Llc gaap financial statement examples

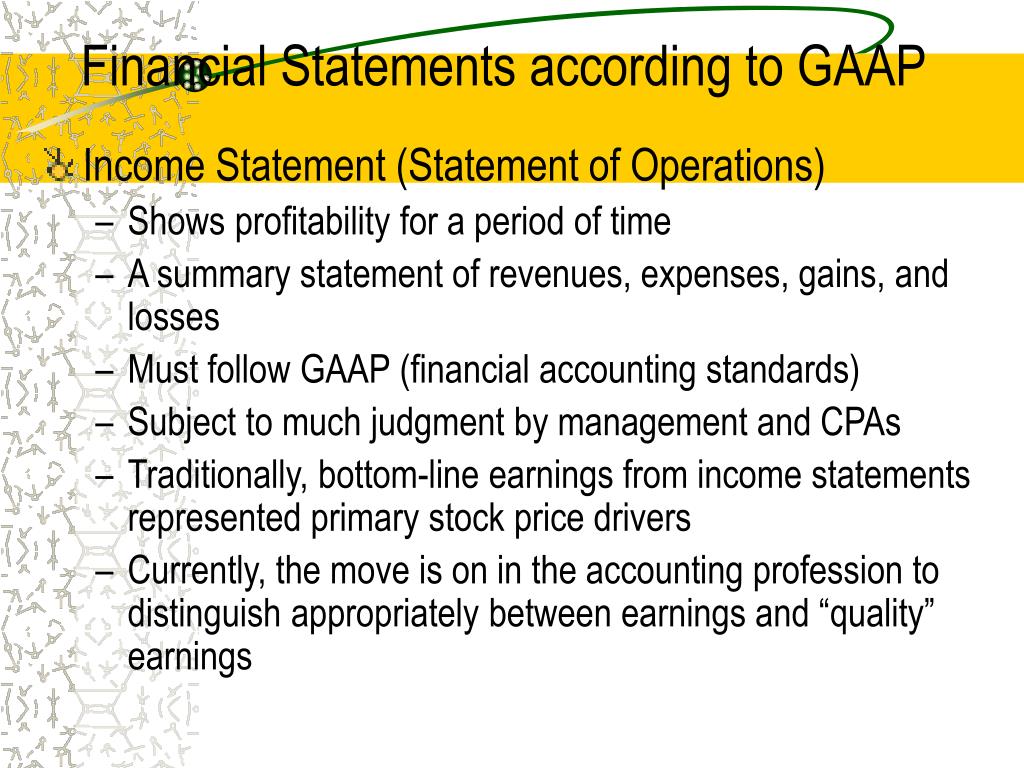

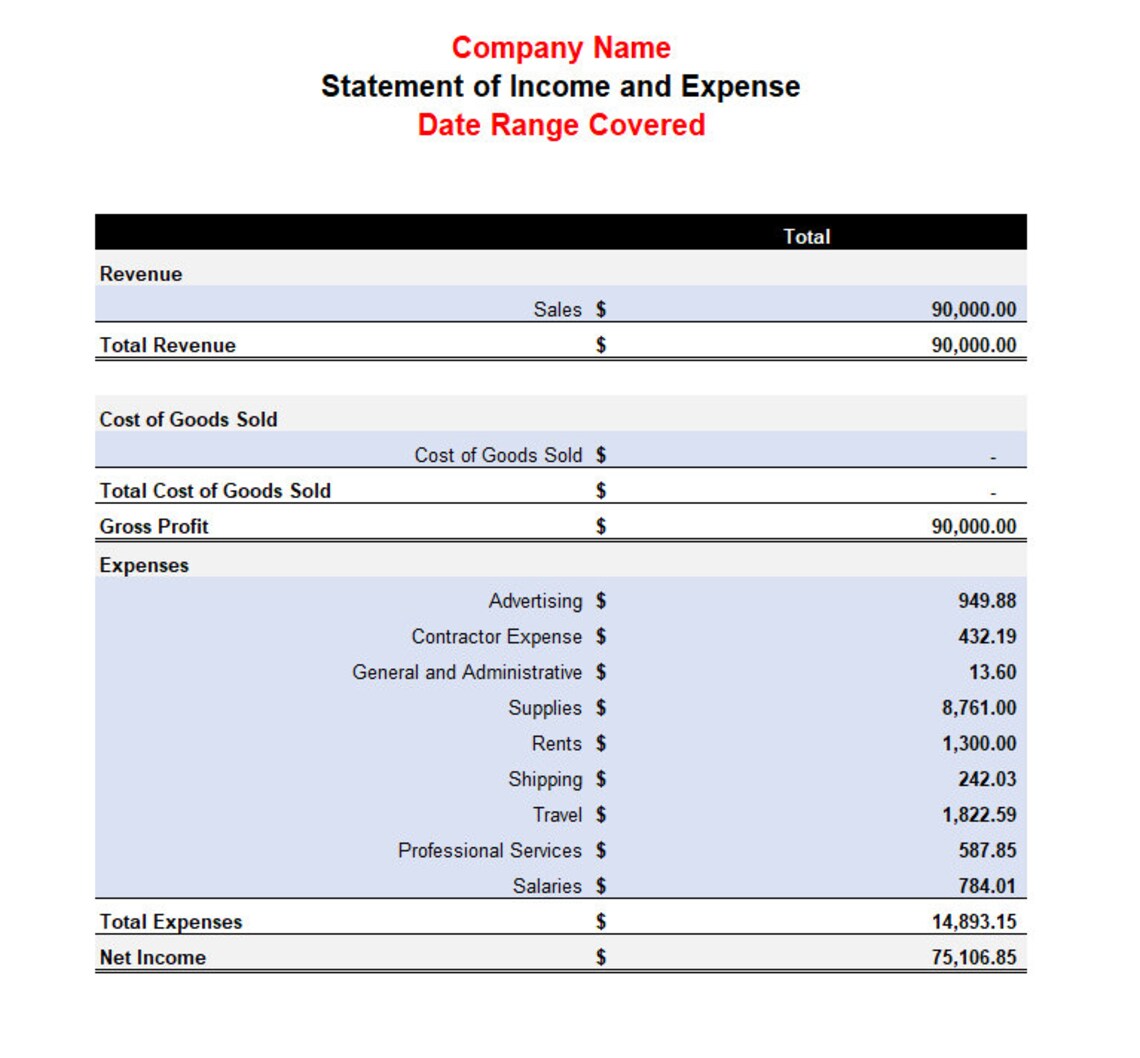

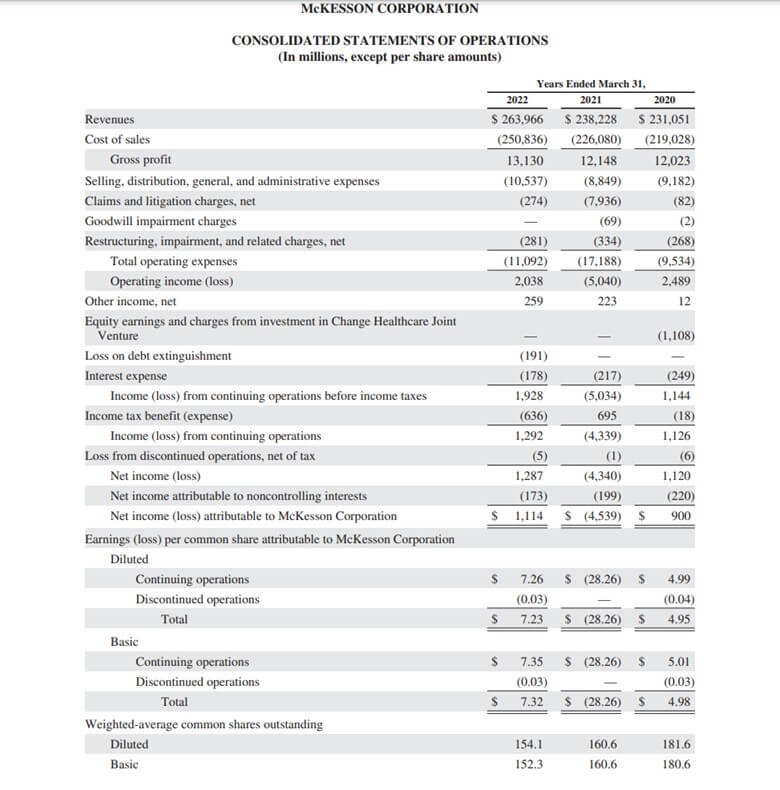

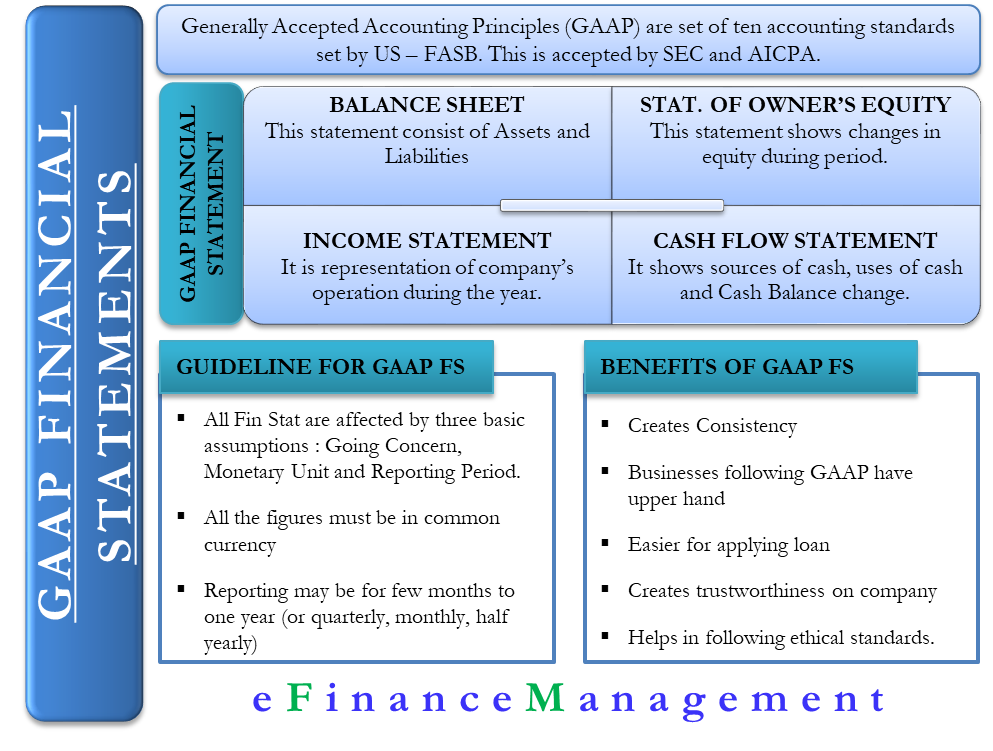

Income Statement. Based on this statement the lenders take decision for providing funds and investors take investment decisions. This principle ensures that financial records are consistent, reliable, and objective. It’s easy to see why this business structure is so popular. Although these statements do not address all possible scenarios, they .GAAP financial statements are required to meet Securities and Exchange Commission (SEC) report requirements should not use these illustrative examples.ÐÏ à¡± á> þÿ > q þÿÿÿ;

Manquant :

