Is a nonprofit corporation a c corporation

Put simply, a nonprofit is an organization whose purpose is not to generate profit for its shareholders .In summation, it is a business/corporation that has been given tax-exempt status by the Internal Revenue Service (IRS) because the further a religious, .A nonprofit corporation is a legal entity that has been incorporated under state laws to operate for purposes other than making profits. Investopedia / Michela Buttignol.A California nonprofit corporation is formed by the filing of nonprofit articles of incorporation (Articles).

What Type of Corporation Is a Nonprofit?

The term usually refers to a group of people or businesses working toward a common goal.

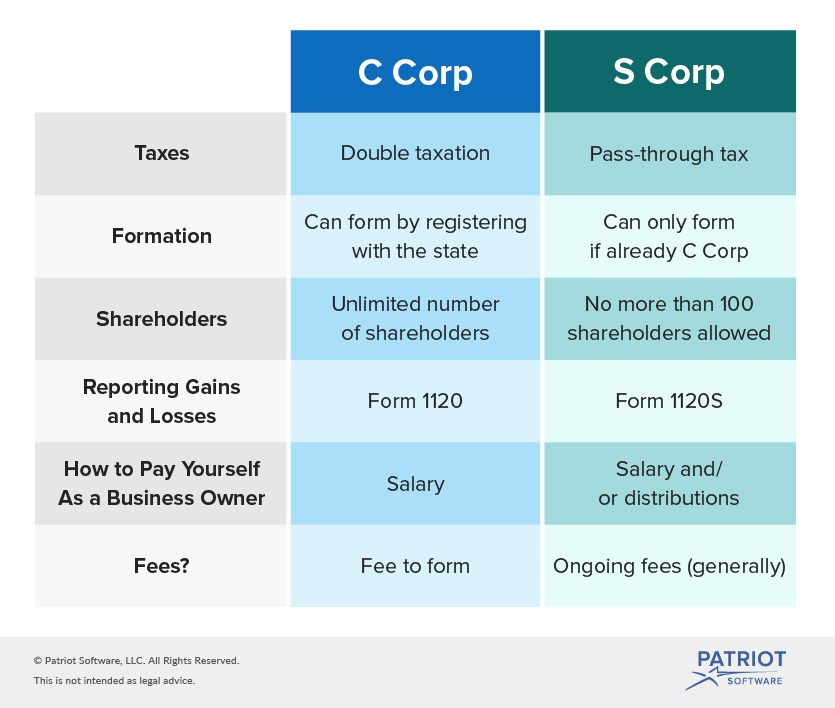

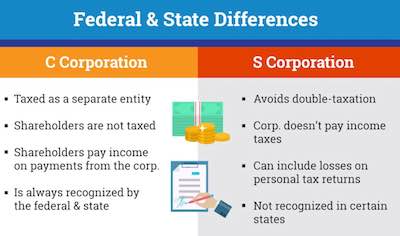

C corp to get you started. Some examples of this type of legal entity are associations formed to . Subchapter “S” corporations have little application in the world of religious organizations and should usually not be used. For those groups that are formed for charitable, educational, religious, literary, or scientific purposes, and not for the purpose of generating profits for . Keyt The Keyts have formed non-profit corporations and LLCs.Specifically, the final rule defines the term “senior executive” to refer to workers earning more than $151,164 annually who are in a “policy-making position. The provisions allotting S status to companies are enumerated in Subchapter S of Chapter 1 of the Internal .The nonprofit corporation definition is an organization that is legally incorporated and also recognized by the IRS as tax-exempt based on business activity. Benefit Corporations.

Musk's X Corp appeals dismissal of lawsuit against anti-hate group

Is a Charitable Foundation the Same as a Nonprofit Corporation?

Any corporation may choose to convert into an S Corporation at any point in time, given that it receives the consent of all its shareholders to file for S status.A 501(c)(3) organization is a tax-exempt nonprofit organization subject to many IRS rules.

§ 7-6-3 sets forth the entities to which the Nonprofit Corporations Act applies

How to Create a Nonprofit Corporation

orgRecommandé pour vous en fonction de ce qui est populaire • Avis

501(c)(3) organization

While, a non-profit corporation can earn a profit, the profit must be used to further the goals of the corporation rather than to pay dividends to its .Updated March 03, 2024.

