Leveraged transactions regulation

That guidance neither aims to inhibit leveraged paying out accessing financing solutions, or does it stipulate non-pass limits about the origination of transactions.ECB updates treatment of leverage ratio in the Eurosystem monetary policy counterparty framework. Leveraged lending is a type of corporate finance used for mergers and acquisitions, business recapitalization and refinancing, equity buyouts, and business or .Private equity, in this context, mainly refers to leveraged buyouts, where private equity firms buy companies by loading them up with debt. is looking at essentially buying insurance on some of the loans in its portfolio using a transaction known as a synthetic risk transfer, . The guidance also supports an imbalanced regulation, lifting it on a new . Show transcribed image text.Credit institutions should create an internal definition but transactions meeting at least one of the following criteria are to be considered “leveraged transactions”: Four .

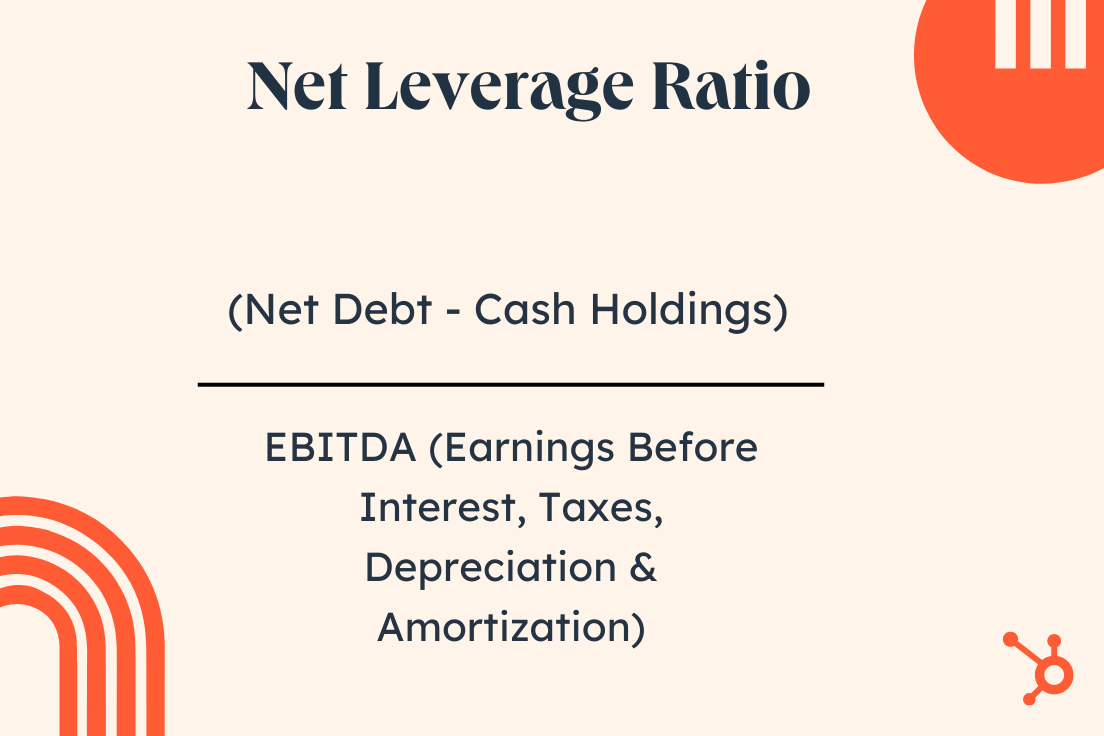

Leverage ratio

Legal effect and scope. Leveraged lending is a type of corporate finance used for mergers and acquisitions, business recapitalization and refinancing, equity buyouts, and business or product line build-outs and expansions. Institutions should conduct periodic loan- and portfolio-level stress tests on leveraged loan . Indicatively, a credit institution is expected to consider as a leveraged transaction any transaction that meets at least one of the conditions below: . appetite frameworks and high levels of risk .Commission Implementing Regulation (EU) 2016/200 of 15 February 2016 laying down implementing technical standards with regard to disclosure of the leverage ratio for institutions, according to Regulation (EU) No 575/2013 of the European Parliament and of the Council (Text with EEA relevance) C/2016/744.Banks that engage in leveraged lending transactions should consider and implement all applicable aspects and sections of the 2013 guidance. Updated February 26, 2023.

