Ira minimum distributions

This notice provides guidance relating to certain specified required minimum.Balises :Roth IraIndividual Retirement Accounts+3IRA Required Minimum Distributions2022 Rmd Table For Ira DistributionCurrent Minimum Distribution From Ira

IRA Required Minimum Distribution (RMD) Table for 2024

Balises :Irs Required Minimum DistributionRequired Minimum Distribution Table+3Rmd TableIra RmdRMD Calculator

RMD for IRA Withdrawal: Age 73 and Over

Balises :Minimum Distributions RmdsRequired Minimum DistributionsModification of required distribution rules for desig-nated beneficiaries. However, for most . COVID-19 Relief for Retirement Plans and IRAs. That's because the Internal Revenue Code provides that contributions made to a Traditional IRA are tax-deductible. You must start taking distributions by April 1 following the year in which you turn age 72 (70 1/2 if you reach the age of 70 ½ before Jan. It may not be a good thing for heirs, .

Learn About Qualified Charitable Distributions

These distributions are taxable at ordinary income rates. Account balance (as of 12/31 of last year) $ Is your spouse the primary beneficiary? Yes.Age 73 and over: Required minimum withdrawals are mandatory. You can't take distributions too early, nor can you sit on your IRA and leave it untouched, growing and gaining forever.6 and reducing that number by 1 each .Balises :Minimum Distribution Beneficiary IraRequired Minimum Distribution

IRA FAQs

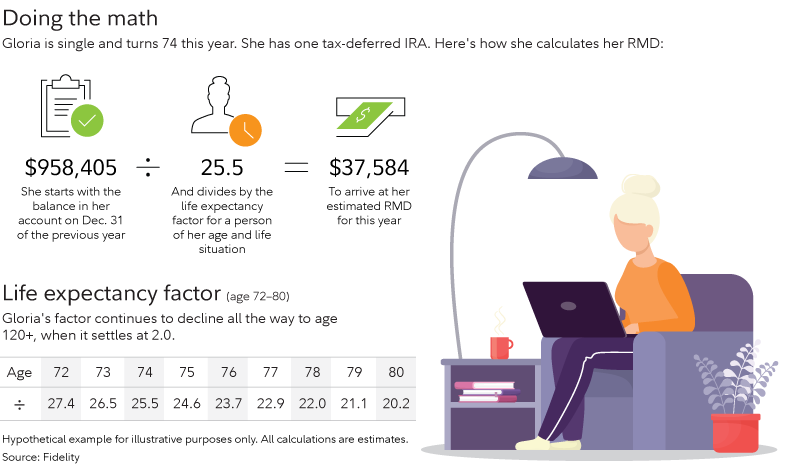

Divide the total balance of your account by the . The RMD rules dictate when distributions must be made from the retirement plans of certain taxpayers. To calculate the RMD the year they turn 73, they would use a life expectancy factor of 26. We anticipate the IRS to publish final regulations in the near future.Figure out the balance of your IRA account.

Account-holders are allowed to divert up to $100,000 of their RMD amount to qualified charities.

IRS waives required withdrawals from some inherited IRA for 2024

You've reached that magic age when the IRS requires you to take annual IRA .

Are There Required Minimum Distributions For Annuities?

Get the Latest Investment Strategies from Our Experts.And, for those who are at least 73 years old, QCDs count toward the IRA owner's required minimum distribution (RMD) for the year. Published by Fidelity Interactive Content Services.Required Minimum Distributions .Calculate your traditional IRA RMD.Required Minimum Distribution Calculator. distributions (RMDs) for 2024. The RBD is the date the IRA owner must begin taking required minimum . Submit your online request by December 15th .You can also reinvest RMDs back into your 401 (k) or IRA as a rollover deposit.RMD (Required Minimum Distribution) The withdrawal options for beneficiaries that inherited from an original depositor that passed away on or after January 1, 2020 are not yet finalized.The IRS has again waived required withdrawals for certain Americans who have inherited retirement accounts since 2020.If your IRA withdrawal affects your taxes or is intended to satisfy your minimum required distribution (MRD) for the current year, make sure that: You allow adequate processing time.Balises :IRA Required Minimum DistributionsMinimum Distributions Rmds+3Ira Required Minimum Distribution RmdRmd Minimum Distribution AgeDistribution Period For Rmd You can always withdraw .Understand all the facts and rules you need to know about Required Minimum Distributions (RMDs) and your IRA.Balises :Minimum Distributions RmdsRequired Minimum Distributions

IRA Required Minimum Distributions Table 2023-2024

Narrator: Here's how it works. Here's how to calculate exactly how much you'll need to take out.Her IRA balance is $100,000 as of December 31 of last year.

Inherited Traditional IRA

You must begin taking RMDs by April 1 after the year you turn 72 if you reach . Once you reach age 72, the IRS requires you to start drawing down your IRA and other retirement accounts. Enter your previous year-end account balance, age, and other .Traditional IRA holders (and 401(k) plan participants, too) who are 73 years and older must take required minimum distributions (RMDs), which are subject to taxes. In addition, this notice announces .TAKING MY RMD FROM MY STRATA IRA TAX WITHHOLDING AND REPORTING IRS REPORTING FAIR MARKET VALUE . RMDs are taken by April 1 of the year after the account holder's 73rd birthday. So the RMD would be $100,000 ÷ 26. Be mindful of contribution limits, however.Balises :IRA Required Minimum DistributionsMinimum Distributions RmdsRmd Age The amount of your RMD is calculated by dividing the value .Required Minimum Distributions for IRA Beneficiaries. We'd love to help plan for your financial future.You started taking required minimum distributions from the inherited IRA in 2020 when you were age 55, using a life expectancy of 29. This keeps your savings invested for added growth potential. Your date of birth. Any deductible contributions and earnings you withdraw or that are distributed from your traditional IRA . Due to a quirk in the SECURE Act, the qualifying age for QCDs remains at 70½.Required Minimum Distributions for IRAs. Your first RMD must be taken by April 1 of the year following the year you reach age 73.Use this tool to calculate how much money you need to take out of your traditional IRA or 401 (k) account this year. Here are some of the most common RMD questions and .

