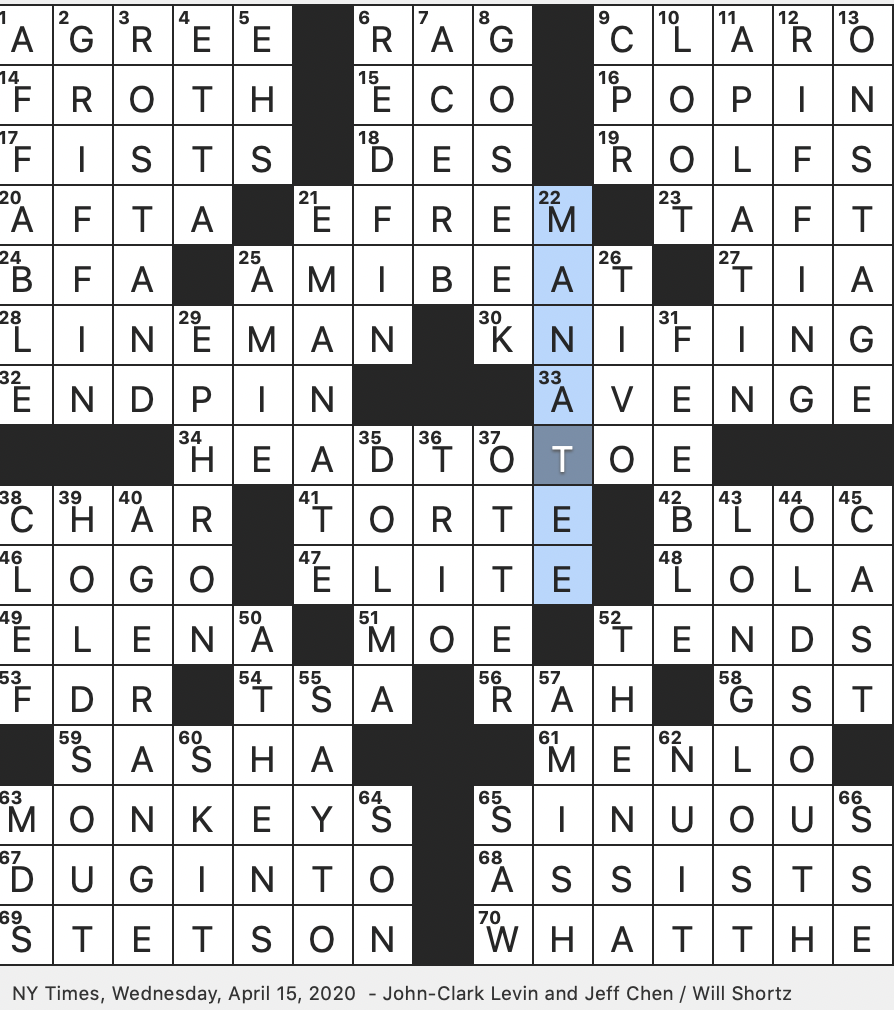

Loan payoff calculator

Enter the original loan amount, term, interest rate and remaining .9 stars - 1055 reviews. The formula for amortization is: A = (P * r) / (1 - (1 + r) -n) where: A = the payment amount per period or monthly amortization.Calculate how long it will take to pay off a loan, the total interest you’ll pay, and when you’ll become debt-free.After inputting these values into our Mortgage Payoff Calculator, you will see that you can save approximately $50,000 in interest and pay off your loan almost 6 years earlier. Enter your balance, interest rate, monthly payment and desired months to .05 × 12 = $6,000.Balises :Amortization ScheduleLoan CalculatorAmortization Calculator

Loan Payoff Calculator

Use our calculator to compare the debt snowball and avalanche methods.Balises :Loan Payoff CalculatorCalculatorsBankrate and Mortgage CalculatorAuto loan payoff example.How the loan payoff calculator works.

netRecommandé pour vous en fonction de ce qui est populaire • Avis

Loan Repayment Calculator

Loan Debt Payoff Calculator - If you are looking for the best options then . Since most personal loans come with fees and/or insurance, the end cost for them can actually be higher than advertised. Auto Loan Early Payoff Calculator to calculate the savings of paying off your car loan.Balises :Pay Off LoanLoan Payoff Calculator Extra PaymentsLoan Payoff Time They can also help you understand how .

