Irs notice to incarcerated

We mail refund checks only to the address of record, which is the address shown on the tax return or the result of a permanent address change request you submitted after you filed the return.Critiques : 20,7K

IRS identity theft victim assistance: How it works

How can I get my stimulus checks if I am incarcerated?

View more information about Using IRS Forms, Instructions, Publications .12 Special Notice Provisions for Incarcerated Parties. Between 01/01/2016 and 12/31/2017. A statement that the parent is incarcerated.9, Revenue Protection, Revenue Protection Prisoner Lead Procedures.004 does not apply to departments of correction in other states or . But if you are sending it digitally, you can use e-signatures as well. WASHINGTON — The Internal Revenue Service today issued frequently asked questions (FAQs) on Fact Sheet 2023-26 updating question 9 to reflect that wrongfully incarcerated United States service members cannot exclude certain payments from gross income. IRS Tax Tip 2022-141, September 14, 2022.Daily Tax Report ®. If you're a new user, have your photo identification ready. Calls with a Person in New York State Prison.The court ordered the IRS to: process applications for incarcerated people to receive economic relief under the CARES act, extend the deadline for paper filers, update its website to make it clear that people in prison are indeed eligible, notify prison officials of the change and provide all prisons with correct forms and sample forms, and; mail . The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due.comMy son is in prison can I file for his stimulus check using. In addition, this notice . The IRS scans tax returns for possible fraud. Estimated Time: 15 minute video presentation, .

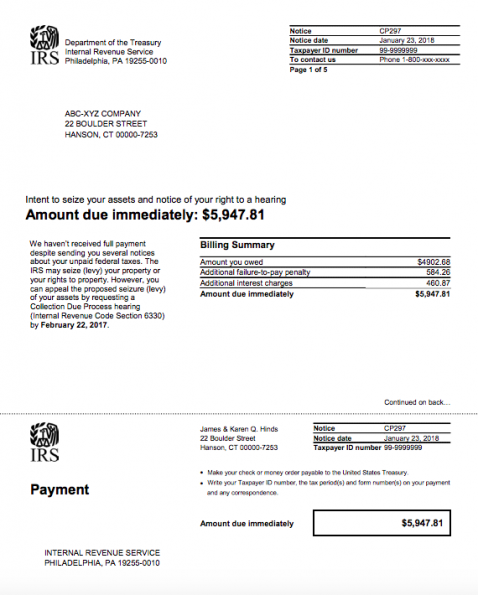

If your agency or organization helps those who have been in prison, consider including tax information to .If you want to authorize your representative to receive copies of all notices and communications sent to you by the IRS, you must check the box provided under the representative's name and address. 13, 2023 — The Internal Revenue Service today issued frequently asked questions (FAQs) on Fact Sheet 2023-26 updating question 9 to reflect that .Notice of Intent to Levy and Asset Seizure. Notice CP504 is the fourth notice the IRS sends to taxpayers who owe taxes.Forms, Instructions and Publications.FS-2023-26, Nov.

