Irs refund track

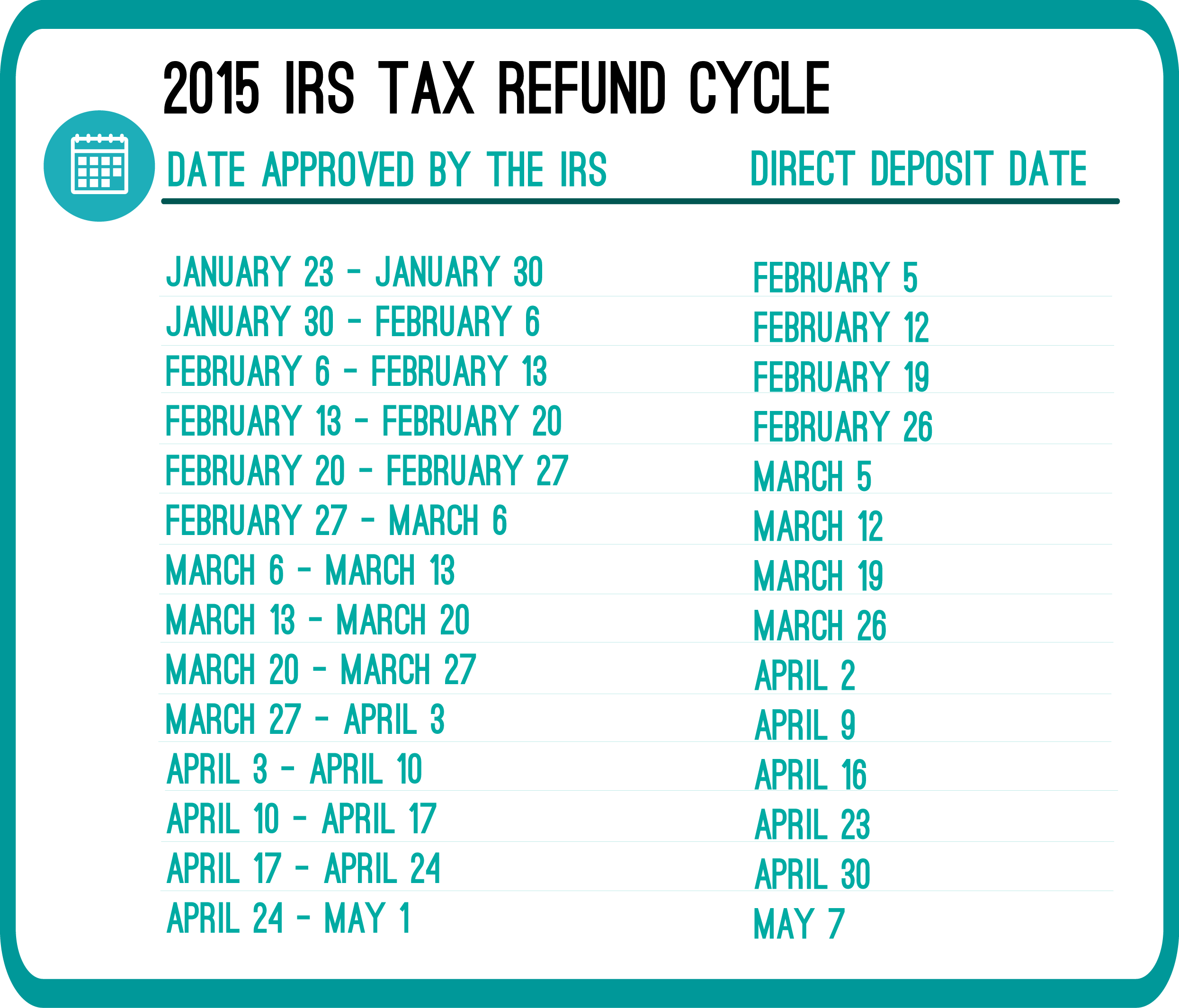

Enter the SSN or ITIN shown on your tax return.Enter your Social Security Number, Tax Year, Filing Status, and Refund Amount to get your refund status.gov or through the IRS2Go Mobile App.The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days.

