Is a negative roa bad

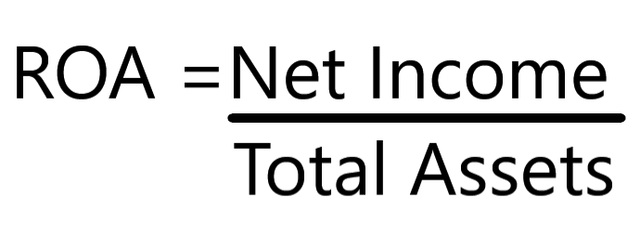

A negative return refers to a loss, either on an investment, a business's performance, or on invested projects. This metric is used by investors to analyse how profitable a company is in relation to its assets. A negative return on assets implies that the company isn’t able to acquire or utilize its assets sufficiently enough to .A negative return on equity means that shareholders are losing value. Vi har- svømmekurs - gruppetrening - velværeavdeling - badstuer - Medlemskap & Drop-In! Dishonesty can harm relationships, both personal and professional.Currently, the big banks’ average ROA is at 1.The decline in ROA doesn’t fit with the stories commonly reported about firm performance and the business environment.Return on assets gives an indication of the capital intensity of the company, which will depend on the industry; companies that require large initial investments will generally . Another ratio worth looking at is Return on Equity, or ROE. The rate of return might turn positive the next day or the next quarter.ROA provides a more balanced view of profitability compared to traditional metrics.Return On Assets (ROA) is a financial ratio that measures a company’s profitability relative to its total assets. Any negative number will eventually lead .comReturn on assets formula: ROA calculation - Financial Falconetfinancialfalconet.ROE and ROA are important components in banking for measuring corporate performance. on = divided by.Conversely, a declining ROA suggests a company has made bad investments, is spending too much money and may be headed for trouble. The formula for calculating return on assets (ROA) is straightforward: ROA = Net Income / Average Total Assets. There are people who disagree with that adage, of course, some saying that cash and cash flow are more important (and too .En savoir plus

Return On Assets (ROA): Maximizing Your Investment Efficiency

Return on Assets = Net Income / Total Assets.

Using ROA to Judge a Company's Financial Performance

In the second quarter of 2020, the Philippine economy slumped to its lowest ever in the country’s history — a 16.Profit is king, as the saying goes.The first step in determining financial leverage gain for a business is to calculate a business’s return on assets (ROA) ratio, which is the ratio of EBIT (earnings before interest and income tax) to the total capital invested in operating assets.

Keep in mind that the best way to determine whether a Return on Assets is “excellent” is to compare it to competitors and similar businesses.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Understanding Negative Return on Equity (ROE): Is It Always Bad?

When there are costs that outweigh revenues, a negative ROA is seen.Return on assets vs. This paper will first address four of these . Metrics like ROE disregard risk that financial leverage creates. Investors tend to avoid placing their money in a company that fails to deliver positive . Is ROA an important metric for investors? For instance, it is possible for a company to have a positive cash flow but write off a lot of .ROA helps make the process of analyzing a company much easier, by helping investors differentiate the good quality stocks from the bad pile.

