Kevin in app payment

To get started with the kevin.Payment initiation service (PIS) is a payment option made possible by open banking. Clients don’t .

Read on to learn more about mobile payments, including an expert from the kevin. into your business. The company, which was . Wins Investment from Global PayTech Ventures. lets users and merchants treat .

Manquant :

appHassle-Free In-App Payment for Your Clients.eu, phone number +370 (679) 23 909 passported across EEA’s PSD2-based solution enables companies to receive mobile app payments directly from pre-linked bank accounts.April 25, 2024 at 7:33 p.Novel Open Banking Payment Solution from kevin.

Manquant :

kevineu, phone number +370 (679) 23 909 passported across EEA . mobile SDK for online payments: Before you begin. secures $10M to disrupt card networks. PIS enables consumers to pay for goods or services directly from their bank account without leaving the merchant’s app or website. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits.Novel Open Banking Payment Solution from kevin

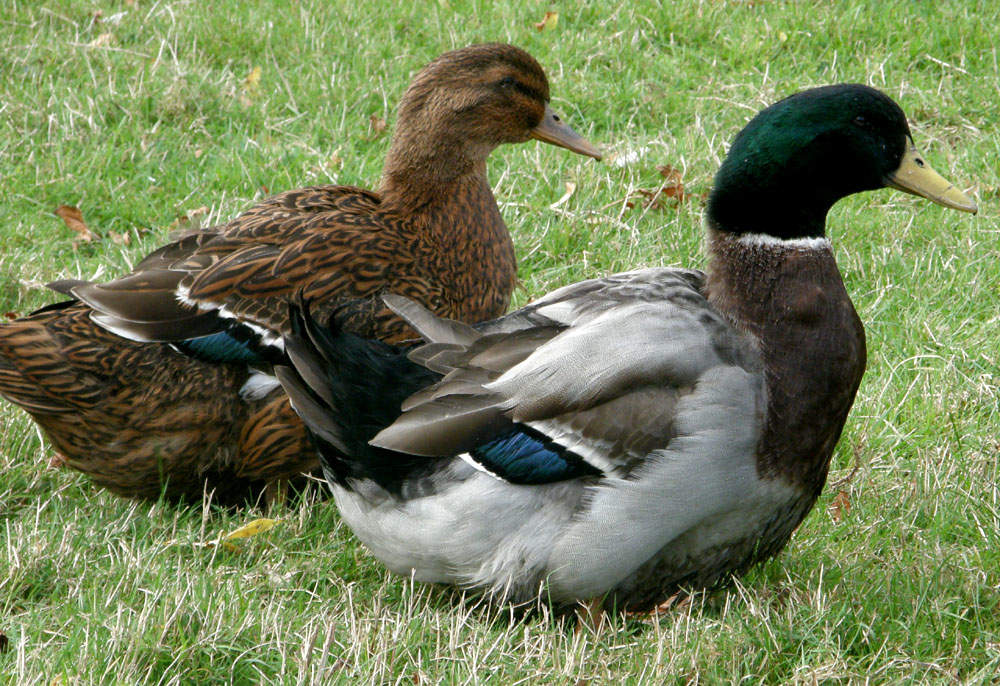

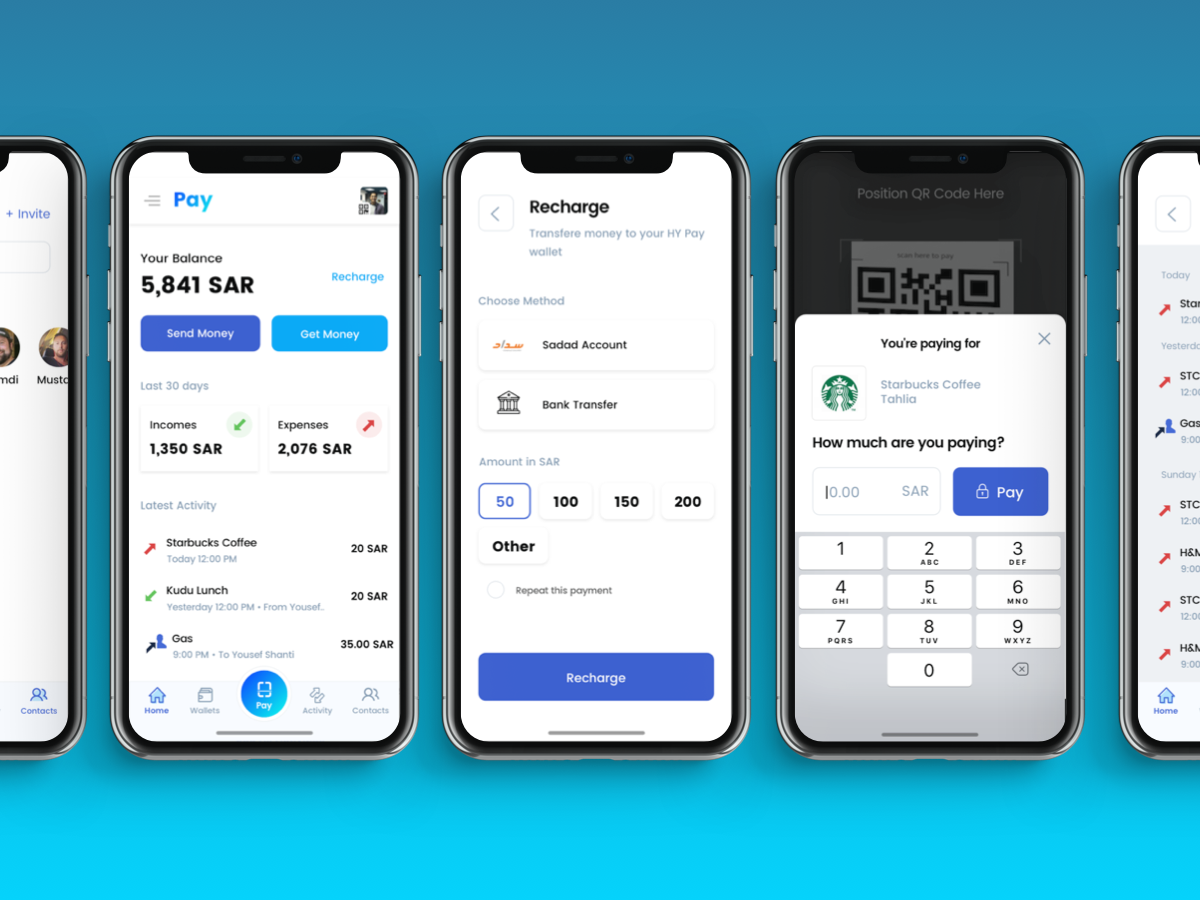

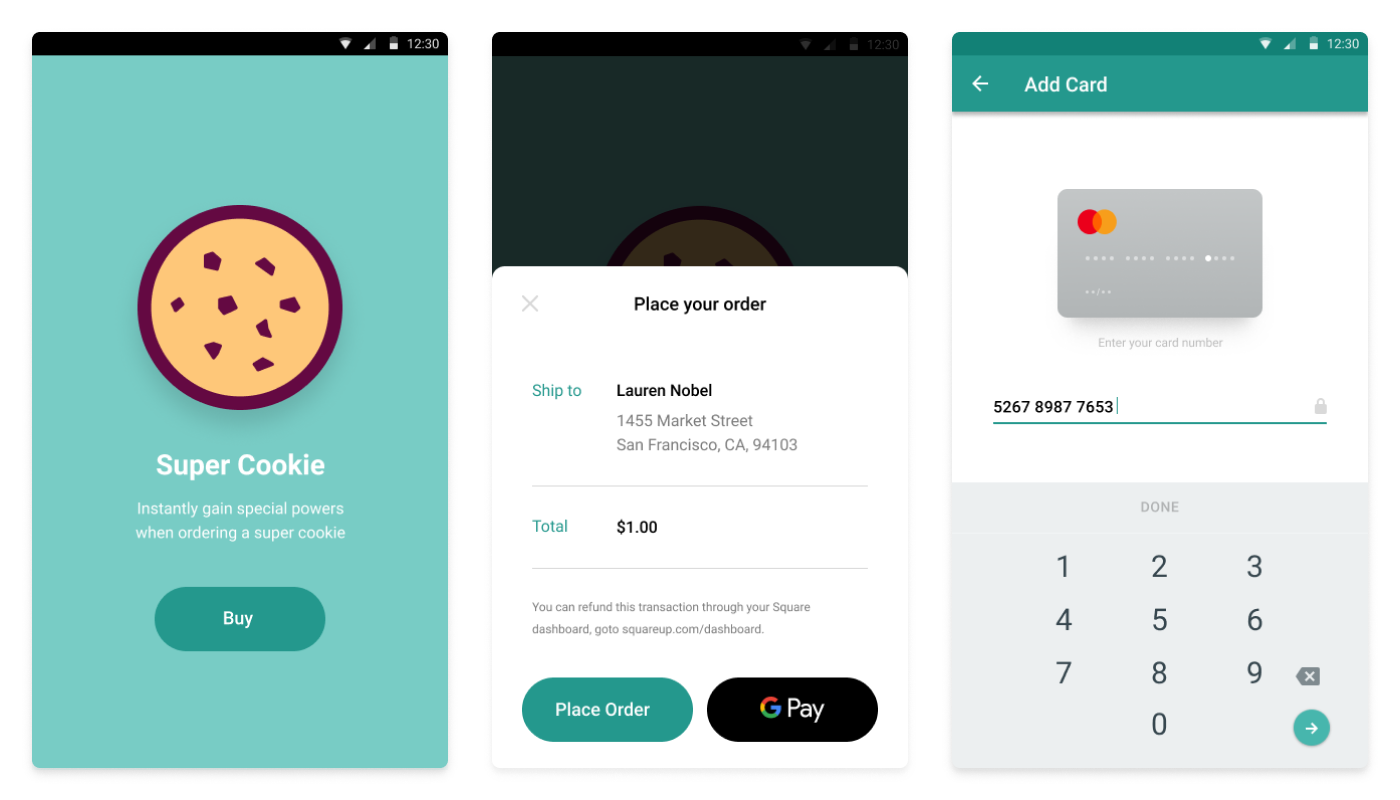

Mobile payments can be made in-app, via a QR code, or even via SMS. Get your API keys. What are the types of mobile payments? The types of mobile payments include point-of-sale (POS) payments (also .

