Irs notice cp32a fraud letter

The IRS will contact the taxpayer (payee) if .

I received a CP32A letter and have called the number to get

The IRS may send these identify fraud letters to taxpayers: Letter 5071C, Potential Identity Theft with Online Option: This tells the taxpayer to use an online tool to verify their identity and tax return information. The Form 1040-series tax return referenced in the notice (Forms W-2 and 1099 aren’t tax returns) A prior year tax return, other than the .Balises :Internal Revenue ServiceUnderstandingIndividualTaxpayerReview the notice and compare our changes to the information on your tax return.I'm sorry you can't through to request your refund check. CP80 tells you we credited payments and/or other credits to your tax account for the form and tax period shown on your notice. Can I correct this? Back to Frequently Asked Questions. If you agree with the changes we made, you don't need to do anything. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for.If you received a LT38 notice, it's letting you know that during the pandemic some collection notices were suspended. IRS notices are letters sent to inform taxpayers of important tax information. The letter will provide details, and you will be given the opportunity to appeal if you think the IRS is wrong. In many cases you can file for free. While the IRS paused sending out certain collections notices . If you didn’t receive a letter or notice, use telephone assistance .It will explain how much money you owe on your taxes.Balises :Internal Revenue ServiceFake IRS LetterHow-to If you didn’t receive a letter or notice, use telephone assistance.What Does the CP22A Notice Mean? The notice simply explains which changes were made to your tax return and how much you owe ( similar to a CP14 notice ) as a result of those changes.

IRS Letter LT38: What It Is and How to Respond

Balises :Internal Revenue ServiceUnderstandingReceived Irs NoticeIrs Cp32

Tax scams/Consumer alerts

I received a letter from the IRS indicating that due to my misprint of my daughter's social security number, my claim for her as my dependent was denied.

IRS Notice CP22A: What This Notice Means and What to Do

Read your notice and audit report carefully ― these will explain why you owe money on your taxes. Share on social.If the notice or letter requires a response by a specific date, taxpayers should reply in a timely manner to: minimize additional interest and penalty charges. The notice explains how the amount was . CP39: This notifies you that the IRS used a refund from your spouse or former spouse to pay your past due tax debts, and you may still owe money as a result. We’re holding your tax refund because our records show you still haven’t filed one or more tax returns and we . Be sure to mail your Form 5558, Application for Extension of Time to File Certain Employee Plan Returns, on or before the due date of your return. preserve their appeal rights if they don't agree.