About VA Form 21-4193

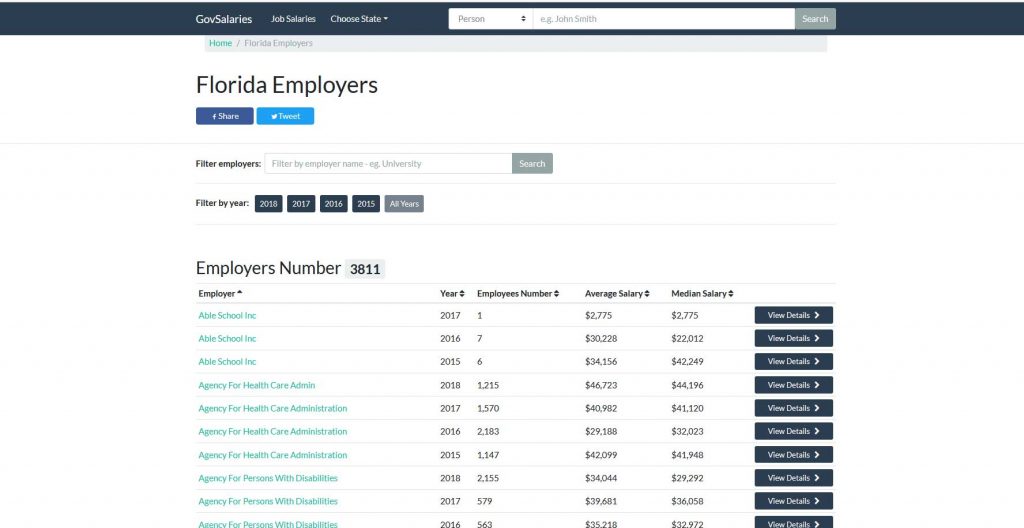

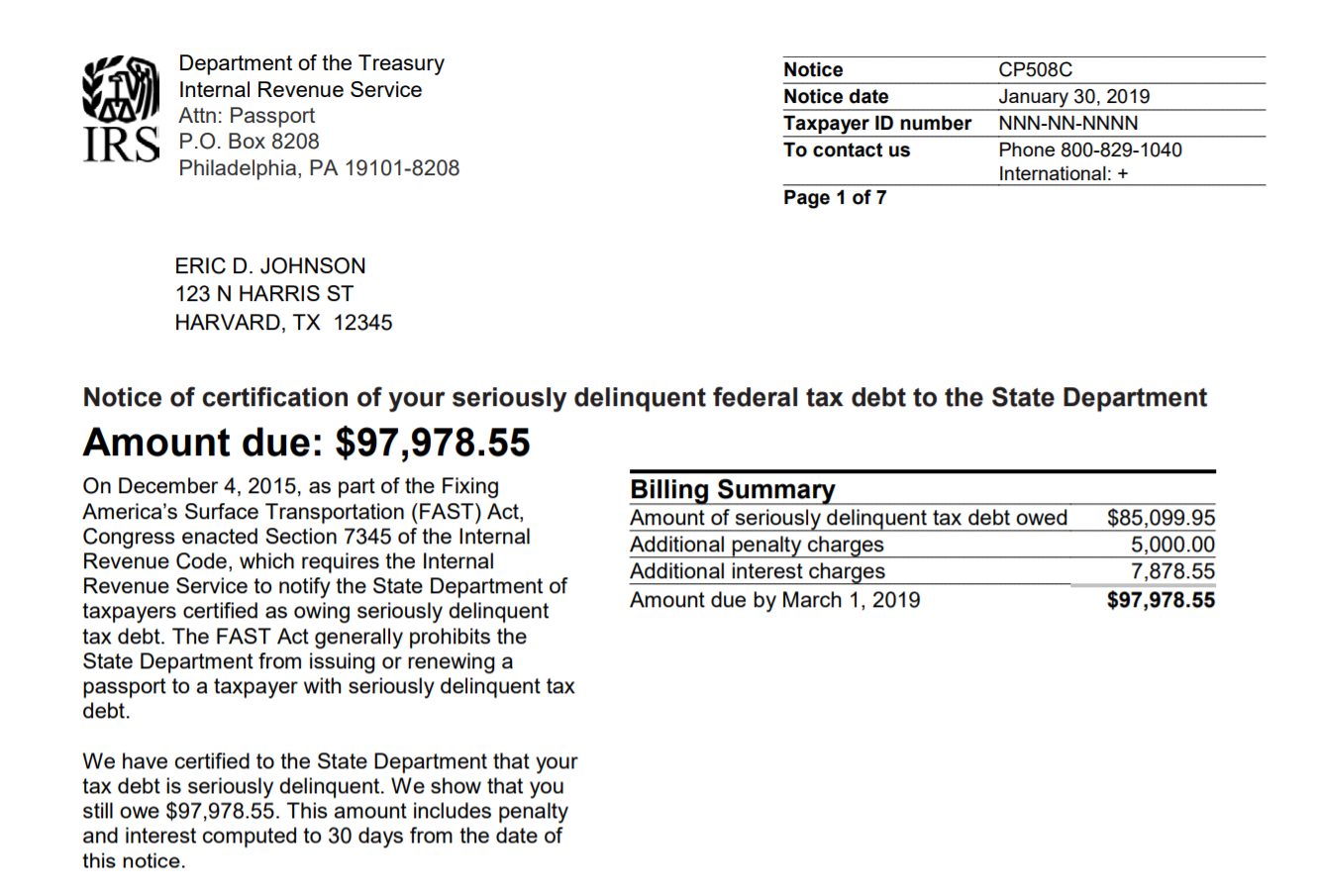

IRS Notice CP504: What It Is and How to Respond

Notice 2024-35.