Different Payment Methods: The Complete Guide

Online payments. team giving unique information on mobile vs. It lowers the rate of abandoned carts, improves customer .Today, a startup called Kevin that’s taking one piece of that puzzle — payments made from account to account, an alternative to payment card payments .Hassle-free in-app payments for your clients., a fintech startup based in Lithuania, has launched the first ever PSD2 payments solution for mobile payments from pre-linked bank accounts, and has . Plus, you’ll get access to extensive . Find everything you need to understand, navigate and integrate kevin.Mobile payments are made via a smartphone, using a mobile payment app, such as Samsung Pay, PayPal or others. is the payments reset no one saw coming. We exist to free partners from the pains of legacy technology . We exist to free partners from the pains of legacy technology, so we can build a world of payment possibilities together. The payments reset no one thought possible. Initialise plugins you will use in your Application . We've got your back.All the checkout happens on the merchant’s website or a mobile app, giving the merchant full control of the payment experience. It is a company registered in Lithuania with a company code 304777572 and address at Lvivo str.Kevin EU, UAB is a payment institution authorized and regulated by the Bank of Lithuania., a Lithuanian fintech startup which provides unique payment infrastructure for online, mobile, and physical sales, has secured $10 million of new ., a fintech startup based in Lithuania, has launched the first ever PSD2 payments solution for mobile payments from pre-linked bank accounts, and has raised €1. Our in-app payment solution can be used in iOS or Android natively, and cross-platform frameworks. The round was led by Accel, with participation from Eurazeo and all existing investors, including OTB .kevin_flutter_in_app_payments | Flutter package. In-store payments. October 26, 2021.Google Wallet app can be downloaded from the Play Store (Image credit: Vivek Umashankar/The Indian Express) Google has confirmed that the Wallet app is not . Digital wallets enable users to store funds electronically. ensures the best payment experience for your customers. Discover various integration options to enable account-to-account payments on your website and in-app. In this case, the merchant needs to hold a PCI DSS certification in order to collect all the payment data encrypted and sent from the merchant’s site to the gateway for authorisation and further processing.Experience the power of our payment technology in action. Share on: Il est évident pour les utilisateurs de pouvoir payer des biens et des services via une application sur téléphone portable. The Biden administration on Tuesday announced a new rule that would make millions of white-collar workers newly eligible for overtime pay.’s in-app payment solution? kevin. sécurise et facilite le règlement sur votre application sur téléphone portable, en . This allows the payments to . In conclusion, mobile payments are not the same as in-app payments, as they embody different ideologies and where and how the payment is completed.

Produits Solution de paiements par téléphone portable intégrée à l’app de kevin. in-app payments, their history and where mobile payments will be going in the future.

Kevin raises $65M for account-to-account payments

Users can top up their wallets via a bank transfer, mobile carrier or a bank .

What are Mobile Payments?

2023-12-07 Temps de lecture: 4 min.

Some solutions can even make in-app purchases so easy . kevin_flutter_in_app_payments 1. C’est rapide, .’s technology, consumers can now make payments for these services in the same convenient way as cards.android:in-app-payments: } Latest SDK version can be found here. Users can link their bank accounts with the merchant’s app and make all the purchases in one click, without any extra authorisation.”

Novel Open Banking Payment Solution from kevin

Suffolk District Attorney Kevin Hayden has agreed to pay a $5,000 civil penalty for violating conflict of interest law by allowing his . | 31,174 followers on LinkedIn.

Published 8 months ago • kevin. La solución es fácil de integrar y viene con una documentación para desarrolladores que servirá de guía durante todo el proceso en .

Google clarifies its Wallet app is yet to launch in India

Starting July . Payment initiation service providers (PISPs) are authorized third-party service providers that enable these direct payment . Welcome to our blog, where you can discover the most recent news and case studies about our solutions, open .Welcome to our documentation hub.2023-12-19 3 min read.’S In-App Payment Solution?Why choose kevin. We use cookies on our website to give you the most relevant .In-app payment solutions can help businesses boost conversion rates and increase customer retention.

Clients don’t need to leave the .

It would enable merchants to have lower fees and prosper in the app world.

In-app payments: what are they and how they work

Digital wallets.La solution de paiements par téléphone portable intégrée à l’application de kevin. Our new solution enables seamless, instant transactions that don’t need to be authorised every time a service, like getting a ride on a ride-hailing .Here is the flow of how a payment works using kevin.Lithuanian startup Kevin allows customers to make payments directly from their bank accounts by linking them to a merchant's account., the Lithuanian fintech startup providing an advanced A2A (account-to-account) payment infrastructure to replace costly card transactions, today announces that it has secured $65 million in Series A funding., a Lithuanian fintech startup which provides unique payment infrastructure for online, mobile, and physical sales, has secured $10 million of new capital in a seed funding round – one of the largest in Europe.

Manquant :

kevinNew Biden rule would cover 4 million more workers for overtime pay

implementation eu. By clicking “Accept”, you consent to the use of the cookies.