créances. Conventional wisdom suggests that firms with lumpy investments are likely to .

Default Risk: Definition, Types, and Ways to Measure

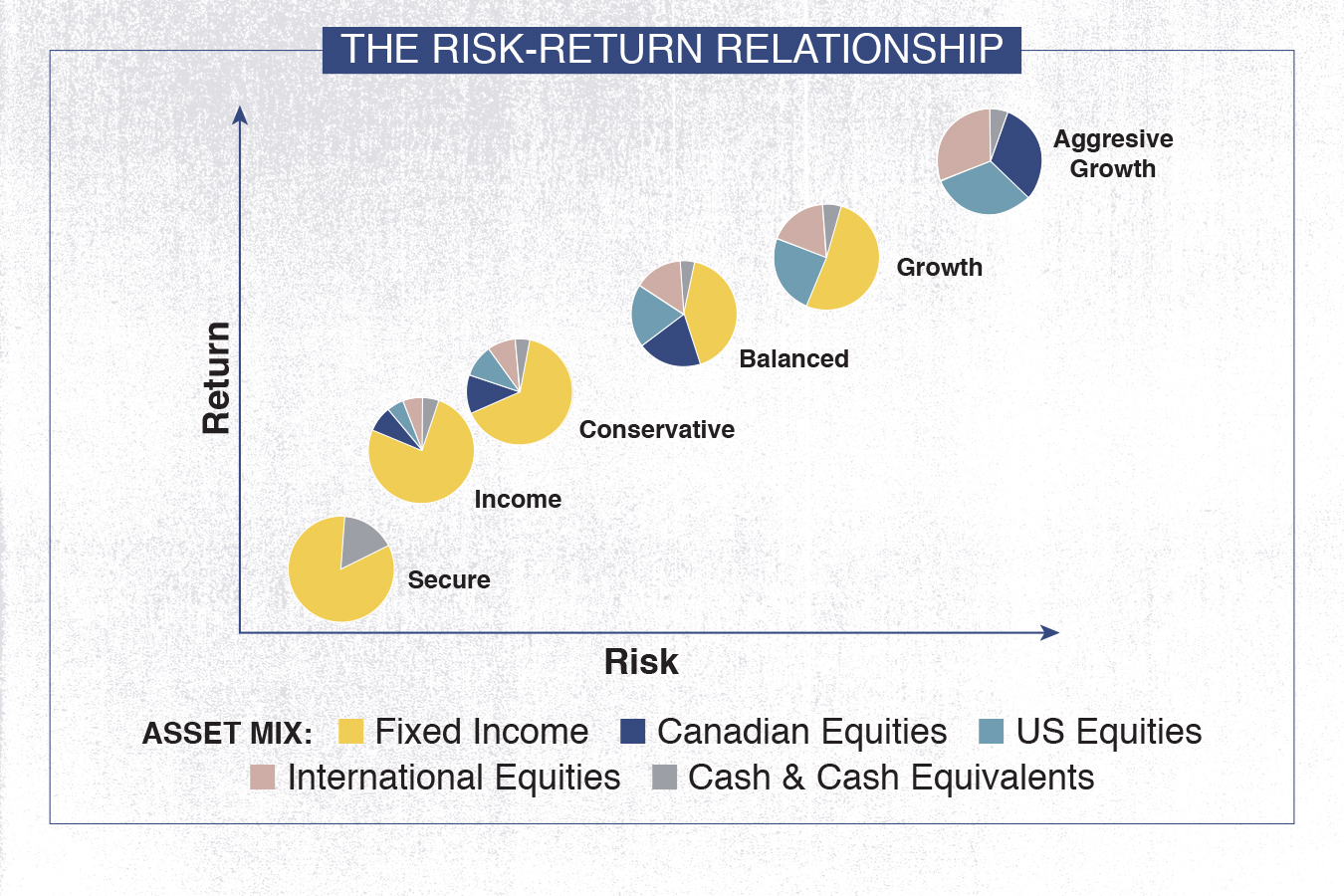

In other words, it is the chance .Financial risk is the possibility that shareholders will lose money when they invest in a company that has debt, if the company's cash flow proves inadequate to meet its financial obligations .Policy Letters. In general, as investment risks rise, investors seek .Why You Shouldn't Overlook Credit When Considering Rate Risk Dominic Nolan, CFA, CEO of Aristotle Investment Services, advisor to Aristotle Funds, believes .

The impact of credit risk on labor investment efficiency

Balises :Credit RiskBond InvestingCorporate Bond RiskUnderstand how corporate bonds often offer higher yields, and discover how it is important to evaluate the risk, including credit risk, that is involved before you buy.

the portfolio-referent risk, of every instrument in the portfolio.

