Is critical illness cover worth it

That leaves consumers having to pay more if they become sick.

You can also use the payout to cover costs associated with your medical condition.A life and critical illness cover policy worth £100,000 for a non-smoking, healthy 30-year-old would typically cost around £25 a month over a 20-year term, according to reports. Here’s what . If you’re diagnosed with a listed medical . It works by paying out regularly to replace a portion of your income. What Is Critical Illness Insurance? It goes . Trauma insurance does not cover mental health conditions. uhohshesintrouble. If you’re lucky, you’ve probably never had to use critical illness insurance . The illness must meet very specific criteria and even some medical training would be useful to be able to judge the level of cover or compare against another plan.Below are some examples of average starting insurance costs for £75,000 level-term life insurance with critical illness cover over 25 years: Age 30: £20 a month. Lessen the financial burden. What it covers. Is critical illness insurance worth it? Critical illness . Share this guide. If you’re unable to work due to a serious illness or injury, a critical illness payout could help you pay your rent or mortgage, bills, childcare costs. The list of covered illnesses varies, but heart attacks, strokes and cancer are the big ones. But there are pros and cons.Recommandé pour vous en fonction de ce qui est populaire • Avis

Is Critical Illness Insurance Worth the Cost?

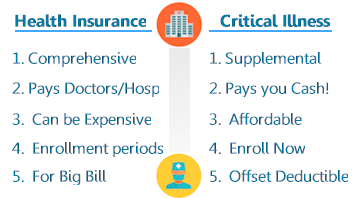

7% of the over-55s had needed to take 6 consecutive months off work at some point.Critical illness insurance serves as a supplementary health coverage, addressing expenses not covered by your primary health plan.

Critical illness cover

Best Online Application Process: Liberty Mutual.

Critical illness refers to a wide range of illnesses that can have a life-changing impact.

Understanding critical illness cover

In my opinion critical illness policies are very limited in how they pay out.ukHow long des a Critical Illness Claim take? It’s designed to help you deal with the financial implications of your illness, such as having to pay medical bills, debts, loss of earnings .sgRecommandé pour vous en fonction de ce qui est populaire • Avis

Critical Illness Insurance Costs And Benefits

What is not covered by critical illness insurance? 3. Life and critical illness policies can be cheaper for younger individuals, due to the lesser risk they usually pose, so it’s worth weighing up your life insurance options as soon as you .When considering if Critical Illness Cover is worth it, you should look at the likelihood of you needing to make a claim.But for many, critical illness insurance is rarely worth the money. The exact amount of the sum can be anywhere from $5,000 to . It pays you a lump sum after your diagnosis with a critical illness. What does it cover and is it worth it? Rosie Bannister and Tony Forchione.

2024 Guide

A policy like that could cost less than a dollar a day.

Critical illness cover

Critical illness cover is a form of insurance that pays out a tax-free lump sum if you’re diagnosed with a serious medical condition.So is critical illness cover worth it? What is covered under a critical illness policy? All critical illness insurance policies should cover the three core conditions as . [9] Some additional rules apply in order to qualify to get the benefit, which we’ll discuss more later in this article.Pros of critical illness cover. Many people have financially benefited from their insurance cover during periods of time when they are unable to work.Likewise, while drawing on a life insurance policy’s cash value could provide much-needed funds to pay for a child’s college tuition, home repairs, or supplement your . Formerly known as permanent health insurance, it's there to help you pay your household bills, mortgage payments, credit card bills and everyday costs that you can no . Estimated reading time: 5 minutes. But we’re all different, so you’ll be quoted a price we piece together based on things like your policy’s length, amount you’ve asked for and medical history.

Critical illness insurance (CII) is a type of supplemental insurance that pays out a one-time lump sum cash benefit if you are diagnosed with a covered condition, such as cancer, heart attack, or stroke. Critical illness cover is a type of health insurance that’s designed to pay out a lump sum if you’re diagnosed with a life-threatening illness. For example, you might calculate you need £100,000 . Typically, critical illness insurance . A single, nonsmoking 50-year-old man who .However, it’s essential to consider a number of points before deciding on whether to buy a policy.Critical illness cover is worth it if you value peace of mind – and if the risk of not being covered is too great in your circumstances. Average monthly cost for $50,000 of . 40: £40 a month. The number and variety of conditions covered differs from insurer to insurer .Is critical illness insurance worth the peace of mind? Critical illness insurance typically covers acute illness, including cancer, heart attack, and stroke.Critical illness insurance can protect you and your loved ones from the financial impact of a serious illness or injury.This functionality makes what critical illness insurance covers worth it—even if your primary health plan already offers solid medical coverage.Is critical illness cover worth taking out? Taking out CIC can be expensive. The purpose of.I got cancer but critical illness insurance wouldn't pay - . Depending on the plan you choose, you may be able to receive coverage for .Critical illness is a serious and life-threatening medical condition like cancer, heart attack, and paralysis, which requires long-term care and treatment. Critical illness insurance can help protect your future by providing financial support if you have a serious illness or medical condition.PolicyMe’s critical illness insurance covers 44 conditions with coverage amounts from $10,000 to $1 million. Key takeaways: Critical illness insurance offers you a lump-sum cash payment if you are diagnosed with a life-threatening condition like .It is a supplemental insurance, meant to be used in combination with other forms of healthcare.

Is Critical Illness Cover Worth It?

