Learn real estate financial modeling

Resources; About .

The Advanced Real Estate Financial Modeling Bootcamp

Topics include income and expense assembly; multiple lease analysis, including effective rent; sizing debt with lender parameters and calculating levered and . 76,727 Students.5 billion dollars of closed commercialreal estate transactions, this course was designed to take you from complete beginner with no knowledge of real estate financial . We empower students, graduates, and finance professionals with the practical skills and insights required to thrive in the highly competitive real estate industry.

By the end of this course, you'll be way . The Real Estate . Includes models covering all properties and .4,7/5(8,9K)

REFM

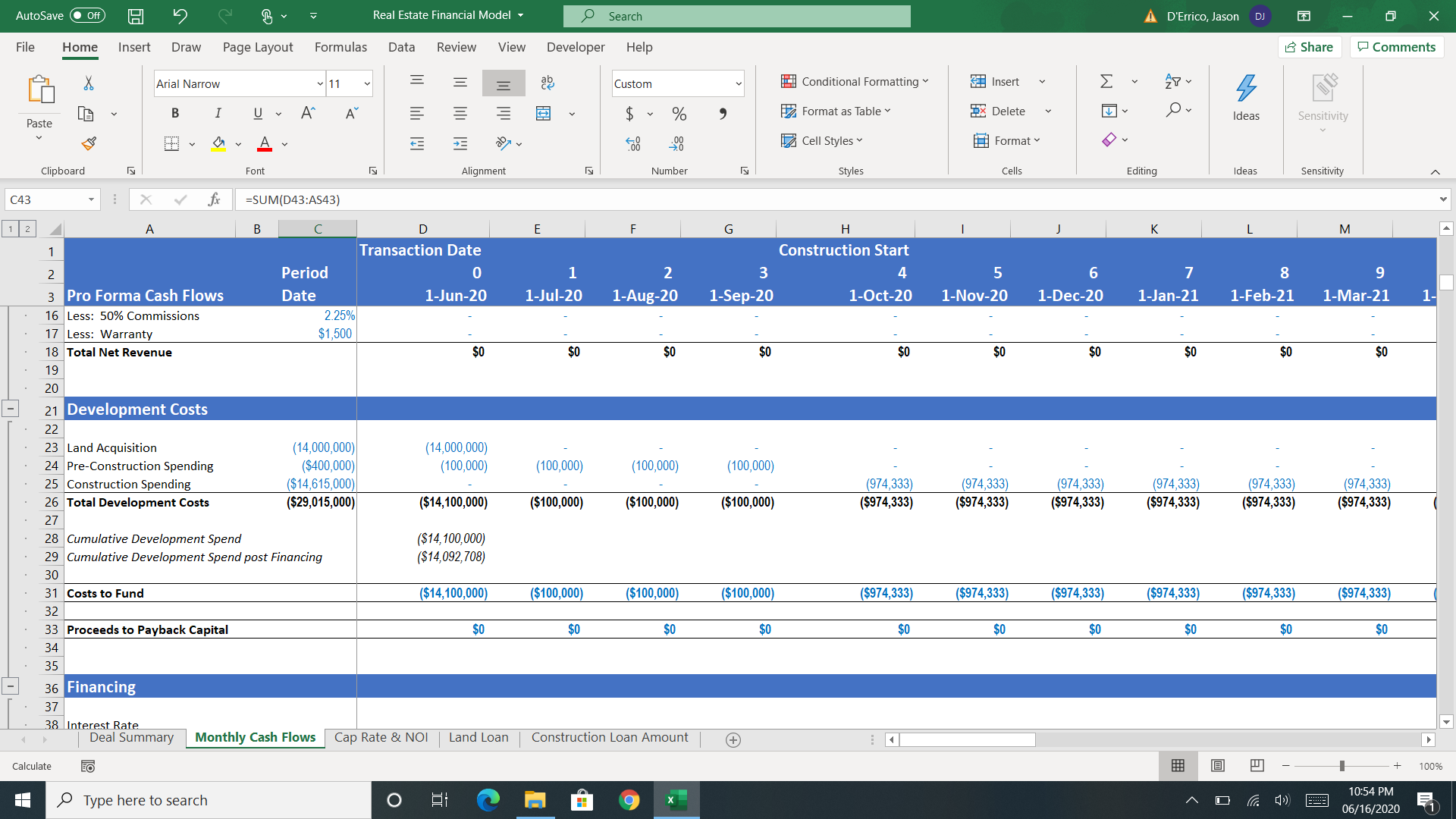

Download an Excel real estate model from our extensive library of real estate financial pro formas.

