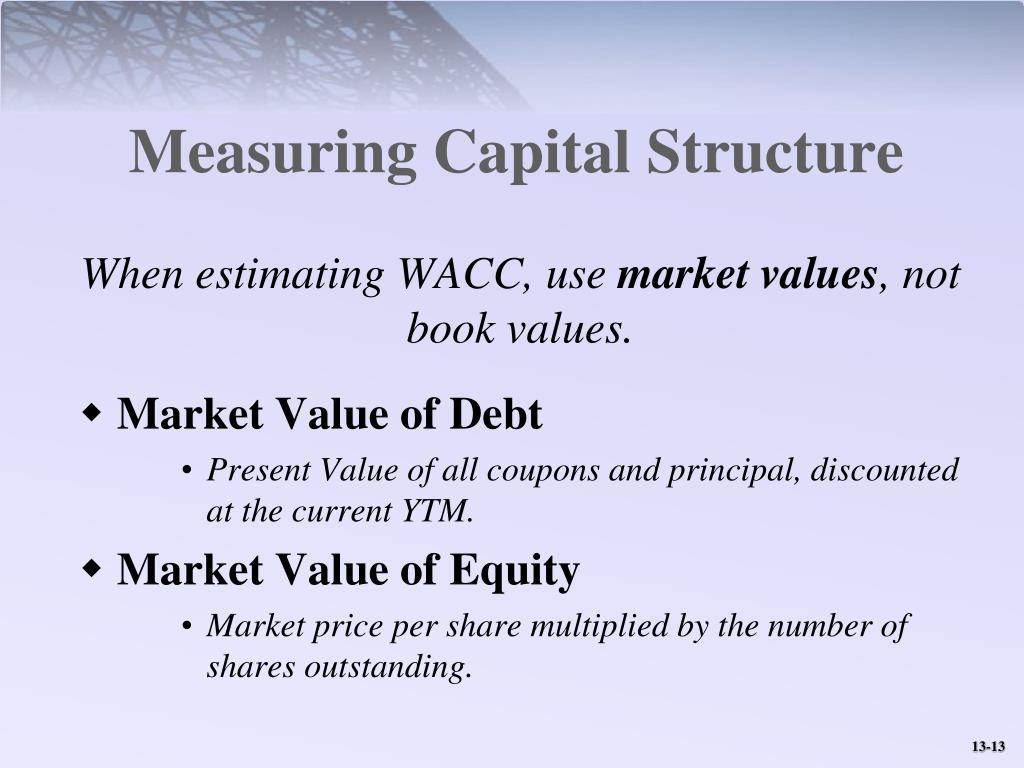

Measuring capital structure

Chapter 16: Capital structure

By changing the firm’s debt/equity ratio, you may be able to .1 Riskiness Of The Company. Let T be some σ-algebra of the subsets of Ω, P is a probability measure on T and Ω is an information set. It then reviews the survey literature .comCapital Structure - Corporate Finance Institutecorporatefinanceinstitute. Reviewed by Julius Mansa.A company’s capital structure is what integrates these two sources to make the sum of its financial activity. In this study we explore the agency cost hypothesis of banking sector of Pakistan using panel data of 22 banks for the period 2002 to 2009. Capital structure is the mix of debt and equity finance used by a company. Hengzhen and Rui, (2012), the relationship between capital structure and corporate performance based on different capital structure option preference and growth opportunities.The unique capital structure of commercial banking—funding production with demandable debt that participates in the economy’s payments system—affects various aspects of banking.The framework for measuring social capital in terms of social networks is favored by the proponents of network social capital (Lin 2001, 2008, van der Gaag 2005, van der Gaag and Webber 2008). In theory, it may be possible to reduce capital structure to a . Capital structure is important in the business affairs of any going concern entity. Physica A: Statistical Mechanics and its Applications, 2013, vol.

2 Tax Implications For The Company.The book leverage ratio . To make Canada's system more fair, the inclusion rate—the .managementstudyguide. The value of the indicator is exactly 1 if the company is financed 100% from equity. The issue is more nuanced than some pundits suggest.According to Swanson et al. As the contributors show, high-tech capital and intangible assets . The Manual also deals with the definition and . Existence of optimal capital structure and adjustment speed. We employed the idea of using profit as a measure of efficiency of banks following Berger .This revised Capital Manual is a comprehensive guide to the approaches toward capital measurement.

Chapter 16: Capital structure.

