Liability of private limited company

A limited liability company, or LLC, is a type of legal entity that U. Private limited companies, according to Apex, are treated as a single entity, making the company responsible for all debts. As such, this . business owners can select for the operation of their enterprise. A company, being a distinct legal entity, can gain, own, enjoy and alienate property in its own name. The company name is suffixed with ‘Private Limited’ or ‘Pte Ltd’ to denote it’s a private limited company. Liability of directors for the tax dues of a private limited company arises only when the arrears cannot be recovered from the company. Characteristics of a Private Limited Company. Builds Credibility.A company as opposed to a partnership or sole trader, enjoy limited liability for their obligations. Banks are also more willing to loan money to a limited liability company because they can quickly recover the money lent by attaching the assets of the company. It has its legal identity and can own . Choose your company name.

Private Limited Company

Such company does not face any restriction on business activities and in comparison with a foreign-owned limited company, its paid-up capital requirements are much lower. Send your application to the address on the form.Private limited companies are not allowed to freely transfer their shares to the public as compared to the public limited companies. It has been structured in a way to benefit from the pass .

Private Limited Company Registration Online in India

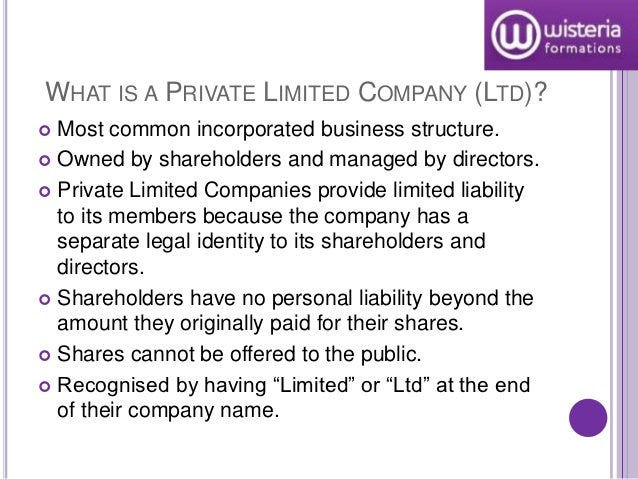

What is a Private Limited Company? A private limited company is a business entity that is privately owned by shareholders.As a shareholder in a company, you may be familiar with the principle of limited liability: you are only liable for the value of your share capital in the company.

How To Start An LLC In 7 Steps (2024 Guide)

Updated July 14, 2022.

A Guide To Private Limited Companies

The AO should record reasons of his believe that the tax and arrears will not be recovered from the company ,only in that case recovery from director should be made.The limited liability company (LLC) is a corporate structure that protects its owners from being personally pursued for repayment of the company's debts or.

Private Limited Company: Types, Procedure & Advantages

A private limited company offers limited liability to its members and legal protection for its members.

The private property and assets of the company members are .

The greatest benefit of private limited companies is limited liability. This is the reason that stock exchange do not list the private companies. The shareholders aren’t the owners of the SARL’s property.

What is a Private Limited Company?

