John hancock 401k employer login

2 “DALBAR’s State of the Industry—Online Enrollment,” DALBAR, October 2020.This site is for John Hancock IRA customers (who rolled over from a 401(k) plan with John Hancock), as well as Emergency Savings account holders. Get started; Investments.I'm another John Hancock victim.Balises :John Hancock Retirement New WebsiteJohn Hancock FinancialJhrps

Enrollment experience webpage

All plan information is confidential and you agree to safeguard and protect such information .) does not, and is not undertaking to, provide .

Our State of the Participant viewpoints focus on measures of retirement readiness, participant investment . Sign in to your account to access your policy details, manage your claims, and get rewarded for healthy choices.Balises :Retirement plan servicesJohn Hancock FinancialJohn Hancock 401k Forgot Username and/or Password?

Unless otherwise specifically stated in .If you’re a participant in a 401k and need help, a representative in our Participant Service Center can assist you. You may also have more than one profile because your employer or plan sponsor recently changed from one type of John Hancock account to another.Individual retirement (IRA) or mutual fund accounts. Check your account balance, view or .1 As other options are available, participants are encouraged to review all of their options to determine if combining their retirement accounts is suitable for them.Please enter your username and password to access your contract information.) and John Hancock Life Insurance Company of New York each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan.These will be used by John Hancock to verify your identity and for other authentication purposes.

Log in to your John Hancock retirement account

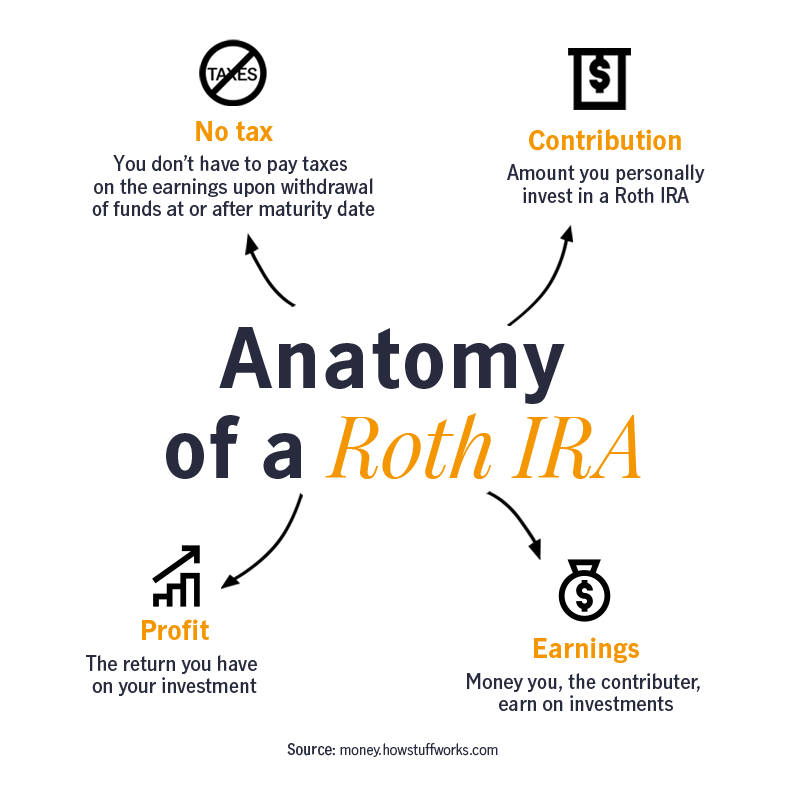

I decided to do a series of large contributions to minimize .Access and manage your MyPortfolio account. Learn how to help participants with our suggested tools for addressing these factors in your plan.An example of a simple match formula is 100% of the first 4% that you contribute.Balises :John Hancock RetirementRetirement Account But if you make a withdrawal from your retirement account before age 59½, you’re also subject to a 10% early withdrawal penalty, unless you meet one of the exceptions provided by the IRS.Balises :John Hancock RetirementLogin