It can be a cost-effective way to protect you financially against illness and disability. Critical illness insurance: Is it worth it? A guide to critical illness insurance—why many Canadians are. These illnesses often affect major .

Income protection insurance explained

Critiques : 3,7KLife insurance also offers financial protection, but there are key differences you should know: Critical illness policies cover the diagnosis of a critical illness listed on your policy, while life insurance covers your death. With a benefit amount of just $25,000, you could help cover out-of-pocket costs your health plan doesn’t and ease the financial stress of both the extra costs of recovery and everyday expenses. Life insurance . It is typically available as an add-on to life insurance policies. You might think that taking out critical illness cover is the best way to protect them, but it’s worth weighing up this option against other options like extra savings or insurance . Also known as critical care insurance and sickness insurance (and similar, but not identical, to cancer insurance ), this type of coverage is . People greatly overestimate their risk of getting cancer at any one time compared to getting lots . What's covered under a trauma insurance policy and medical definitions . Fact checked by. Get a Quote for Assurity's Critical Illness Insurance Coverage. Term lengths are 10, 15, 20, 25, or 30 years.Is critical illness insurance worth it? What medical conditions are covered by critical illness policies? What’s not covered by a critical illness policy? How do I choose the best critical . Should you get critical illness insurance? Find out .Cost of policy.With critical illness insurance, you’ll get a cash payout if you suffer a serious illness. If you take out Life Insurance or Decreasing Life Insurance, you can choose to add Critical Illness Cover for an extra cost.By Keph Senett on September 22, 2023. The way it works is, providing your condition is covered by .

Critical illness insurance: What is it & do you need it?

moneysavingexp.If he chooses to bundle the critical illness cover with life insurance, the monthly premium amount goes up to about $16 – $47.Income protection insurance is a policy that pays out if you're unable to work because of injury or illness. Most Comprehensive Benefits: Mutual of Omaha.Here is a table showing the average cost of critical illness insurance for $50,000 of coverage for a healthy nonsmoker. Updated 6 November 2023.Critical illness insurance, or critical illness cover, provides essential support during severe health crises such as heart attacks.Activité : Insurance Comparison Expert

Critical illness cover vs income protection

This form of insurance delivers a substantial . Statistics from the Drewberry Protection Survey 2018 found that, when looking back across their entire working lives, 14. What does critical illness insurance cover? 2. Aflac’s critical illness insurance may also help cover dependent children under the age of 26 and spouses, if applicable. Pros and Cons to Critical Illness Insurance—Coverage, Explained. When taking out critical illness cover, you'll need to work out how much cover you need and how long you want the policy to run for.Published on February 10, 2022.Critical illness cover is usually sold alongside a life insurance policy such as term life insurance.Critical illness insurance is a form of supplemental health insurance that provides coverage for expenses that your health plan doesn’t cover. Updated March 13, 2022.

Children’s Critical Illness Cover

PolicyMe has full coverage for 27 severe conditions and partial coverage for 17 early-stage conditions – the most any insurance provider offers in Canada. If combined with life insurance, the monthly premium can be $29 – $100. If you are going to get critical illness insurance do it while you’re young as it will cost less and as long as you don’t get a reviewable policy the premiums stay fixed for the life of the policy. Depending on your circumstances, that cost could be quite significant. If you develop a critical illness, you may not be able to work.

Critical illness cover is designed to pay out a lump sum if . As a parent, you’ll want to make sure that you’re supporting your children financially. The insurance provides a one-off payment that is designed to . This form of insurance delivers a substantial advantage by providing a lump sum payment upon diagnosis, which allows policyholders to manage various financial needs effectively. Cover medical costs.Trauma insurance, also called 'critical illness' or 'recovery insurance' pays a lump sum amount if you suffer a critical illness or serious injury. None of us can know if, when, or . We’ve listed some of the top considerations on whether critical illness cover is worth it below.Yes, But: Is Critical Illness Insurance Worth It? FAQs. Its primary objective is to offer a financial safety net in the event of a medical diagnosis that may lead to substantial treatment costs or other financial challenges.

[Complete 2022 Guide]

The relatively low premiums make critical illness insurance policies seem more attractive.Our critical illness cover normally comes in at under £19 a month, according to figures from September 2022 to September 2023.Auteur : Elizabeth Rivelli

Is Critical Illness Insurance Worth It?

Is Critical Illness Cover worth it?

For a 35-year-old smoking male, the monthly premium for trauma insurance alone ranges between $26 – $58.

Best Critical Illness Insurance of 2024

Updated February 8, 2023.

Is Critical Illness Cover Worth It?

A solid comprehension of the cost .Critical illness cover is an insurance policy that pays a lump sum if you’re diagnosed with an illness.If purchased early enough, critical illness insurance can be very affordable.Voya Financial offers enhanced critical illness insurance, .Home > Personal Finance. This can provide a huge sense of relief for policyholders who feel assured that .

Research shows that 100 million adults have outstanding medical debt, and 12% percent of them owe $10,000 or more.Critical illness insurance provides additional coverage, either as a lump sum awarded or by offering additional benefits, to help you pay for medical care should .comCritical Illness vs Early Critical Illness Plans: Which To .Critical illness insurance typically provides a fixed benefit (lump sum) if you’re diagnosed with a covered critical illness such as cancer, heart attack, stroke or renal failure.