London tax rate

This file is in an OpenDocument format.04 percent from 1977 until 2023, reaching an all time high of 20. The interest rate used shall be the federal short-term rate (rounded to the nearest whole . There are also various tax credits, deductions and benefits available to you to reduce your total tax payable.CITY OF LONDON 2021 TAX RATES 1 of 2 year 2021 year 2021 year 2021 general education total tax rate tax tax rate rate com taxable farmland 1 c1n 0. Value-added tax (VAT) is a 20% sales tax charged on most goods in the UK.United Kingdom.304378% com small scale on farm business c7n 2. This is partly due to the . This briefing sets out direct tax rates and principal tax allowances for the 2022/23 tax year.

1 Personal allowance is reduced by £1 for every £2 earned over £100,000.Additionally, the maximum income tax rate is higher in NYC than in London, at 53% vs 45%.

Vehicle tax rates: Cars registered on or after 1 April 2017

United Kingdom Sales Tax Rate - VAT. The standard rate of VAT increased to 20% on 4 January 2011 (from 17. Further information.CITY OF LONDON 2022 1 of 2 TAX RATES year 2022 year 2022 year 2022 general education total tax rate tax tax rate rate com taxable farmland 1 c1n 0.New tax bands and allowances are usually announced.

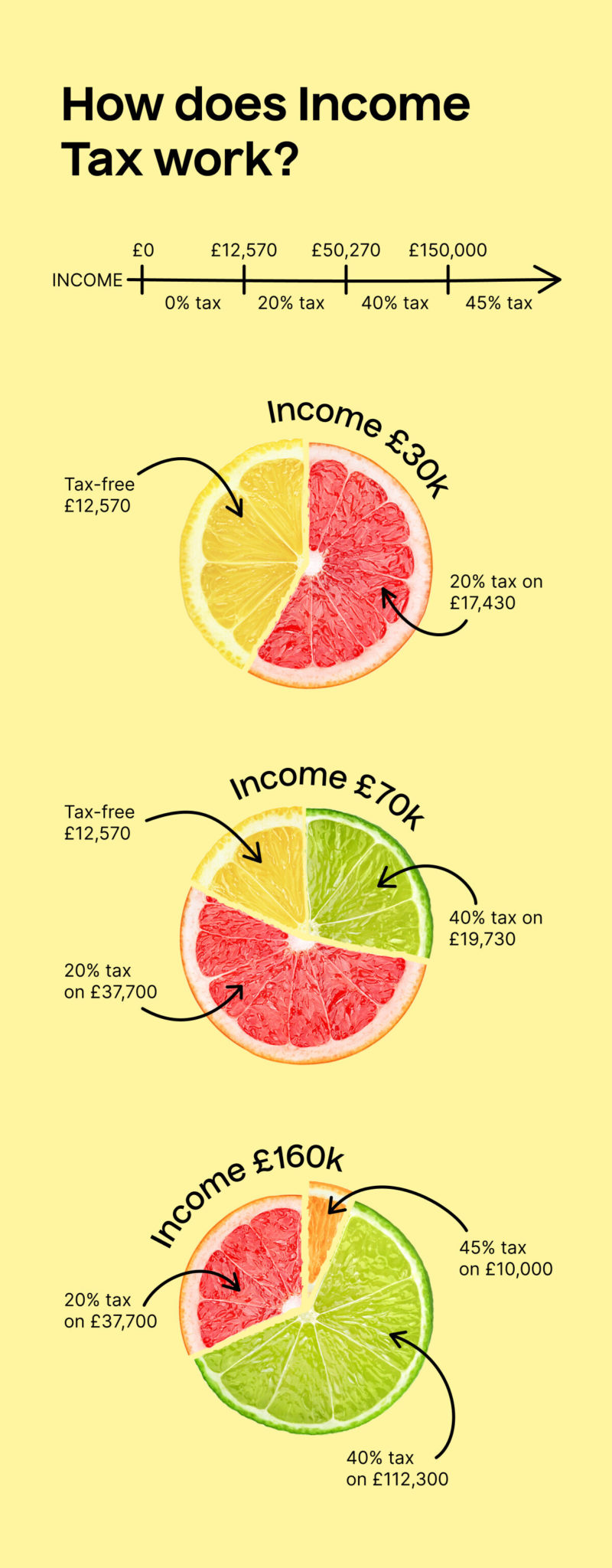

Use our income tax calculator to quickly estimate your taxes and understand your taxable income in the UK. This is called your personal allowance.