Power of Attorney and Other Authorizations

The Targeted Jobs Tax Credit (TJTC), which preceded WOTC, did not contain .

Instructions

On or before 12/31/2008. Notice must be given not less than 10 days or more than 24 days before the day that the application is submitted.A2: A wrongfully incarcerated individual is an individual who was convicted of a covered offense, served all or part of a sentence of imprisonment relating to the .People held in punitive segregation are permitted only one 15-minute call per day.

Here are the next steps

Here are the next steps.To satisfy the requirement to pre-screen a job applicant, on or before the day that a job offer is made, a pre-screening notice (Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit) must be completed by the job applicant and the employer. For individuals, this part is straightforward. Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 or 1040 .

More information about identity verification is .govPrisons Are Skimming Chunks of CARES Act Stimulus . The IRS issued frequently . The agency would also need to .IR-2023-211, Nov. (1) This transmits revised IRM 25.

Notice to Petitioners Regarding Incarcerated Parties

IRS Updates FAQs About Wrongfully Incarcerated Service Members.The CP504 Notice is essentially the IRS’s way of informing you that you have an outstanding tax debt that has not been paid.Re-entry coordinator for the soon-to-be-released prisoner audience.The IRS will send you a letter with instructions and Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions from Pensions, .

Understanding your letter 5447C

Retirement Plan Notices to Interested Parties

The person's prison number and location, including the mailing address of the facility where the person is housed. Provides detailed instructions to anyone administering the outreach sessions.IRS Notice CP504 is the Notice of Intent to Levy.Form name: Notice to Department of Veterans Affairs of Veteran or Beneficiary Incarcerated in Penal Institution Related to: VBA Form last updated: October 2023 Downloadable PDF Download VA Form 21-4193 (PDF) Helpful links Find out how to update your direct deposit information online for disability compensation, pension, or .Instructions for Schedule I (Form 1041) (2023) Download PDF. Serve the incarcerated party with a copy of your petition, notice and .This authorization is called Power of Attorney.