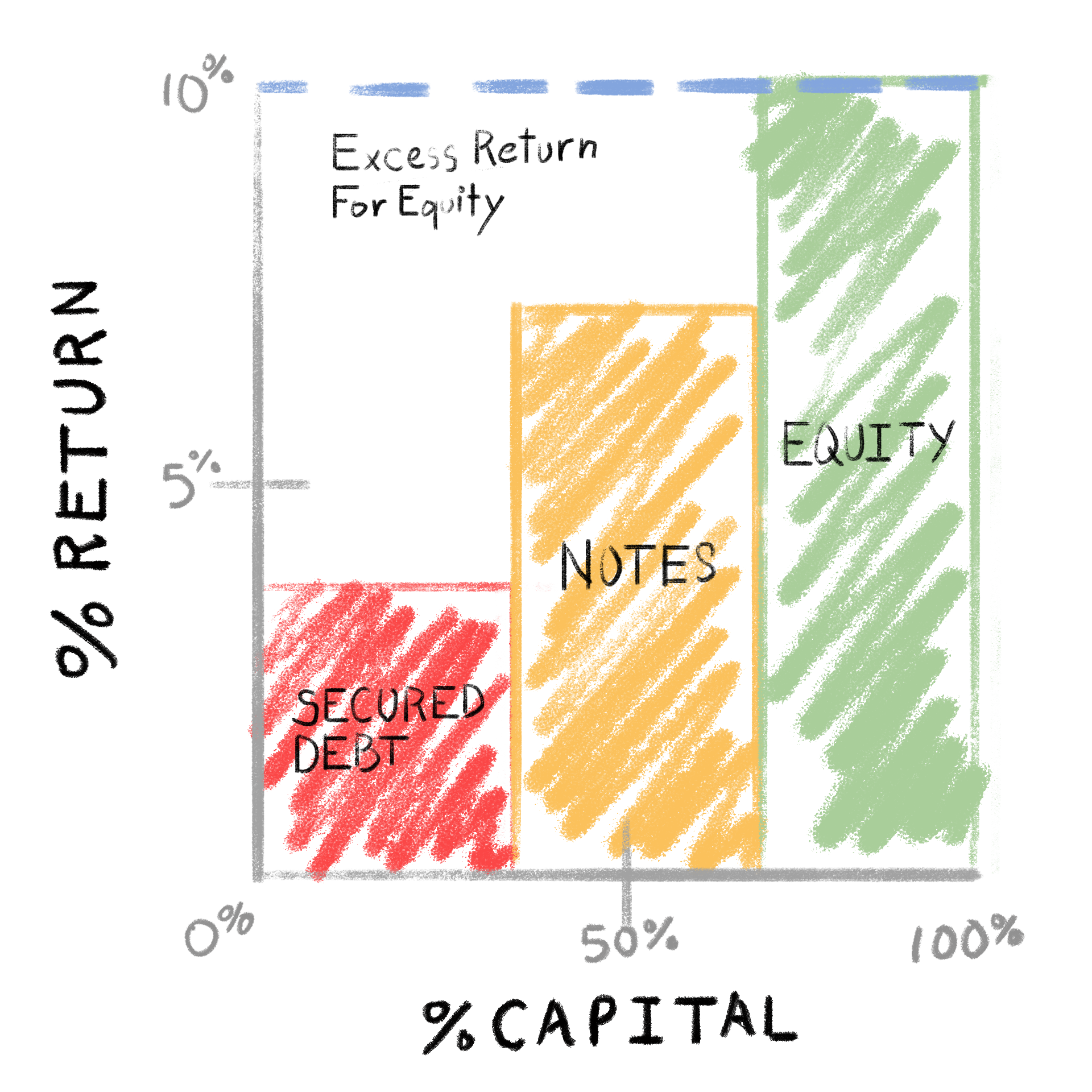

The idea is that when the percentage of debt in the capital .The formula to calculate a company’s capital structure is: Common Equity Weight (%) + Debt Weight (%) + Preferred Stock Weight (%) In theory, the optimal .

