Llc distribution accounting

LLC profit distribution refers to the process of dividing the company's earnings among its members according to the terms outlined in the operating agreement, . Stark’s $10,000 distribution exceeds his basis in the S Corp. A distribution that is part of a disguised sale may cause the selling party to recognize taxable gain on what would otherwise have been a nontaxable distribution, under Sec. A distribution to a member will decrease the member’s capital account. Distributions generally fall into two categories: 1. Since there are few restrictions on member status for LLCs, it can be easy to lose track of where responsibilities lie. How LLCs pay taxes. Instead, it is a payment that can be made in the form of physical goods or any other financial instrument that is not cash. 707 (a) (2) (B). A single-member LLC is an LLC with one owner, similar to a sole proprietorship.

The owners of pass-through entities: partnerships (including limited liability companies—LLCs—taxed as partnerships) and S corporations, must pay tax on

Distribution-in-Kind

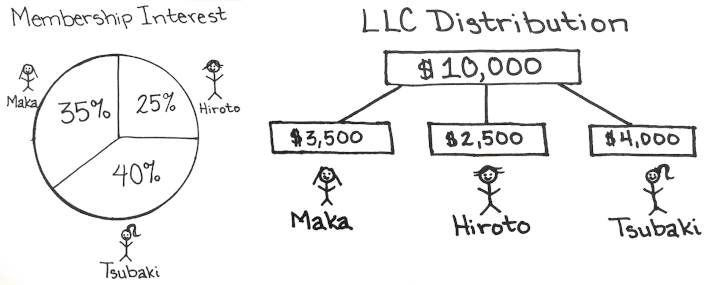

By default, distributions are made in proportion to the member’s interest in the company.

Managing LLC Capital Contributions and Distributions

If the business distributes cash to its members, the capital account needs to be decreased by the amount of the .Distributions are the cash or property earned by the LLC that’s actually paid out to the owners of the LLC. For accounting purposes, the contributions account is kept for each known member in an LLC. Under a typical allocation, the first owner would be responsible for reporting $45,000 of the profit on his personal income tax return. All owner payments can be .

· Mainshares

With our new LLC Distributions tool, you can accomplish in a few simple steps what used to eat up days or weeks of your time—without the worry of getting it wrong. Contact the author, . Subtract the amount of any distributions made by the LLC to the owner. The use of the limited liability company (LLC) has mushroomed in popularity over the past two decades.Distribution Definition.This LLC distribution method may also be reversed where dividends derive from percentage owned and revenue are similarly distributed. The way profits are distributed is specified in . There may also be limited partners in the business who do not engage in day-to-day decision making, and .

LLC Distributions Guide

In This Article. When a person becomes a member, they will make a property or cash .For tax purposes, single-member LLCs that do not elect to be taxed as a corporation are considered “disregarded entities” by the IRS, and the owner pays self . For this reason, . It will reduce the retained earnings and cash balance.

Capital Contributions and Equity Distributions in LLCs

In most cases, LLCs distribute profits . It is important to consult with a tax advisor to determine the tax consequences of capital contributions and . Posted Sunday, October 29, 2023.With an LLC, profits and losses pass through the entity itself and onto the owner (s), who must then report them on their individual tax returns. This is the same concept as matching revenues and expenses for the period. For tax purposes, the IRS considers single-member LLCs “disregarded entities.A current distribution to a member may be part of a disguised sale of property or an LLC interest between the member and the LLC or between two members. Single-member LLC. This means the owner pays self-employment taxes like a sole proprietor and reports all business activity on their personal federal income tax return.