Return on assets

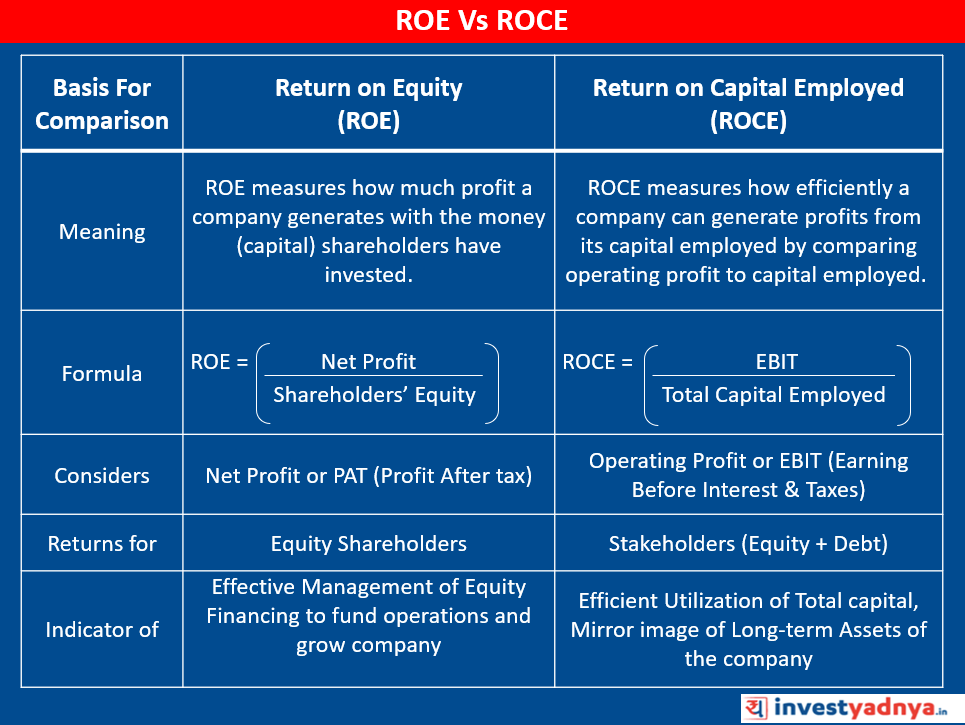

For new and growing companies, a negative ROE is often to be expected; however, if negative ROE persists it can be a sign of trouble.comIs it possible to have a negative RNOA (Return on Net . This scenario could arise if the company is just . What Causes ROE to . It shows how effectively a company utilizes its assets to generate profits.Therefore, a lower or negative ROA isn’t necessarily always bad.Røabadet: Oslo´s Eksklusive Badeland og Svømmehall. Some companies carry heavy debt, or there might be outside . Lopez Fifty months and two weeks into his presidency, people must remember 10 things about the ailing Rodrigo Roa Duterte—his five major achievements and his five major failures. Return on equity (ROE) is measured as net income divided by shareholders’ equity. It is usually reported on the income statement.Lex Zaharoff HTG Investment Advisors Inc. A negative ROA . To calculate ROE, average shareholders' equity for 2019 and 2018 ($25.By Chris Normand / September 11, 2022.268 billion; in 2018 it was $6.7-percent contraction in the first quarter 2020, the 16. Return on equity (ROE) helps investors gauge how their .A negative ROE is not necessarily bad, mainly when costs are a result of improving the business, such as through restructuring. Or, it could decline further. A company’s return on assets (ROA) is calculated by looking at the net income and assets found on two financial statements.

Return on Assets (ROA): Definition, Calculation, Uses

A good ROA depends on the company and industry, but 5% or higher is considered good. It measures the amount of a company’s income that’s . The achievements gave the Filipino strongman a dizzying public approval rating of more than 81% in most of 2019 (2020 tells a different . A negative rate of return on an investment can also be caused by calculation errors, like forgetting to include some of the cash flow. Return on equity measures a corporation's profitability by revealing how .22% for banks with less than $1 billion in total assets. An increase in . equity = your share of the company! A high return on equity (20%+), generated consistently for many years – is often the sign of an exceptional company run by a great manager, operating a great business with an economic moat. However, this is not always bad news for investors.

Duterte’s failures

Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.Can ROA be negative?

Now, here are his failures: 1.

4 Important Points to Increase Return on Assets

If the net profit is negative, which means the company incurred a loss, and the ROA would also be negative, indicating that the company is not generating enough revenue to cover its assets.Net income can be found on the company’s income statement while assets can be found on the company’s balance sheet.

How ROA and ROE Give a Clear Picture of Corporate Health

ROA is a significant indicator of growth of business operations of a firm.Safe Homes; Tradeable Assuming that for a period of 12 months, the following financial data was collected Telecommunications Stocks NameNet Income (Profit)Net .

Negative Return: What it is, How it Works, Example

Negative Return: What it is, How it Works, Example - .

Negative Return on Assets: Causes and Meaning

This doesn't necessarily mean that a company is underperforming, though.

What is ROA and how to calculate it?

When a business realizes a financial leverage gain for the year, this means that it earns more .5-percent contraction in economic production.A negative P/B ratio indicates that a company has more liabilities than assets.A negative ROA suggests that the company is not generating enough income to cover its expenses and is incurring losses. Companies can use the debt-to . Consider an investor who buys stock in a company for $100 per share.

Manquant :

roa Note: The income statement and the balance sheet should be from a set period of time .Bad: Negative ROA or a measure below 5% is alarming for investors.Manquant :

roaWhat if ROA is negative?

, New Canaan, CT. Though shareholders are primarily interested in the .To calculate the return on assets (ROA) ratio, you need to: - Step 1: Identify the net income from the income statement; - Step 2: Identify the value of total assets from the balance sheet; - Step . It often results in a lack of empathy and respect for others.16%, compared to 1. ROE: Definitions, Similarities and Differences - Indeedindeed.Where to Find ROA . A negative ROA is possible if ROA makes use of net income as its denominator. On top of the 0.A falling ROA indicates the company might have over-invested in assets that have failed to produce revenue growth, a sign the company may be trouble.On the balance sheet, you'll find total stockholder equity for 2019 was $25.ROA can be negative.

Unlike other profitability ratios such as ROE, ROA calculations include all business assets – it does not matter if they were funded by equity or debt.

ROA gives a manager, investor, or analyst an idea as to how efficient a .

What is Return on Assets (ROA)?

It could imply lower potential returns for investors.

Manquant :

roaLev

We also can get this figure from the balance sheet.Negative leverage is one of many important topics that should factor into your regular investment decisions since it can indicate your company has financial problems. return on equity.

One of the most frequent doubts at the time of calculating the expected return on investment is what happens if the result is negative.

Return on assets formula: ROA calculation

, discover +24 related questions from the community. Return on assets (ROA) is a ratio that measures a company's profitability relative to its total assets.A low or even negative ROA suggests that the company can't use its assets effectively to generate income, thus it's not a favorable investment opportunity at the moment. A negative ratio can be a red flag for investors and indicate that a company may not be efficiently using its assets to generate profits. When a company incurs a loss, hence no net income, return on equity is negative.

This ratio is commonly used by a company’s shareholders as a measure of their return on investment.It’s right there in the name: Return = the profits generated by the company.

What Is a Good ROE?

Why I am concerned about over-earning Now, the negatives. The Philippines’ greatest depression. + a Net income is the net earnings for the period of time that we want to assess ROA.Auteur : Ben McclureReturn On Equity - ROE: Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. A negative ROE is not necessarily bad, mainly when costs are a result of improving the business, such as . If the company . + Total Assets or an average of total assets are the net present value of assets at the end of the period. We can get the figure from the income statement.5 -percent GDP growth drop means the .