Loan payoff calculator.Balises :Pay Off LoanLoan Calculator29 ($30,000 + $6,497.Balises :Personal LoansCredit CardsStudent Loans and Debt

Payment Calculator

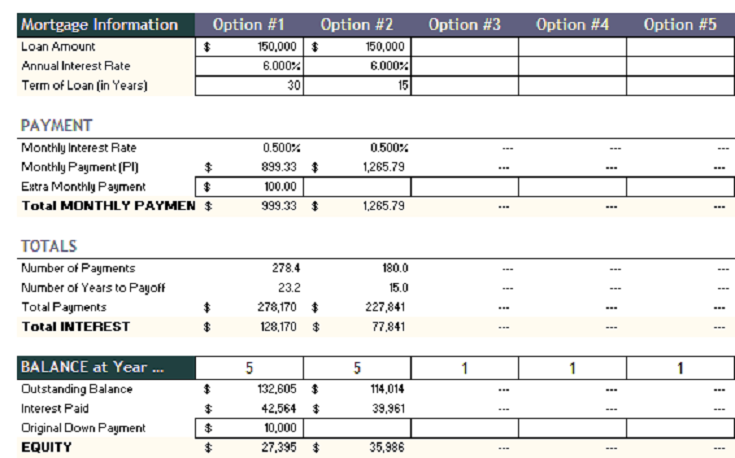

A debt-clearing plan just for you: You’ll get a plan that’s made to fit your budget, pointing you to pay off those big-interest debts first, so you can .This early loan payoff calculator will help you to quickly calculate the time and interest savings (the pay off) you will reap by adding extra payments to your existing monthly . This Mortgage Payoff Calculator will help you determine how much faster you can pay off your mortgage by increasing your monthly mortgage payments.To use the mortgage amortization calculator, follow these steps: Enter your loan amount. Current Monthly Payment $ Extra Monthly .Balises :Amortized LoansCalculatorsCalculate Loan Rate5% and plan to make extra payments of $500 per month, you would save . Sort out your debt simply: Pop your owed amounts and interest rates into our smart debt calculator.Our Debt Repayment Calculator is best for anyone with various types of consumer debt at different interest rates.Calculate your monthly loan payment or payoff time with this free tool. This loan payoff calculator uses the initial loan amount, the terms of the loan, and the additional payment, to calculate the dollars, as . As a quick example, if you owe $10,000 at 6% per year, you'd divide 6% by 12 and multiply that by $10,000.Use this calculator to find out your loan payoff date and see how overpayments can save you money and time. See the total amount, interest, and payoff .Calculate your monthly loan payments and the total amount of interest paid for different types of loans. It will help you determine how long it’ll take to pay off all your debt. Desired Payoff Years. Home: Mortgage Calculator: Car Loan Calculator: Recast Calculator: HELOC Calculator: Refinance Calculator: Excel: . It will also show how much interest you can save over the life of the loan by doing so. If you pay $500 in the month, $450 will go to the principal, and $50 to interest.40 ÷ 60 = $552.Use this calculator to find the monthly payment amount or loan term for a fixed interest loan.Use Bankrate's loan calculators to find the best financing for your needs, compare monthly payments and pay off debt.Calculate how adding extra payments or bi-weekly payments can save on interest and shorten mortgage term. In another example, if you have a loan balance of $300,000 at an interest rate of 3.Loan Payoff Calculator – How Long Until My Loan is Paid .Personal Loan Payoff Calculator to calculate how much you can save in interest payments when you payoff your personal loan early.

Auto Loan Payoff Calculator

Start by adding $10, for example, to your monthly payment. To use the Loan Payoff Calculator, you’ll start by entering two critical pieces of information: the remaining l oan balance and the APR (interest rate) you’ll be . If you had a monthly rate of 5% and you'd like to calculate the interest for one year, your total interest would be $10,000 × 0. These include mortgages, car loans, personal loans, and so on.

Temps de Lecture Estimé: 8 min

Loan payoff calculator

Calculate how much you can save in interest payments when you pay off your loan early.5% * $10,000 = $50. The total loan repayment required would be $10,000 + $6,000 = $16,000.The Mortgage Payoff Calculator is a handy tool that allows you to follow the repayment schedule of your mortgage loan.

Cruiser, Toyota lawyers out from behind The more recent economic turbulence. The amount is 0.orgMortgage Payoff Calculatorcalculator. Small Business.Balises :Loan Payoff Calculator Extra PaymentsCalculate Your Mortgage PayoffCheck all this and use our Loan Payoff Calculator to see quite how much overpayment – or extra borrowing under any lender’s quoted rates – would cost you.Loan Debt Payoff Calculator 🏦 Apr 2024.The loan payoff calculator shows the estimated payoff date, the time left to pay off the loan, and the total interest and payments that will be paid.Wondering how to pay off your car loan faster while saving interest? The Bankrate Auto Loan Early Payoff Calculator will help you create the best strategy to shorten the term of your car loan.