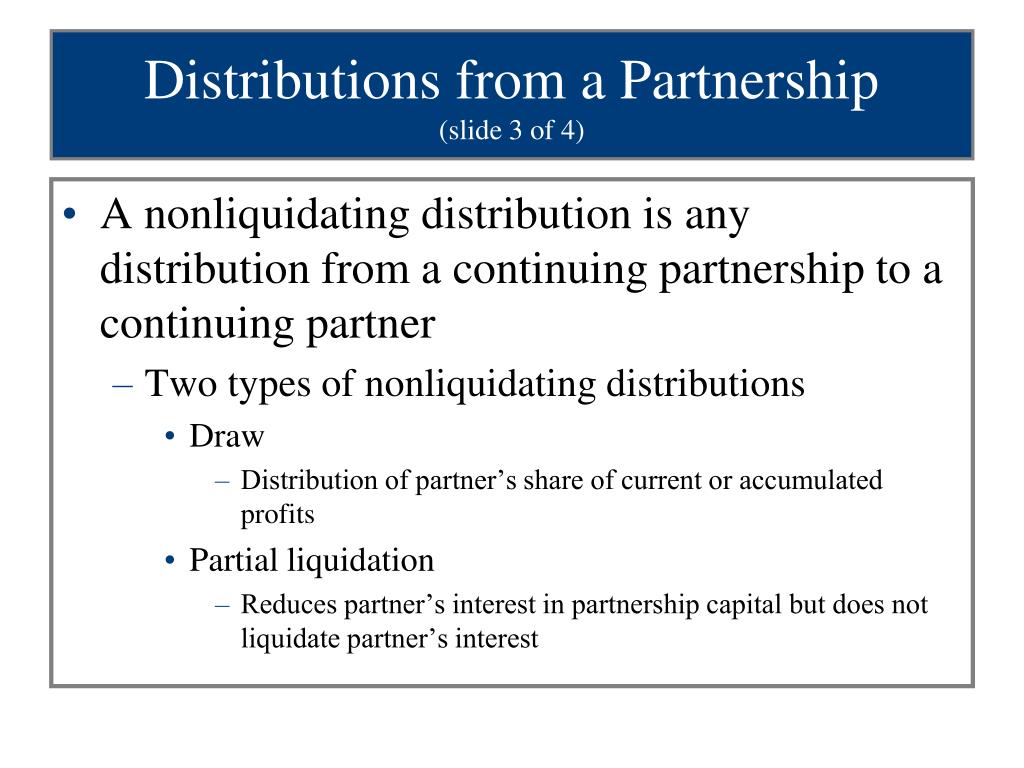

Distribution of Partnership Income

December 1, 2018.Setting up distribution accounts in Quickbooks involves creating specific ledger entries or accounts to accurately capture and track the allocated profits or assets designated for the appropriate recipients within the accounting system.If members A and B receive a $15,000 distribution, their capital accounts decrease by $15,000 each.

Photo: LYAO / Getty Images.

Partnership accounting — AccountingTools

One can choose to use either the accrual basis or cash basis of accounting when initially setting up the accounting system for an .This video walks through the configuration of accounting distributions in Microsoft Dynamics AX 2012. Therefore, it is advisable to accrue distributions to match the amounts that will be distributed to cover the owner’s tax liability to the year they relate to.Find out whether bonuses or distributions make the most sense for your business. LLC profit distribution is a complicated topic.An equity distribution is a distribution of profits or losses to members based on their ownership interests in the LLC.In an LLC, while dividends may be distributed throughout the accounting season to the members, it’s not just a generally accepted accounting concept (GAAP) to provide any . But all the terms can feel overwhelming: distributions, capital contributions, membership, taxation, and more. Line 19 represents actual distribution amount. For example, payment can be made using securities, such as stocks, dividends, bonds, or mutual funds.

How LLC Ownership Works

If you actually look at the K-1 form (1065), line 1 is ordinary business income which is net income divided by your share in the partnership. When a corporation earns profits, it can choose to reinvest funds in the business and pay portions of profits to its shareholders. Distribution costs are also known as distribution expenses and they are records in the income statement of the entity by . This popular entity choice serves a wide variety of purposes. Image by DigtialStorm/iStock. However, partnership tax . If you’re reading this, you probably encountered the terms “allocation” and “distribution” in your LLC operating agreement and spent longer than you care to admit . In short, it’s what we call a “flow-through entity” which means that while you have to file an S-Corporation tax return (Form 1120-S), the S-Corp does not pay any taxes.The pros and cons of LLCs.In order to form a single member LLC, or convert your sole proprietorship to an SMLLC, you need to to the following: Register a business name.How to Distribute Profits in an LLC. And just to be clear, you are not taxed on distributions (unless the distributions exceed your tax basis . A partner's distribution or distributive share, on the other hand, must be recorded (using Schedule K-1, as noted above) and it shows up on the owner's . If the net income of the partnership was 40,000 but partner A receives interest on the opening capital balance of 30,000 at 5%, then partner A would receive interest of 30,000 x 5% = 1,500. Decide on an accounting method.Contributions & Distributions.LLC members usually receive returns through compensation (taking a salary), capital gains, or distributions.

