Lease adjustment for ebitda

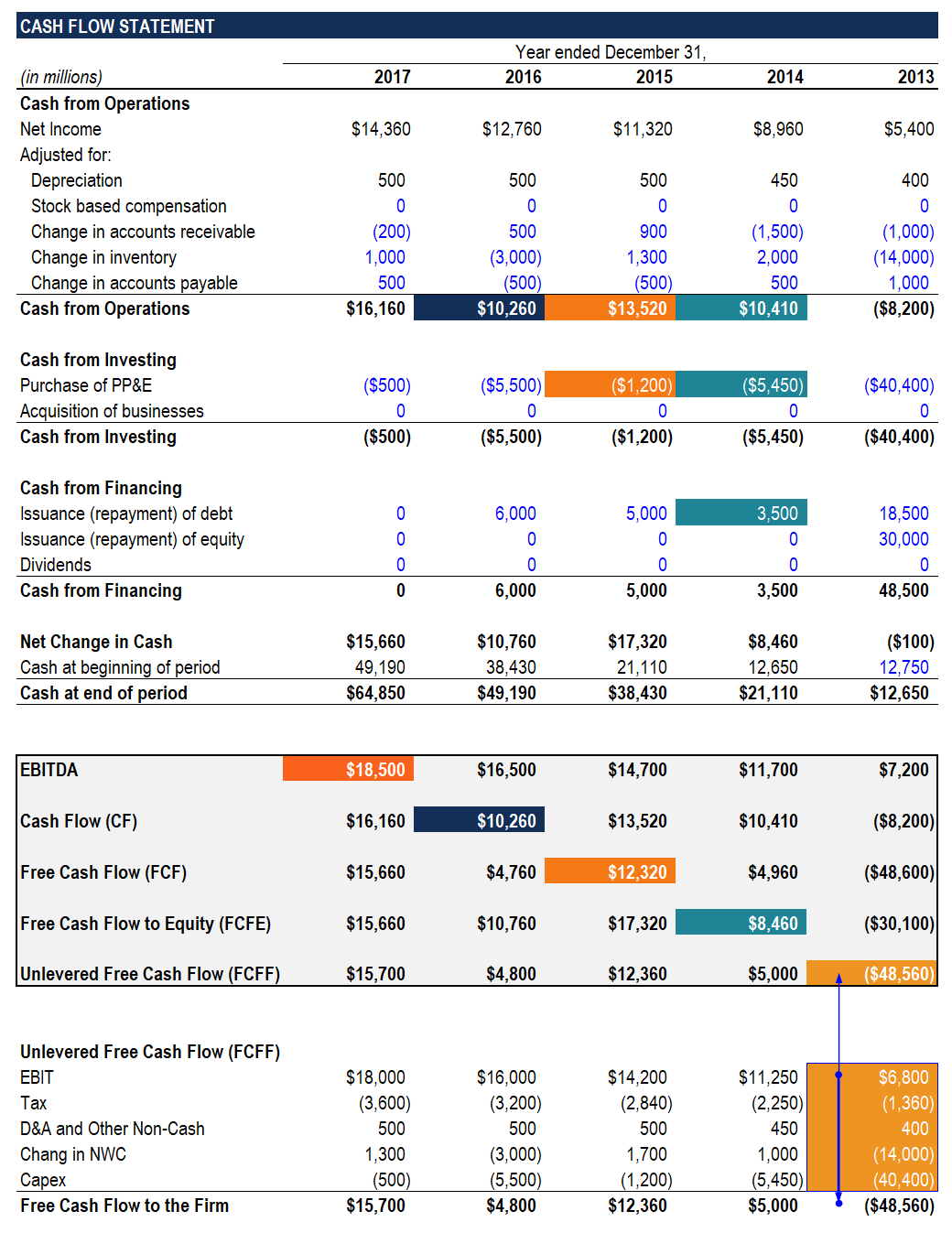

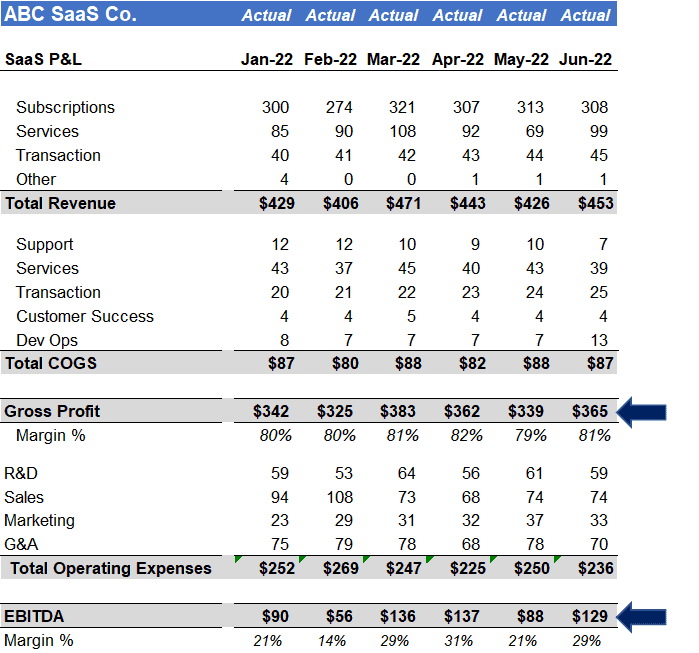

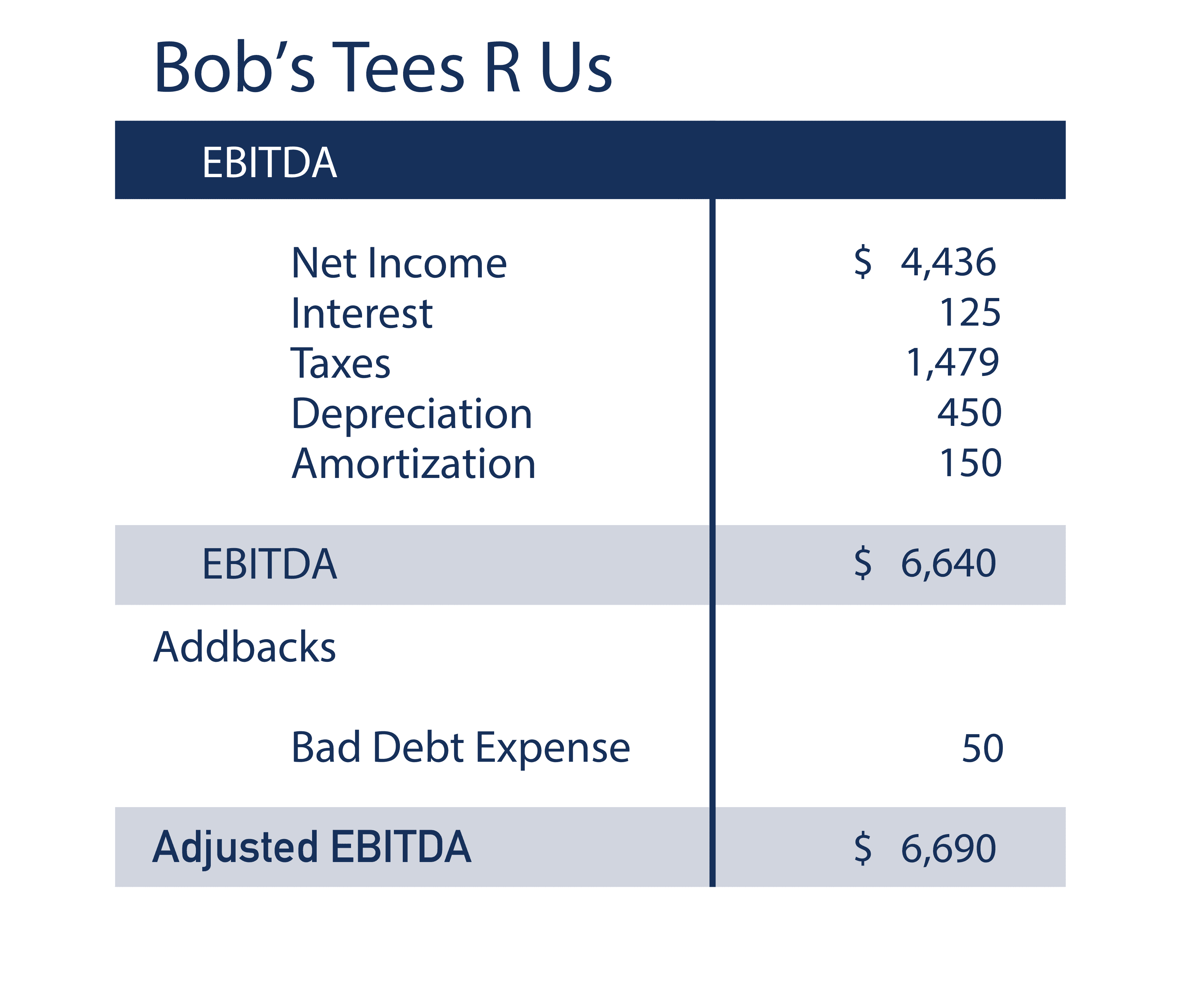

The correct way to calculate EV/EBITDA in this case is to divide the enterprise value (including lease liabilities) of 10. The Corporate Interest Restriction operates to provide interest allowances based on the aggregate amount of ‘tax-EBITDA’ of the worldwide group for the period of account .TIOPA10/PART10/CH6. More Resources. Since the company in this example is paying the actual costs of the insurance and taxes, there is no need to make an adjustment for that. New lease accounting rules short-change .To compute adjusted or normalized EBITDA, irregular, one-time, or nonrecurring items are subtracted from the total to provide a comparable number. Under IFRS, it’s trickier because Operating .调整后的EBITDA是在原有的EBITDA基础上加上更多的费用,以更准确地反映公司的盈利情况。. Standard EBITDA = Earnings + Interest + Taxes + . As illustrated above, although the impact on the restated EBITDA to account for the difference between rental rate paid vs. market rent may be small, the valuation multiple used amplifies the rent adjustment as shown below.January 23, 2020. If EBITDA is the driver, the lease can be structured as a true lease with a 90% PV which could be a terminal rental adjustment clause (TRAC) lease—only available for vehicles and trailers) with a 90% PV. The depreciation charge relating to the new finance lease asset is a non-cash item and .Adjusted EBITDA removes various one-time, irregular, non-recurring items that are not related to the day-to-day, ongoing operations of a business.