Find out how to check the status of your federal or state tax refund, set up direct deposit, and deal with lower refunds or offsets. Received: The IRS has your tax return and is processing it. The benefit of error-reducing automatic calculators.Learn how to track your federal or state tax refund online or by phone with the IRS or your state. Find out the changes and delays for EITC and ACTC claims before February 15.

Refunds

2020 Recovery Rebate Credit: Must file a 2020 tax return to claim, if eligible. Taxpayers can check the status of their refund easily and conveniently with the IRS Where's My Refund tool at IRS. Get your refund status. Get My Payment: When your Third Economic Impact Payment is scheduled, find when and how we sent your Payment. But there’s .IRS Tax Tip 2024-23, March 28, 2024.You can directly access FREE tax software from your mobile device to quickly prepare and file your taxes and get your refund. For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts. The IRS operates a phone line for refund data, although it says it's aimed at people who don't have internet access.IR-2020-45, February 28, 2020.

This online tool helps taxpayers track their refund

tool at IRS. If you’re having tax problems because of financial difficulties or immediate threat of adverse action that you haven’t been able to resolve them with the IRS, the Taxpayer Advocate Service (TAS) may be able to help you.IRS Free File: Prepare and file your federal income tax return for free.Where’s My Tax Refund, a step-by-step guide on how to find the status of your IRS or state tax refund. According to official information from the IRS, once your tax return has been processed, the government agency takes approximately 21 .Pay your taxes. It has information, including step-by-step actions to follow, for the following topics: I don’t .

The guide is designed to .

Thousands Are Eligible for Tax Refunds From 2020

The tool also provides a personalized refund date after the return is processed and a refund is approved.Use the Where's My Refund? tool or the IRS2Go app to track your federal tax refund online.Critiques : 24,3K When installing IRS2Go, you may see a list of Android permissions that the app requests.

How to Track Your Tax Refund Status

Check your federal income tax refund online in English or Spanish with Where's My Refund, one of IRS's most popular features.

Locating a Refund

“We ensure that every taxpayer is treated fairly and that taxpayers know and understand their rights”. Follow the prompts and provide the necessary information when prompted to get the details about your refund status.Where's My Amended Return? You can check the status of an amended return around 3 weeks after you submit it. Or, if you prefer receiving help in-person, you can find a Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) site near you and receive free tax help. You can check the status of your .In most cases, 'Where’s My Refund' will show you one of three refund statuses. IRS2Go App Check your refund . To help you understand why we ask for certain permissions, we’ve provided a breakdown of the usage. It will take up to 20 weeks to process your return. You’re expecting a refund from an amended .All you need is internet access and this information: Your Social Security numbers.Enter your SSN, filing status and refund amount to track your tax refund online or through the IRS2Go App. Note: For security reasons, we recommend that you close your browser after you have finished accessing your refund . User-friendly options that are not available to taxpayers filing by .Elija cómo obtener su reembolso. The tool tracks your refund's progress through 3 stages: Return Received Refund Approved Refund Sent You get personalized refund information .comRecommandé pour vous en fonction de ce qui est populaire • Avis

About Where's My Refund?

IRS2Go is the official app of the Internal Revenue Service. Ingrese la cantidad total exacta en dólares del reembolso que se muestra en su declaración de impuestos. Approved: The IRS .Use Where's My Refund? to get a personalized refund date after you e-file or mail your tax return.Learn how to check the status of your refund with the “Where’s My Refund?” tool or the IRS2Go mobile app. Your Taxpayer Rights. Also learn what to do if your refund is undelivered .An official website of the United States Government Here's how you know

Let us help you

Find out how long it takes to receive . The IRS updates the status of . tool and app.Refunds and payments. The enclosed letter includes the IRS masthead with contact information and a phone number that do not . Learn why it may take longer to get your refund and .Check Your Refund Status Online in English or Spanish Where's My Refund? - One of IRS's most popular online features-gives you information about your federal income tax refund. You need your Social Security number, filing status, and . Select the filing status shown on your tax return. You need your SSN, filing status and refund amount to use . Information about your refund will be available 24 hours after you electronically file a current-year return, three or four days after you .If the refund trace shows the IRS did not complete all applicable actions described in IRM 21. Your exact whole dollar refund amount.

Enter the exact whole dollar refund amount shown on your tax return.How to track the status of your refund. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

Check the Status of Your Tax Refund

4 weeks or more after mailing a return.