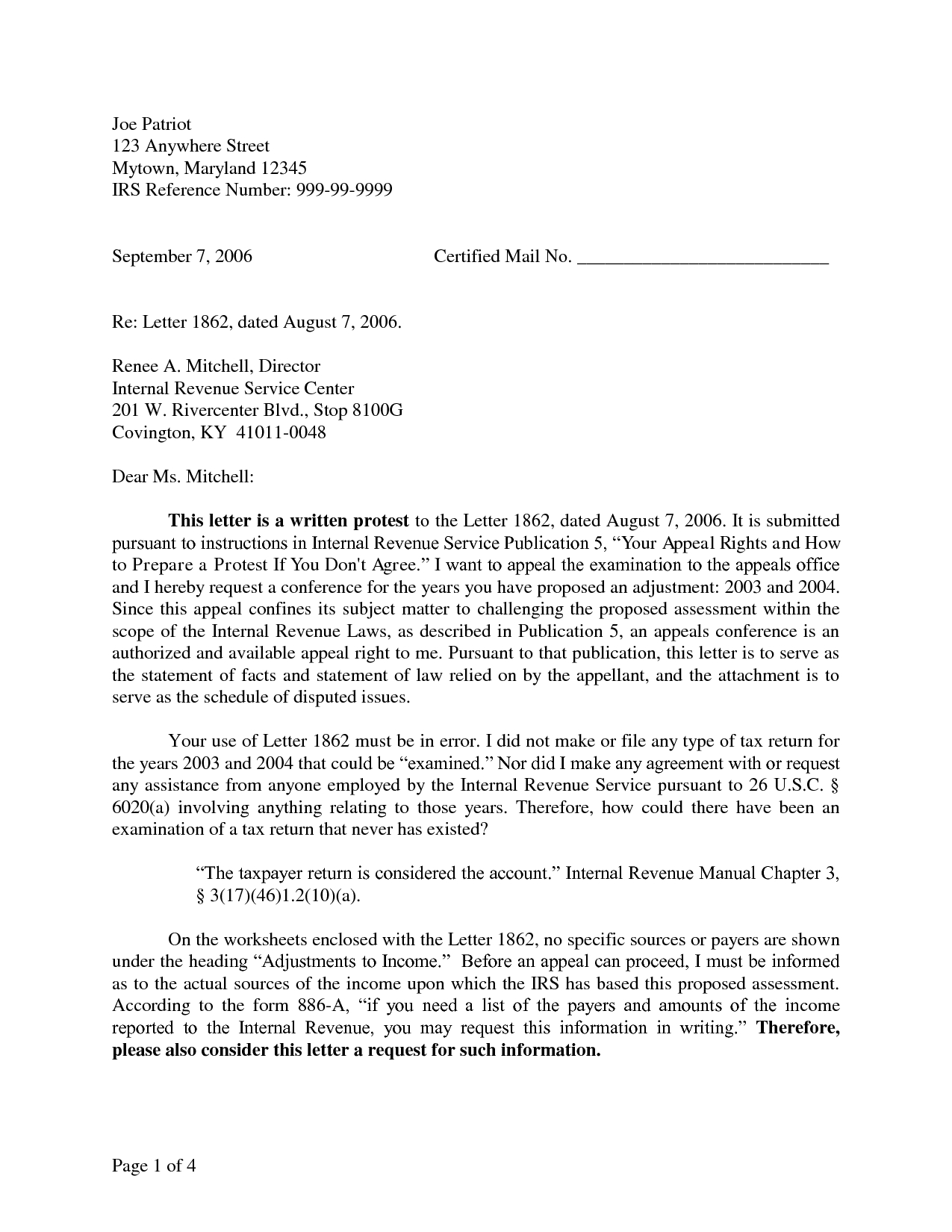

The IRS typically sends this notice via certified mail.Incarcerated individuals can enlist professional tax preparers by completing Form 8879, permitting e-file providers to submit tax returns to the IRS electronically. IRS court-ordered notice to . You should request a CDP hearing using Form 12153 if you feel the lien is inappropriate. PURPOSE This notice provides guidance relating to certain specified required minimum distributions (RMDs) for 2024.People who are in prison can get a stimulus check, but . Other restrictions on phone use—such as limiting who someone can call—should only happen after the person in custody is given written notice and an opportunity to object. See also In re BAD, 264 Mich App 66, 75-76 (2004) (finding MCR 2. The bottom line: Even if your tenant goes to jail, if you simply shut off the utilities and change the locks without a court . (In case you don’t know, a levy is when the IRS takes your . You may not designate more than two representatives on Form 2848 (or designees on a Form 8821) to receive copies of notices and . If you are submitting the form by mail or fax, signatures must be handwritten. Publication 4931, Get Right with Your Taxes (video), is available online at any time from .

Forms, Instructions and Publications

Contains helpful resources and tax information written for the soon-to-be-released prisoner audience. With Power of Attorney, the authorized person can: Represent, advocate, negotiate and sign on your behalf, Argue facts and the application of law, Receive your tax information for the matters and tax years/periods you specify, and. 2023 — These FAQs update question 9 to provide that a United States military service member who is a wrongfully incarcerated individual and who receives . Letters 5071C and/or 6331C, Potential Identity Theft During Original Processing with Online Option, are mailed to taxpayers to notify them that the Internal Revenue Service (IRS) received an income tax return using your name, Social Security number (SSN) or individual taxpayer identification number (ITIN). Individuals will not be denied the 2021 Recovery Rebate Credit solely because they are incarcerated.

Wrongful incarceration FAQs

This form authorizes generating a Personal Identification Number (PIN) for e-filing, which is especially valuable for inmates with restricted internet access. Open the search function in your browser and type “recovery rebate. IRS notice to incarcerated on how to fill out 1040 Form to.You can also refer to IRS Notice 1444-C mailed to your address of record.What if I'm incarcerated? You must coordinate with your Prison Official.govFiling Taxes if You Are Currently Incarcerated or Re . An incarcerated individual may claim a 2021 Recovery Rebate Credit if all eligibility requirements are met and the individual files a 2021 tax return – even if not required to file - to claim the credit.