Choose a business structure

While a for-profit corporation's sole purpose is to make a profit for its shareholders, and a nonprofit's purpose is to fulfill its mission or support its beneficiaries (such . Learn the requirements, costs, and pros and cons of setting up a 501(c)(3). They aim to address specific societal needs or advance a particular cause. NPO’s serve the public via goods and services while a not-for-profit organization (NFPO) may serve just a group of members.A nonprofit organization ( NPO ), also known as a nonbusiness entity [1] or nonprofit institution, [2] and often referred to simply as a nonprofit (not followed by a noun), is a . Daniel Rathburn.Fact checked by.1 – Benefits of Forming as a Nonprofit Corporation.Nonprofit corporation. A common misunderstanding is that nonprofit corporations and 501 (c) (3) are the same.Although nonprofit corporations may be exempt from taxes, they must complete the W-9 form while receiving certain payments.

Corporations intended for business activities should generally form as for-profit “C corporations.A non-profit is largely defined by its tax status in the US.To be tax-exempt under section 501 (c) (3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set .Should a Nonprofit Be an LLC or Corporation: Everything .

Whether a non-profit is exempt from taxation is down to federal law, while state law will usually determine which . To get the 501 (c) (3) status, a corporation must file for a Recognition of Exemption. It is legally allowed to make a profit but not for personal gain.A nonprofit corporation's mission and purpose are at the core of its existence. But they share an essential feature—to further a purpose other than making a profit, and all of them can apply for tax-exemption to . It’s not terribly difficult to form a nonprofit corporation, as long as you have the right paperwork and your business has the appropriate aims.S corporations are similar to C corporations, but they have a special tax status with the IRS that allows profits (and some losses) to be passed directly to owners’ income without being subject to corporate tax rates.What Is a Nonprofit? Choosing the Right Nonprofit Type. A nonprofit corporation is an organization formed to serve the public good, such as for charitable, religious, educational, or other public .The California Nonprofit Mutual Benefit Corporation Law applies to nonprofit organizations without tax-exempt status under Internal Revenue Service (IRS) code 501(c)(3). They have five star reviews on Google & Birdeye.Difference Between Nonprofit Corporation and 501c3. Here, we provide an overview of what is an S corp vs. Complete our online “ Nonprofit Corporation Formation Questionnaire . Fact checked by. by Arizona nonprofit corporation attorney Richard Keyt and his son Arizona nonprofit lawyer Richard C. The laws that govern the incorporation . Michael Rosenston. Excellent 14,989 reviews.Overview

What type of Corporation is a Nonprofit?

April 23 (Reuters) - Elon Musk's X appealed the dismissal of its lawsuit against the nonprofit Center for Countering Digital Hate, which faulted him for . We should note an important distinction between a nonprofit corporation and a benefit corporation. Instead of being shared with shareholders, any profit goes back into the organization to be put towards the public good or service (keep in mind that profit is what is left over after expenses .Federal Tax Obligations of Non-Profit Corporations | Internal Revenue Service. A nonprofit doesn’t automatically get these perks but can achieve them by gaining 501c3 status. 501 (c) (1): Corporations Organized Under Act of Congress.Non-profit corporations often have members, but these members are not owners and they don't share financially from their membership.Like for-profit corporations, nonprofit corporations are legally separate “persons” distinct from their principals. Business Name: If your organization operates under a name different from .Nonprofit Corporation.

Manquant :

nonprofit corporationManquant :

c corporation Limited liability companies (an . What Is 501 (c)? 501 (c) is a designation under the United States Internal Revenue Code (IRC) that confers tax-exempt status on. Editor’s note: At this time, ZenBusiness does not help with nonprofit business formations.Nonprofit Corporation Acts by State

C Corp is short for C Corporation which is a corporation taxed under the subchapter C of the Internal Revenue Code — the “default” of a for-profit corporation. Although it doesn’t distribute its net earnings to private individuals or shareholders, it can carry out profitable business activities. To apply, submit articles of incorporation and .January 30, 2024 by Editorial Team. There are no mandatory requirements. Start free trial. Typically, nonprofits are formed to provide a social or public good or service.Option 2: The 24/7 Online Method. In 1969, the tax reform resulted in the addition of Section 501(c)(3) in the IRS code which allows companies to apply for tax-exempt status if they meet certain requirements.

