Letter from the irs scam

Reasons The IRS Sends Notices to Taxpayers. Here’s how it will work—and how to spot a scam. Many of these schemes peak during filing season as people prepare their tax .Do avoid scams. We are talking about some cool cash, too, maybe . The notice or letter .Think you might've been targeted in a fake IRS letter scam? Consider filing a report with the Treasury Inspector General if you're dealing with an impersonation. Most IRS letters and notices are about federal tax returns or tax accounts. The IRS is warning taxpayers about a new scam involving tax refunds. These unscrupulous promoters make false claims about their .The 4883C or 6330C letter; The Form 1040-series tax return referenced in the letter (Forms W-2 and 1099 aren't tax returns) A prior year tax return, other than the year in the letter, if you filed one (Forms W-2 and 1099 aren't tax returns) Supporting documents for each year's tax return you filed (e. IRS impersonators have been around for a while.Any official correspondence from the IRS will begin with official documents that will arrive via the U.Why You Might Receive a Letter From the IRS and How to Spot a Scam. COVID Tax Tip 2022-99, June 29, 2022 Compiled annually, the Dirty Dozen lists a variety of common scams that taxpayers can encounter anytime.

Identify Real vs Fake IRS Letters: Spot & React to Tax Scams

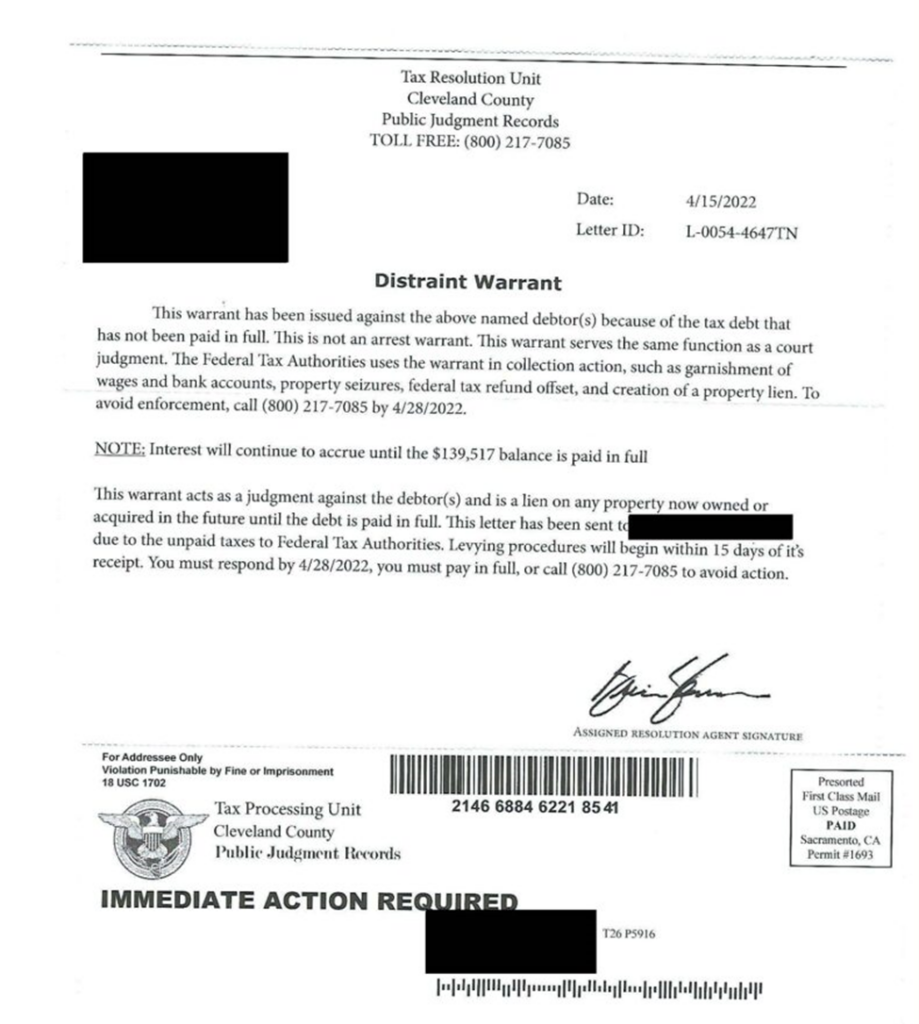

Call you without first sending a bill in the mail.Beware – Fake IRS Letter Scam - The Big Pictureritholtz. If you don’t have a tax debt, the letter is definitely a scam.