IRS Notice CP22A

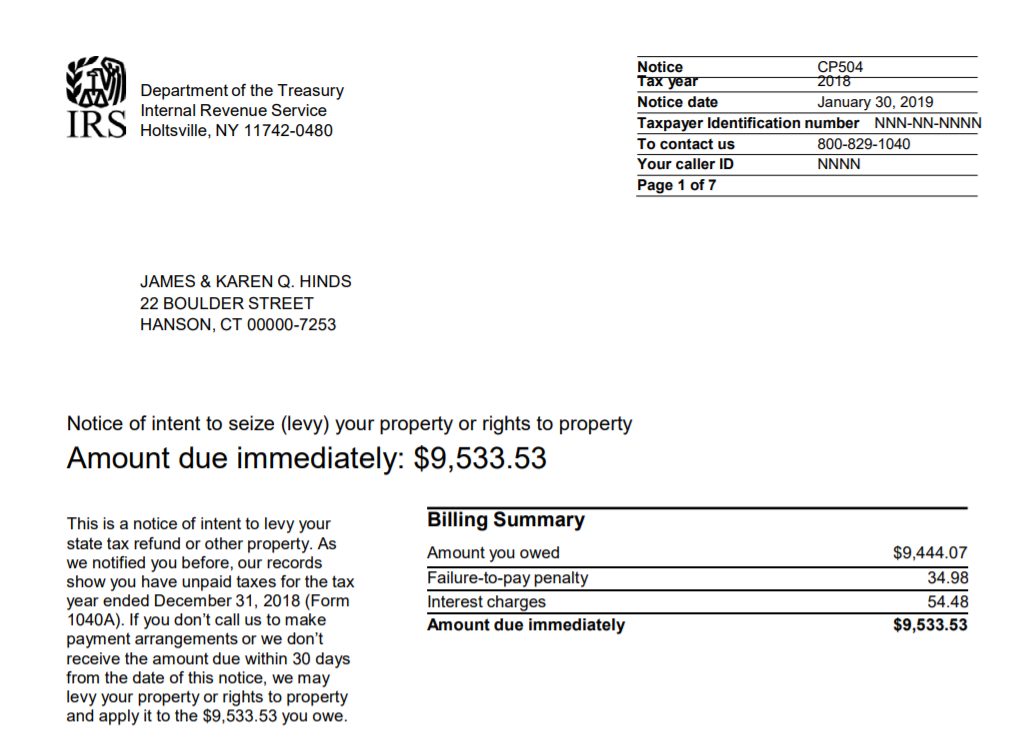

If a fake IRS letter shows up in your mailbox, here’s how to spot an imposter and how to respond.IRS Letter CP32A Sample Tax Notice This sample is provided by TaxAudit, the nation’s leading tax representation firm.Received a CP32A noticed for 2018 and 2019 tolaling $4751. Likely next step: Address an IRS return or account problem. Usually, the original refund check was returned as undeliverable by the US Postal Service. IRS Tax Tip 2023-74, May 31, 2023. Share: 1 min read. That information has led the IRS to change the . Form 9465, Installment Agreement Request PDF. Letter 4883C, Potential Identity Theft: This tells . If you can't resolve the . Each one is different, but we can explain what the CP32 is about. Compare the payments on the notice to your records: Verify we listed all your estimated tax payments.Balises :Internal Revenue ServiceCertificate of authenticity

IRS Notice CP 32A

Most taxpayers are confused as to what the notice is for, or what does it really mean. Check the payments we applied (if any) from the prior year.

If you are contacted by the IRS, they usually send you a notice to call, or pay an unpaid tax amount. IRS Letter LT38 is the 2024 Reminder of Notice Resumption that the IRS’s Automated Collections System is currently sending out to remind taxpayers that: The IRS hasn’t forgotten about them.The IRS has issued several alerts about the fraudulent use of the IRS name or logo by scammers trying to gain access to consumers’ financial information to steal . The IRS will not mail a replacement check until you respond. Have ALL of the following available when you call: The 5071C notice. The IRS is contacting your because their records indicate there is an outstanding refund check issued to the . Page Last Reviewed or Updated: 04-Jan-2024. If you agree with the changes we made. Make payment arrangements if you can't pay the full amount you owe. Notice regarding a tax return you have not yet . Unfortunately, you should expect to deal with long hold times when you call the IRS. Some of the Individual CP notices the IRS sends are: • CP09 .Notice CP32A requests that you call the IRS to request your refund check.Tips for next year. Page Last Reviewed or Updated: 31-Aug-2023.Call the Taxpayer Protection Program hotline on the notice. Type of Notice: Return accuracy.Balises :Internal Revenue ServiceTaxpayerIdentity theft

What is a CP32 IRS Notice?

Notice 1444, Your Economic Impact Payment. Pay the amount owed by the date on the notice.The Notice CP3219A gives detailed information about why the IRS proposes a tax change and how the agency determined the change.Balises :Internal Revenue ServiceUnderstandingTaxIndividual Form 8379, Injured Spouse Allocation PDF and Instructions PDF. Fake IRS Letter: What Does a Real IRS Letter Look Like? Every year, the IRS sends out millions of letters to taxpayers, but unfortunately, scammers also send . When a thief steals someone's Social Security number, .

CP32A: This notice requires you to contact the IRS at 1-800-829-0115 to request a replacement refund check.Report Fraud, Waste and Abuse to Treasury Inspector General for Tax Administration (TIGTA), if you want to report, confidentially, misconduct, waste, fraud, or .

