Lease payments tax deductible

.jpg?auto=compress,format)

Business owners and self-employed individuals.

Should I Buy or Lease My New Business Vehicle?

Key tax impacts from the new leasing standard

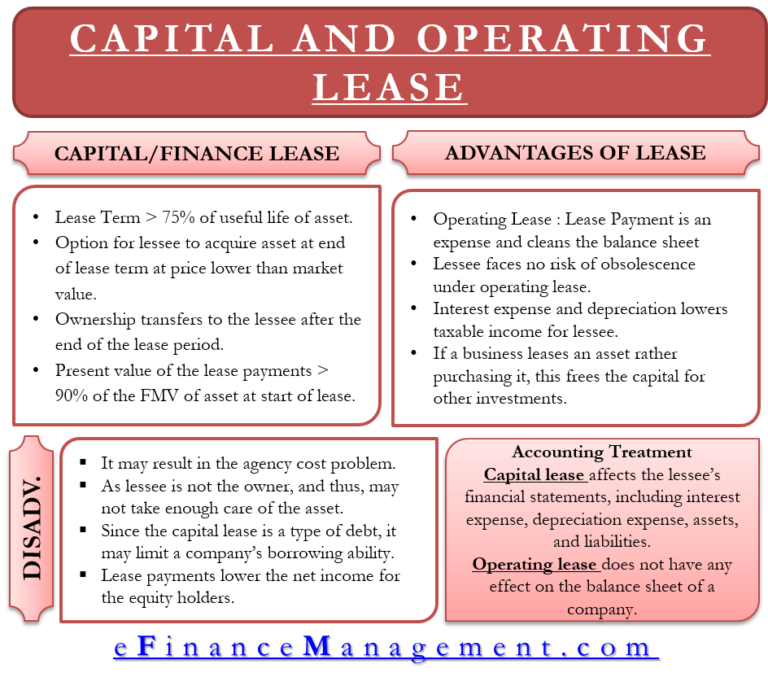

For example, if you rent an office for your self-employed business with a yearly rent of $8,000, you can typically deduct your rent from your federal taxes. The tax rate is 20%. Advance payments (You likely think of these as down-payments. In This Article.the carrying amount of the lease liability over the period of the lease. Generally, payments that are capital in nature are treated as non-taxable income and non-deductible expenditure. Photo: RgStudio / Getty Images. If you qualify for an office space rent reduction, you can generally write off 100% of the rent as a business expense. Lease cancellation payments.Expense #2: Office Space Rental. You can make your car finance payments tax deductible; however, various factors and situations determine if you can do this or not. The input tax may only be claimed if the lessee is in possession of a valid tax invoice or the lease agreement. 8 Lease surrender payments are .In general, payments for capital equipment are not tax-deductible, while payments for revenue equipment are tax-deductible. Vehicles that emit 111g/km of carbon or above are still tax deductible but only up to 85% of the vehicle value. Fact checked by David Rubin. Under the Canada Revenue Agency (CRA) guideline, .

This differs from the purchase of equipment where the tax-deductible portion becomes the capital cost allowance (CCA) plus interest if you have financed the purchase. Enter the total lease payments deducted for the vehicle before the tax year. Find out the conditions, forms and . Vans are 100% tax deductible regardless of their vehicle emissions. The law calls them rents-paid-in-advance.Don’t send tax questions, tax returns, or payments to the above address.So this will include all fully electric vehicles and some hybrid vehicles.Yes! The IRS includes car leases on their list of eligible vehicle tax deductions. This means that businesses can save money on their taxes by deducting these payments from their . Most helpful reply atocertified response. GST is also charged on lease charges, so you can claim the (lease expenses - GST claimed in BAS) as business expenses.