The Real Estate Financial Modeling Bootcamp Course

Wharton Online has collaborated with Wall Street Prep, the real estate industry’s leading financial modeling training provider, to create a unique program that combines .

Real Estate Financial Modeling Course

Now, the second thing I’d recommend doing to prepare for an Excel modeling test is to use both the length of the exam and the activities of the company to help guide your focus leading up to the test. I have been exploring online for resource to expand my knowledge on RE financial modeling and courses.If you don't know me already, my name is Justin Kivel, and I’m a real estate consultant, investor, and now teacher, with over 70,000 students who have used the Break Into CRE coursework to land their first job in the industry, advance their existing real estate career, or do their first deal on their own. Get Register Today! +971 8000311193 - Available 24/7. Learn how to use Excel functions and formulas to build out cash flows for you, on autopilot. In this specific episode, I lay out the basic .Wharton Business and Financial Modeling Capstone.Learn how to build financial models for real estate investments with Real Estate Financial Modelling training course in the United Arab Emirates.Foundations of Real Estate Financial Modelling, Second Edition is specifically designed to provide the scalable basis of pro forma modelling for real estate projects. Whether you’re looking to go into commercial or private equity real estate, our real estate financial modeling course will help you succeed.

Realty Capital Analytics

The Next Step (How To Master Your Craft) Learn how to take your skill set to the next level and become an expert in real estate financial modeling & analysis.Our extensive library of financial modeling courses covers a wide range of topics from beginner to very advanced models.The Secret Sauce of Real Estate Financial Modeling. (477 reviews) Mixed · Course · 1 - 3 Months. Three types of real estate financial modeling—Acquisition . In addition, REFM’s self-study products, Excel-based templates and its Valuate ® property valuation and investment analysis software are used by more than 100,000 .In this series, I show you how to build complex financial models for the analysis of a real estate investment.I am looking to break into Real Estate finance hopefully within Acquisitions or Asset Management for CRE, PERE, or other funds. Advanced Real Estate Debt. 100% Money-Back Guarantee.

Discover how to organize and to present data in order to analyze real estate investments more efficiently. Company brochures Company Knowledge .Additionally, REFM’s Real Estate Finance and Investments Certification (REFAI®)certification is great to have in the industry, but it's expensive ($1499).

Foundations of Real Estate Excel Modeling

Secure checkout. April 19, 2024. From a timing perspective, most in-office Excel modeling exams will be somewhere between about 1-4 hours long, with most companies telling you .

How To Prepare For a Real Estate Financial Modeling Excel Test

The skill set to model development projects, major renovation projects, and complex debt and equity . $0 (FREE) Pay in full or make 3 monthly payments of.5 (272 ratings) 1,448 students. Deep dive into traditional real estate investments, and master the skills needed to complete a comprehensive REIT valuation model based on real company data.Master real estate financial modeling.A mastery of real estate financial modeling functions and formulas.People learn about properties at a real estate sales office in Beijing on June 24, 2023. Deep dive into traditional real estate . A Course with 30+ Lessons, 1 Modeling Test + More To Help you Thrive in the Most Rigorous RE Interviews and Jobs.

Learn Financial Modeling

Real estate financial models help analyze risks and returns, aiding investors in making informed decisions.Critiques : 38,5KLearn the three pillars of real estate financial modeling & how to analyze deals on autopilot.

University of Pennsylvania. This course is not required to earn an Accelerator Certificate .

After almost a decade of working with .

Real Estate Financial Modeling in Excel

Unless you qualify for the student/military discount, the retail price might be too high for some. Real estate industry Overview; Calculate Cap Rate and Net Operating Income (NOI) Build an interactive financial . The book introduces students and professionals to the basics of real estate finance theory prior to providing a step-by-step guide for financial real estate model . Finally, you’ll build a complex value-add multi-family model complete with an equity waterfall.As the founder of Real Estate Financial Modeling (REFM), Bruce Kirsch has trained thousands of students and professionals around the world in Excel-based projection analysis.