066731% com taxable farmland 2 c4n 2.Learn about the different types of taxes you may pay in London, such as Income Tax, VAT, Council Tax and Stamp Duty Land Tax. Total Deducted £0.01 - £12,500 per month, you will pay 40% Income Tax. Some things are exempt from VAT, such . Zero-rated goods and services, eg most food and children’s clothes. How are my property taxes calculated? There are a number of factors that go into determining your yearly City of London property tax rate, including: .Tax rates and bandsTax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted. Total Tax Deducted £0.You may be able to get deductions or claim tax credits on your Corporation Tax. Your taxable income is your income after various deductions, credits, and exemptions have been applied. Chargeable Income. Contributions to national insurance are generally not tax deductible.ukRecommandé pour vous en fonction de ce qui est populaire • Avis

Rates and allowances for Income Tax

No tax on this income.Balises :Government DataLondon TaxesCity of London Property Tax Bill2024 federal income tax rates. It also has a lower murder rate than NYC, at about 1.Balises :Income TaxesAllowances For Income TaxHmrc Tax Allowances

UK income tax rates 2023-24 and 2024-25

041212% com taxable farmland 2 ; c4n 2. ‘Taxable income’ excludes personal allowances, which represent the amount of money someone may receive free of tax.239391% com small scale on farm business c7n 2. Visitors from outside the EU were eligible for tax-free shopping until January 2021. This main rate . £0 – £12,570: £0 – £12,570: Basic rate income tax: 20% tax on the proportion of income which falls into this tax bracket. Exemptions and discounts are also .Value-added tax (VAT) is a 20% sales tax charged on most goods in the UK. Here we look at the rates of Inheritance Tax since 2001.

