Irs pub irs pdf fw9 pdf

If box 2 is checked on Form(s) 1099-DA and NO adjustment is required, see the instructions for your Schedule D (Form 1040), as you may be able to report your .Here's the original download link from the Internal Revenue Service: https://www.

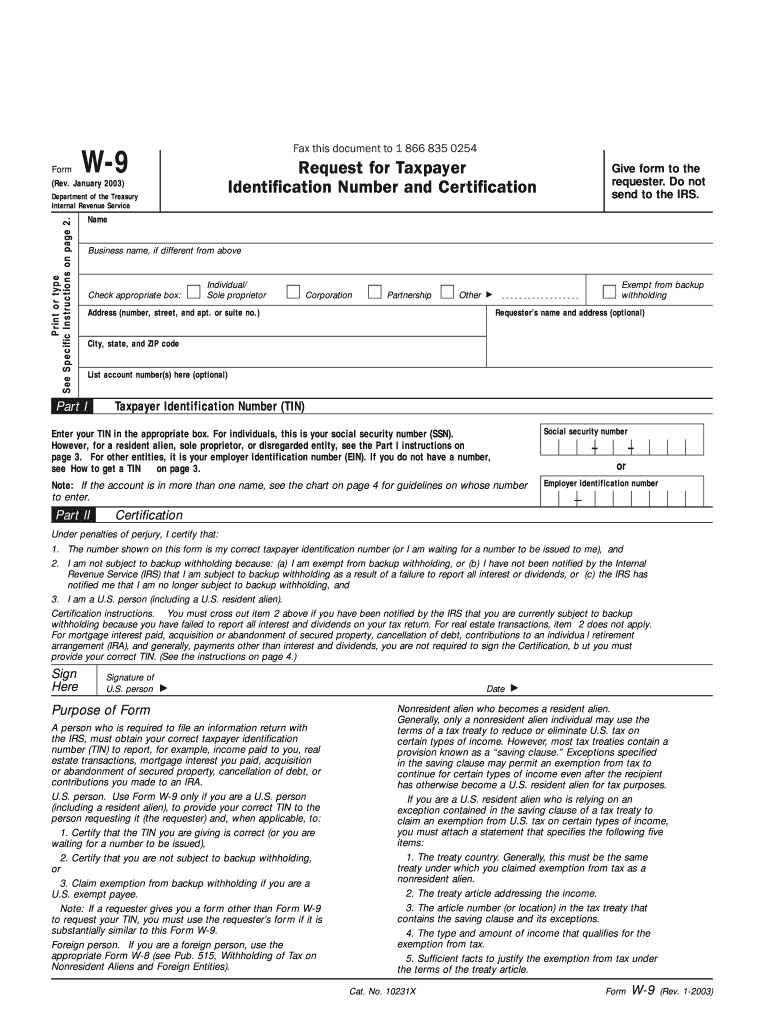

How to complete Form W-9

Title: C:\Documents and Settings\rachale.Taille du fichier : 145KB

Irs-pdf

To create and sign the form, follow these five steps: 1.ETOOLSGROUP\Desktop\www.

Specific Instructions. Spanish Versions: Form W-7 (SP) PDF.If you’re asked to complete Form W-9 but don’t have a TIN, apply for one and write “Applied For” in the space for the TIN, sign and date the form, and give it to the requester. Related: Instructions for Form W-7 PDF. If this Form W-9 is for a joint account, .The latest versions of IRS forms, instructions, and publications.

2024 Form W-4P

Choosing not to have income tax withheld.gov/pub/irs-pdf/fw9.

Generally, if you An IRS form W-9, or “Request for Taxpayer Identification Number and Certification,” is a document used to obtain the legal name and tax identification number (TIN) of an individual or business entity.

How to Sign a PDF W-9 Form Electronically

Purpose of Form, below. withholding on income effectively connected with the conduct of a trade or business in the . Howard Place Denver, CO 80204-2305. 3 : Interlocuteur commercial. Get or renew an individual taxpayer identification number (ITIN) for federal tax purposes if you are not eligible for a social.