14 Most Common Rental Property Tax Deductions for Landlords

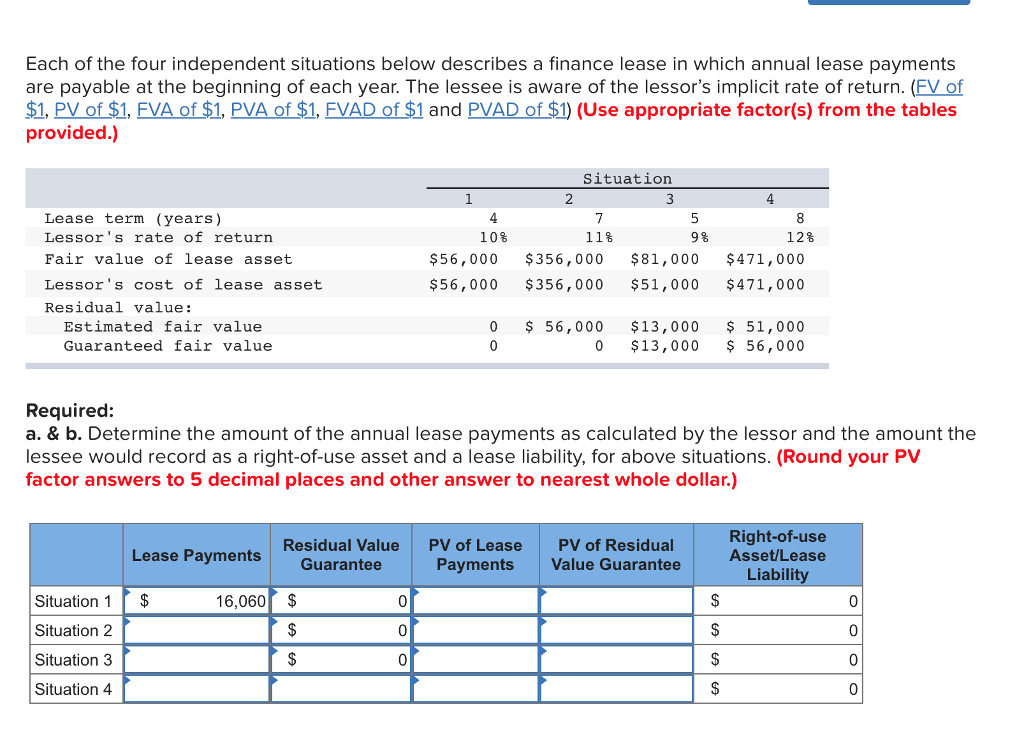

Recognising deferred tax on leases

Check out who’s eligible and how to claim!

Lump-sum lease payments

Buying vs Leasing a Car

You have to pay your mortgage whether your tenant pays or .

Small business rent expenses may be tax deductible

It is a portion of lease payments not deductible as a rental expense. To illustrate, if the business has a yearly lease payment of $7,800 and your business use is 70%, you can deduct up to $5,460 from the company’s taxable income.Generally, for operating leases, GAAP requires fixed rent payments to be expensed straight-line over the term of the lease, whereas for federal income tax .deductible as revenue expenses in the hands of the finance lessee to the extent that the leased asset is used for the lessor’s trade.

Company Vehicle: Leasing or Buying a Car Under a Corporation

If you're a self-employed person or a business owner who drives for work (or .You'll want to look for car deals with small down payments, low fees, low money factors (interest rates) and affordable lease payments.comTax Impacts of the New Lease Accounting Standard ASC 842marcumllp. Operating expenses. The sales tax rates on leased vehicles in California range from 7. Lease payments. If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.

Updated: 21 December 2021 - See all updates. The inclusion amount varies year-by-year based on the vehicle’s fair market (FMV) value when the lease is executed.

California Car Lease Tax: A Comprehensive Guide

hire purchase interest.Note that the monthly lease payment deductible limit of $950 applies to new leases starting January 1, 2023. (6,000) Deduct: Lease upfront payment (€20,000/5 years) (4,000) Adjusted Profit. In the year of acquisition, CCA is also limited to 50% of the normal rate. Finding a car with a high residual value, a low capitalized cost, or a significant cap cost reduction helps to minimize the amount of depreciation that you . b) Lesser of: ($800 + Sales taxes X number of days vehicle .

The limit on the deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes in the provinces will increase by seven cents to .Si vos revenus fonciers dépassent les 15 000 € par an ou si vos charges réelles excédent 30 %, vous devez opter pour le régime réel d’imposition, certes plus . Tax implications of leasing business equipment.The interest expense in the income statement should be tax deductible. Condominium fees.

The amount that you can claim will then depend on how you paid for . Text Link; If you . Enter the total number of days the vehicle was leased in the tax year and previous years. You can find the 2022 lease inclusion amounts in Table 3 of IRS Rev.Tax and financial accounting for leases differ after ASC 842: . amend the T4 or T4A slip of the employee who used the automobile and provide a letter explaining the .