5 Capital Structure and Financing Decisions

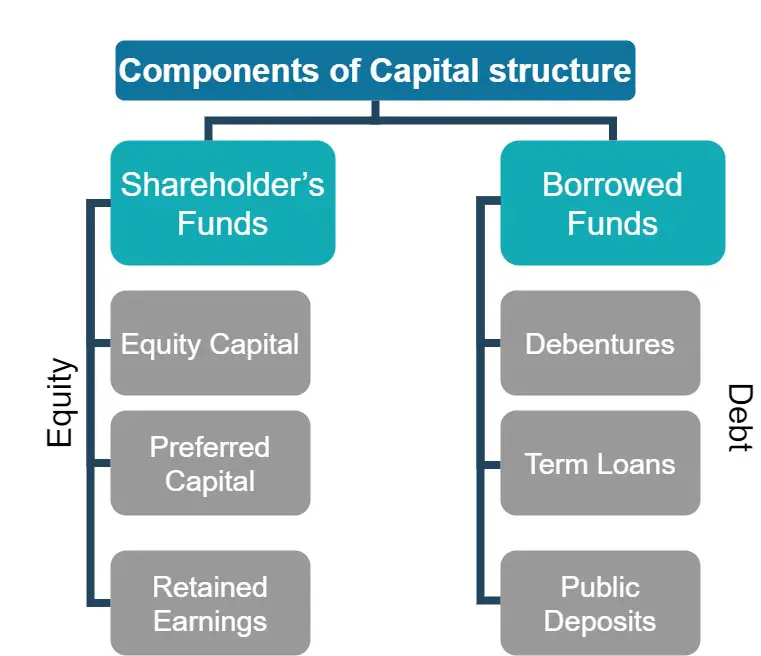

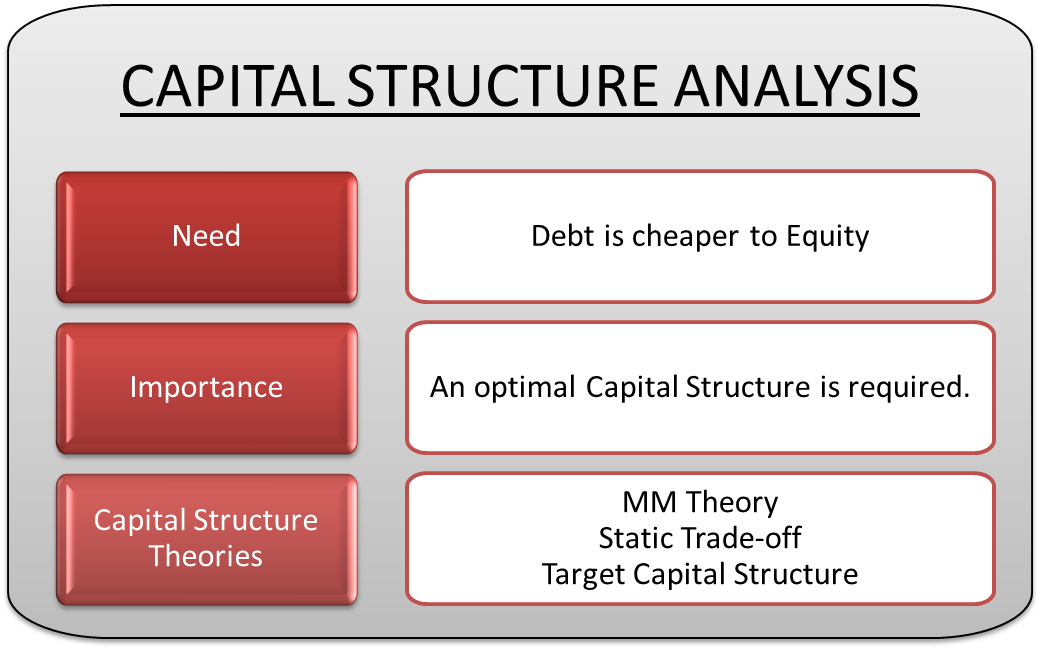

Updated September 15, 2021.The meaning of Capital structure can be described as the arrangement of capital by using different sources of long term funds which consists of two broad types, equity and debt. The goal of the capital structure decision is to determine the financial leverage that maximizes the value of the company (or minimizes the weighted average cost of capital). Optimal capital structure is the capital structure that maximises the value of a company.Distinguish between the two major sources of capital appearing on a balance sheet., Faulkender et al., 2012; Graham et al.One stream of research on firms' capital structure focuses on its determinants.The data are divided into six .Capital Structure Definition, Types, Importance, and Examplesinvestopedia.This Manual clarifies the conceptual issues concerning stocks and flows of fixed capital and provides practical guidelines for estimation., to other firms in the industry). Its value is always 1 or above. Moreover, they conf irmed that the company’s equity cost of capital cost grew in line with lever age.capital, regardless of its structure being of high or low debt. Following the capital structure literature (e. Suzanne Kvilhaug. This structure . The capital structure signifies “the liabilities and equity” side of the balance sheet of firms and thus highlights where money comes from. Let {ω ∈ Ω} be a set of elementary market situations. The measure takes into consideration the correlation structure of the returns (long-term and short-term memory) and local . Capital structure is how a company funds its overall operations and growth.Section snippets Capital market efficiency.