IFRS 16

Understanding EBITDA for Restaurant Owners

The lease expense recognised under IAS 17 will now be recognised as depreciation of the right-of-use asset to be recognised on the balance sheet as well as .EBITDA would increase if lease expense is treated as amortization and interest. (Nasdaq: DXCM) today reported its financial results as of and for .To be consistent with how finance leases are accounted for, I also add the depreciation expense embedded in the operating lease to the EBITDA.As EBITDA is reduced by the lease expense, the seller is not penalized twice by also including the lease as indebtedness; however, one would generally expect .As such, while not required, Management’s Adjustments are a permissive adjustment under Regulation S-X going forward and any add-back restrictions in the calculation of Adjusted EBITDA that hinge on Regulation S-X should be closely scrutinized.When comparing U.441m EUR by the reported EBITDA of 1,001. Ultimately, 5x a higher EBITDA is always better.Adjusted EBITDA is a financial metric that includes the removal of various one-time, irregular, and non-recurring items from EBITDA (Earnings Before Interest Taxes, . The remainder of this document presents our methodology for all standard adjustments for .EBITDA = Revenue – Cost of Goods Sold – Operating Expenses + Depreciation & Amortization Expense = $82,000 – $23,000 – $19,000 + $12,000 = $52,000. Accordingly, we expect our simplified approach will not impact our credit ratings.Our modeling suggests that our simplified approach to the operating lease adjustment closely approximates the results we would achieve using our more complex approach. companies have dealt with the “new” lease standard, Accounting Standards Codification (ASC) 842, since the accounting policy went into effect for fiscal . There is the potential .The future FCFF will be higher over the remaining lease period, as rental expenses are excluded from EBITDA. The capital (expenditure) adjustment removes amounts of capital expenditure from calculating group-EBITDA. Although the adjustment may not be considered very material, it would nonetheless help pay for a . There is nothing holding you back from reviewing your own numbers well before you decide to sell to ensure that you get the best deal when you do.Finance Act 2019 inserted a new rule to provide that where a lease was subject to re-measurement, eg due to a change in rentals based on outturn performance, tax relief could be claimed for an upward increment (if relief was not available via the capital allowances computation).EBITDA will be different depending on whether an analyst treats the operating leases as debt or non-debt liabilities (note that this change does not significantly impact the calculation of EBIT or net income). For example, if a business is valued at 6.The formula looks like this: (EBITDA + Lease Payments)/ (Interest Payments + Principal Payments + Lease Payments) Adjusted EBITDA. Ind AS 116 defines a lease as a contract, or part of a contract, that conveys the right to use an asset (the .Employee Benefit Plan AuditsOutsourced Accounting SolutionsHigh Net Worth & Wealth TransferIntern & Entry Level OpportunitiesIndustriesTIAG Membership

EBITDA Adjustments

The new guidance on lease accounting is effective for annual periods beginning after Dec. Lease Accounting Change Makes EBITDA an Even Muddier Metric.

Debt-to-EBITDA Ratio: Definition, Formula, and Calculation

5m EUR for an EV/EBITDA of 10. The standard provides a single lessee accounting model, requiring .The total annual market rent for this site would be $398,708 compared to the actual lease rate of $602,461.

Large, public U. EBITDA is one indicator of a company's .New Lease Standard in M&A Negotiations.comIFRS 16: The leases standard is changing - PwCpwc. Where other guardrails exist in the credit agreement related to pro forma adjustments for . SAN DIEGO-- ( BUSINESS WIRE )--DexCom, Inc.EBITDA: The lease-related expense is allocated to interest and depreciation, whereby interest expense share in total rent expense is calculated .

IFRS 16 (Leases)

Other changes, such as the accounting for initial costs and the allocation decision between lease and non-lease components could have long-term ramifications for EBITDA.The additional ‘AL’ means ‘after leases’, with the IFRS expenses related to capitalised leases deducted from EBITDA, even though, under IFRS accounting, these .

If treating operating leases as debt, EBITDA should be computed by adding back related operating lease rent to arrive at EBITDAR.Investment bankers will prepare a five-year summary of normalized EBITDA to market your company.

Using EV/EBITDA under IFRS 16: pitfalls and solutions

Adjusted EBITDA: Definition, Formula and How to Calculate

GAAP since there’s already a full deduction for it in Operating Income.Adjustment to tax-EBITDA TIOPA10/S460 excludes each of the following when calculating a company’s adjusted corporation tax earnings when determining a company’s tax-EBITDA:

Guide to Fitch’s Credit Metrics, Financial Terms and Adjustments

The new standard will affect virtually all commonly used financial ratios and performance metrics such as gearing, current ratio, asset turnover, interest cover, . 为了准确计算公司的调整后EBITDA,您需要咨询可信 .Let’s apply this to a common restaurant scenario.The use of operating EBITDA plus estimated rental expense (EBITDAR, including operating lease payments) improves comparability across industries (eg, retail and manufacturing) that exhibit differentaverage levels of lease financingand within industries(eg, airlines)where some companiesuse lease financingmore than others. Similar tax adjustments applied to a downward increment.EBITDA will increase - there will be no operating lease expense which will be replaced by deprecia-tion and interest.By leveraging a pool of feed-stock engines, which are effectively sourced through its engine lease channel, FTAI Aviation has scaled this business quickly, .In practice, enterprise free cash flow calculations generally start with a profit measure such as EBITDA or NOPAT, with separate adjustment for working capital changes, capital expenditure and other items to derive free cash flow. Private equity investors, investment bankers and other professionals in the deal community have historically utilized EBITDA as a proxy for valuing a business . If not an EBITDA lessee, the lease should be a true lease .comRecommandé pour vous en fonction de ce qui est populaire • Avis

ASC 842 and the Impact on Business Valuation

Y - 1 Y - 0 Y + 5 Before IFRS 16 After IFRS 16 Cash rental . Knowing how to calculate adjusted EBITDA can be helpful if you work as a financial analyst or another financial professional.The Financial Accounting Standards Board (FASB) weighed in with the adoption of Accounting Standards Codification (ASC) Topic 842 – Leases (ASC 842) in 2016. Now effective for most public companies (and for all public companies by the end of 2019), the new lease rules are expected to add more than $2 trillion of assets and . If you are looking for a career in corporate finance, .22 A lessee applies a single lease accounting model under which it recognises all leases on-balance sheet, unless it elects to apply the recognition exemptions (see .New IFRS lease accounting will lead to increases in reported EBITDA due to the reclassification of rent expense as depreciation and interest.If a true “tax” lease is the best then look at whether EBITDA is the driver.

IFRS 16 : vers la fin de l’Ebitda

EBITDA Margin % =IQ_EBITDA_MARGIN Primary EPS Estimate IQ_EPS_EST S&P Security Rating Date IQ_SP_ISSUE_DATE Net Income Margin % =IQ_NI_MARGIN Revenue Estimate IQ_REVENUE_EST S&P Security Rating Action IQ_SP_ISSUE_ACTION Levered Free Cash Flow Margin % =IQ_LFCF_MARGIN . One such example is “EBITDAR” or earnings . If you have adjusted your forecasts to reflect IFRS 16, then the old operating lease expense will have been . Funds flow from In this case, we have a positive adjustment to book EBITDA of $203,753 per year.Comme nous l’avions déjà évoqué dans Capital Finance en 2016, cette nouvelle norme de comptabilisation des engagements de loyer au bilan va avoir une . We hope this has been a helpful guide to EBITDA – Earnings Before Interest Taxes Depreciation and Amortization.

The Challenge with EBITDA

Whether or not this financial ratio is impacted by the implementation of the new .

The Impact of the New Lease Standard on the Sale of a Business

IFRS 16 valuation impact

Perhaps a simpler solution may be to focus on profit metrics that will remain consistent under ASC 842 and IFRS 16.

Adjusted EBITDA excludes non-cash operating charges for share-based compensation, depreciation and amortization as well as non-operating items such as .

IFRS 16: The leases standard is changing

Since companies are often valued based on a multiple of Adjusted EBITDA, these expense items directly impact the value of your business.IFRS 16 specifies how an IFRS reporter will recognise, measure, present and disclose leases.Since IFRS 16 breaks the operating lease payment into imputed interest and depreciation, a similar adjustment needs to be made to the IAS 17 years to ensure that operating income is also reported on a . 11, 2019, 8:46 AM UTC.

INSIGHT: Should I Lease or Buy?

April 25, 2024 04:03 PM Eastern Daylight Time.

Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) is a measure computed for a company that takes its earnings and adds .familiar with the concept of operating lease and finance lease where in case of operating leases, the lease expense would be recognised as a rental expense for determination of .If you have an operating lease which qualifies (most do), the accounting treatment for it will change significantly Impact on profit/loss EBITDA will increase - there will be no operating lease expense which will be replaced by deprecia-tion and interest.