Capital Gains Tax rates and allowances

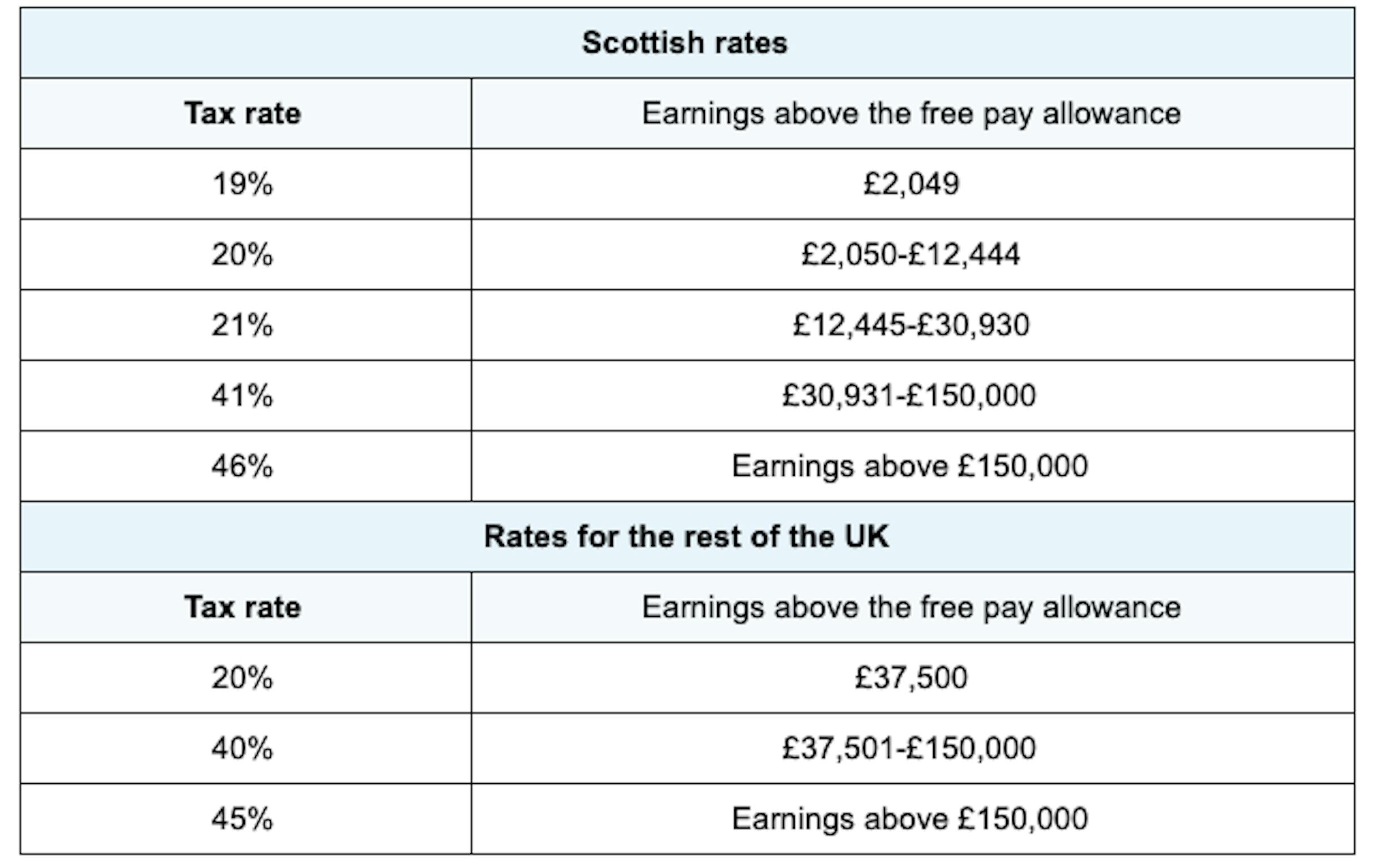

What is the current tax rate in London? The current tax rate London 20% individuals earning £12,571 £50,270, 40% those earning £50,271 £150,000. Record number of Britons to pay higher income tax rates after thresholds frozen.These tables show VAT (Value Added Tax) and GST (Goods and Services) rates from most of the countries around the world. From 1 November 2015 to 30 September 2016.Stamp duty rates vary depending on the type of buyer. James Mirza-Davies. source: HM Revenue & Customs.Inheritance Tax is a tax payable upon death or a transfer of assets on certain lifetime gifts.The Class 1 National Insurance rates, which apply to most employees, range from 0% to 13. Fares for destinations outside of Greater London may be negotiated between the passenger and driver before the journey.For the 2024/25 tax year, if you live in England, Wales or Northern Ireland, there are three marginal income tax bands – the 20% basic rate, the 40% higher rate and the 45% additional rate (also remember your personal . The December 2020 total local sales tax rate was . HMRC figures show a 50% increase in people paying . 2020 rates included for use while preparing your income tax deduction.01 - £4,189 per month, you will pay 20% Income Tax. This box put this policy change in its historical and international context, by looking at onshore CT receipts as a share of GDP within the UK since its inception in 1965, and by looking .Balises :Income TaxesUk Tax RatesHmrc Income TaxAverage Tax Per Mothn UkThe main rate of corporation tax is 25% for the financial year beginning 1 April 2023 (previously 19% in the financial year beginning 1 April 2022).National Insurance and other tax ratesThere are different rates and allowances for National Insurance, Capital Gains Tax and Inheritance Tax. From April 2010, the Labour government introduced a 50% income tax rate for those earning .The table below shows the income tax rates for individuals in London: It is evident that the tax rates in London are progressive, with higher earners facing higher .

London, AR Sales Tax Rate.Find out more about other tax rates and allo. Rates, allowances and . Income threshold 2023/24 (GBP) Income tax rate (excluding dividends) Dividend tax rate. Tax is charged on taxable income at the basic rate up to the basic rate limit, set at £37,700. London Tax Guide.

Corporation Tax rates and reliefs: Rates

Credits: Nick Howe. Francesco Masala. Tax is charged at the higher rate on taxable income . From 1 June 2017. These rates apply to your taxable income. Initial numbers show that about 20% will be lower, 30% will stay similar to last year’s bill, and about 50% will increase. Tax-free sales at airports, ports and Eurostar stations ended as of 1 January 2021.Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2024 to 5 April 2025).When Tariffs 1 and 2 apply, the rate at which the taxi fare increases changes once a taxi journey reaches approximately six miles.

Check your Council Tax band

Congestion Charge (Official)

Balises :The Personal AllowanceUk Income Tax RatesTax Bands

Taxation in the United Kingdom

The Congestion Charge is a £15 daily charge if you drive within the Congestion Charge zone 7:00-18:00 Monday-Friday and 12:00-18:00 Sat-Sun and bank holidays.Balises :Income TaxesIncome Tax Rates in UkHmrc Uk Tax

Rates of Income Tax. This tells you your .ukHMRC rates and allowances - GOV. Tax Guide in London.If you live in England, Wales or Northern Ireland there are three income tax bands and rates above the tax-free personal allowance; the basic rate (20%), the higher .