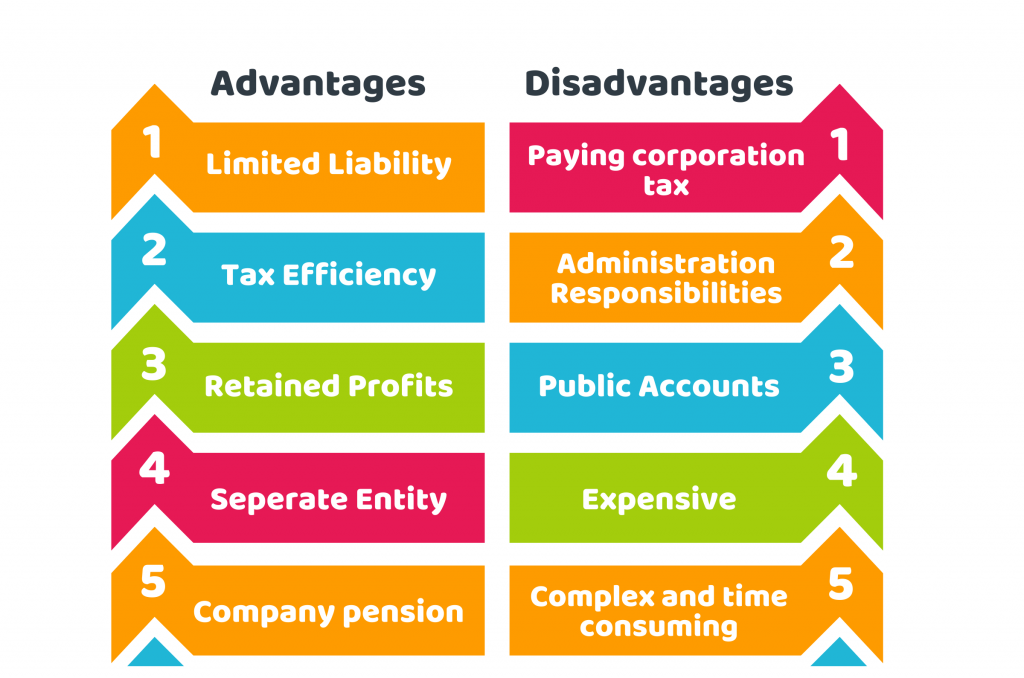

Pros and Cons of a Limited Liability Company (LLC)

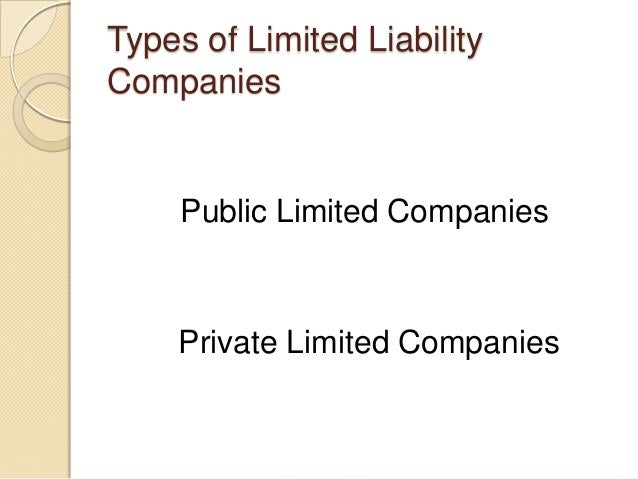

The liability of each of the shareholders is limited to the par value of their shares.Limited Liability Companies can either be 100% foreign-owned, 100% Cambodian-owned, or have a combination of foreign and Cambodian ownership. A public limited company is a large national retailer, like Tesco – with shares that anyone over the age of 18 can buy and sell. You business will become a separate legal entity. What Is Limited Liability? Limited liability is a type of legal structure for an. Hans Daniel Jasperson. You can set it up either in partnership with a Thai national or opt for foreign ownership (up to 100%).What is a Private Limited Company? A private limited company is a type of legal entity in the UK. Habituellement, les professions où l'État nécessite une licence pour fournir des services .The liability of all members or shareholders of a private limited company is limited. Most LLCs choose to be taxed as pass-through entities with no taxation on the corporate level. Whereas private limited company shareholders are only liable for any debts up to the value of their share in the company.A private limited liability company in Malta is a company that restricts the right to transfer shares, prohibits any invitation to the public to subscribe for any shares, and limits the number of members to 50. Shares do not trade on the stock exchange and a minimum member in a private limited company is one and .Limited Liability Company - LLC: A limited liability company (LLC) is a corporate structure whereby the members of the company cannot be held personally liable for the company's debts or . A company, being a distinct legal .

Private limited liability company (SARL)

It is easy to form and provides more flexibility for operations as .

This means that the owners of companies are usually not legally responsible for the debts of their businesses.Limited Liability.A private limited company is a small local retailer, like your small independent greengrocers. This comprehensive guide delves into the intricacies of Private Limited Companies, covering their formation, structure, key features, compliance requirements, .

Legal solutions for industries which limit . The shareholders do not have any personal liability and hence need not pay for the company’s .Postal applications take 8 to 10 days and cost £40 (paid by cheque made out to ‘Companies House’). Creating an LLC protects an individual’s or group’s . That reduces the risk of having your personal assets seized to pay for the debts of the . Its key features are: It is owned by a minimum of three shareholders.A Limited Company, particularly a Private Thai Limited Company, is the most popular form of business structures in Thailand. As a sole trader, you are personally liable for all the debts and liabilities of your business. Disadvantages of a Private .

What is a Limited Liability Company (LLC)?