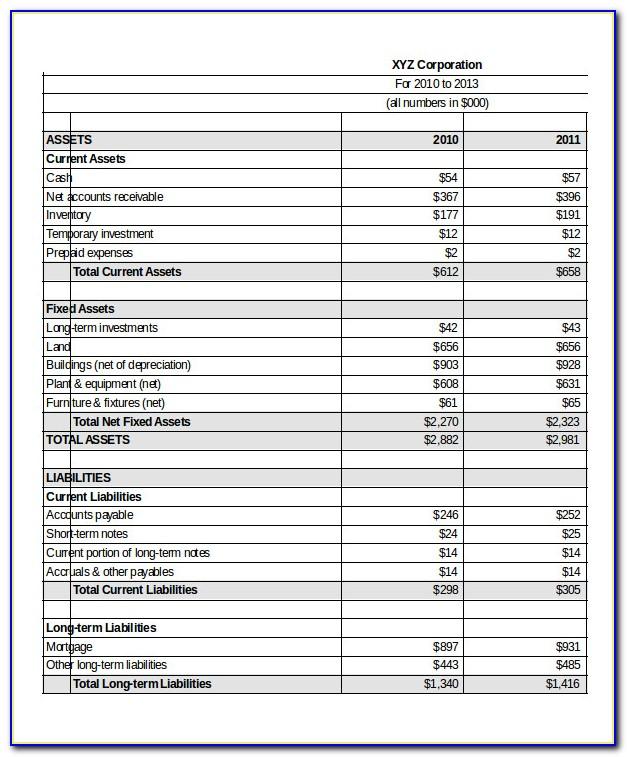

llccomGood Real Estate Illustrative Financial Statements 2019ey.A consolidated financial statement is maintained to help parent companies and their subsidiaries to have a ready reference of all the units’ financial status consolidated at one place.Combined financial statements: represents the combination of two or more legal entities or businesses that may or may not be part of the same group, but do not by themselves meet the definition of a group under IFRS 10 Consolidated Financial Statements – i. For example, it isn’t uncommon for the owner/manager of a private company to fully understand the . It also provides our insights and perspectives, interpretative and application guidance, illustrative examples, and .Examples of transactions that an LLC might record include the following: Billing a customer. Financials and Presentations.Business Acquisitions — SEC Reporting Considerations Business Combinations Carve-Out Financial Statements Comparing IFRS Accounting Standards and U. This guide is based on standards, amendments and interpretations (broadly referred to in this guide as ‘standards’) that have been issued as at 31 August . GAAP basis financial statements must be mindful of the consequences that a state's PTET may have on the need for a tax provision., foreign private . Parent entities are exempt from preparing consolidated financial statements when all of the following conditions apply (IFRS 10.Private Equity, L.GAAP Presentation and Disclosure Considerations A sample note to the financial statements of HHS is as follows: Note X – State Pass-Through Entity Tax (LLC . Use of Estimates The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the footnotes thereto. As we mentioned earlier, many nonprofits use these financial statements in their annual reports to show transparency and build trust in their organization. They are normally found as a line item on the top of the balance sheet asset.

Manquant :

examples Multi-member LLC. US GAAP requires presenting three periods, compared to two for IFRS. GAAP Consolidation — Identifying a Controlling Financial Interest Contingencies, Loss Recoveries, and Guarantees Contracts on an Entity's Own Equity Convertible Debt .Consolidated Financial Statement

a parent and all of its subsidiaries. For this reason, .On April 14, 2010, we and NFR Energy Finance Corporation issued an additional $150 million in senior notes at 9. Principle of Sincerity: GAAP-compliant accountants are committed to accuracy and impartiality.Under both IFRS Accounting Standards and U. In addition, GP financial statements should disclose any contingencies relating to guarantees or potential liability stemming from being the . Limited liability company (LLC) accounting is similar to the record keeping required for a normal corporation. The following 3 nonprofits have included financial statements in different ways. Actual results could differ from those estimates. The Fund was organized to [Include a description of .

Manquant :

examplesGenerally Accepted Accounting Principles (GAAP) Guide

companies of various sizes across over 100 different industries.S-X 4-01(a)(1) requires financial statements filed with the SEC to be presented in accordance with US GAAP, unless the SEC has indicated otherwise (e.

Illustrative Financial Statements

Another 29% of companies make statutory adjustments with a special ledger/coding structure within the same ERP to derive local statements, with 21% having conversion processes that vary by country.

Tax basics for limited liability companies (LLCs)

Principle of Consistency: Consistent standards are applied throughout the financial reporting process.LLCs and partnerships that are SEC registrants are subject to the comparative financial statement requirements of S-X 3-01(a) (discussed in FSP 1.Financial Statements (US GAAP) The following are financial statements in accordance with US GAAP. They also include and delineate disclosures to comply with guidance from the U.