Real Estate Financial Modelling Training

Get Register Today! +91 8037244591 - Available 24/7. Start subscription.The Ultimate Real Estate Modeling Course.Overview of Real Estate Financial Modeling (REFM) Components and Construction of a Real Estate Financial Model; Commercial Real Estate Valuation . Everything you need to build and interpret real estate finance models. You can also learn how to build models for specific industries such as mining, real estate, startups, . Purchase with confidence knowing that your order is backed by our 30-day, 100% money back guarantee.

15 Best Real-Estate Financial Modeling Courses (2023)

About About Us Contact Us Clients Careers. Investopedia offers its own financial modeling class as part of the Investopedia . The Step-by-Step Process to Real Estate . Evaluate property .

Real Estate Financial Modeling

In addition, REFM’s self-study products, Excel-based templates and its Valuate® property valuation and investment analysis software are used by more than 250,000 .

The Real Estate Financial Modeling Bootcamp

With all this knowledge, you’ll then create a stabilized real estate model to introduce you to the unique aspects of real estate modeling. The ones that stand out are: 1)REFM 2) BIWS 3)WSP.COURSE DESCRIPTION.What’s the Point of Real Estate Financial Modeling? Types of Real Estate Financial Modeling.Before you use one of our real estate financial models (i. Excel templates), or before you set out to build your own real estate analysis tool in Excel, it’s important to keep in mind a few real estate financial modeling best practices.You’ll then learn the key financial metrics used in real estate. A mastery of the foundational analytical and financial modeling tools .Real Estate Financial Modeling Learning Content. Enroll For Free . This is the same training program we deliver to the . Resources Blogs News. Three types of real estate financial modeling—Acquisition Modeling, Renovation .Built by an instructor with over eight years of real estate private equity finance experience modeling over $1.

Get Unlimited Lifetime Access To The WSO Real Estate Crash Course For 100%Off. The different . Meet Your Instructor After .What’s the best real-estate financial modeling course? Career Advancement in Real Estate.The skill set to model real estate transactions for multiple different asset types and solve for key investment metrics evaluated by real estate firms. Real estate is a pillar industry of the Chinese economy. CFI's Financial Modeling & Valuation Analyst (FMVA®) Certification imparts vital financial analysis skills, emphasizing constructing effective financial models for confident business decisions. Skills you'll gain: Data Analysis, Finance, Investment Management, Business Analysis, Financial Analysis, Leadership and Management, Mathematics, Performance Management, Probability & Statistics, General Statistics.

REFAI® Certification

Our real estate financial modeling (REFM) course is designed to teach you how to build a development model in Excel from the ground up.

About Real Estate Financial Modeling

Wharton Online Real Estate Investing & Analysis Certificate

This list combines industry conventions for modeling in Excel, with various suggestions specific . You can learn to build standard three statement financial forecast models, M&A models and LBO models.Real estate financial modeling is a sophisticated process that involves the creation of intricate financial models to assess the viability and profitability of real estate investments.Focusing on things like the property cash flow statement and how it’s structured, the key real estate investment metrics that are commonly used in the industry to analyze deals, . Learn to build dynamic, institutional-quality commercial real estate acquisition models, development models, and equity waterfall . Wall Street Prep - Real Estate Financial Modeling Course. Advanced Concepts in Real Estate Financial Modeling is a supplemental bonus course offered as part of the Accelerator curriculum. Make more money.Real Estate Financial Modelling & Investment Courses. Home Who We Are What We Do Market Intelligence News, Tips & Education FREE Resources Client Portal Let's Connect Back What We Do Real Estate .

Investment Banker from Financial Edge. Financial modeling is an essential aspect of real estate analysis. Add 36, ready-to-use, institutional-quality real estate financial models to your personal library ($599 value) Choose plan.This online real estate course has been put together exclusively for the Real Estate Financial Modelling certificate, using state of the art digital resources such as animations, video-steps, digital whiteboard and video-interactions as well as the spreadsheets, text based resources and tutor contact you would expect from any of Bayfield Training’s .