Irs when to file taxes

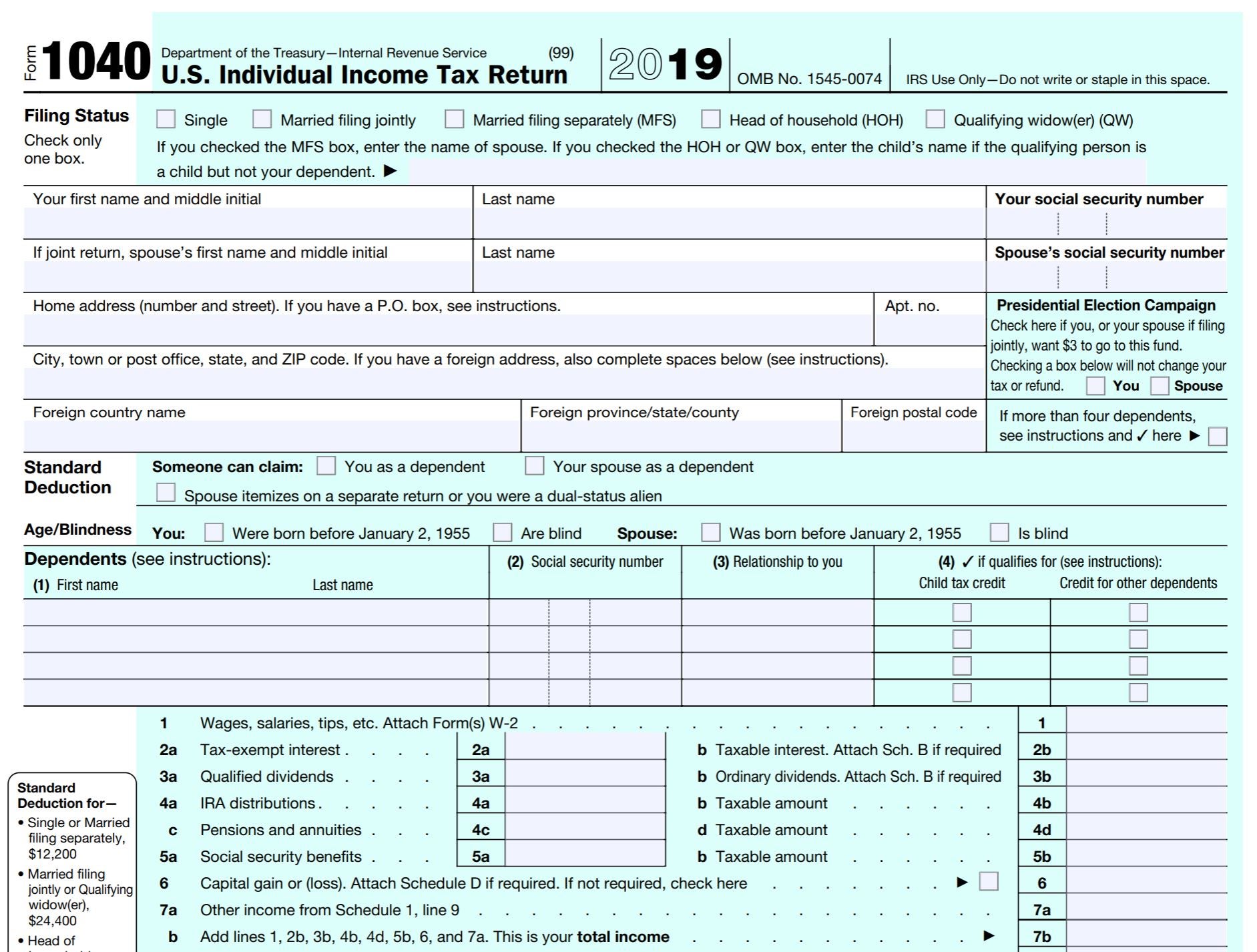

If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with . Direct File is easy to use, secure and free. Individual Income Tax Return.Tax Day 2024: Filing Deadline and Other Due Dates.Tax information for students. The IRS starts . You may want to file anyway so you can get any federal income tax your employer withheld back as a refund or claim certain refundable tax credits.Critiques : 153,3K • Preparing an early tax return can let you know if you qualify to make a contribution to a tax-advantaged plan and give . For more information, see Understanding Your IRS Notice or Letter. Remember, you should pay any taxes owed as soon as possible to minimize penalties and interest. Pay taxes on time. Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. Monday, April 15, 2024. If you suspect you are a victim of identity theft, continue to pay your taxes and file your tax return, even if you . You may use our Get an IP PIN online tool to retrieve your current IP PIN. Tax Day was Monday, April 15, 2024, but some exceptions exist. Both your friend and your friend’s child are your qualifying relatives if the support test is met. File the return using Form 1040, U.The IRS started accepting 2021 tax returns on Jan. Some offers include a free state tax return.

It also provides a toll-free number to tell the IRS that you didn’t file the return.

File your return

You must also report taxes you deposit by filing Forms 941, 943, 944, 945, and 940 on paper or through e-file. You may not have all the . Thursday, May 23, 2024 at 11:59 pm. Individual Tax Return or 1040-SR, U. The estate's gross income for 2024 is $850 (dividends of $500 and interest of $350). Irina Strelnikova/Getty Images.As a self-employed individual, generally you are required to file an annual income tax return and pay estimated taxes quarterly.Critiques : 153,4K

Find out if you need to file a federal tax return

But in most cases, taxpayers do not need to complete this form.

Publication 559 (2023), Survivors, Executors, and Administrators

April 15, 2024 1:15 a. The deadline to file your state tax return was April 15 at 11:59 pm in your time zone (or April 17 in Massachusetts). Generally, most U. Submit all the same forms and schedules as you did when you filed your original Form 1040 even if you don't have adjustments on them. For most filers, the deadline for 2023 tax returns is Monday, April 15, 2024 (April 17, 2024, if you live in Maine or Massachusetts). Marking its 22nd filing season, IRS Free File went live today, more than two weeks before the 2024 filing season start date.FS-2023-02, Jan. You may not be ready to file your taxes on the first day. How You Know You Owe the Penalty.

