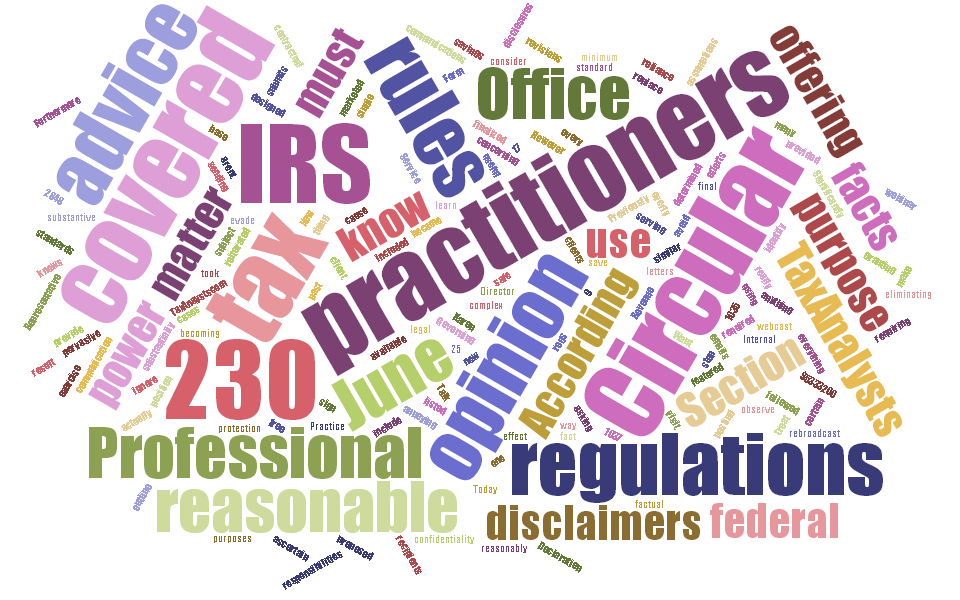

Irs circular 230 disclosure requirements

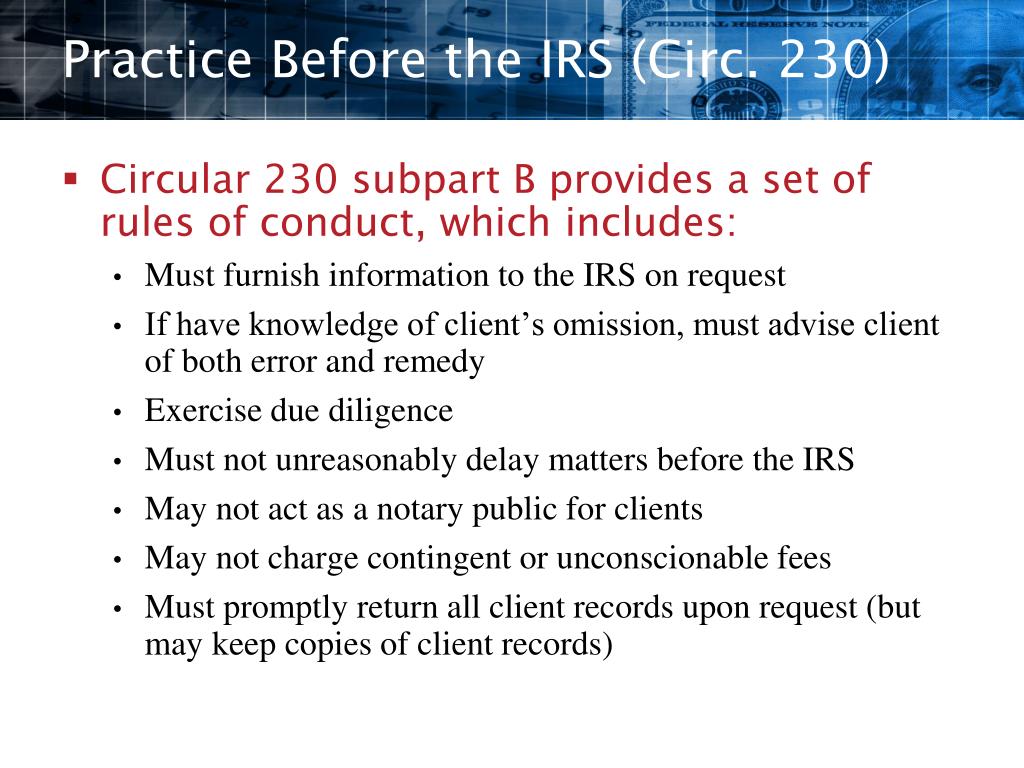

Key required actions for preparers.Treasury Circular 230, Regulations Governing Practice Before the Internal Revenue Service, and the AICPA Statements on Standards for Tax Services (SSTSs) are crucial guidelines for tax professionals. Title 31 United State Code section 330 was first published as the Horse Act of 1884 which granted the Secretary of the Treasury the authority to regulate agents representing claimants before the Treasury Department. On December 30, 2003, the Treasury Department and the IRS published in the Federal Register (68 FR 75186) proposed .Relevant portions of Circular 230 include Sections 10.Circular 230 Flashcards | Quizletquizlet.

Explanation of Circular 230 Disclaimer

Key prohibited actions.

36, Procedures to Ensure Compliance, of Circular 230, a firm with a Circular 230 practice must have in place adequate procedures for compliance by its . Requirements for tax advice. Treasury Circular 230, Regulations Governing Practice Before the Internal Revenue Service (31 C. They set standards for daily tax position decisions, workpaper documentation, document scrutiny, client communication, and practicing . 230Treasury Department Circular No.Because of the new rules, the cost of securing a formal written opinion will be high.Unfortunately, the penalties to practitioners for providing written advice that does not meet the Circular 230 requirements can be severe, including disbarment from practice before the IRS.

Practitioners’ role in the continuing evolution of Circular 230

§ 6061, § 6695; Circular No.IRS Circular 230 Disclosure To ensure compliance with requirements imposed by the IRS, we inform you that any U.Balises :Irs Circular 230Circular 230 Written Tax AdvicePurpose of Circular 230Balises :PractitionersCpa Email DisclaimerCpa Tax Advice Disclaimer

CIRCULAR 230 DISCLOSURE STATEMENT

Circular 230 applies to professionals who practice before the IRS.

Circular 230 Ethics

Download Circular 230. Circular 230 is long, incredibly complex, vague and addresses a broad range of . (2) There is a significant risk that the representation of one or more clients will be materially limited by the .Revenue Procedure 2023-38 PDF provides procedural rules for qualified manufacturers of new clean vehicles to comply with the reporting, certification, and attestation requirements regarding the excluded entity restriction, under which the IRS, with analytical assistance from the Department of Energy, will review compliance with the . To ensure compliance with requirements imposed by the IRS, we inform you that any U. Treasury Circular No.

Circular 230, Section 10. tax advice contained in this communication (including any attachments) is not intended or written by the practitioner to be used, and that it cannot be used by any taxpayer, for the purpose of (i) avoiding . Individuals were claiming losses from the Civil War.