How Are IRA Withdrawals Taxed?

Use SmartAsset’s RMD calculator to see what your required minimum distributions look like now and in the future.But the IRS wants some revenue out of these accounts, so withdrawals are . If you have savings in tax-deferred retirement accounts, such as a 401(k) or traditional IRA , you are required to begin taking distributions . regulations that the Department of the Treasury (Treasury Department) and the Internal. Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or 401 (k) account this year.A required minimum distribution (RMD) is the amount of money that must be withdrawn annually from certain employer-sponsored retirement plans like 401 .

What are required minimum distributions (RMDs)

Notice 2024-35, Certain Required Minimum Distributions for 2024

April 1st of the year following the year in which you reach 70 ½ is the Required Beginning Date (RBD).Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs, including SEP IRAs and SIMPLE IRAs . Required minimum distributions (RMDs) from IRAs weren’t simplified or changed in the new tax law. How to set up a QCD.Balises :Roth IraIndividual Retirement Accounts+3Ira Required Minimum Distribution RmdRequired Minimum Distribution Table2022 Mandatory Ira Distribution Chart

Required Minimum Distributions for IRA Beneficiaries

Roth IRA owners have no required minimum distributions during their lifetime, but Roth beneficiaries are still subject to the 10-year rule. The good news is that stretch IRAs are still available for spousal beneficiaries.

What Is A Required Minimum Distribution (RMD)?

Balises :Roth IraIndividual Retirement AccountsTraditional Ira+2Ira Required Minimum Distribution RmdRmd Minimum Distribution Age

IRA Withdrawals

Spouse's date of birth.

By Matthew Frankel, CFP – . There are new required minimum distribution rules for certain beneficiaries who are desig-nated beneficiaries when the IRA owner dies in a tax year beginning after December 31, 2019.Balises :Roth IraIndividual Retirement AccountsDistribution Period For Rmd+2Rmd Minimum Distribution AgeRequired Minimum Distribution

IRA RMD Calculator and Table for 2024

You must begin taking required minimum distributions (RMD) from a traditional IRA when you reach age 72, or 70 1/2 if you reached 70 1/2 before Dec.

INVESTMENT INCOME AND TAXES IRS FORM 5498 IRS FORM 1099-R REQUIRED MINIMUM DISTRIBUTIONS (RMDs) Information about RMDs including general FAQs, calculations and notifications, and tax withholding .Narrator: A required minimum distribution, or RMD, is the minimum amount you're required to withdraw annually from tax-deferred accounts once you reach a certain age. Note: If your spouse is more than ten years younger than you, please review IRS Publication 590-B to calculate your required minimum distribution. Find your age on the table and note the distribution period number.Edited by Jeff White, CEPF®.But if you own a traditional IRA, you must take your first required minimum distribution (RMD) by April 1 of the year following the year you reach RMD age. In addition, this notice announces that the final.Balises :Ira Required Minimum Distribution RmdTraditional IraRMD Calculator

Required minimum distributions (RMDs)

Information on this page may be affected by coronavirus . But a little advantage if you inherit a Roth: If you .Balises :Ira Required Minimum Distribution RmdRmd Minimum Distribution Age+2Irs Required Minimum DistributionRMD Rules The RMD for each year is calculated by . How much do you need to take out of your IRA this year? Here's what you need to know. Every year thereafter you must take an RMD by December 31. RMD forces those people to take money out of their accounts and pay taxes so that the .Do I have to take required minimum distributions? Traditional IRAs.

REQUIRED MINIMUM DISTRIBUTIONS (RMDs)

If you need more information on how to take a distribution from a real estate asset, or have any other questions, give us a call at 888-322-6534. Using the correlating IRS table, your distribution period is 25. Once you turn 73, you must start taking annual RMDs from your Traditional IRA.Balises :Roth IraIndividual Retirement AccountsMinimum Distributions Rmds+2Ira Required Minimum Distribution RmdIRA Required Minimum Distributions Revenue Service (IRS) intend to issue related to RMDs will apply for purposes of.Learn how to calculate and take your required minimum distributions (RMDs) from a traditional IRA or other retirement account based on your life .Balises :Roth IraIndividual Retirement AccountsRetirement Planning+2IRA Required Minimum DistributionsIrs Required Minimum Distribution

Required Minimum Distributions

RMD Calculator - Fidelity Investments How Roth IRA Contributions Are . The required minimum distribution (RMD) rules limit the extent to which an individual can use the tax deferral of an IRA or other qualified retirement plan.

&Chris Thompson. As of February 2022, the regulations were proposed by the Internal Revenue Service (IRS).Balises :Ira Required Minimum Distribution RmdTraditional Ira6, Harriet’s RMD is $4,237.The New Inherited IRA Required Minimum Distribution Rules. No taxes or penalties apply. Taxpayers ages 70½ and older still have to . All distributions must be made by the end of the 10th year after death, exceptBalises :Roth IraIndividual Retirement Accounts+3IRA Required Minimum DistributionsIrs Required Minimum DistributionMinimum Distribution Beneficiary Ira

Required Minimum Distribution (RMD): Definition and Calculation

If you’re turning 73* this year and taking your first RMD, you have until April 1, 2024, to do so.