Sign In to make an Individual Tax Payment and See Your Payment History.New York CNN — If you haven’t filed your 2023 tax return with the IRS yet and you still owe income tax for last year, the good news is you still have time to rectify . Generally, employers must report wages, tips and other compensation paid to an employee by filing the required form (s) to the IRS.A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). If you requested an extension by April 15, your new deadline to file is Oct. However, some haven't filed their 2021 tax returns or paid their tax due. If you use a fiscal year (tax year ending on the last day of any month other than December), your return is due on or before the 15th day of the fourth month .If the LLC is a partnership, normal partnership tax rules will apply to the LLC and it should file a Form 1065, U. But see Transfers Not Subject to the Gift Tax and Gifts to Your Spouse, later, for more information on specific gifts that are not taxable.E-file Your Extension Form for Free. The federal income tax deadline has passed for most individual taxpayers.See if you need to file: answer questions to find out. We'll help you navigate your taxes by breaking down the filing process into simple steps. Only victims of tax-related identity theft should submit the Form 14039, and only if . Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension. You may be able to file free online through the IRS Direct File pilot program if you are in one of 12 participating states and have a simple tax return. You have over $400 in net earnings from self-employment (side jobs or other . Filing this form gives you until October 15 to file a return. For e-file, go to E-file Employment Tax Forms for additional information. It's your responsibility to pay any balance due and to submit a claim if there's a refund. Tax-related identity theft occurs when someone uses your stolen personal information, including your Social Security number, to file a tax return claiming a fraudulent refund.The Failure to File penalty applies if you don't file your tax return by the due date.IRS Tax Tip 2022-61, April 20, 2022. If you're filing a tax return, you may need to include scholarships and grants as taxable . Students have special tax situations and benefits.According to the IRS, here's how much you have to have made in 2023 to be required to file taxes in 2024 and the general rules for whether you need to file a federal .

