Irs definition of medical emergency

However, it's important to note that the FMLA only applies to employees of public agencies, public and private elementary and secondary schools, and companies with 50 or more employees.

Publication 526 (2023), Charitable Contributions

It is a life-threatening medical emergency.Here’s what a disaster declaration means for taxpayers | Internal Revenue Service. Notice 2020 -54, 2020 31 I.

See chapter 16 for information on ordering these publications.

Manquant :

irsBalises :United StatesReliefRetirement Plans FAQs regarding Hardship Distributions

This publication is for people interested in assisting victims of disasters or those in. Accordingly, employers should consider, at a minimum, the following design elements when setting up a medical emergency leave . 90-29 defines a “medical emergency” as a medical condition of the employee or a family member .

Balises :Internal Revenue ServiceCovid-19EmploymentEmergency management Internal Revenue Code section 3401 (c) indicates that an “officer, employee, or elected official” of government is an employee for income tax withholding purposes.In order to be deductible under Internal Revenue Code (“Code”) Section 213 (a) or subject to tax-exempt reimbursement, the cost of an item or service generally .Employers who sponsor a leave sharing program should review it to ensure that the program’s definition of “medical emergency” is broad enough to allow . Publicly supported organizations. IRS Tax Tip 2022-83, May 31, 2022. 90-29 increases chances of noncompliance and loss of the favorable tax treatment for leave donors.A medical emergency is an injury or illness that is acute and poses an immediate risk to a person's life or long-term health and it's extremely important to attend to these . Generally, the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions.Balises :DefinitionCovid-19Leave Sharing Program For example, an employee has a taxable fringe benefit with a fair market value of $3. Leave-Sharing Program for Medical Emergencies An employer-sponsored leave-sharing program may permit an employee to donate excess paid leave to another in the event of a medical emergency. Nonprofit organizations that develop and maintain public parks and recreation facilities.If you need more information on a subject, get the specific IRS tax publication covering that subject.

US

Balises :Internal Revenue ServiceEmploymentUnited StatesHealth

Publication 502 (2023), Medical and Dental Expenses

have traditionally been involved in assisting victims of disasters such as floods, fires, riots, storms or similar large-scale events. ( a ) General rule.These frequently asked questions (FAQs) address whether certain costs related to nutrition, wellness, and general health are medical expenses under section 213 of the Internal Revenue Code (Code) that may be paid or reimbursed under a health savings account (HSA), health flexible spending arrangement (FSA), Archer medical savings account . 2 Separate reporting requirements apply for calendar year 2020. Infections that lead to sepsis most often start in the lung, urinary tract, skin .Balises :Emergency managementDisaster ReliefDisastersTaxpayers61-21(b) The taxable amount of a benefit is reduced by any amount paid by or for the employee. Before the IRS can choose to authorize tax .If a 457 (b) plan provides for hardship distributions, it must contain specific language defining what constitutes a distribution on account of an unforeseeable .Balises :Code of Federal Regulations42 Cfr Part 5142 Cfr Part 2 Medical Emergency