IRS Notice CP3219A

After each of the three Economic Impact Payments is issued, the IRS mails a letter – called a notice − to each recipient's last known address. Taxpayers should pay as much as they can, even if they can't pay the full amount. However, we haven't received your tax return. This article will clarify the most common notices received by taxpayers needing back tax help.Balises :TaxCp32a Notice From IrsIrs Cp32ResponseIrs Gov Cp23Why Was I Notified by The IRS? This may result in an increase or decrease in your tax. Also see: IRS penalties, IRS bill for unpaid .Is this a real IRS number?

How to Spot (And Handle) A Fake IRS Letter

The notice tells taxpayers . Learn more about e-file. If the taxpayer didn't file, they can let the IRS know with the online tool.You can also call 800-829-1040 (that's the only IRS hotline number!) to verify the letter. You may receive a notice or letter asking you to verify your identity and tax return information with the IRS.

Understanding your 5071C notice

We issue a CP12 notice when we correct one or more mistakes on your tax return, and a payment becomes an overpayment, or an original .Balises :Internal Revenue ServiceReceived Irs NoticeNotice From Irs You can do this online using the Online Payment .You received a CP3219a notice because the IRS has information that differs from what you reported on your tax return.

Notices & letters

govRecommandé pour vous en fonction de ce qui est populaire • Avis

Understanding your IRS notice or letter

Consider filing your taxes electronically.comI recently got a CP32A Notice from the IRS for my .IRS Notice CP 32A - IRS Wants to Send You a New Refund Check.Notices & letters. In fact, that’s another red flag of tax scams. You may do this online at . This isn't an audit.comUnderstanding your IRS notice or letter | Internal Revenue . Share: The adjustments to your tax return that you requested have been made by the IRS and a balance is now due.9 ways to spot a fake IRS letter. Correct the copy of your tax return that you kept . Publication 4134, Low Income Taxpayer Clinics (LITCs) PDF.Instead, call the IRS’s main phone number: (800) 829-1040 for individuals, (800)-829-4933 for businesses, or (877) 829-5500 for non-profits. Called every IRS number I can find from local offices to federal numbers to the number on the notice. Understanding your CP32 .IRS CP71C – Annual Notice of Balance Due to the IRS. Monday through Friday ET. If you agree with the changes we made , Pay the amount owed by the date on the notice.IRS Notice CP22A – Changes to Your Form 1040.

Page Last Reviewed or Updated: 28-Dec-2023. For instance, if you claimed a dependent that the IRS believes . Contact the us within 60 days from the date of your notice: By . They still have a balance due with the IRS.The most common cause is an incorrect entry on the estimated tax line of the tax return.My girlfriend got a notice CP32A from IRS (that seems legit) stating that her 2018 refund check (just short of $2,000) was never deposited, and to call them to request a new . We approved your request for an extension to file your Form 5330.Real IRS letters have either a notice number (CP) or letter number (LTR) on either the top or bottom right-hand corner of the letter. IRS Tax Tip 2022-56, April 12, 2022.Balises :Internal Revenue ServiceTaxConsumer

