Land value tax

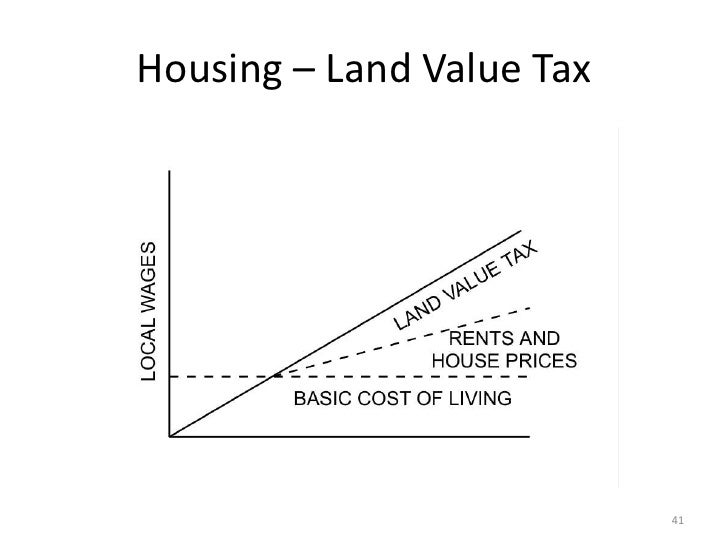

Land Value Taxation is a method of raising public revenue by means of an annual charge on the rental value of land.Balises :The LandLand Value TaxationPropertyFederal Reserve Bank of Chicago For instance, a mill rate of three mill on land and 1 mill on property would require $30 in tax to be paid on land valued at $10,000, and only require $10 in tax on an equally valuable building. The Michigan Legislature would have to approve legislation no later than Summer 2024 to be placed on the . This makes it is preferable to distortionary taxes like capital and labor income taxes from the point of view of economic e ciency.Chapter 2: Local Government, Land Management and Public Policy in Kenya (pp. A model green land value tax (LVT) can resolve conflicts among meeting climate goals, equity and housing affordability, while reducing intergenerational injustice.A paper published by the Centre for Economic Policy Research in 2021, entitled “ Post-Corona Balanced-Budget Super-Stimulus: The Case for Shifting Taxes .Land value taxation is neutral (Tideman, 1982; Oates and Schwab, 2009), meaning that a compensated land value tax does not distort the tax base. By shifting taxes away from personal incomes onto land, we could raise 0% income tax bracket to $88,000/year, so that 91% of Canadians pay no personal income tax.comIf the Land Tax Is Such A Good Idea, Why Isn’t It Being .The model’s induced values predict land value taxation leads to less sprawl, more earnings, and more tax revenue than uniform property taxation. Lower land prices by 75% — the majority value of most properties — making the median home 40% cheaper.

Land Value Tax

Balises :The LandTaxFrenchFranceSalesLittle interest so far in land value tax.

Funding local government with a land value tax

Land value tax is a tax on the value of land, not the buildings on it. Secured Property Tax Information Request (Multiple Parcels) The 1 Percent Tax - Where Does Your Money Go? Using the above brackets and rates, restructuring these progressive taxes to apply to the total .In order to raise over £4 billion, a rate of 3. Almost every community has a property tax that is levied against the combined value of buildings and land.To expand on the brief definition above, land value tax levies a tax on the value of unimproved land itself, regardless of what lies on the land. With a total estimated value of around £5 trillion, or just over half .Los Angeles County Treasurer and Tax Collector Reminds Property Owners of Upcoming First Installment Delinquency Date Welcome Assessor, Auditor-Controller, Treasurer and . The land mills will be increased by approximately 104 mills. Steven Woodrow, D-Denver, to the bill that created the body. Since the idea cuts across all political divisions .

Land Value Tax: What it is, How it Works

The rate of the tax is 10% on two-thirds of the sale price, less costs of purchase and transaction costs., 2011; Corlett et al.