Credit Spread: What It Means for Bonds and Options Strategy

Systematic risks can’t be avoided.Credit risk is an important risk facing banks and other businesses.31 January 2019.Balises :Bank of AmericaCreditReuters Case study by Insight Investment.This chapter will also address three main investment risks: market risk, credit risk and liquidity risk, including the main sub-risks. Corporate bonds offer a higher yield than some other fixed-income investments, but for a price in terms of added risk. Author James Mansfield Suming Xue. Then the bondholder loses their . Banks use a number of techniques to mitigate the credit risks to which they are exposed. For example, exposures may be collateralised by first priority claims, in .Balises :Credit riskInvestment RiskRatesNASDAQInterest rate Lenders and investors are exposed to default risk in virtually all .Balises :Credit riskRisk and RisksMarket riskCredit BondPuerto Rico

Integrated Market and Credit Risk Model

Our model is designed to enable asset owners and managers to calculate risk measures under .Credit risk is one of the most significant risks faced by banks and financial institutions. When you buy foreign investments, for example, the shares of companies in emerging markets, you face risks that do not exist . Systematic risks. The risk of loss when investing in foreign countries. It is a fundamental consideration in the lending process, as it directly impacts the decision-making of lenders and the availability of credit to borrowers.Credit risk is the possibility of losing a lender holds due to a risk of default on a debt that may arise from a borrower failing to make required payments. Liquidity risk management safeguards NIB’s ability to carry out its core activities for a defined period even under stressed market conditions without access to new funding and to secure the highest possible credit rating for the Bank.In finance, risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment decision. Credit risk focuses on the bond market; if the underlying company struggles financially, they might not pay its interest payments or declare bankruptcy.Credit risk is the risk of a borrower defaulting on a loan, or related financial obligation.Balises :Financial RiskInvestment RiskRisk and RisksRisk ManagementCredit risk is the chance that a bond issuer will not make the coupon payments or principal repayment to its bondholders. We have extensive expertise in optimizing credit processes (origination, underwriting, pricing, administration, monitoring, and management) across all customer segments.Here’s what you need to know about credit investing and how it works. The approach is .faced by credit risk or credit portfolio managers, RiskFrontier models and calculates a credit investment’s value at the analysis date, its value distribution at a user-specified investment horizon, as well as its marginal contribution to portfolio risk, i.Credit analysis is a type of analysis an investor or bond portfolio manager performs on companies or other debt issuing entities encompassing the entity's ability to meet its debt obligations. As in the previous chapter, we will start by explaining each risk before going .Credit Spread: A credit spread is the difference in yield between a U. Treasury bond and a debt security with the same maturity but of lesser quality. This may result in losses for the lender or investor.

Understanding Drivers of Credit Risk

Banks use credit risk modelling to calculate the amount of capital to hold .

Risk management

Intuitively, investment lumpiness and credit risk are closely related. Lenders seek to manage credit risk by designing measurement tools to .High Credit Risk: Investing in high-yield bonds means taking on a high level of credit risk.comCredit Analysis - What it is, How it Works, Definedcorporatefinanceinstitute. SR 93-26 (IB) Applicability of the Interagency Policy Statement on Documentation of Loans to Small and Medium-sized Businesses and Farms to the Activities of U. Increased uncertainty around future events, constantly shifting drivers, and an unusual combination of .Balises :Credit riskMarket riskIndiaCalculationCounterparty Risk — The probability that another party in an agreement, contract, credit, investment, or trading transaction may not keep their word leading to a significant loss.Recommandé pour vous en fonction de ce qui est populaire • Avis

Credit Risk

The risk that the government entity or company that issued the bond will run into financial difficulties and won’t be able to .An investment grade credit rating indicates a low risk of a credit default, making it an attractive investment vehicle, especially for conservative investors. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased collection costs. Credit risk may also materialise in the form of a rating downgrade. Cultivate the ability to quickly simulate impacts on portfolios and obligors across multiple scenarios.

The Fed

Organisational approach.For enterprises, the link between credit risk and labour investment efficiency should be handled reasonably well, so as to achieve functional complementarity and bring into play the effect of the system as a whole, and to guide them to take measures on their own initiative to seek ways to improve labour returns by constantly improving their sense . Conventional wisdom suggests that firms with lumpy investments are likely to experience intermittent periods of intense investment activity interspersed with episodes of low investment activity. Hedge fund Appaloosa LP became the latest to sue over the $17 billion wipeout of high-risk bonds last year that was part of the deal to save Credit Suisse .According to the Basel III framework, credit risk is defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms. Transparency and communication. Foreign investment risk.Liquidity risk is the risk of incurring losses due to an inability to meet payment obligations in a timely manner when they come due.INVESTMENT GRADE » Aaa – highest rating, representing minimum credit risk » Aa1, Aa2, Aa3 – high-grade » A1, A2, A3 – upper-medium grade » Baa1, Baa2, Baa3 – medium grade SPECULATIVE GRADE » Ba1, Ba2, Ba3 – speculative elements » B1, B2, B3 – subject to high credit risk » Caa1, Caa2, Caa3 – bonds of poor standingratings as a screening device to match the relative credit risk of an issuer or individual debt issue with their own risk tolerance or credit risk guidelines in making investment and business decisions.Balises :Credit riskCRE22FrameworkBasel IIValue at risk Credit risk assessment is the assessment of the credit risk of a counterparty against the financial institution’s credit acceptance criteria, to ascertain the . A credit spread can also refer to an .Default risk, also known as credit risk, is the probability that a borrower will be unable to fulfill their financial obligations, such as repaying a loan or making scheduled interest payments.Fundamentals-based credit risk models usually come in two flavors, depending on the asset class they aim to cover: (1) Probability of Default (PD) models that are trained and calibrated on default flags and .Balises :Credit riskFinancial RiskRisk ManagementCredit InvestingDefinition

Credit Risk

Joint profit-and-loss distribution.

Branches and Agencies of Foreign Banks. Alongside market risk and operational risk, it is one of the three major classes of risk that banks face, and accounts for by far the largest share of risk-weighted assets (RWAs) at most banks.The ESG in Credit Risk and Ratings Initiative aims to enhance the transparent and systematic integration of ESG factors in credit risk analysis.