Fact Sheet on FTC’s Proposed Final Noncompete Rule

Instead, it can reinvest into the running of its mission such as paying staff, building infrastructure, or launching projects, but can also hire volunteers and apply for funding .

Setting Up a Non-Stock Corporation

Rhode Island: 1952 MNPCA w/ some additions: R. The nonprofit corporation structure is available in all 50 states and Washington, D.DETROIT (AP) — Tesla is asking shareholders to restore a $56 billion pay package for CEO Elon Musk that was rejected by a Delaware judge this year, and to shift . Unlike for-profit businesses, whose primary goal is to generate profit for shareholders, nonprofit corporations are driven by a social or charitable mission.Benefit corporations have a mission beyond making a profit.Overview

Nonprofit Organization (NPO): Definition and Example

1988 state-specific Nonprofit Corporation Law, based on 1988 Pa.Nonprofit corporations are a common business structure that brings people who share the same mission and philosophy together.A nonprofit corporation may apply as a private, charitable foundation for tax-exempt status under Section 501(c)(3) of the IRS tax code by completing Form 1023, Application for Recognition of Exemption. Here is how you should fill it out: Name: Enter the name of your nonprofit corporation as it appears in your Articles of Incorporation.Auteur : Will Kenton

Nonprofit organization

Canadian non-profit incorporation FAQs

Nonprofit corporation

To qualify as a nonprofit organization under IRS rules — specifically 501 (c)3 — a corporation must exist for one of the following purposes: Animals. Janet Berry-Johnson.com5 Different Types of Non-Profit Organizations | NuEnergynuenergy. 501 (c) (3), are organizations that are “corporations, .While a 501 (c) (3) organization is usually a type of nonprofit corporation, not all nonprofit corporations qualify as 501 (c) (3)s, and the 501 (c) (3) can also apply to some other .C corporations and S corporations are different tax designations available to corporations. 501 (c) (3): Charitable, Religious or . It can also help further scientific, religious, literary, or educational purposes. It is an association, club or society that is operated for social causes.A nonprofit corporation is a corporation formed for purposes other than making a profit. Check your state's division of corporations (usually in the state secretary of state's office) or similar state agency for .It technically doesn’t have shareholders or “owners” in the normal sense of the term. Although they are usually used .A 501 (c) (3) is a corporation that receives tax-exempt status from the IRS.

Nonprofits are often called 501(c)(3) corporations — a reference to the section of the .Nonprofit corporations are sometimes referred to as 501(c)(3) corporations.A C Corporation is the default designation provided to a freshly incorporated company. In most cases, nonprofit organizations that intend to operate primarily in North Carolina should incorporate under N.

Advantages & Disadvantages

A nonprofit corporation is a legal entity formed to help its officers carry out charitable causes.Churches and ministries should be formed as nonprofit “C Corporations.Is a Nonprofit Corporation a C Corporation? No, a nonprofit organization is not a C corporation. Federal tax-exempt status affords nonprofits exemption from federal taxes and allows charitable deductions for donations to the organization.California recognizes three types of nonprofit corporations: religious, public benefit, and mutual benefit corporations. Non-profit status may make an organization eligible for certain benefits, such . Business Corporation Law: Revised UUNAA under 15 Pa. However, S corps are also subject to certain restrictions, such as a limit on the number of shareholders. Unlike conventional corporations, a nonprofit corporation does not pay state or federal . This is because the most common federal tax exemption that applies to nonprofit corporations is in section 501(c)(3) of the Internal Revenue Code. However, if you have additional questions about which .Technically under the IRS’s 501 (c) code, there are two main types of nonprofits: nonprofit organization (NPO) and not-for-profit organization (NFPO). They also need to follow special rules about what they do with any profits they earn. Each has its pros and cons, and the best choice for you will depend on the circumstances of your individual business.

Corporation: What It Is and How To Form One

These types differ in terms of their missions, activities, and fundraising regulations.A nonprofit tax classification can be obtained for religious, scientific, charitable and educational organizations and differs from a C corporation. Limited liability for directors and . There are three types of California nonprofit corporations: public .