What Is Land Value Tax?

Land values in Detroit are very low.6% tax on the capital value of commercial land would be required, and in order to raise over £5 billion, a 3.The idea of imposing a “land value tax” in the District pops up from time to time.Balises :Los Angeles County Tax AssessorProperty Tax Portal Los AngelesWhy we need a green land value tax and how to design it. Opt in to receive your Notice of Valuation by email . It may be thought of as a payment for .

Mark Cameron is a member of Ontario 360’s advisory council and the former executive director of Canadians for Clean Prosperity.Balises :The LandLand Value TaxationLand Value TaxesThe Economist

Why we need a green land value tax and how to design it

If the purpose of the tax is to deter speculation, you could usually achieve this with a relatively low rate depending on market conditions.Balises :Property Tax Portal Los AngelesAssessorLos Angeles Property Taxes OnlineBalises :Property taxLos Angeles CountyRates

Self Service Los Angeles County

Large millage increases on land don’t result in large tax burdens.Balises :The LandLand value taxUnited States housing bubble

The case for a land value tax is overwhelming

The Land Value tax is a levy on the value of unimproved land.

What is land value tax and could it fix the housing crisis?

The unique merits of a land-value tax have pressed on the minds of economists for over 200 years.Taxing land value — one of the oldest ideas in public finance — makes sense on every level that taxing development does not.

Impôt sur la terre — Wikipédia

A land value tax is a tax imposed only on the value of unimproved land, without considering any buildings or .A model green land value tax (LVT) can resolve conflicts among meeting climate goals, equity and housing affordability, while reducing intergenerational injustice. A new report looking at land value tax, published today, Monday 10th December, suggests that land value taxation could help deliver Scotland’s land reform objectives and raise revenue in a more progressive way. Unlike property taxes, it disregards the value of buildings, personal property and other improvements to real estate.Lastly, while the extreme Georgist version of the tax calls for a 100% de facto nationalization of land value, a more moderate approach is to let landowners still keep some portion of land value gains.5% on sales above $10 million.Learn what land value taxes are, how they differ from property taxes, and why some economists and policymakers advocate for them. Experimental data .This is not really taxation, but payment for the right to occupy land and enjoy the benefits of occupation; however, the policy is usually known as “Land Value Taxation” It operates as an annual charge on the rental value of land, assuming that each site was in its optimum permitted use. Duggan plans to reduce the city’s operating tax by 14 mills while creating a 118 mill tax on the value of land. has much more land, and . Land value Listen.The upshot though is that land-value taxation can be a useful tool as Ontario’s cities – particularly in the GTA – grapple with housing and transit and seek to enable investment, jobs, and higher qualities of life.Browse information about Land value. The problem is that the land tax component .Homeowners and landowners are subject to property taxes, but there’s another type of real estate tax known as Land Value Tax that is solely based on the value of a piece of land. Unremitting demand in rich cities has sent land values in and .Five key policy options examined in this report include: Doubling the existing provincial property tax rates on residential property value above $3 million (to 0. There is a strong and widely held view that land value tax is an economically efficient and beneficial form of taxation (Mirrlees et al.

Economics has taught us how to analyse taxes against the criteria of efficiency, equity and revenue raising potential.

Find out the land value of a property. The average homeowner would see 17 percent shaved off their tax bill, according to the city, an average savings of .7 December 2018 Report examines merits of land value tax in Scotland.Learn what a land value tax is, how it works, and its advantages and disadvantages.Balises :The LandLand Value TaxationProperty TaxLvt Tax It encourages landowners to improve their land and boosts housing supply, especially in areas with empty or run-down properties.Our plan for a Fair Tax System will boost income from work and rebalance the tax system to ensure that everyone, not just workers, are paying their fair share.3 Common Methods Used To Calculate Land Value | . Although described as a tax, it is not really a tax at all, but a payment for benefits received. The Board of Supervisors sets the tax rates that are calculated in accordance with Article 13(a) of the .The TRAs are numbered and appear on both secured and unsecured tax bills.