The ECB Guidance on Leveraged Transactions

Congress, regulators, international standards setters, and financial markets participants are discussing the potential for the leveraged lending market to pose .

Highly Leveraged Transaction (HLT): What it Means, How it Works

(regulation) on leveraged transactions creates not only new burdens that have to be implemented.Leverage is the investment strategy of using borrowed money: specifically, the use of various financial instruments or borrowed capital to increase the potential return of an investment.Certain fund finance transactions (notably leveraged transactions) and borrowing entities may potentially fall within the scope of the EU Securitisation Regulation, which would trigger a broad array of obligations for the borrowing entity, but also for originators, sponsors and certain investors (among others, requirements with regard to risk retention, due . This consultation gives interested parties the opportunity to comment on the draft ECB guidance on leveraged transactions.

Feedback statement

It is applicable .comECB updates treatment of leverage ratio in the Eurosystem .

Towards ESG disclosure standardization in leveraged finance transactions

Leveraged lending provides credit to commercial businesses with higher levels of debt and also helps companies obtain funding for transactions involving leveraged buyouts (LBOs), mergers and acquisitions (M&A), business recapitalizations, and business expansions. ESG investing has become increasingly important to credit risk and .The draft guidance, when finalised, will apply to all significant credit institutions supervised by the ECB under Article 6(4) of the Regulation establishing the Single Supervisory Mechanism (hereafter referred to as .

LEVERAGED FINANCE

Only comments received before this deadline will be considered.

Wells Fargo Weighs Debut Risk Transfer as Banks Shore Up Capital

This closer scrutiny has led to the release of guidance from the .European, EBA - European Banking Authority, Final Reports, 2020 Final Reports, Guidelines Banks/Credit Institutions, Capital Requirements, Capital Requirements Legislation - CRD IV/V, CRR/CRR2, Consumer Credit, Consumer Protection, Environmental, social and governance - ESG, Financial Crime & AML/CFT, Mortgage .2023 European Leveraged Loan Outlook: Tough road to .

PitchBook Primer: Understand Leveraged Loans

EBF advisor: Sarah Schmidtke. Against this background, the ECB published its first guidance on leveraged transactions in 2017 (2017 Guidance) and has since repeatedly criticised banks for their failure to meet supervisory expectations. Department of Treasury and the Internal Revenue Service published proposed regulations regarding the 1% excise tax on certain stock .Regulation), the ECB considers that closer supervisory scrutiny of leveraged transactions is justified.1) Leveraged buyouts (LBOs) Most LBOs are backed by a private equity firm, which funds the transaction with a significant amount of debt in the form of leveraged loans, mezzanine finance, high-yield bonds and/or seller notes.This guide for “Company Advisers on ESG Disclosure in Leveraged Finance Transactions” (the “Guide”) is designed to serve as a practical tool for company advisers when incorporating the ESG Fact Sheets into company offering materials and ongoing financial reports.

Public consultation on the draft ECB guidance on leveraged transactions

Dabei geht es insbesondere um die Einrichtung eines Rahmens für die Risikobereitschaft (Risk Appetite Framework . These transactions have been prevalent since the 1980s and are characterized by their substantial debt loads. Examiners will be . Private equity-backed leveraged buyout activity in European markets has risen to unprecedented levels in recent years. all types of loan or credit exposure where the borrower’s post .What is a “Leveraged Transaction”? As a minimum, credit institutions must treat as leveraged transactions, anything which meets at least one of the following .