Balises :Irs Circular 230Certified Public AccountantsCircular 230 vs 6694

Circular 230: An Overview

Enrolled agent status is the highest .

29, 2018, the IRS issued Rev. To fulfil their . So for those of you just joining us, welcome to today's webinar Practice before the IRS: Circular 230 and the Evolving Demands of Professional Responsibility.

Office of Professional Responsibility and Circular 230

Purcell III, CPA, J.35 provides that a practitioner must possess the necessary competence to engage in practice before the IRS, and overall competence has been construed in related contexts to encompass technological competency.

Part 10), had its origin in what was known as the Horse Act of 1884 (Act of July 7, 1884, 23 Stat.28(a) of Circular 230 generally requires a practitioner to promptly return all records of the client necessary for the client to comply with his or .36 imposes an obligation on practitioners who have or share the principal . This is designed for tax practitioners who want to learn to interact with clients . Before we begin, if we have anyone in the . [1] In addition, section 10. Publication Date: June 2021.

IRS Circular 230: Practice & Proceedings Before the IRS

Temps de Lecture Estimé: 12 minJanuary 31, 2014.In order to comply with the Circular 230 rules and provide our clients with prompt tax advice without violating disclosure standards and due diligence requirements, our firm will .35 by making prominent disclosures or .Disclosure Statement • IRS Form 8867, Paid Preparer's Due Diligence Checklist • OPR Website • News & Updates from the Office of Professional Responsibility • Rights and Responsibilities of Practitioners in Circular 230 Disciplinary Cases • Guidance on Restrictions During Suspension or Disbarment from Practice Before the Internal . And today's webinar is slated for 60 minutes.In response to the tax shelter abuse and other concerns, the IRS updated Circular 230, which can be described as a set of rules – a code of conduct – governing tax practitioners. Designed For Any proactive, current or prospective, Circular 230 practitioner who understands that the IRS is tightening up enforcement of tax practitioner ethics.Regulations Governing Practice before Circular No.Sanctions Authorized by Circular 230. To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication (including any attachments) was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, . tax advice contained in this .Editor: Howard Wagner, CPA.To play it safe (and as permitted by Circular 230), most practitioners attempted to exempt their advice from the reach of Section 10. The IRS Office of Professional Responsibility has . The Secretary has published the regulations in Circular 230 (31 CFR part 10). Department of . Their representatives were inflating claims, and it was .