Report it to the Federal Trade Commission.

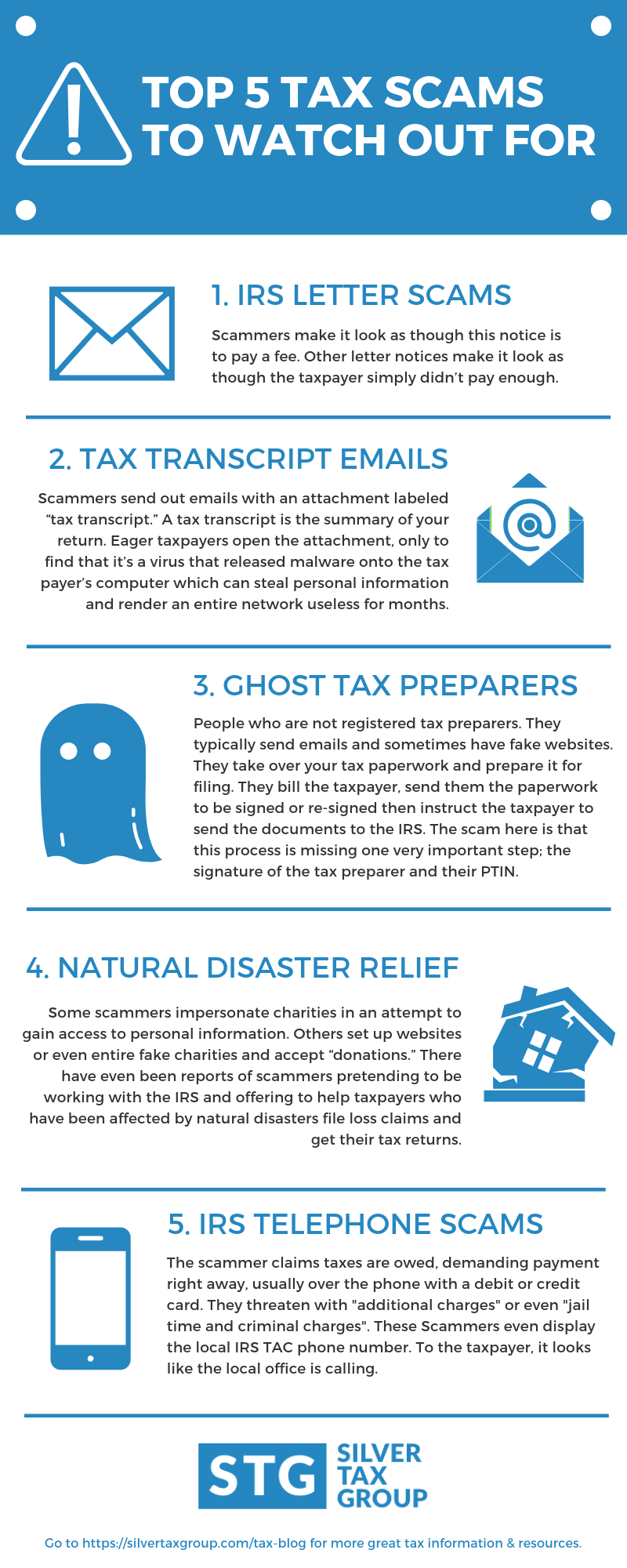

Know the Sneakiest IRS Scams

The IRS has warned taxpayers about a scam in which letters are being mailed to taxpayers from a fake agency called the Bureau of Tax Enforcement . An IRS envelope will include the IRS logo, and the letter will have your partial tax ID . The agency is holding nearly $1.