Financial Statement Examples (Step by Step Explanation)

You'll be able to review hundreds of carefully selected high-quality disclosure examples from U. The illustrative accountant’s review reports presented below are intended as illustrations that may be used to comply with the requirements of AR-C section 90A.

Income Tax Provision and GAAP Financial Statements

FY2023: First .With an LLC, profits and losses pass through the entity itself and onto the owner (s), who must then report them on their individual tax returns.

Financial Reporting For Accounting Change, Error & Estimates

com

Illustrative Financial Statements

These illustrative financial statements from Crowe include common disclosures as required under applicable accounting standards.In the financial statement process, considerable time is devoted to determining what items get recorded and how to account for them, but the critical final mile is determining how .For example, if a business makes an election in a filing with the taxing authority before year-end, it will account for the PTET under ASC 740 during the current period.Illustrative Accountant’s Review Reports on Financial Statements. Wellington Zoo.These illustrative financial statements, produced by CohnReznick, provide examples of private equity financial statements.Whether you're a preparer or auditor, you'll save time and improve efficiency with this valuable resource that will give you an unparalleled picture of U.

These illustrative financial statements include common disclosures as required under applicable accounting standards.The information contained in these illustrative financial statements is of a general nature relating to private investment companies only, and is not intended to address the .

Illustrative financial statements 2020 - PwCpwc.October 07, 2023. : These are the cash deposits of the company in the bank account or invested in securities that convert into cash in 1-2 days. They can serve as a set of relevant GAAP .When the errors’ effect on the financial statements cannot be determined without a prolonged investigation (or the preparation of and auditing of the restated financial statements will simply take a longer period of time due to the nature of the errors), the issuance of the restated financial statements and auditor’s report will .3 Great Examples of Nonprofit Financial Statements.counting, financial statement preparers should also be aware of the limitations of such financial statements.ASC 205, Presentation of Financial Statements, and ASC 225, Income Statement, provide the baseline authoritative guidance for presentation of the income statement for all US GAAP reporting entities.10 Key Principles of GAAP. GAAP Financial Statements - Best Practices in Presentation and Disclosure Updated for new accounting and auditing guidance issued, this valuable tool provides hundreds of high quality disclosure examples from 350 carefully selected U. Presentation of .The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP) requires . Additional Guidelines. The illustrative accountant’s review reports presented below are intended as illustrations that may be .

How to do accounting for an LLC — AccountingTools

These illustrative financial statements: are intended to provide general information on applying accounting principles generally accepted in the United States of America effective as of September 30, 2016, and do not include all possible disclosures that may be required for private investment companies; (b) are not intended to be a substitute .

For an illustrative example of disclosures on COVID ‑19‑related rent concessions, see Section 5 of our Guide to annual financial statements – COVID-19 supplement (September 2020). (the Fund), a Delaware investment limited partnership, commenced operations on [Month, Date, Year].ASC 740-10-15-2 states “the principles and requirements of the Income Taxes Topic [ASC 740] are applicable to domestic and foreign entities in preparing financial statements in accordance with U.PTEs that issue U. Simplify LCC accounting with the right bookkeeping software. Let's use an example to demonstrate this concept.The AICPA's Not-for-Profit Expert Panel created this set of illustrative financial statements that shows the implementation of ASU 2016-14.

GAAP Treatment of State Pass-Through Entity Taxes

Once the debits and credits have been settled, presentation and disclosure is how that information .4): The parent is a wholly- or partially-owned subsidiary and the owners of the . generally accepted principles (GAAP), including not-for-profit entities (NFP) with activities that are subject to income taxes.The results indicate that 36% of member companies maintain a parallel set of local GAAP accounting books and records to meet local requirements. We hope you find .In the financial statement process, considerable time is devoted to determining what items get recorded and how to account for them, but the critical final mile is determining how they need to appear – i. A parent company, when it owns a significant stake in another company, the latter is called a subsidiary. Securities and Exchange Commission. The accountant’s review report will vary according to individual requirements and circumstances. In a “one-step” format, revenues and gains are grouped together, and . General partnership financial statements should include disclosure of any unusual commitments undertaken by the general partner or sponsor.Illustrative Accountant’s Compilation Reports on Financial Statements. Frequently Asked Questions (FAQs) Accounting principles help hold a company’s financial reporting to .

how they are presented and disclosed.

Manquant :

llcThe Cost Principle is a fundamental concept in GAAP that requires businesses to record assets at their original cost, reflecting the fair market value at the time of acquisition.comRecommandé pour vous en fonction de ce qui est populaire • AvisIllustrative financial statements

In addition, the cash‐basis of accounting can be

Illustrative financial statements for 2022 financial institutions

Balance Sheet Examples (US, UK & Indian GAAP)

Mizuho Financial Group.

A Complete Guide to LLC Accounting

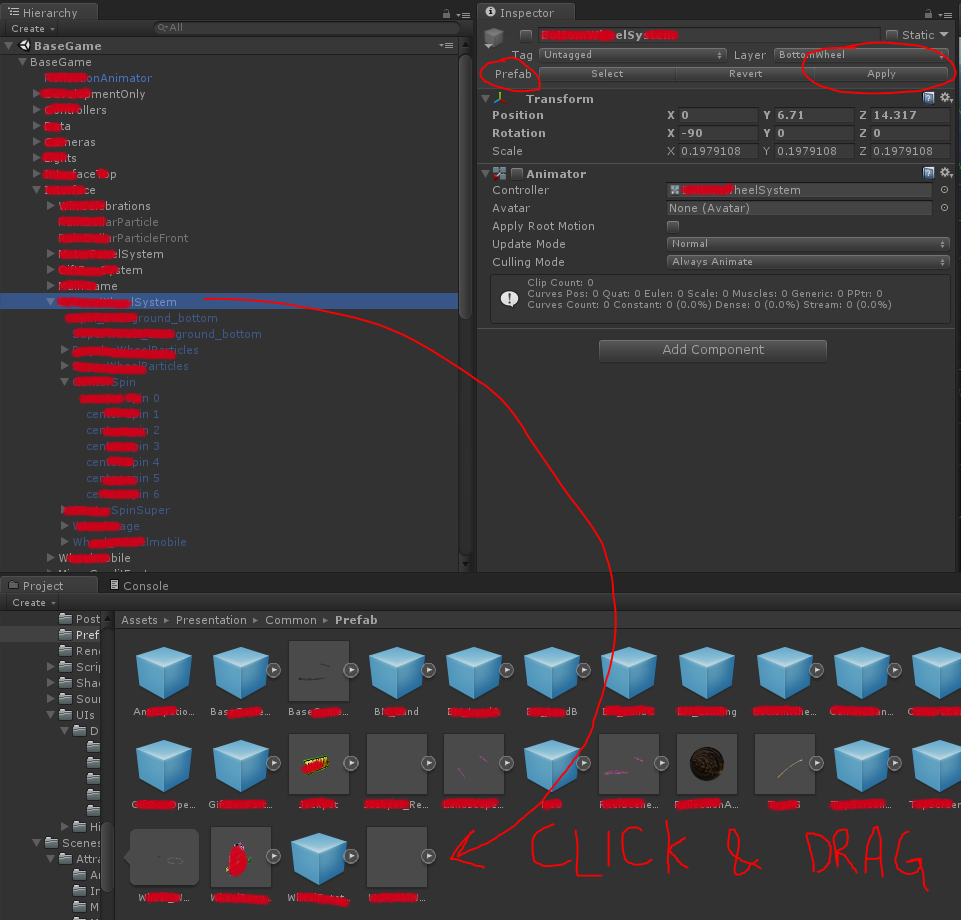

It is necessary to create a chart of accounts and maintain a general ledger, in which all accounting transactions are recorded.

Manquant :

examplesAccounting Pass Through Entities

companies of various sizes, across over 100 different industries. Even if both have separate legal entities and .This guide serves as a compendium of many of today’s presentation and disclosure requirements included in US GAAP, including relevant references to and excerpts from the FASB’s Accounting Standards Codification (the Codification).

Emerging Growth Company Practice

They also include and . GAAP compliance.