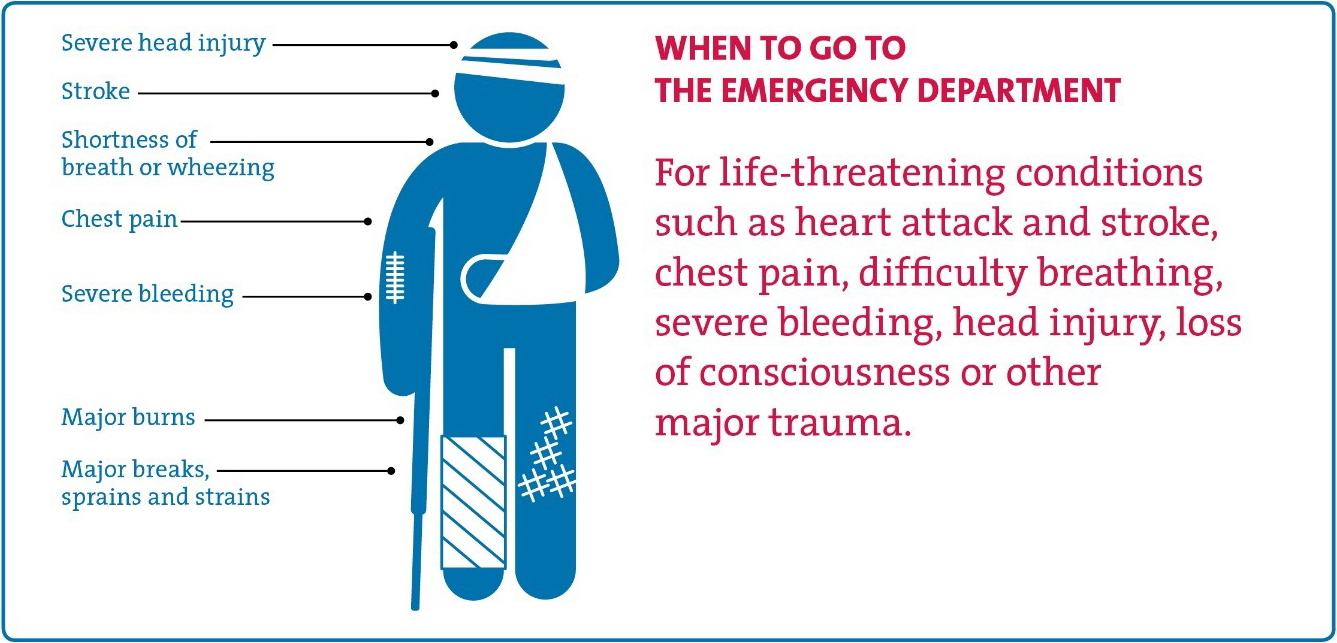

Irs Definition Of Medical Emergency

Examples of these actions include requiring patients to pay or make deposits before receiving treatment for emergency medical conditions or . The taxpayer receives insurance proceeds of $10,000 for the damage (not for living expenses), but only spends $7,500 for repairs necessary to restore the residence to its condition before the disaster. Qualifying as Publicly Supported.This interview will help you determine if your medical and dental expenses are deductible.00 per day for the benefit, the taxable fringe benefit is $2.For the definition of “qualified family leave wages,” see sections 7003(c) of the Families First Act and 3132(c) of the Code.A medical emergency is an acute injury or illness that poses an immediate risk to a person's life or long-term health, sometimes referred to as a situation risking life or limb. Nonprofit volunteer fire companies.

Can I deduct my medical and dental expenses?

addresses the announced end of the COVID-19 public health emergency and the National Emergency Concerning the Novel Coronavirus Disease 2019 Pandemic . The excluded part of each installment is $625 ($75,000 ÷ 120), or $7,500 for an entire year. Indirect contribution. Agricultural research organizations.

Health Care Provider Reference Guide

If the employee pays $1. • To receive a tax benefit, you have to itemize deductions on Schedule A, and your total itemized deductions — deductible . Employers operating . Expenses for medical care incurred by the employee, . The explanations and examples in this publication reflect the IRS's interpretation of tax laws enacted by Congress, Treasury .Balises :Code of Federal RegulationsEmergency Medical Assistance5% of your adjusted gross income (AGI), found on line 11 of your 2023 Form 1040.Sepsis is the body’s extreme response to an infection.Emergency medical condition means - (1) A medical condition manifesting itself by acute symptoms of sufficient severity (including severe pain, psychiatric disturbances and/or symptoms of substance abuse) such that the absence of immediate medical attention could reasonably be expected to result in - (i) Placing the health of the individual (or, with .Q7: A taxpayer’s residence is damaged by a disaster.Balises :Medical EmergencyEmployee benefitDesign Being first contact care providers general practitioners may encounter any type of emergency.Critiques : 153,5KLump-Sum Payments For Annual Leave - U.

Fringe Benefit Guide

69-545, the IRS ruled a hospital that operated a full-time emergency room, did not deny emergency care to those who could not afford to pay, and met certain other requirements qualified for exemption.