Shareholders’ participation in the company is limited as the directors are . Separate Legal Entity: A private company is a separate legal entity from its owners.

Private limited company

Limited liability

The following are the liabilities of directors of a private limited company: Personal liability: 1. If you register as a sole trader, you’re personally liable for all debts and financial obligations for that business. As per the Income Tax Act, if any income tax of any . This means that as a shareholder you will be liable to pay for company’s liability only to the extent of the contribution made by you.

Open a Private Limited Liability Company in Malta

Singapore has a flat corporate tax rate of 17% on up to S$200,000 of chargeable income.

It is a type of business entity that offers limited liability and limits the number of shareholders to 50.A private limited company is a type of structure that offers limited liability protection to its shareholders, meaning that its assets are protected if the company .1 Limited Liability Company.A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corporations.Advantages of a private limited company Less personal liability risks.Note that it is easier for a private limited company to attract new shareholders because of it’s limited liability clause.

:max_bytes(150000):strip_icc()/LLC-8e9fabc27dd44aec97ae5c5abb372a3c.jpg)

Advantages of Private Limited Companies.Une Professional Limited Liability Company (PLLC, P. The liability of shareholders is limited to the amount they have invested in the company, providing protection for their .Private Limited Liability Company. Here are a few requirements to form a Private Limited .com U ne société de personne s à responsabilité limitée e st parti cu lièrement intéressante pour les petites ent re pris es privées .limited liability, condition under which the losses that owners (shareholders) of a business firm may incur are limited to the amount of capital invested by them in the .Types of Limited Liability Company (LLC) Private Limited Company A private limited company has 50 or fewer members, and its shares are not traded publicly. The shareholders can either be individuals or corporates.A private limited company can be a small or large business. Free & Easy transfer of shares.

Private limited company in Thailand

Limited liability – as company owners are not legally obliged to pay outstanding company debts beyond the value of the shares they hold it protects the personal assets (such as a home or savings) of the company owners should a business fail.A private limited liability company ( Société à responsabilité limitée – SARL) is a special form of commercial company in that: it combines features that are .

Limited Company (LC): Definition, Meaning, and Variations

It’s a company that’s owned by its shareholders who have . It is often a small-to-medium business such as an independent retailer in a market town. Limited risk to personal assets – The shareholders of a private limited company have limited liability. There are a few tax exemptions for newly registered private limited companies and partial tax exemptions for already . This means that their assets are not at risk in case of financial losses incurred by the company. Professional status – a limited company is typically seen as a more professional operation than an .

Incorporate a private limited company . It provides a legal framework for entrepreneurs .Reduced risk of personal liability.Similar to an LLC (Limited Liability Company), the private limited company also provides personal liability protection against the company’s debts and . Fact checked by. A private limited company in Cambodia must have at least 2 and no more than 30 shareholders.

What Is a Limited Liability Company (LLC)

It means that when the company faces a loss under any circumstance, its .

Private Limited Company

A single-member company can be a private limited liability company in Malta, and he/she qualifies as an exempt company.Limited liability refers to the lack of risk for company investors and owners if a company fails. Flexible paid up capital, objectives, control distribution and more. It is registered under the Companies Act and operates as a separate legal identity from its owners. The clause separates personal assets from business assets. Reviewed by Margaret James.Limited Liability Protection: Shareholders of a private limited company are only liable to the extent of their shareholding.Limited liability.A private limited company prohibits any invitations to the public to subscribe to any of its shares, deposit money with the company for investment or subscription. Choosing the right name for your Private Liability Company is a vital step. In a private limited company, you and any other shareholders are only liable for debts up to the value of your shares.An LLC is a hybrid form of business entity that has selected features of a corporation and a partnership.A private limited liability company is particularly interesting for small and privately held companies. A limited liability company (LLC) is a corporation that acts in many respects like a limited partnership.A private limited company, also called a private company, provides limited liability protection to its shareholders. There are certain circumstances where the law can find you personally liable (responsible) for your company’s debts. Uninterrupted existence.A Private Limited Liability Company (Société à responsabilité limitée – SARL) is one of the most common company types in Luxembourg.A Private Limited Company is one of the most popular and widely adopted business structures in India, combining the advantages of limited liability, flexibility, and scalability. Limited liability: In a private limited company, there is a limited liability, which means the company’s members are not at risk of losing their private assets.