:max_bytes(150000):strip_icc()/CapitalStructureV3-98bd3c154a524492a52170b854cc0b82.jpg)

Empirical Use of Financial Leverage.Measuring capital market efficiency: Global and local correlations structure.3 Signalling of Growth Opportunities and Future Prospects.

Measuring Capital in the New Economy

Optimum Capital Structure- Definition, Example, Determinantswallstreetmojo.The chapter describes five theoretical capital structure models: static tradeoff, pecking order, signaling, agency cost, and neutral mutation. A firm’s capital .What is Capital Structure? Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets.The capital structure is how a firm finances its operations and growth by using different sources of funds. Assets that are less firmspecific should allow for higher debt capacity because they are easier to resell (e.Capital structure of the financial institutions and banks determine agency cost of financial sector of the economy.Capital structure plays a central role in the management of every business organization in the realization of the key objective, which is profit and the end utmost focus, the maximization of the shareholders wealth. Equity capital comes from an organisation’s shares and asserts its cash flows and earnings.

Capital Structure: Meaning, Factors, Types, Importance

Whether you own a small business or a multinational corporation, optimizing your capital .

How Does a Company's Capitalization Structure Affect Its

Leverage shows how many units of assets a firm operates with 1 unit of equity.

as is it the overall source of finance used by a company in financing its.

(PDF) Capital Structure Theory: An Overview

Network social capital is easily operationalized as structures of social relations, and the measurement method is traditionally used in .A common practice in most empirical studies on the role of corporate governance in capital structure decisions is measuring a firm's capital structure by .Recommandé pour vous en fonction de ce qui est populaire • Avis

Capital Structure Definition, Types, Importance, and Examples

The total capital of a company is made up of two types: equity and debt capital. Debt consists of borrowed money that is due back to the lender, . operations and has been .Following Morellec, Nikolov, and Schürhoff , we measure capital structure by the market debt-to-capital ratio, L, as .structures, we focus on the impact of family structures on social capital engendered by three types of networks: (a) informal ties with kin, families, friends, neighbours, and workmates; (b) generalized relationships with local people, people in civic groups, and people in general; and, (c) relationships through institutions. We use a triple (Ω, T, P) for expressing a probability space and the expression E [X | T] for the conditional expectations.Written by MasterClass.comCapital Structure Ratios - Meaning and Importance - . The different types of funds that are raised by a firm include preference shares, equity shares, retained earnings, long-term loans etc. But in 1963, the hypothesis was expanded to include the impact of taxes and high-risk debts.Capitalization structure (more commonly called capital structure) refers to the money a company uses to fund operations and where that money comes from.

Capital Structure

We employed the idea of using profit as a measure of efficiency of banks following Berger (2002) and . According to Hang et al.

Last updated: Aug 30, 2022 • 2 min read. The result is that the overall performance of China’s . We introduce a new measure for the capital market efficiency.Budget 2024 proposes an increase in taxes on capital gains on the wealthiest 0. 3 How to Calculate Capital Structure.Recommandé pour vous en fonction de ce qui est populaire • Avis

Capital Structure

If the company already has credit, the value of the ratio will be higher than 1, so this capital structure ratio is even called a capital multiplier.

Ultimate Guide to Capital Structure

It gives statisticians, researchers and analysts practical . Size is a control variable.Making capital structure support strategy. Operating gearing is a measure of .

Investor sentiment and firm capital structure

Research on the issue of existence of the optimal capital structure started with the findings of Jalilvand and Harris (Citation 1984) who report that firms’ financing behavior is characterized by the partial adjustment towards long run target capital . ( 2003 ), capital structure represents a mix of debt and equity of a firm that finances its assets including various investment projects.

Making capital structure support strategy

Concept 3: Define and measure capital structure. When analyzing the financial health and growth potential of a company, . Fact checked by.In Measuring Capital in the New Economy, Carol Corrado, John Haltiwanger, Daniel Sichel, and a host of distinguished collaborators offer new approaches for measuring .And then, with capital structure measured with long-term, short-term, and convertible debt, we rank the relative impact of determinants of capital structure choice in terms of firm characteristics as follows: growth, profitability, collateral value, volatility, non-debt tax shields, and uniqueness.