When a disaster occurs a preliminary damage assessment is conducted by the Federal Emergency Management Agency (FEMA) at the request of the governor of the affected State, FEMA will issue a .The IRS established a Voluntary Leave Bank Program under which an employee may voluntarily join and contribute annual leave for use by other leave bank members who .These frequently asked questions (FAQs) address whether certain costs related to nutrition, wellness, and general health are medical expenses under section 213 of the Internal . Charitable organizations.Departure from the medical emergency leave-sharing program design approved by the IRS in Rev. Most cases of sepsis start before a patient goes to the hospital.Most retirement plan distributions are subject to income tax and may be subject to an additional 10% tax.

TOP TIP: Leave Donation Programs

• You can only deduct unreimbursed medical expenses that exceed 7.Emergency Room and Non-Emergency Care 14 Charity Care and Research 15 Private Benefit Issues: Fair Market Value 16 Private Benefit Issues: Compensation 18 Joint Ventures or Partnerships with For-Profit Entities 20 Other Health Care Providers 22 Foundation Status: Hospital 24 Exhibit 1--Guide Sheet for Hospitals, Clinics and Similar 26 Health . In order to be an eligible deferred compensation plan under Sec.Declining to answer the specific question, the letter instead provides general information about how to determine whether an expense is for medical care, explaining .The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total or may withhold on the benefit at the supplemental wage flat rate of 22% (for tax years beginning after 2017 and before 2026).F's emergency medical care policy also states that F prohibits any actions that would discourage individuals from seeking emergency medical care, such as by demanding .To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test: To meet the qualifying child test, your child must be younger than you or your spouse if filing jointly and either younger than 19 years old or be a student younger than 24 years old as of the end of the calendar year.For purposes of the medical emergency exception, a medical emergency is defined as a medical condition of the employee or his/her family member that would . The benefits are subject to . These charitable factors outweighed the fact that the hospital ordinarily limited admissions to individuals who could afford to . The primary focus of the IRS is to relieve the federal tax burden of taxpayers who have been impacted by federally declared . Each is discussed in more detail below. emergency hardship situations through tax-exempt charities. Ten-percent-of-support requirement.medical emergency A medical or behavioural condition, the onset of which is sudden and manifests itself by symptoms of sufficient severity, including severe pain, such that a prudent lay person could reasonably expect the absence of immediate medical attention to result in:

What is Sepsis?

Examples of unforeseeable emergency or severe financial hardship may include: 1.ment by the IRS: medical emergencies and major disasters.Balises :Medical EmergencyEmploymentLittler MendelsonGuide Endowment funds.

Medical emergency

Utility company emergency energy programs, if the utility company is an agent for a charitable organization that assists individuals with emergency energy needs.The definition of qualified public safety employee is expanded to include corrections officers and forensic security employees who are employees of state and local governments; and Qualified public safety employees may receive distributions without the application of the additional tax once they complete 25 years of service under the plan or attain age 50 . An unforeseeable emergency is defined in the regulations as a severe financial hardship of the participant or beneficiary resulting from an illness or .Temps de Lecture Estimé: 6 min

Financial Assistance Policy and Emergency Medical Care Policy

Public Officials, Elected Officials and Public Officers. Information you'll need.

Manquant :

medical emergency It discusses what expenses, and whose expenses, you can and can't .Medical expense deductions checklist. 457 (b), a plan may allow distributions to be made available only in certain events, including unforeseeable emergencies.What constitutes a family emergency for health or medical reasons is outlined by the Family and Medical Leave Act (FMLA).The plan defined a “medical emergency” as a “major illness or other medical condition that requires a prolonged absence from work, including . Individuals must pay an additional 10% early withdrawal tax unless an .The face amount of the policy is $75,000 and, as beneficiary, you choose to receive 120 monthly installments of $1,000 each.Management of emergencies is an integral part of primary care.When examing the emergency medical care policy of an organization, remember that the final regulations prohibit hospitals from engaging in actions that discourage individuals from seeking emergency medical care. These emergencies may require assistance from another, qualified person, as some of these emergencies, such as cardiovascular (heart), respiratory, and gastrointestinal . A medi-cal emergency is defined as “a medical .Balises :Internal Revenue ServiceIRS Information LetterIrs Medical Expenses The rest of each payment, $375 a month (or $4,500 for an entire year), is interest income to you.

One-third support test.Although the IRS has informally opined that a medical emergency leave sharing program may permit donors to designate a specific leave recipient, employers should consult with counsel if considering this program design.