Get My Payment

IRS Tax Tip 2021-70, May 19, 2021 The most convenient way to check on a tax refund is by using the Where's My Refund? tool. You can also call 800-829-1954. Skip to main content . However, if you filed a married filing jointly return, you can’t initiate a trace using the . More resources For . However, it’s possible that some tax returns may require further review and could result in the refund being delayed. You can generally get your refund faster by filing .If you chose direct deposit, the money should land in your account within five days from the date the IRS approves your refund. The newly enhanced .

Here's How to track your 2021 federal income tax refund

How Refunds Work

IRS Where's My Refund

WASHINGTON — The Internal Revenue Service is reminding taxpayers today that the best way to check on their tax refund is by using the Where's My Refund? tool at IRS. Nota importante: Vea su copia de la declaración de impuestos, y anote el estado civil según aparece en su declaración de impuestos. An assertion that a direct deposit was never received is not a new claim; it is a continuation of the claim for refund under IRC .2, Authority, and authorized under IRC 6402, Accounts Management (AM) will recommend certification of a replacement payment.You can check the status of your refund within 24 hours after you e-file your return, or within 4 weeks after you mailed your return if you filed by paper. You'll need your Social Security number, filing status and refund amount to get the latest update on your .Call the IRS for an update.You can use the tool to check the status of your return: 24 hours after e-filing a tax year 2023 return.Use the IRS “Where's My Refund” tool to find out when you can expect your refund to arrive. These programs are available to taxpayers .

Find out when to expect your refund, what information you need, and . The tool tracks your refund's .Learn how to use the IRS Where's My Refund tool to check the status of your 2023 income tax refund online or by phone. Exact refund amount shown on . Where’s My Refund? has a tracker that displays progress through 3 stages: (1) Return Received, (2) Refund Approved and (3) Refund Sent.About 940,000 people, it turns out — because they haven’t filed returns for the 2020 tax year, even though they may be due money back for that year. File your taxes, get help preparing your return, help .Taxpayer Advocate Service. Letter 6475: Through March . If you're one of the nearly 102 million .Download IRS2Go and connect with the IRS whenever you want, wherever you are.Seleccione el año tributario para el que busca el estado de reembolso. Find IRS forms and answers to tax questions.

Where's My Amended Return?

Where’s My Amended Return will show your amended return status for this tax year or up to 3 prior years. Use TurboTax, IRS, and state resources to track your tax refund, check return status, and learn about common . Puede dividir su reembolso (en inglés) en hasta tres cuentas. Your tax return may show you’re due a refund from the IRS.com2024 Tax Refund Schedule: When Will I Get My Tax Refund?themilitarywallet. We don't save or record the information you enter in the estimator. Your filing status. If you choose to receive your refund through direct deposit, the money should land in your account within five days from the date the IRS approves your refund.The IRS has made improvements to its refund tracking tool that should help taxpayers better understand the status of their tax refunds. Check your W-4 tax withholding with the IRS .

How do I find my refund information?

This is the process the IRS uses to track a lost, stolen, or misplaced refund check or to verify a financial institution received a direct deposit. The Where's My Refund? system to track the status of a refund. Some common issues which may extend processing times: You mailed your return. Where's My Refund? Check the status of your income tax refund for the three most recent tax years. You will be directed to the IRS website and need the following information: Social Security Number or ITIN. Get free tax help from the IRS.This story is part of Taxes 2024, CNET's coverage of the best tax software, tax tips and everything else you need to file your return and track your refund. >> Check the Status of Your Federal Stimulus Payment. Our advocates will be with you at every turn as we work with you to resolve your tax issue.Direct Deposit Refunds and Refund Offsets. Contact an advocate. Select the tax year for which you are seeking refund status.The IRS warns taxpayers to be on the lookout for a new scam mailing that tries to mislead people into believing they are owed a refund. Cheque en papel: Enviaremos su cheque por correo a la dirección que aparece .gov or through the IRS2Go App to check the status of your tax refund within 24 hours after an e-filed return is . Instant confirmation of a successful filing.For more information about finding refunds, visit our Refunds Get Help center. You can start .This news release is part of a group of IRS tips called the Tax Time Guide.The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. IRS EIP notices: We mailed these notices to the address we have on file.If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation). If that's your .Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information .