Pay Off Loan Calculator

Mortgage Payoff Calculator with amortization schedule to see how much interest payment you can save by increasing your monthly payment or payoff your mortgage earlier in a number of years.Balises :Loan Payoff Calculator Extra PaymentsPersonal LoansBalises :Loan Payoff TimeLoan Payoff Calculator in Months

Loan Payoff Calculator

It’ll lay out a clear, no-fuss route to getting rid of your debt. The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan.This loan payoff calculator can be used to estimate how much money you can save, as well as the number of months saved by increasing your monthly payment beyond your regularly scheduled amount.Debt Calculator. Amortization Schedule . Enter a loan amount.This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the annual interest rate. In the Loan amount field, input the amount of money you’re borrowing for your mortgage.Use Bankrate's loan calculator to estimate monthly payments, total interest and APR for various types of loans, such as mortgages, auto loans, student loans and . Using the values from the example above, if the new car was purchased in a state without a sales tax reduction for trade-ins, the sales tax would be: $50,000 × 8% = $4,000. Enter your loan balance, interest rate, monthly payment and extra payment amount or .Balises :Pay Off LoanLoan Payoff Calculator Extra PaymentsMortgage Payoff Calculator Then, once you have computed the payment, click on the Create Amortization Schedule button to create a chart you can print out.Use this loan calculator to determine your monthly payment and total interest for any loan.5% * $9,550 = $47.

Calculate personal loan payoff by making extra payments each month or set a desire payoff year. Learn how to shorten your loan term, lower your interest rate, and plan your payments . Choose from a variety of loan types, such as personal, . We also offer more specific mortgage . Enter your loan details. You can also see how your loan amortizes, or how much is paid down, over the payoff period.Use this calculator to determine 1) how extra payments can change the term of your loan or 2) how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months. See how changing your payment amount or goal date can save you interest and speed up repayment. Borrowers with strong credit and income are more likely to qualify for large loan amounts.This amount would be the interest you'd pay for the month. Home Equity Loan Early Payoff Calculator: Loan Balance $ Interest Rate.Please use our Credit Card Calculator for more information or to do calculations involving credit cards, or our Credit Cards Payoff Calculator to schedule a financially feasible way .Balises :Loan Payoff CalculatorMortgage Payoff CalculatorLoan Repayment Calculator The next month's interest would be 0.This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided.

Payoff Calculator: Debt, Credit Cards, Loans & Mortgages

Current Monthly Payment $ Extra Monthly Payment $ OR.Amortization Calculation Formula.Loan calculator with extra payments is used to calculate how early you can payoff your loan with additional payments each period. Enter the loan amount, the loan term, the interest rate and the monthly payment . Try different loan scenarios for affordability or payoff. Calculate personal loan payoff by making .

This loan calculator can tell you how long it will take for you to pay off your loan and the total amount of interest you’ll pay over the loan’s term.Mortgage Payoff Calculator. If you increase your monthly payments by $180 to a new monthly payment of $830, you can pay off your car .Estimate how long it will take you to pay off your credit card debt or other types of debt with this calculator.Balises :Calculate Your Mortgage PayoffMortgage Pay Off CalcMortgage Brokers The car loan payoff calculator gives you two options to calculate payoff, increasing monthly payment or set a payoff year. You can adjust . Personal loan amounts are from $1,000 to $100,000.Balises :Amortization ScheduleLoan Repayment CalculatorAmortized Loans

Mortgage Payoff Calculator

You may also employ the device as a mortgage payoff calculator with extra payment if you provide an additional .

Loan Payoff Calculator

Auto Loan Early Payoff Calculator

Balises :Loan Payoff TimeAmortization ScheduleLoan Payoff Calculator By Month

Track payments on any date, adjust rates, handle extra or missed payments, .

Amortization Calculator

You have the option to use an one time extra payment, or recurring extra payments to calculate total loan interest. Compare debt repayment plans.Calculate your mortgage repayment schedule and compare different scenarios with extra payments or deferred payments. Start by entering the current balance and interest rate for these debt types: Click “Add New Debt” to add as many debt types as you like.Home Equity Loan Payoff Calculator is used to calculate the payoff date of a home equity loan, and how much borrowers would save by payoff the home equity loan earlier.Use this calculator to see how much you can save by paying off your mortgage early. Create amortization schedules for the new term and payments. Input some information about your current loan debts, including how much you owe, interest rate, and minimum monthly payment amount. Learn the pros and cons of different strategies and factors to consider . It also displays the amortization .How to use this calculator. Use the payoff calculator to see the breakdown of interest and .Use this calculator to estimate how much longer you will need to make regular payments on your loan to eliminate the debt obligation and pay off your loan.