An overview of the IRS’s 2022 Dirty Dozen tax scams

But as more people get to know their tricks, they’re switching it up.Americans urged to watch out for tax scams during the pandemic IR-2021-135, June 28, 2021 WASHINGTON — The Internal Revenue Service today began its Dirty Dozen list for 2021 with a warning for taxpayers, tax professionals and financial institutions to be on the lookout for these 12 nefarious schemes and scams.

Report phishing

We have a question about your tax . However, if you receive a letter in relation to a tax return you have yet to file, you can be confident it’s a fake.Here are some tips on spotting a fake IRS letter and protecting yourself and your business from tax scams.

Tax scams/Consumer alerts

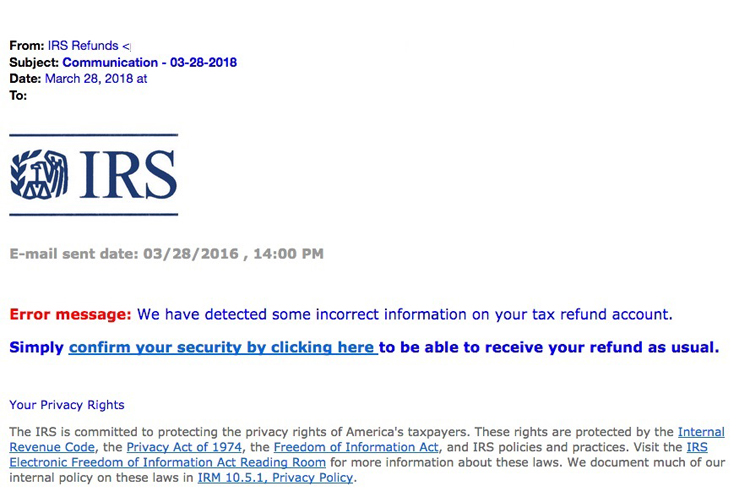

But one common one that’s been going around for a few years is the “tax transcript” email scam.comIRS identity theft victim assistance: How it worksirs.

Watch Out For These IRS and Tax Scams in 2022

Use their “IRS Impersonation Scam Reporting” page or call 800-366-4484.You may soon get an IRS letter promising unclaimed tax refunds. These scams often increase in frequency during the tax season, as criminals prey on the heightened anxiety taxpayers may experience when dealing with complex tax-related . For years, the IRS has warned about scammers using phone calls, text .Fake IRS letters are a common scamming technique used by fraudsters to trick taxpayers into revealing their personal and financial information or even handing over money. You are due a larger or smaller refund. Submitting false information to the IRS could land you in serious trouble. Real IRS letters usually provide a 30-day window to respond, giving you ample time to verify their authenticity and address any issues.

IRS Warns About New Tax Refund Letter Scam

Why are mail scams so tricky?

Tax scams

Is that the IRS contacting you

A lot of scam letters will be sent early in the year when people are busy filing tax returns.com5 Most Common IRS Letter Scams To Look Out For - Silver . Please add “IRS Telephone Scam” in the notes.A call or a visit usually only happens after several letters, the IRS says — so unless you've ignored a bunch of letters about your unpaid taxes, that caller claiming to . IRS employees will not: Call demanding an immediate payment.Watch your mailbox: IRS warns of new scam targeting taxpayers via fake letter.

However, many of the letters could be scams. Which tax scams should I be aware of? In fact, that’s another red flag of tax scams.govRecommandé pour vous en fonction de ce qui est populaire • Avis

Fake IRS Letters: How to Identify Them and Protect Yourself

Here's what to do if you receive one of these scam messages.If a taxpayer receives an IRS letter or notice, they should: Not ignore it.