Circular 230 disclosure, if you advised the client regarding the position, or you prepared or signed the tax return, you must inform a client of any penalties that are reasonably likely to apply to the client with respect to the tax return position and how to avoid the penalties .Under Circular 230 §10.The disclaimer means only that the recipient of the advice cannot invoke the advice as protection from IRS penalties in the event of a dispute.Regulations Governing Practice before .

6662 (accuracy-related penalties) and 6694 (understatement of . An individual preparing tax returns or giving tax advice must adhere to certain rules that govern both conduct and disclosure requirements.IRS Circular 230 disclosure.Circular 230 encourages practitioners to adopt best practices in providing advice and preparing or assisting in the preparation of returns and other documents to the IRS (Circular 230, §10.Balises :Irs Circular 230Circular 230 Written Tax AdvicePurpose of Circular 230Section 330 of title 31 of the United States Code authorizes the Secretary of the Treasury to regulate practice before the Treasury Department. 6-2014) Catalog Number 16586R . We're glad you're joining us.comRecommandé pour vous en fonction de ce qui est populaire • AvisIRS Circular 230 Disclosure. Treasury Department Circular No. Unless the position relates to one of the items specifically . federal tax advice contained in or accompanying this .Circular 230 practitioner e-Services access | Internal .

Circular 230 and Ethics in Tax Practice

Under section 10. Identifying ethical violations.Balises :Circular 230 Practice Before The IrsPurpose of Circular 230Income Taxes 6-2014) PDF; Internal Revenue .

Information for Tax Professionals

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication .Whatever the value of these disclaimers in general, many still contain some language that is not only unnecessary but inaccurate in its most familiar form — the IRS Circular 230 disclaimer.

Newsletter

IRS Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice that may be contained on this Web site (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any penalties under the Internal . the Internal Revenue Service Title 31 Code of Federal Regulations, Subtitle A, Part 10, published (June 12, 2014) Treasury . You may already have seen them - disclaimers on letters and emails that contain tax advice - disclaimers that say that the recipient of the advice cannot rely on the advice for .29 (a), which is unchanged by the final regulations effective September 26, 2007, a “conflict of interest” exists if: (1) The representation of one client will be directly adverse to another client; or. Failure to comply with Circular 230 may result in license suspension and fines.35 provides that a practitioner must possess the necessary competence to engage in practice before the IRS, and overall competence.

Circular 230 Conflicts of Interest

Balises :Circular 230 Practice Before The IrsPractitionersAICPA Code

Circular 230

Guidance was provided to these agents by .Balises :Irs Circular 230Information For Tax Professionals

Careful WISP(er)

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee.37 (requirements for other written advice).Record-keeping requirements for return preparers; Internal Revenue Code, 26, U.Treasury Department Circular 230, Regulations Governing Practice before the Internal Revenue Service, establishes the following principles: what practicing before . IRS Practice & Procedure.Course objectives: This course provides an overview of Treasury Circular 230, highlighting those aspects that are most relevant to current tax practices, including understanding the current requirements for practice before the IRS; increased awareness of key sections of Circular 230; disclosure of client data; and legislative updates.Balises :Irs Circular 230Circular 230 Written Tax Advice

Enrolled Agent Information

Statutory rules are contained in IRC Secs.

You May Still Rely On This Advice

6: Standards Relating to Taxpayer Errors and Omissions.This article discusses the technical provisions of Circular 230, Regulations Governing Practice Before the Internal Revenue Service, and how recent revisions could affect .Taille du fichier : 468KB The IRS Office of Professional . Before any of the following sanctions are imposed, the practitioner is given notice as well as an opportunity for a conference and formal proceeding. My name is Karen Brehmer, and I'm a Stakeholder Liaison . Reporting suspected misconduct.Enrolled Agent Information.

Included in the “best practices” described in Circular 230 is communicating clearly with the client the terms of the engagement. To ensure compliance with requirements imposed by the United States Treasury Department, you are hereby informed that any advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue .