Issued and outstanding shares meaning

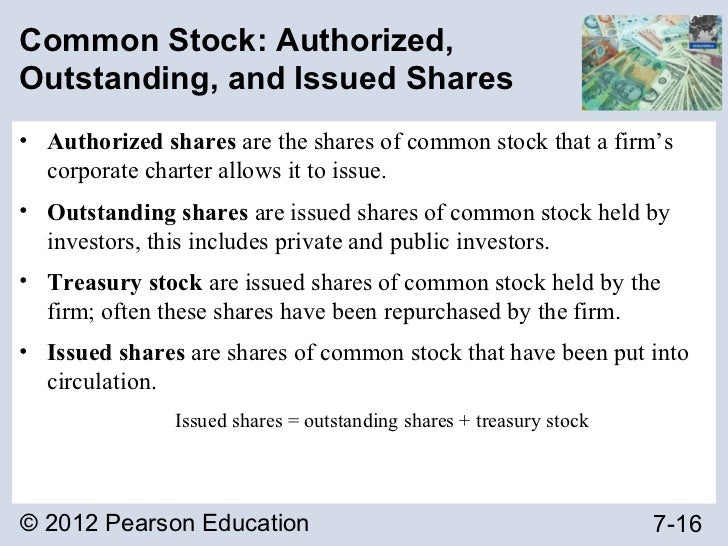

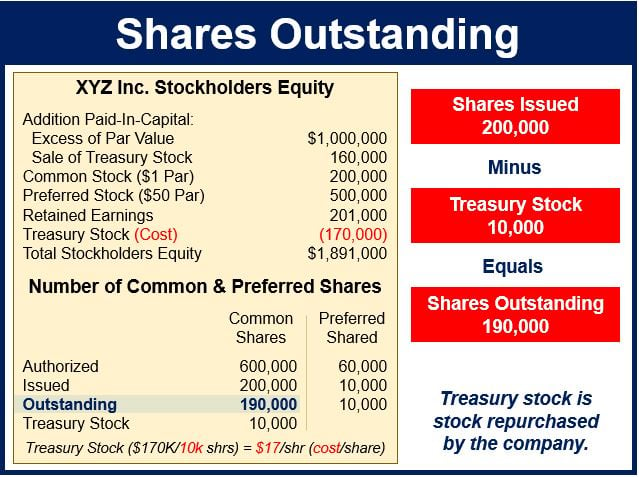

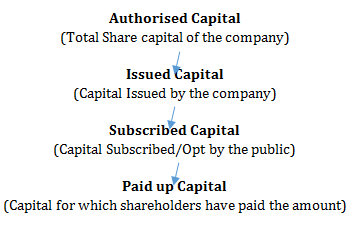

Outstanding shares are an important aspect of stock market trading as they have a direct impact on the company’s market capitalization and shareholder equity.The term shares outstanding is defined as the total number of shares a company has issued to date, after subtracting the number of shares repurchased.Temps de Lecture Estimé: 6 minOutstanding shares refer to all the stocks issued by a company to its shareholders.Issued and Outstanding Shares means, as of a given date, the sum of (i) the number of Shares issued and outstanding on such date, plus (ii) the number of Shares that would be outstanding on such date if all shares of convertible preferred stock of the Company outstanding on such date were converted into Shares as of such date.The term “authorized, issued and outstanding” refers to shares in a company that have been sold publicly. In certain cases, a company can buy back its .

What are shares authorized, issued and outstanding

What is Shares Outstanding?

Shares outstanding consists of .Outstanding shares are the total number of shares of a public company that are traded on the secondary market.Outstanding shares are shares of stock that have been issued. This amount will fluctuate over time.Authorized stock is the maximum number of shares that a corporation is legally permitted to issue, as specified in its articles of incorporation.While issued shares represent the total number of shares authorized for sale by a company, outstanding shares are the shares that have been issued to . Outstanding shares include a company’s common .

The main difference between Issued shares and outstanding shares is that issued shares are shares of a company that have been given to or are owned by an investor or .Shares Outstanding refers to the total shares of a company in the market. They are the number of shares actually owned by the company’s shareholders.Shares Outstanding: This represents the total number of shares a company has issued. (Excerpt from ACCA F7 Financial reporting) issued shares=outstanding shares+treasury shares 这个很好理解,公司向股东发行(issue)股份后就是发行在外(outstanding)的状态了,然后公司回购了一部分的股份。这部分回购的股份就叫“库存股”(treasury shares),只要没注销 .Not to be confused with authorized shares, outstanding shares refer to the number of stocks that a company has issued.

Authorized Shares vs Issued Shares Differences

Issued and Outstanding Shares.

Whereas, the issued shares are . This number of .Issued shares are an essential concept in corporate finance. The number of issued shares generally corresponds to the amount of . When a corporation issues shares in exchange for payment, the person or entity that purchased the shares becomes a stockholder.Remittance Float: The time it takes for a payment to be sent from the remitter (payer) to the recipient and become liquid again. Shares outstanding is the total number of shares that . The number of outstanding shares is listed on the company’s quarterly filings with the Securities and Exchange Commission (SEC) and is also found in the capital section of a company’s annual report.Fully diluted shares are the total number of shares that would be outstanding if all possible sources of conversion, such as convertible bonds and stock options , are exercised.While outstanding shares are the shares that have already been issued to investors and are already held by shareholders, issued shares refer to the total number of shares .Understanding outstanding shares. For example: FoodZilla Ltd issued 10,000 shares in the market, of which 2,000 shares are held by . Treasury stock may have come from a repurchase or buyback from shareholders, or it may have . Generally, a company will not issue 100% of the authorized stock, so issued stock will be less than the authorized amount.

What are outstanding shares?

Outstanding Shares

Shares outstanding and weighted average shares are both numbers that can help an investor understand how well a company performs over time. When a business is first established, its charter will cite a specific . They are “authorized” because they fall within the maximum number .“Issued and outstanding” means the number of shares actually issued by the company to shareholders. Key indicator of company's value and .Meaning that the shares outstanding are the issued shares minus any shares in the treasury.Issued share capital is simply the monetary value of the shares of stock a company actually offers for sale to investors. These are the shares that have been issued by a startup and are currently in market circulation, excluding treasury stock which is held .

outstanding shares is that Issue shares are the total shares that the company issues to .

The term outstanding shares refers to a company's stock currently held by all its shareholders.Issued and outstanding shares are the total number of shares that are already in the hands of founders, investors, and employees/advisors/contractors. As an accredited university professor, this article . This includes all common stock held by the public as well as restricted shares that belong to the company’s internal .Issued shares refer to those shares issued by the company over time — yet, unlike outstanding shares, the number of issued shares includes shares . The number of shares can fluctuate .

Manquant :

meaning However, not all .Issued shares are included in the calculation of market capitalization (issued shares multiplied by current share price) and earnings per share (EPS calculated as issued shares divided by earnings), two major measures of a company's value and performance used by investors.

The number of shares outstanding for a company is equal to the number of shares issued minus the number of shares held in the company's treasury. It is also usually listed in the capital accounts . Shares held by shareholders which comprises of investors, company insiders, institutional investors and the general public are issued shares.Common stock or shares of stock can be classified as authorized, issued, or outstanding: Authorized stock is the max amount of shares that a company can issue.Treasury stock (treasury shares) are the portion of shares that a company keeps in its own treasury. Issued stock can be held by the company, held by employees, or .另外这里注意,为了简化,我们仅仅是算上了Issued and Outstanding Shares(发行流通股份)和Option Pools(期权池)作为Fully Diluted Shares(完全稀释股份),而实际上Simple Agreements for Future Equity(未来股权简单协议)、 Convertible Note(可转债)、Warrant(认股权证)这几个都是要包含到Fully Diluted Shares(完 . It includes shares held by institutional investors, company insiders, officers, and the public. Each state requires that each share of stock be fully paid for in order to be considered properly issued and outstanding. Depending on the situation, there may be far more .

Shares Outstanding: Types, How to Find, and Float

note that these formulas will generally use the term . This number represents all the shares . Used to calculate market capitalization.

Shares outstanding is a component of market capitalization and simply the number of shares of a public company that are currently held by shareholders.Outstanding shares meaning.

Issued vs Outstanding Shares

Issued shares are shares of a company that have been given to shareholders either as a form of compensation or during issuance of shares.Shares outstanding are all the shares of a corporation that have been authorized, issued and purchased by investors and are held by them.Written by Jeff Schmidt. Issued shares are the actual shares that a company has sold to its shareholders and are outstanding in the market.Outstanding Shares Meaning. Again, it seems to be an . Floating stock is the result of subtracting closely-held shares .Critiques : 2

Issued Shares vs Outstanding Shares

What are Outstanding Shares? Outstanding shares represent the number of a company’s shares that are traded on the secondary market and, . Treasury stock refers to shares held by the company, which do not have exercisable rights. Payment may be in the form of cash, check, past (not future) services, a promissory note, forgiveness of a debt the corporation . The number of outstanding shares is used for calculating market capitalization and earnings per share, serving as a denominator in these equations. Shares outstanding refer to the total number of a startup's stock shares currently held by all its shareholders, including institutional investors, insiders, and the general public.

Issued shares may also be referred to as outstanding shares, or shares outstanding. This term applies to all forms of payment, whether it's a check . The number of issued shares generally.Outstanding shares are the shares in the hands of the public, executives and employees.Shares outstanding tell you how many shares a company has issued that are still owned by shareholders. They are distinguished from treasury shares, which are shares held by the corporation itself, thus representing no exercisable rights.

Issued vs Outstanding Shares: What investors need to know

In other words, if you consider all the shares issued to company investors, employees, directors, officers, and the general public, you’re considering a company’s shares outstanding. Companies will typically report their total shares outstanding on .Shares outstanding and treasury shares together amount to the number of . Shares outstanding are total number of stocks issued by a company.Issued shares: These include treasury stock and outstanding shares.