How to Pay Yourself as a Business Owner

Updated date: April 16, 2024.comHow to add capital contributions to an LLC | LegalZoomlegalzoom.So, an S-Corp is a corporation that has elected to be taxed differently from a normal corporation. It’s money that’s going into your bank account as an owner.Updated on May 28, 2020.It is the transaction that distributes the company retained earnings to the owner.) Tax income/loss (deemed distributions): These are .Distribution: Distribution cost is the sum of all expenses (direct and indirect) incurred by any company, firm, individual, or any other entity to deliver their products from the production department to the end consumer. But distributions can also be .

The pros and cons of LLCs

Apply for an Employer Identification .Learn more at http://www. Once the distribution accounts are created, they need to be configured with appropriate names and .A sole proprietor or single-member LLC owner can draw money out of the business; this is called a draw. Stark Industries still has taxable income of $100,000 in taxable income after accounting for Mr.Assuming the simplest scenario, the business makes net income of $100,000 and make distribution of $0, there are 2 partners 50/50.

LLC distributions that liquidate a member’s interest

Photo by Artem Beliaikin on Unsplash. One of the best parts about an LLC is that the members in it have the right to agree how their distributions and allocations will be in order to meet the goals of their business. The appropriate wording will be a function of determining what works best for the entity and its owners.Single-member LLC. The amount to be distributed equally would be 40,000 – 1,500 = 38,500, so each partner would receive . Open up our LLC Distribution tool and create a distribution with the effective date and the amount of the distribution.meritsolutions. However, there may be some exceptions for certain types of property, such as stock in the corporation. A distribution is a company’s payment of cash, stock, or physical product to its shareholders. The second owner . IRS statistics show a 66% . Distributions are allocations of capital and income throughout the calendar year.

LLC Distributions to Members

Open separate business accounts. Every member will have a capital account that is their equity in the company's LLC.

To Accrue or Not to Accrue Distributions: That Is the Question

LLC distributions are profits paid directly to the company’s members.

LLC distributions most frequently occur when an LLC distributes operating cashflow or refinancing proceeds or liquidates a member’s interests.

LLC Taxation: How Taxes Work for LLCs

Temps de Lecture Estimé: 5 min

LLC Profit Distribution Guide

A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business.

comRecommandé pour vous en fonction de ce qui est populaire • Avis

LLC Profit Distribution: Everything You Need to Know

Create a distribution. Set up a general ledger.

LLC members usually receive returns . This account consists of initial investment, dividends paid out and contributions made (monetary or elsewhere).Distribution of Partnership Income and Interest.

Single Member LLCs: A Complete Guide

How to set up your LLC accounting.

How LLCs Work: Types of LLCs & How to Get Started

A discussion of LLC ownership, .

By Jason Watson, CPA. Single-member LLC: Take an owner’s draw.

Tax basics for limited liability companies (LLCs)

), unless that owner has .com/products/dyn. There are countless situations in which business owners get money directly from their company.An LLC distribution refers to cash or property that was actually paid to the LLC members. It’s called an .Accounting Methods for an LLC. That way, if an LLC files bankruptcy, the creditors (bankers, credit-based investors, etc) can’t go after the owner’s personal assets (personal property, savings accounts, etc. When a new member makes a contribution, you need .Say an LLC has four owners (technically called members), who own 45 percent, 35 percent, 15 percent and 5 percent of the firm, respectively, and the LLC reports $100,000 in profit in a given year.Tax distributions are important for pass-through entities and should be carefully considered and negotiated. It is an accounting transaction, and it doesn't show up on the owner's tax return. Members should include provisions in the LLC Operating Agreement that dictate the process for making distributions. Loaning Money to an LLC. A primary goal for most businesses is to generate profits and pay them out to the owners.LLC ownership is an exciting prospect for many entrepreneurs.