Understanding your LT38 notice

Unfortunately, you should expect to deal with long hold times when you call the IRS.FS-2021-06, April 2021 For taxpayers who received a letter from the Internal Revenue Service about their Recovery Rebate Credit, here are answers to frequently asked questions.Contact TIGTA to report the call. The IRS will never contact a taxpayer using social media or text message., Form W-2, Form 1099, Schedules C .November 23, 2022. There’s a fake IRS email that keeps popping into people’s inboxes. However, panic is unnecessary.comRecommandé pour vous en fonction de ce qui est populaire • Avis

If you think you might owe taxes, call the IRS directly at 800-829-1040.

How to Spot a Scam

These emails contain the direction “you . This new program only applies to taxpayers who have had an IRS debt for years and who were previously contacted about it by the IRS. Effective September 23, 2021, when the IRS assigns your account to a private collection agency, one of these three agencies will contact you on the government's behalf: CBE Group Inc.Here are some common characteristics of fake IRS letters.

Taxpayers should open and carefully read any mail from the IRS

Postal Service. If you're due a refund based on the automatic penalty relief, you should have received an IRS notice (CP21 or CP210) explaining the adjustment.You May Have Been Sent a Fake IRS Letter — Here's How to .We’ll show you how to identify genuine IRS letters so that you can protect yourself from postal scams. Some of the most common tax scams are phone calls and emails from thieves pretending to be from the IRS. Concerning a tax return you haven't filed yet.The letter contains a message from Joe Biden, beginning: My fellow American, On March 11, 2021, I signed into law the American Rescue Plan, a law that will help vaccinate America and deliver . Demand you pay your taxes in a specific way.Instead, call the IRS’s main phone number: (800) 829-1040 for individuals, (800)-829-4933 for businesses, or (877) 829-5500 for non-profits.If you were assessed taxes of less than $100,000, the balance reflected on your letter for these tax years includes the automatic failure to pay penalty relief. Cryptocurrency, non-filing, abusive syndicated conservation easement, abusive micro-captive deals make list IR-2022-125, . There are so many IRS email scams out there that it can be tough to keep track of them all. It says that you can get a third Economic Impact Payment (EIP) if you click a link that lets . WASHINGTON — The Internal Revenue Service wrapped up the annual Dirty Dozen list of tax scams for 2023 with a reminder for taxpayers, businesses and tax professionals to watch out for these schemes throughout the year, not just during tax season.Suspicious email/phishing.The enclosed letter includes the IRS masthead and wording that the notice is in relation to your unclaimed refund.What Are Fake IRS letters?

How to Spot (And Handle) A Fake IRS Letter

If your debt is put into this program, the IRS . Do not reply, open any attachments, or click on any links in the message.A fake IRS letter will ask for payment addressed directly to the IRS or a specific IRS “processing center.October 27, 2021.The IRS contacts taxpayers for a variety of legitimate reasons, such as discrepancies in tax returns, outstanding tax liabilities, or to confirm identity for processing refunds.comTop 9 IRS Scams: How to Spot Them and Fight Back - .If you receive a text message that claims to be from the IRS, it’s a scam.

Top 9 IRS Scams: How to Spot Them and Fight Back

IRS, Security Summit partners warn taxpayers of .