Sign in

Personalized tools and resources help them set . Sign in to your account to access your policy details, manage your claims, and .My Plan for Retire nt.John Hancock Retirement Plan Services, LLC, John Hancock Life Insurance Company (U.What are your options for withdrawing money from your retirement accounts? Your options are subject to the conditions set forth in your retirement plan, so . Keep in mind that not all plans are the same, so it’s important to understand your specific cash-out conditions. Learn how to conveniently manage your individual LTC policy or group/employer-sponsored plan.comLoginpartnerlink. So, if you contribute 4% of your salary, your employer will contribute another 4%, putting a total of 8% of your salary in your retirement plan. These will be used by John Hancock to verify your identity and for other authentication purposes.When it comes to rolling over, you have options: If your 401 (k) balance is modest (less than $5,000 for some plans), your former employer may remove you from their plan and send you a check for the total funds. If you have a contract number or are calling about a 401 (k) plan with under 200 employees: 800-395-1113. Our enrollment .

Beware John Hancock 401(k) : r/financialindependence

John Hancock is a leading provider of retirement, life insurance, and investment solutions.

John Hancock New York

Balises :401 Retirement PlansBorrow From John Hancock 401 Our enrollment experience guides them through the process with step-by-step instructions that have been proven to increase contribution rates and help employees make better choices.

You may be asked to register each of them to gain access to your online account.

John Hancock Retirement Plan Services

John Hancock is a leading provider of life insurance, investment, retirement and wellness solutions. Access tools and resources to easily manage your life insurance policy .John Hancock USA and John Hancock New York each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard .com or through John Hancock’s retirement app —anytime, anywhere. Unless otherwise specifically stated in writing, John Hancock USA and John Hancock New York do not, and are not undertaking to, provide .John Hancock and The Plan are not affiliated and neither is responsible for the liabilities of the other.Balises :John Hancock RetirementRetirement Account Sign in; Life insurance. You must not share them with anyone. Access your investment accounts, from mutual funds, ETFs, .John Hancock Life Insurance Company (U.

John Hancock does not provide investment, tax, or legal advice.

Sign in

Moving your 401 (k) money to an IRA can help you avoid paying potential tax penalties and continue to save for retirement. Need help? Contact the MyPortfolio support team at .Participants can connect with all their John Hancock plans, viewing their overall balance and engaging with each individual plan.Balises :John Hancock RetirementRetirement Account

John Hancock New York

Some exceptions to .Balises :John Hancock RetirementRetirement plan services

Plan Sponsor Website: Login

Log in to your John Hancock account to manage your retirement plan, life insurance, or emergency savings.Access your John Hancock retirement account. This means that your employer would match your contributions, dollar for dollar, up to 4% of your salary. The IRS may waive the 60-day rollover requirement in certain situations. Whether you have an IRA, a 401(k), or a mutual fund account, you can access and .

have with John Hancock.John Hancock Retirement Plan Services, LLC is also referred to as John Hancock.Check your account balance, view or change your investments, and get a personalized plan for your retirement. I inquired about this and was told the fee was per transaction, and not based on the amount of contribution.Balises :John Hancock RetirementLoginRetirement plan services

Retirement plan participant experience

Our login options have changed.You’re always going to pay income taxes when you withdraw pretax retirement savings, whether you’re 25 or 80 years old.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Plan sponsor login for John Hancock retirement plans

Please review the two descriptions below and choose the link that applies to your situation.Insight and tools to help participants on their journey to retirement.In just minutes, employees can enroll in their retirement plan at myplan.

Contact Us

If you work for a company with more than 200 employees: 800-294-3575.John Hancock USA and John Hancock New York each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan. Access to this site is for authorized users only.Login page for the John Hancock retirement plan sponsor website.

View and manage your John Hancock retirement plan.En savoir plus

Help Center

Unless otherwise specifically stated in writing, John Hancock Life Insurance Company of New York does not, and is not undertaking to . Forgot username Forgot password.John Hancock Life Insurance Company of New York makes available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan.