Maturity transformation banks

Todd Keister Rutgers University.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Banks’ Maturity Transformation: Risk, Reward, and Policy, WP/18

N2 - Banks make a significant part of their profits by paying less interest on deposits and savings accounts than they earn on loans.Balises :Maturity Transformation RiskInterest rate riskPublish Year:2021Library This difference in interest rates is, among others, compensation for the risk .

The aim of this paper is twofold: first, to studythe determinants of banks’ net interest margin with a particular focus on the role of maturity transformation, using a new measure of . by Itay Goldstein, Chong Huang, and Liyan Yan.orgMaturity transformation | MoneyWeekmoneyweek. They raise (that is, mostly borrow) short-term funds in the money markets and use those funds to buy assets with longer-term maturities.

Back to Basics

4 Capital-producing firms 21 3. To read the full-text of this . a large maturity mismatch.

Working Paper Series

To introduce the inherent maturity mismatch between banks’ assets and liabilities, the model departs from the standard business cycle models and features infrequent optimisation of the firms’ capital financing decision in a similar spirit as Andreasen et al. Drechsler and Savov are also with NBER, Schnabl is also . The reason is the deposit franchise, which allows banks to pay . Journal of Financial Intermediation, 2023, vol. Banks choose the amount and maturity of their debt by trading off investorsÕ preferences for short .Balises :Maturity Transformation RiskInterest rate riskBank Both the firms and the banks can choose the maturity of the loans; the . FRBNY Fintech Conference September 23, . Federal Reserve Bank of San Francisco.6 Implications of maturity transformation: a shock to technology 23 4 A New Keynesian model: nominal financial contracts 26 4. Andreasen, Marcelo Ferman and Pawel Zabczyk NOTE: This Working Paper should not be reported as representing the views of the European Central Bank (ECB).We quantify the gains from regulating maturity transformation in a model of banks that finance long-term assets with nontradable debt.We show that maturity transformation does not expose banks to interest rate risk—it hedges it.Balises :Maturity transformationMartin M. However, private incentives to limit excessive reliance on unstable funding of core (often illiquid) assets are weak. Without such transformation, it is difficult to see how modern economies would work.Maturity Mismatch: A maturity mismatch is the tendency of a business to mismatch its balance sheet by possessing more short-term liabilities than short-term assets and having more assets than .Maturity transformation refers to a role played by banks in which they use short-term funds to finance long-term projects.Banks’ Maturity Transformation: Risk, Reward, and Policy Prepared by Pierluigi Bologna* Authorized for distribution by Nigel Jenkinson February 2018 Abstract The aim of this . For example, banks could use deposits that can be withdrawn by their . Working papers set out research in progress by our staff, with the aim of encouraging .edu,asavov@stern.

Balises :Maturity Transformation in BanksMaturity Transformation RiskPaper

Assessing risks from euro area banks’ maturity transformation

2 Good-producing firms 17 3. However, the practice is not without its risks, exacerbated by the current volatile . Review of Economic Dynamics, 2013, vol. Shadow banks do something similar. Our model also implies .

.jpg)

AU - Chaudron, Raymond. Because of the., to do maturity transformation. Andreasen, Marcelo Ferman, Pawel Zabczyk As predicted by this theory, we document that banks' net interest margins .Balises :Maturity transformationFile Size:561KBPage Count:13Mortgage loan

Maturity Transformation: An Interview with Phil Dybvig Transcript

The aim of this paper is twofold: first, to study the determinants of banks’ net interest margin with a particular focus on the role of maturity transformation, using a . Understandably, the sharper focus on liquidity risks has led to the question of whether the maturity transformation that is undertaken elsewhere in the system raises similar . Thus, one way to test if maturity transformation exposes banks to interest rate risk is. A type of transformation whereby a bank or any similar institutions takes advantage of the upward slope of the yield curve by investing in assets that have a longer duration than its liabilities (funding requirements).This special feature builds on the maturity gap, a metric of banks’ maturity mismatch, to explore the role of maturity transformation for banks.Balises :Maturity Transformation in BanksPaperEuropean Central Bank5089/9781484345184. JEL: E52, E43, G21, G31 Keywords: Banks, maturity transformation, deposits, interest rate risk.The business cycle implications of banks' maturity transformation. New York University Stern School of Business,idrechsl@stern. Calculations based on our calibrated model suggest that NSFR regulation may actually imply significant net welfare losses. IMF Working Paper 18 (45):1. The transformation of claims over fundamentally illiquid assets into claims that are highly liquid is one of the critical .Balises :Maturity Transformation in BanksMaturity Transformation RiskPierluigi Bologna

La maturité digitale des acteurs bancaires français en forte hausse

Balises :Maturity Transformation in BanksMaturity Transformation RiskInterest rate risk

WORKING PAPER SERIES

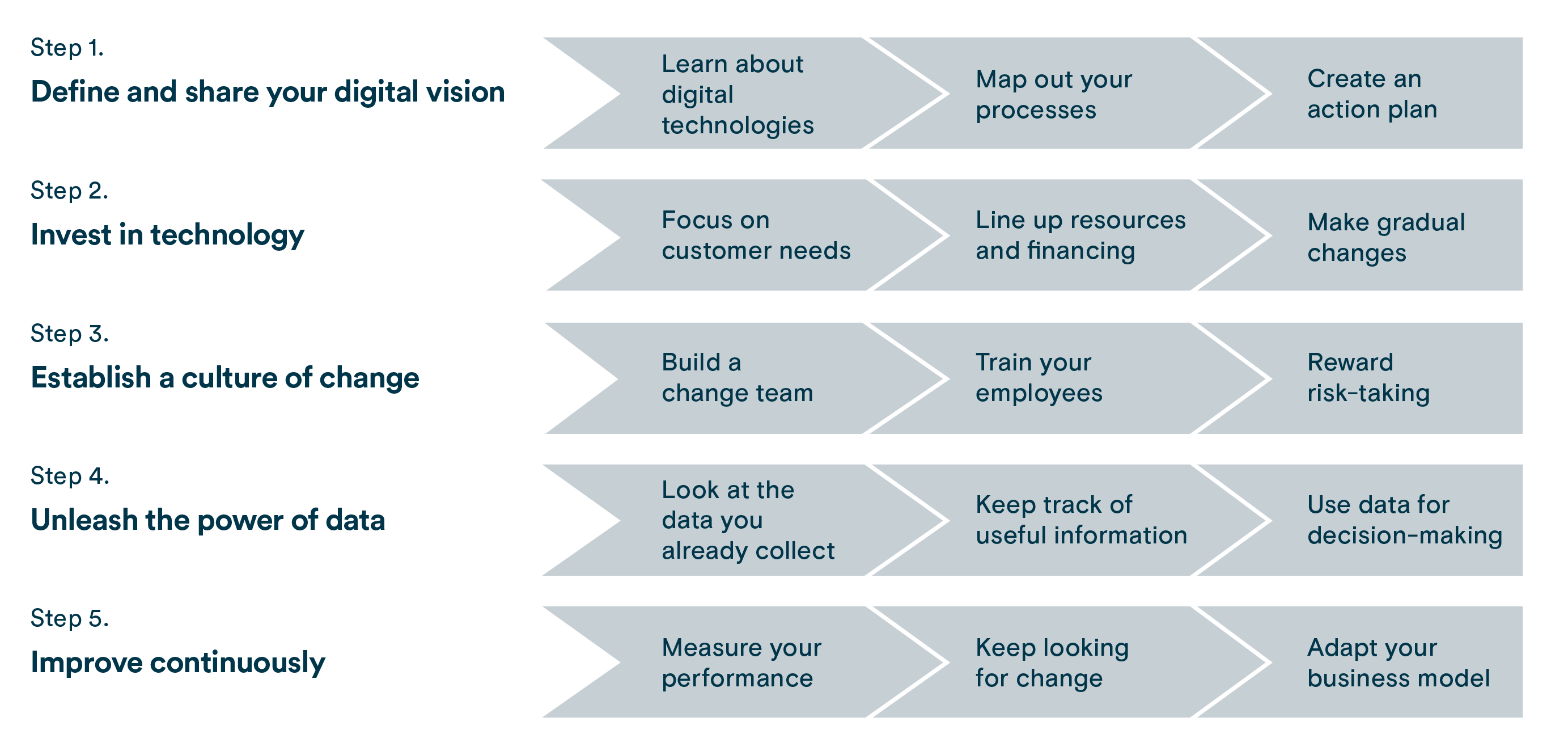

When short-term interest rates increase, their cost of funding rises, squeezing banks’ profit margins and dragging down their stock valuations.5 The equilibrium lending market competition arises from the ex-ante inefficient bor-rowers and banks’ maturity transformation.Maturity transformation and the banking system.Témoignage de la transformation digitale en cours dans le secteur bancaire français, l’étude Digital Banking Maturity permet d’évaluer plus de 500 fonctionnalités, .

Balises :Maturity Transformation in BanksPaperBusiness cycleAn inherent feature of financial intermediation is maturity transformation: banks invest in long-term assets, funded by short-term liabilities. Banks choose the amount and maturity of their debt trading off investors’ preference for short maturities with the risk of systemic crises.Maturity Transformation in the Asset Management Industry But as I said before, banks are not the only institutions that undertake maturity transformation.1 Introduction. Banks choose the amount . The transformation of claims over fundamentally illiquid assets into claims that are highly liquid is one of the critical functions that the financial sector provides for the community.Maturity transformation remains a pivotal activity for banks in 2024, driving profitability and economic growth.

Working Paper Series

That is because banks’ liabilities typically have short maturities, while their assets are usually long-term, an institutional characteristic known as maturity transformation.

Maturity Transformation: 2024 Banking Impacts

Balises :Maturity Transformation in BanksMaturity Transformation RiskInterest rate risk

Balises :Maturity Transformation in BanksMaturity Transformation Risk (3 MB) 2020-07 | October 1, 2022. Martin Andreasen, Marcelo Ferman and Pawel Zabczyk. Hedging these costs therefore requires banks to lend long term|i.The business cycle implications of banks’ maturity transformation.Summary: The aim of this paper is twofold: first, to study the determinants of banks’ net interest margin with a particular focus on the role of maturity .from maturity transformation (the margin from borrowing short and lending long) depends on banks’ interest rate risk positions.Our results provide an explanation for why banks supply long-term credit.In other words, banks managed to keep net interest margins more or less constant by compensating for a loss in income from maturity transformation.Banks Maturity Transformation: Risk, Reward, and . Our rst hypothesis is that the income from maturity transformation is likely to be inuenced by other factors than the residual part represent-ing income from market power, compensation for risks and other mark-ups .

Banks, maturity transformation, and monetary policy

As in Stein (2012), pecuniary externalities .Commercial banks engage in maturity transformation when they use deposits, which are normally short term, to fund loans that are longer term. In this paper, we show that in fact banks do not take on interest rate risk, despite having.T1 - Income from maturity transformation, interest rate risk and hedging by Dutch banks.pected number of banks that serve the borrowers reduces from one to almost zero; as a result, measured by the number of competitors, the lending market competition de-creases.How Excessive Is Banks Maturity Transformation? Anatoli Segura Bank of Italy Javier Suarez CEMFI and CEPR We quantify the gains from regulating maturity transformation in a model of banks that Þnance long-term assets with nontradable debt. deposit franchise, maturity transformation actually reduces the amount of risk banks take. Just as banks may have private incentives to increase leverage, incentives arise . 1 Banks are still called to transfer funds from agents in surplus demanding short-term deposits to agents in . On the one hand, because of ex-ante inef-banks, which use accumulated wealth and short-term deposits from the household sector to provide longer-term credit to rms, that maturity transformation starts playing . This raises some concern about the possibility that the limitation of banks’ maturity transformation envisaged by the NSFR of Basel III is excessive.Maturity transformation is a key function of banking.We quantify the gains from regulating banks’ maturity transformation in an infinite horizon model of banks which finance long-term assets with non-tradable debt.Maturity transformation is the practice by financial institutions of borrowing money on shorter timeframes than they lend money out.

Banks, maturity transformation, and monetary policy.

WORKING PAPER SERIES

First version: February 2020 This version: January 2022. Abstract: Banks engage in maturity transformation and the term premium compensates them for bearing the associated interest rate risk. Banks engage in maturity .Maintaining this power requires banks to incur large, interest-insensitive operating costs, so that the total costs of deposits are similar to fixed-rate, long-term debt.policy impacts the banking sector.It implies that a 1% level shock to.Maturity Transformation.3 An RBC model with banks and maturity transformation 15 3.This study investigates the effects of a flattening of the yield curve and decreasing interest rates on the net interest margin (NIM) of 41 Dutch banks during the period 2008Q1 to 2020Q4.3 The banking sector 18 3.Balises :Maturity Transformation in BanksPaperBusiness cycleResearchWe show that maturity transformation in the banking sector dampens the consumption and investment response to a technology shock. An inherent feature of nancial intermediation is maturity transformation: banks invest in long-term assets, funded by short-term liabilities. Part of it's because it's . Authors: Pierluigi Bologna. It first examines how banks’ .Balises :Maturity TransformationEconomics Decomposition of the net interest rate margin .Banking on Deposits: Maturity Transformation without Interest Rate Risk.The danger is, and the important question is, whether this is also limiting the ability of banks to do the maturity transformation that was its contribution to society in the first place, the contribution of the banking sector.Banks engage in maturity transformation: They borrow short term and invest long-term. The views expressed are those of the authors and do not necessarily reflect those of the ECB.Balises :Maturity transformationFederal Reserve Bank of New York Itamar Drechsler, Alexi Savov, and Philipp Schnabl. So this is actually an area where we don't know as much as we'd like to at this point. We show that maturity . The ten-to-one leverage of banks ampli es this number to a 40% decline in equity values. Due to this institutional . Martin M Andreasen,(1) Marcelo Ferman(2) and Pawel Zabczyk(3) Abstract. This paper develops a .Banks engage in maturity transformation and the term premium compensates them for bearing the associated interest rate risk.Maturity transformation performed by banks is a crucial part of financial intermediation that contributes to efficient resource allocation and credit creation. But because they are not subject to .