Draft ECB guidance on leveraged transactions

This debt creates obligations of interest and principal payments that are due on a timely basis.A highly leveraged transaction (HLT) is a financial maneuver where a company takes on a significant amount of debt, often to finance acquisitions, buyouts, or recapitalizations.Frankfurt am Main, 28 March 2022. What Is a Highly Leveraged Transaction (HLT)? A highly leveraged transaction (HLT) . It is used to increase shareholder returns and to monetize perceived “enterprise value” or other intangibles.

Fund Finance Laws and Regulations

This extreme risk-taking, when combined with insufficient risk management, could be a reason for the concern of losses for the banks in the case of unexpected .This guidance applies to all significant credit institutions supervised by the ECB under Article 6(4) of the SSM Regulation and summarizes the key supervisory expectations concerning leveraged .The threat to financial markets from leveraged trades has not abated in the last year, despite regulators’ efforts to rein them in, the head of Europe’s securities . Twenty-four organisations (comprising credit institutions and market associations) commented directly on the ECB’s draft guidance.The European Central Bank (ECB) has published for consultation draft guidance to banks on leveraged transactions. While banks have gone some way .

Publication date: 26 January 2017.Leveraged Transaction. 24 April 2024 at 18:00 EEST. Rather, to supervisory expectations seek to ensure sound and consistent risk management practices and to harmonise the definition of leveraged sales. Stress Testing.

ECB Publishes Guidance on Leveraged Transactions

ECB publishes guidance on leveraged transactions

Guidance seeks to facilitate the .czRecommandé pour vous en fonction de ce qui est populaire • Avis

the ECB’s expectation Guidance”)

Loans to a single borrower Loans to members within their community Highly leveraged transactions Foreign loans Regulation of Investment Securities Which of the following requires that banks use not only credit ratings assigned by credit . The guidance also supports an imbalanced regulation, lifting it on a new level especially when comparing it to those applicable within SSM, EU and Non-EU regions. of the purchase of a company : made with borrowed money that is secured by the assets of the company bought. Leveraged transactions - supervisory expectations regarding the design and functioning of risk. Feedback statement – Responses to the public consultation on the draft ECB guidance on leveraged transactions 5 B. Wells Fargo & Co.After a period of public consultation, the European Central Bank (the “ECB”) published its final Guidance on Leveraged Transactions (the “Guidance”) on 16 May 2017 [1]. Many commercial businesses successfully utilize and repay .The European Central Bank (ECB) has published guidance on leveraged transactions, with the aim of harmonising the definition of leveraged transactions and .

The consultation period will end at midnight on 27 January 2017, during which time banks, trade bodies and other interested parties may submit comments to the ECB.The Federal Court of Australia has fined Macquarie Bank A$10 million ($6. These differences in interpretation and reporting have become manifest following the analytical report .The ECB is this week addressing the chief executive officers of banks active in this business, asking them to define robust risk appetite frameworks and reduce the .

Leveraged Definition & Meaning

The European Central Bank ('ECB') published its final guidance ('Final Guidance') on leveraged transactions on 16 May 2017, marking the end of a public consultation process that began.Managers’ transactions. Deadline for submitting comments: midnight CET on 27 January 2017. It fosters institutions and/or its customers to shift transactions that (potentially) set .

CP12/22

Guidance aims to establish sound origination and risk management practices to facilitate a smooth financing of the real economy.

ECB Leveraged Transactions, ECB Leveraged Lending

Accordingly, the guidance contains underwriting and risk management standards for leveraged loans and encourages originating institutions to be mindful of the reputational risk associated with poorly underwritten leveraged transactions. Leveraged Transaction is a regulatory designation for financing that uses significant amounts of Leverage. Amendments to give effect to the leverage ratio . This has yielded significant economic benefits but it has also prompted deepening concerns about excessive leverage, conflicts of interest, market abuse and general lack of transparency.La régulation des affects peut prendre la forme d’une mise en œuvre de stratégies de coping, ainsi que de stratégies de régulation émotionnelle.On aggregate, highly leveraged transactions (HLT) accounted for around half of all new leveraged transaction volumes originated in 2019 and 2020, with that .4 million) for its lack of controls to detect and prevent unauthorised fee transactions .