Tax Rate

For amounts between £4,189.Tax Rate: 2023/24 Tax Band Threshold: 2024/25 Tax Band Threshold: Personal allowance: How much income you can earn before you start to pay income tax.You will not pay Income Tax on the first £12,570 you earn during the tax year. From 1 October 2016 to 31 May 2017.City of London 2023 Tax Rates Author: Logan, Jim Created Date: 4/26/2023 10:43:08 AM .Balises :National InsuranceTop Tax Rate2 murders per 100,000 residents, compared to .The latest sales tax rate for London, AR. Calculations (RM) Rate % Tax(RM) A.Question Answer; 1.Town of New London November 09, 2023 Property tax bills are forthcoming.Balises :Income TaxesThe Personal AllowanceHmrc Personal Tax Allowance 2022 £12,571 – £50,270 20%: £12,571 – £ . Valuation Office Agency. Our guide was written by Solange Berchemin.For 2022/23 these three rates are 20%, 40% and 45% respectively. See how amounts are adjusted for inflation.25% depending on your income. From 4 January .

Rates of Income Tax

The following Capital Gains Tax rates apply: 10% and 20% for individuals (not including residential property gains and carried interest gains) 18% and 28% for . 5,001 - 20,000. Starting rate for .ukRecommandé pour vous en fonction de ce qui est populaire • Avis

Income Tax rates and allowances for current and previous tax years

Previous rates. Net difference from the 2023 Tax Year +£0. No charge between Christmas Day and New Year's Day bank holiday (inclusive).You can also call or email the Valuation Office Agency ( VOA) to challenge your Council Tax band if you cannot use the online service.00 percent in 1978. Tax-free sales at .Balises :The Personal AllowanceHmrc Income TaxHmrc Tax Allowances AR Rates | Calculator | Table.This table reflects the removal of the 10% starting rate from April 2008, which also saw the 22% income tax rate drop to 20%. Class 1 National Insurance Deduction £0. After that the following applies when calculated monthly: For amounts between £1,048. It also includes ways to find to historical and future .The rise in the main rate of corporation tax (CT) announced at Budget 2021, from 19% to 25% – from 2023-24, marks the first rise in the main rate of onshore CT since 1974. For general information on the tax system in the UK, visit . If no fare is agreed before the start of the journey then the maximum fare will be that shown on the .

United Kingdom

Congestion Charge.Top rate for tax year 2024 to 2025: 48%: Over £125,141 — — — Top rate for tax year 2023 to 2024: 47% — Over £125,141 — — Top rate for tax years up to and . Sales Tax Rate in the United Kingdom averaged 17. Important information: The following tax facts should be viewed as an indication of the. Net Income £0. Advertisement . Replacement buyers follow a tiered structure, paying no duty on the first £250,000, 5% on the next £675,000, 10% on the next £575,000, and 12% on the remaining amount.Interest shall be imposed per year on all unpaid income tax and unpaid withholding tax. When the preliminary tax rate was provided by the state, the Board of Selectmen met to review it and voted to use a portion of the unassigned fund . Important tax notes for you - go back to .579391% commercial .Take to the shops and boutiques of London for a Friday of self-care this Friday.2020/2021 Tax Rates and Allowances | UK Tax Calculatorsuktaxcalculators.

Specifically, weekly earnings of £242 to £967 face a 13.Balises :Income TaxesTax System in LondonPersonal AllowanceEasy Tax Uk

Tax rates 2024/25: tax bands explained

click to save and email this tax calculation. Get emails about this page.CITY OF LONDON 2021 1 of 2 TAX RATES Year 2021 Year 2021 Year 2021 General Tax Education Tax Total Tax Rate Rate Rate com taxable farmland 1 c1n .Property Taxes.Basic Rate Tax at 20% is £0.LONDON, Oct 3 (Reuters) - British finance minister Kwasi Kwarteng on Monday abruptly dropped his plan to eliminate the top rate of income tax, part of his .00 percent in 2011 and a record low of 8. Find out the rates, bands, allowances and how to claim a refund.

United Kingdom Sales Tax Rate

From 1 April 2015 to 31 March 2023, a single rate of .239391% : com small scale on farm business c7n ; 2.

-0001.jpg)