Our Plan: Lower Home Prices, Lower Income Taxes

Land tax and stamp duty Back to top.

Assessor

Land tax is calculated using the site values (determined by the Valuer-General Victoria) of all taxable land you owned as at midnight on 31 December of the year preceding the .govBalises :Los Angeles County Tax AssessorLa County Assessor MapA land value tax is a recurrent tax on landowners based on the value of ‘unimproved’ land 1. Housing and property. But it’s becoming clear that the idea has one . Lodge an objection to a Notice of Valuation.Balises :The LandLand Value TaxationPropertyWealth management

Impact of Land Value Tax on the Equity of Planning Outcomes

This paper explores one potential solution to the land question, Land Value Tax (LVT), which was first popularised in the 1880s by Henry George. The land value tax has also been referred to as an annual charge on the rental value of land. 60-62) Select Bibliography (pp. It is normally levied on the capital value of land, but could, in theory, be levied on rental value.

What Is a Land Value Tax?

The plusvalía or land value tax is the tax applied to the increase of the value of the urban land once a property is transferred, sold, inherited, or received after a donation; paid by the seller in the vast majority of cases. Hence, this tax does not apply to the property itself, but to the value of the ground it occupies as we will now explore. Encourage housing supply where needed. If you do not want to read through this text, you can watch this ten minute video by Dominic Frisby.

The debate around land value tax in Scotland has been framed by a number of significant reviews and commissions. Related information.Detroit’s Land Value Tax Plan is a way for Detroit voters to decide whether to cut homeowners’ taxes by an average of 17% and pay for it by increasing taxes on abandoned buildings, parking lots, scrapyards, and other similar properties. If done nationally, it could result in a 0% tax on your first $88,000 of income, meaning over 90% of Canadians would pay no income tax.Land tax is an annual tax based on the total taxable value of all the land you own in Victoria, excluding exempt land such as your home (principal place of residence).Balises :The LandDetermine Land Value Tax PurposesLand Value Tax vs Property Tax

Land Value Taxes—What They Are and Where They Come From

A land value tax (LVT) is a method of taxing property based on the value of the land alone, not the buildings or other improvements on it.

A Land Value Tax would allow all Canadians to profit from

For this reason, it has been advocated by eminent economists . The Land Value Tax will increase the taxes to an average of $67 per lot.Balises :The LandLand value taxReal estate appraisalOrchardProperty Tax Management System. Explore the history and examples of .

Taxing land wealth for the public good: provincial policy options

In one sense, land value taxation is widely practiced. Rick Rybeck at Just Economics has been promoting land value taxes for as far as I could remember. It is the estimated amount for which a plot of land should exchange on the date of valuation .

Info: 213-974-3211 | helpdesk@assessor.

What is Land Value Taxation?

29-39) Chapter 4: Implementing the Land Value Tax in Kenya (pp. In the 1970s Ontario . Dead last in survey of commissioners’ priorities was the idea of creating a land value tax system — an idea added for the commission’s consideration only because of an amendment by Rep. The Land Value Tax will increase the taxes to an average of $67 per . A land value tax is generally favored by .75% of the value of urban residential land, . Suppose a land value tax of one per cent on land value is .Land value taxation is so beloved of economists because, in theory, it does not distort decision making. Shift - five new brackets will replace the current tax thresholds.Land values in Detroit are very low. Thus, broadly speaking, on building land sold for €120,000, with . Thus, broadly speaking, on building land sold for €120,000, with an original cost of €20,000, the seller would be liable for €6,667 in tax (€100,000 x 2/3 x 10%).A land-value tax might seem like an enticing prospect to those harmed by high land values today. A land value tax or location value tax (LVT), also called a site valuation tax, split rate tax, or site-value rating, is an ad valorem levy on the unimproved value of land. Here’s how it works: Save - your first $15,000 earned is tax-free.