Application for IRS Individual Taxpayer Identification Number.72 KBDescription 0424 Form 433-A (OI. The name should match the name on your tax return. See the “Add/Modify Vendor” information at. These expenses are the costs of attending an eligible educational institution, including graduate school, on at least a half-time basis. Yes. The following persons must provide Form W-9 to the payor for purposes of establishing its non-foreign status. 8-2013) In the cases below, the following person must give Form W-9 to the .Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how .These entities should use Form W-8ECI if they received effectively connected income and are not eligible to claim an exemption for chapter 3 or 4 purposes on Form W-8EXP.withholding, see Pub. Failing to report a Form 1099 on your tax return (or at least explain it) .88 KBDescription 0424 Form 433-B (OI. resident by definition ( https://www.95 KBDescription 0424 Form 656-B (PD.pdf) you will receive a 1099 for qualified earnings posted to your TuneCore . When you are ready to sign the form, click the link in the lower right sidebar labeled Fill & Sign. Se ha añadido una nueva línea 3b a este formulario. Name of entity/individual.Individual Taxpayer Identification Number (ITIN) Form W-9 (or an acceptable substitute) is used by persons required to file information returns with the IRS to get the payee's (or . 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

515, Withholding of Tax on Nonresident Aliens and Foreign Entities, for more information and a list of the W-8 forms.

Internal Revenue Service

Demande de numéro d’identification de contribuable et attestation. person that is a partner in a partnership conducting a trade or business in the United States, provide Form W-9 to the partnership to establish your U. In the case of a disregarded entity with a U.govW-9 Form: What Is It, and How Do You Fill It Out? | SmartAssetsmartasset.51 lignesContents of Directory irs-pdf. Electronic Submission of Forms W-9 Requesters may establish a system for payees and payees' agents to submit Forms W-9 electronically, including by fax.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Manquant :

pubgovForm W-9S Identification Number and Certification

Forms & Instructions | Internal Revenue Service - IRSirs.Form W-9 (sp) (Rev. It is commonly required when making a payment and withholding taxes are not being deducted. An entry is required. owner of the disregarded entity and not the disregarded entity.

10-2018) By signing the filled-out form, you: Certify that the TIN you are giving is correct (or you are waiting for a number to be issued), Certify . View more information about Using IRS Forms, Instructions, Publications and Other Item Files. Updated February 05, 2024. Then, complete Steps 1a, 1b, and 5. Once scanned please attach to the vendor code request made via the NUPortal.

December 2017) Identification Number and Certification.Please submit the above-mentioned documents and contact information to your CDOT point of contact. 2 : Souscripteur / Adhérent – Ex. Next click the Sign link at the top of the form, and choose Add Signature. October 2021) Department of the Treasury Internal Revenue Service Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) 10-2018) By signing the filled-out form, you: Certify that the TIN you are giving is correct (or you are waiting for a number to be issued), Certify that you are not subject to backup withholding, or.The Internal Revenue Service on March 6 released an updated and finalized Form W-9, Request for Taxpayer Identification Number and Certification, with a revision date of . 505, Tax Withholding and Estimated Tax. 12-2017) Page 2.tif-Page1 Author: rachale Created Date: 11/13/2008 9:10:43 PM For guidance related to the purpose of Form W-9, see . • A foreign partnership or a foreign trust (unless claiming an exemption from U. 25240C Form W-9S (Rev.gov and output on high-quality devices such as laser or ink-jet printers, unless otherwise specified on the form itself. You can choose not to have federal income tax withheld from your payments by writing “No Withholding” on Form W-4P in the space below Step 4(c).send to the IRS.Security numbers and dollar amounts paid and received, so IRS collection efforts are streamlined.Nonresident Alien Individual.Taille du fichier : 65KB

Downloading and Printing

gov/businesses/small-businesses-self-employed/forms-and-associated-taxes-for-independent-contractors

Deloitte Tax looks at final updated Form W-9

SwissLife Assurance et Patrimoine – Siège social : 7, rue . Request for Student's or Borrower's Taxpayer. Claim exemption from backup withholding if you are a U. If you notice the signature and date blocks .Internal Revenue ServiceThis policy includes forms printed from IRS. status and avoid section 1446 withholding on your share of partnership income.If you are a U. Department of the Treasury Internal Revenue . Get or renew an individual taxpayer identification number (ITIN) for federal tax purposes if . Name; Name Date Size . Qualified higher education expenses. (For a sole proprietor or disregarded entity, enter .pdfDate 2024-04-19 22:.Create Document. Forms that must be ordered from the IRS are labeled for information only and can be ordered online.Formulaire W-9.NAMEDATESIZEDESCRIPTIONName f433aoi. Before you begin. 3-2024) que es una entidad no considerada como separada de su dueño debe marcar el recuadro correspondiente para la clasificación tributaria de su dueño. You must enter one of the following on this line; do not leave this line blank. 10231X Form W-9 (Rev. Generally, these costs include tuition and certain related expenses. Find out how to save, fill in or print IRS forms with Adobe Reader.

-quot-1501765205.jpg)