IRS warns of new tax refund scam: Here's how to spot it

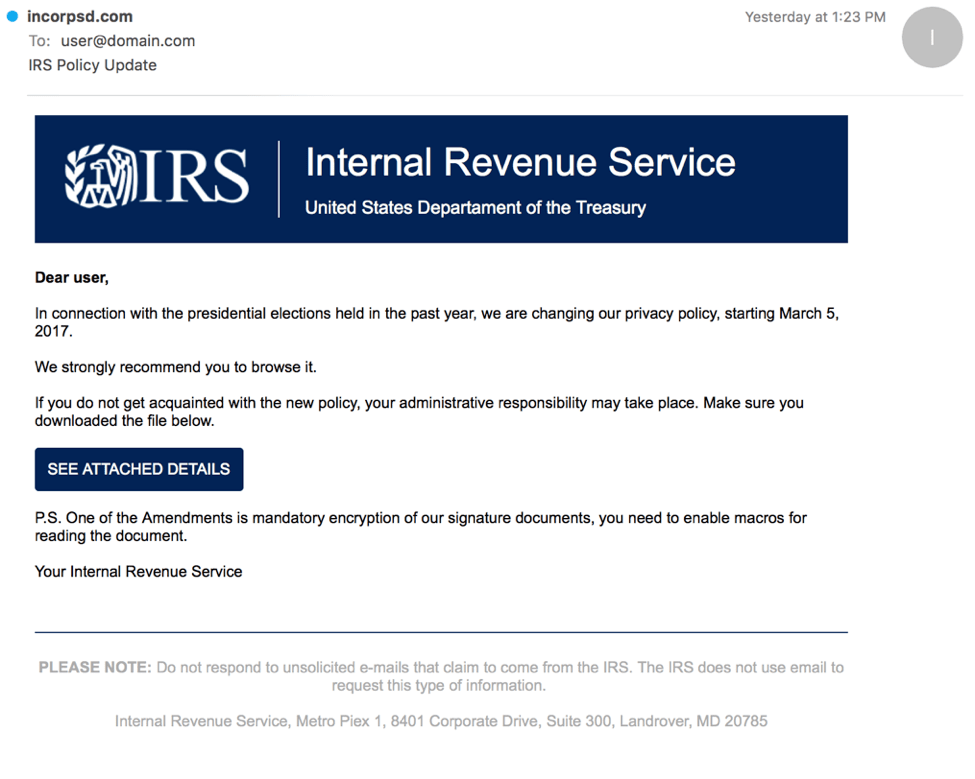

If you have received 5071C, 5747C, 5447C letters, then you can use the ID . Use the “FTC Complaint Assistant” on FTC.Watch Out For These IRS and Tax Scams in 2022 Tax scammers have always targeted our hopes and fears — and the COVID-19 pandemic has given them more ammunition than usual. This year's Dirty . Taxpayers who are unsure if they owe money to the IRS can view their tax account information on IRS.Here are the identity fraud letters the IRS may send to taxpayers: Letter 5071C, Potential Identity Theft with Online Option.IR-2023-71, April 5, 2023. If called, the IRS will never threaten to arrest or demand immediate payment by credit or debit card.IR-2022-125, June 10, 2022 — The Internal Revenue Service today wrapped up its annual Dirty Dozen scams list for the 2022 filing season, with a warning to taxpayers to avoid being misled into using bogus tax avoidance strategies. Why did I get more than one letter from the IRS about my Economic Impact Payments? After each of the three Economic Impact Payments is issued, the IRS mails a . The law requires the IRS to use private agencies to collect certain outstanding, inactive tax debts.comIRS warns of new tax refund scam: Here's how to spot it - . So instead of contacting you about a tax .The IRS is aware of email phishing scams that include links to bogus web sites intended to mirror the official IRS website.

Understanding your IRS notice or letter

An honest mistake, such as a typo or forgetting to include income from a .

Understanding Your Letter 4883C or 6330C

You don’t think you owe any money to the IRS.Even though the IRS does communicate by letter, a letter that seems to be from the IRS may not be legitimate.

Report phishing and online scams.The IRS won't contact you by email or text, so don't click on any links in messages promising you your refund.

IRS Issues Warning On New Tax Refund Scam

Tax Transcript Emails.Report all unsolicited email claiming to be from the IRS or an IRS-related function to phishing@irs.

Waterloo, IA 50704. Scammers can send fake IRS notices by mail, and they can be challenging to authenticate.The IRS warns taxpayers, tax professionals and financial institutions to beware of these scams. Here's how the scam works. What a real IRS letter will look like. Phishing (as in “fishing for information” and “hooking” victims) is a scam where Internet fraudsters send email messages to trick unsuspecting victims into revealing personal and financial information that can be used to steal the victims’ identity.