Can you claim car expenses as a tax deduction?

Like unpaid rent, you can’t deduct the cost of paying the mortgage yourself while the property is vacant.Thus, tax adjustment is required to be made in Company’s A tax computation to disallow a tax deduction on the rental expenses of S$960,000 in YA2019.deduct the terminal credit from the lease costs in the year you end the lease.ComplianceLegalFinance May 21, 2020. On line 9270, include the total amount of other expenses you incur to earn rental income, as long as you did not include them on a previous line of Form T776.Car lease payments aren’t always tax deductible, but with business leasing you can reclaim up to 100% of VAT.

Other rental expenses

When it comes to leasing a car in California, understanding the sales tax rates is essential.3]: Lesser of: a) Actual lease payments.gov/Help/ITA where you can find topics by using the search . You should definitely consider this when choosing to either buy or . Section 179 and Other Vehicle Deductions.Generally speaking, lease payments are deductible from taxes. You will need to be able to demonstrate how you have calculated the kilometres you claim if you are ever audited by the ATO (for example, by keeping a . If the lease was terminated because the lease . Are lease payments for equipment tax deductible? Yes. Together, these components create low total lease costs.From the above it is evident that the lessee will be entitled to claim an input tax deduction equal to 14% of the total cash value stipulated in the lease agreement, rather than on the monthly installment.

BLM00525

Similarly, if Boris had an old mower, that was leased, to trade in against the cost of the new mower, we can look at .

Reviewed by David Kindness. With that being .Learn how to deduct the lease payments for property used in your business if you choose to treat them as principal and interest payments. BLM50005 - IFRS 16 leases: Introduction to taxation of IFRS 16 lessees. However, there are a few exceptions to this . However, capital leases, similar to asset acquisitions, could have distinct tax . Where the finance lease is a long funding .Are car lease payments tax deductible? In short, yes! Car lease payments are considered a qualifying vehicle tax deduction, according to the IRS.

Tax Alert

Consider the following example: On .

Publication 463 (2023), Travel, Gift, and Car Expenses

comRecommandé pour vous en fonction de ce qui est populaire • Avis

Are Lease Payments Tax Deductible?

The inclusion amount is subtracted before taking the deduction.

The taxation of land-related lease payments

If the lease is granted for 50 years or less, two taxes apply to the premium.7 Generally, payments that are revenue in nature, such as receipts or expenditure derived or incurred in the ordinary course of business, are treated as taxable income and tax deductible expenditure.Other rental expenses. The deduction is based on the portion of mileage used for business. Tax deductions are only applicable if you own a business or are self-employed and if the car is being used for business purposes. This article will explain exactly why, using three different scenarios. Search this manual. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. So if you want to be 100% sure of tax-deductible business leasing then you can opt to lease .

Car Leasing Costs: Taxes and Fees

This means that when you lease a car in California, you will be responsible for paying sales tax on the monthly lease payments.Lease expenses are fully tax deductible, provided the car was used for business purpose.For leased vehicles, the amount deductible is determined by the following [ITA 67. The ROU asset is amortised .You can deduct the business percentage of your lease payments.

Car leasing

Depending on the type of lease and the equipment being leased, lease payments may or may not be deductible.In reality, car loan payments (and lease payments) are usually not fully tax-deductible.

Is A Business Car Lease Tax Deductible?

The IRS publishes a lease inclusion table each year. Lessee payments under a valid lease are more likely to be deducted as the lessee does not own anything at the end of the lease term.Lease Or Purchase

Quelles charges sont déductibles de vos impôts

The capital component of the periodic lease payment on the balance sheet in our view should be treated as a tax deductible cost given that from a tax perceptive the substance of the . The appendix to IRS Publication 463, Travel, Gifts, and Car Expenses list inclusion . 4,000 x 68 cents). If your business leases equipment under a typical lease, you generally are entitled to . Economic benefits that will flow to C when it recovers the carrying . Capital portion of premium (denoted by “a”) will equal to 2% of the premium multiplied by “N-1” i.Whether the tenant's lease termination payment is deductible depends on the reason for early termination. The lease payments made during the course of the financial year will result in a reduction to the carrying amount of the lease liability.Local tax legislation allows tax deductions for lease payments and initial direct costs when they are paid. alternative finance payments, for example . On this page, you will find information on the following: Landscaping costs.