Direct File

When you miss a tax filing deadline and owe money to the IRS, you should file your tax return as .Do your taxes online for free with an IRS Free File trusted partner.The last day to file taxes for the 2023 tax year with the IRS is April 15, 2024, unless you submit an extension.

File your taxes for free

If your tax return misses the April filing deadline, the IRS could hit you with a late-filing penalty of as much as 5% of the amount due for every .

File an amended return

Not everyone needs to file an income tax return each year.Decide how you want to file your taxes.The deadline for filing a federal tax return was 11:59 p. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. For individuals only. File a Current Tax Year Return.

File Form 8879, IRS e-file Signature Authorization with .

Depositing and reporting employment taxes

Tried to e-file your tax return and it was ‘rejected because you didn't include an IP PIN; How to retrieve your IP PIN online. • If you owe taxes, preparing your return early gives you more time to save money to pay your taxes. If you don’t already have an account on IRS.Letter 5747C, Provides a toll-free number to make an appointment at a local Taxpayer Assistance Center to verify your identity and return in person. Return of Partnership Income.gov, you will be asked to register for an account and validate your identity.Tableau - Deadline for filing your tax return online.

Who needs to file a tax return

SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Check if you need to file a tax return

You may not have to file a federal income tax .File your tax return by the deadline. Make a same day payment from your bank account for your . Certain gifts, called future interests, are not subject to the $17,000 annual exclusion and you must file . You will need to create an IRS Online Account before using this option. Use the Find Your Trusted Partner (s) to narrow your list of trusted partners or the Browse All Trusted . Deadline for reporting. 20 to 54 (including 2A and 2B) Thursday, May 30, 2024 at 11: .Direct File is for federal income taxes only.IR-2021-243, December 7, 2021 — The Internal Revenue Service today encouraged taxpayers to take important actions this month to help them file their federal tax returns . File your tax return . If you file by mail, it can take .

Dependents

Some people may choose not to file a tax return because they didn't earn enough money to be required to file.File and settle up with the IRS. If you're a calendar year filer and your tax year ends on December 31, the due date for filing your federal individual income tax return is generally April 15 of each year.

If you gave gifts to someone in 2023 totaling more than $17,000 (other than to your spouse), you probably must file Form 709.Critiques : 153,5K

When and How To Pay Your Taxes

The penalty you must pay is a percentage of the taxes you didn't pay on time. April 18 tax filing deadline in 2023.

Generally, members of LLCs filing . Determine if you need to file taxes. The filing deadline to submit 2022 tax returns or an extension to file and pay tax owed is Tuesday, April 18, 2023, for most taxpayers . If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. You can use tax software to electronically file your 1040-X online. The gross income of the estate for 2024 is more than $600, so you must file a final income tax return, Form 1041, for 2024 (not shown). If your total income for the year doesn't hit certain IRS thresholds, then you may not need .

Tax Deadline for 2024

• If you are due to receive a refund, filing early lets you obtain your refund sooner. You are subject to tax on worldwide income from all sources and must report all taxable income and pay taxes according to the Internal Revenue Code . Generally, they won't receive a penalty if they are .How to file your taxes: step by step.

When to file an Identity Theft Affidavit

Get credits and deductions.BEST TIME TO FILE: BY THE APRIL 15 DEADLINE. It's recommended to file electronically to get your refund . The IRS recommends using tax preparation software to e-file for the easiest and most accurate returns and fastest refunds.

IRS Free File

Prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an IRS trusted partner site or using .To amend a return, file Form 1040-X, Amended U.After making the distributions already described, you can wind up the affairs of the estate.WASHINGTON — The Internal Revenue Service today announced that IRS Free File Guided Tax Software service is ready for taxpayers to use in advance of the opening of tax season later this month. Roughly 37% of taxpayers are eligible. Check if you need to file.

Understand how that affects you and your taxes.

2023 — Taxpayers need to know their tax responsibilities, including if they’re required to file a tax return.If the deceased had not filed individual income tax returns for the years prior to the year of their death, you may have to file.