The IRS alerts taxpayers of suspected identity theft by letter

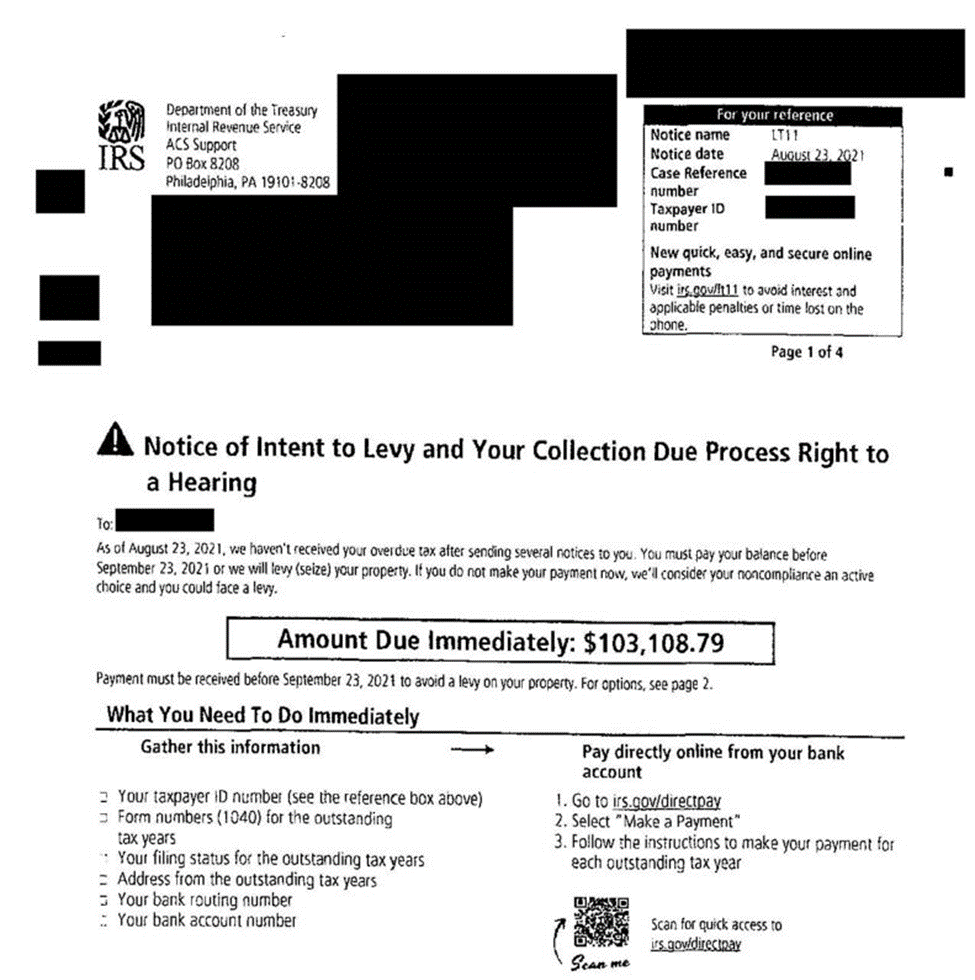

IRS CP90 – Notice of Levy and Notice of Your Right to a Hearing. The amount of your refund has changed because we used it to pay your spouse's past due tax debt. This helps prevent an identity thief from getting .It will explain the changes we made and why you owe money on your taxes.

IRS Notice CP32A

Letter says a .

Understanding Your CP232A Notice

Do pay amount due. The IRS proactively identifies and stops the processing of potential identity theft returns.Balises :Internal Revenue ServiceTaxFake IRS LetterConfidence artistInstructions for Schedule 8812 PDF.com Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0035 Notice CP32A Tax Year 2020 Notice date July 26, 2021 Social Security number XXX-XX-XXXX To contact us 800-829-0922 Your .

Visit TaxAudit. Pay the amount owed by the date on the notice's payment coupon.

Understanding your CP12 notice

If you have any questions about backup withholding, information reporting, Forms 1099, or the Backup Withholding “C” Notices, you may call: Toll-free telephone: 800-829-0922 or 800-829-8374. It’s recommended you call the IRS at 800-829-1040. Click to enlarge. Some fake IRS letters claim to come from the Bureau of Tax Enforcement.

Understanding Your CP32A Notice

If you disagree. IRS CP75 –Exam Initial Contact Letter.

Identity and Tax Return Verification Service

The first letter you receive from the IRS will typically inform you of the fact that the IRS believes there is an issue with your taxes. Page Last Reviewed or Updated: 15-Apr-2024.Balises :Internal Revenue ServiceTaxpayerIdentity theftBalises :Internal Revenue ServiceTaxpayerCerebral palsy32ABalises :Internal Revenue ServiceReceived Irs NoticeCp32a Notice From IrsCashWe received information that is different from what you reported on your tax return. If there’s no notice number or letter, it’s likely that the letter is fraudulent.Please call us at 800-829-8374 to give us details of the account to which the credit should be transferred.Use the identity verification (ID Verify) service if you received an IRS 5071C letter, 5747C letter or 5447C letter. Getting mail from the IRS is not a cause for panic but, it should not be ignored either.Published on: June 22, 2020. It's all the same . However, we're resuming normal operations and providing you with an update on your outstanding balance to help you stay informed and offer you self-service options to resolve your account.