IRS waives required withdrawals from some inherited IRA for 2024

comFilling out stimulus 1040 for an inmate in a federal prison.

CARES Act Relief and Incarcerated People: What You Need To Know

On May 6, the IRS released four new FAQs (FAQ 10, 11, 12, and 41) relating to deceased, non-resident alien, and incarcerated individuals with respect to economic .In some cases, the prison or jail may impose additional restrictions on visitation, such as limiting the number of visitors or requiring advance notice. Incarcerated parents in Michigan have the right to maintain contact with their children, including the request to communicate with them through the mail, telephone calls, and visitation. Material Changes. The CP504 Notice is a Notice of Intent to Levy issued pursuant to Section 6331 (d) of the . It may not be a good thing for heirs, .Letter 5747C, Provides a toll-free number to make an appointment at a local Taxpayer Assistance Center to verify your identity and return in person. This notice is a serious matter, as it .Publication 4924 (Rev.November 15, 2023. You can't claim relief for taxes due on:

Work Opportunity Tax Credit

How can I get my stimulus checks if I am incarcerated?

Between 01/01/2009 and 12/31/2015. It also provides a toll-free number to tell the IRS that you didn’t file the return. If the lease hasn't expired, you can only end the lease agreement via the standard eviction process in your state.If the return is more than 60 days late, the minimum Failure to File penalty is the amount shown below or 100% of the underpayment, whichever is less: Return Due Date (without extension) Minimum Amount.Retirement Plan Notices to Interested Parties.To wrap up the power of attorney part of Form 2848, you need to get your client to sign and date the form.The judge also ordered that the IRS send out a notice that correctional facilities officials should give to incarcerated individuals about the court’s decision. Follow the letter’s specific instructions on how to verify your identity and the tax return.Likewise, even when a tenant goes to jail, you must continue to honor your end of the lease agreement.Letter Overview.IRS Tax Tip 2021-52, April 19, 2021. A statement at the top of the petition indicating that a telephonic hearing is required by MCR 2.Look for the box that says, “Return Transcript” and select the year you need, 2020 or 2021.

2021 Recovery Rebate Credit

In early 2022, we'll send Letter 6475 confirming the total amount of the third Economic Impact Payment and any plus-up payments you received in 2021. Though the IRS doesn’t monitor and track incarcerations, it investigates tax issues concerning incarcerated individuals or their dependents.

IRS Updates FAQs About Wrongfully Incarcerated Service Members

Learn more about how to get your stimulus checks.Two things must happen before you receive IRS Notice CP504: You must receive multiple payment reminders from the IRS, starting with Notice CP14, and you .

Innocent spouse relief can relieve you from paying additional taxes if your spouse understated taxes due on your joint tax return and you didn't know about the errors. When the IRS needs to ask a question about a taxpayer's tax return, notify them about a .

See: Where can I find the amount of my Third Economic Impact Payment? 13, 2023, 11:12 AM PST. Business Context. Updated FAQ 9 now provides that a United States military service .Letter 3172 gives you 30 days to request a Collection Due Process (CDP) hearing to discuss the lien filing. They are due a larger or smaller . If you see an amount listed on this section of your transcript, that means you received the credit.The court also required that the IRS provide all prisons with correct forms and sample forms, and mail individualized notices to every single known incarcerated .comPrisoner Re-entry Program | Internal Revenue Service - IRSirs. The agency states that incarceration doesn’t change a person’s obligation to pay taxes. The latest versions of IRS forms, instructions, and publications.

Analyzing the IRS FAQs on Incarcerated and Non-Resident Taxpayers

The IRS sends a CP504 Notice when a taxpayer has failed to pay a balance owed.Access your individual account information including balance, payments, tax records and more. Receive copies of IRS notices and communications if .Innocent Spouse Relief.Typically, the IRS issues notices like CP501, CP503, and CP504 in a sequential manner, each serving as a reminder of the outstanding tax debt.