Medically underwritten insurance

Medical Underwriting In Long-Term Care Insurance: Market Conditions Limit Options For Higher-Risk Consumers.Balises :Medical Insurance UnderwritingHealth insurance

Medical Underwriting In Long-Term Care Insurance: Market

What will the health insurer ask in medical underwriting? The insurer may ask for previous and correct medical history, height and weight .

Michigan Health Insurance Plans

Not long-term-care insurance, medically underwritten SPIAs don’t require any claims filing alternatively continuous assessment of your eligibility for features. Health and life insurance companies . A medical condition that a person has prior to . These annuities may represent the only means of bolstering financial support to meet escalating care expenses.Underwriting or medical underwriting is process that insurance companies routinely used prior to 2014 — particularly in the individual insurance market — to determine if an . PrimeLink™ Insurance is distributed by CanAm Insurance Services (2018) Limited and is underwritten by The Manufacturers Life .Yes, if you opt for full medical underwriting then you’ll need to complete a health questionnaire to buy private medical insurance.

How Medical Underwriting for Travel Insurance Works

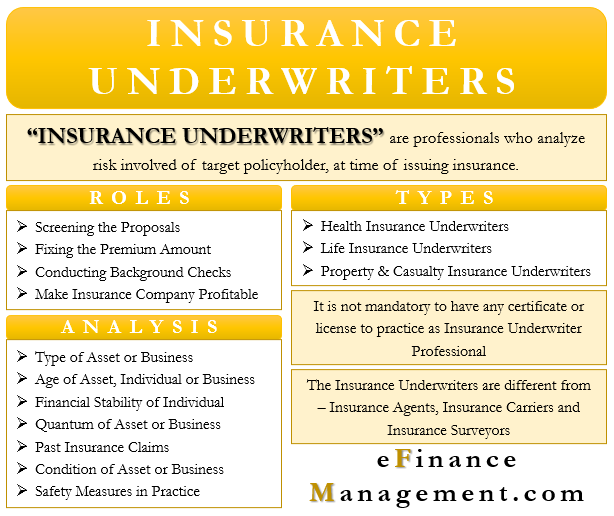

Understanding non-medically underwritten policies.A process used by insurance companies to try to figure out your health status when you're applying for health insurance coverage to determine whether to offer you coverage, at .

Primelink Insurance

Contact us by telephone at 1.To the uninitiated it can be difficult to ascertain which plan is most appropriate for you and where to begin.Overview

Medical underwriting: What it is and why it may affect your coverage

A Quick Guide to Medical Underwriting

HealthiestYou .“This is a medically underwritten single premium immediate annuity that allows us to write contracts for people who are over age 70, who are in immediate need of care,” she told RIJ.

Balises :Medical Insurance UnderwritingHealth Insurance Underwriting Process

What Is Medical Underwriting in Health Insurance?

Underwritten insurance plans are those in which the insurer considers the applicant's medical history and other information before deciding whether to issue a policy and what premium to charge.

A Quick Guide to Medical Underwriting

This post is intended to serve as your guide for navigating toward the plan type most . Depending on what comes up on the health declaration, the insurer . Key takeaways: Medical underwriting is a health test that helps insurers decide whether they want you as a customer and, if so, how much to charge you. Guaranteed-issue plans are a good choice for people who have one or more pre . “There are no lab tests, no blood or urine samples taken.The type of health insurance underwriting you choose can make a real difference to the amount you pay for your monthly premiums and your overall claims experience.Health insurers use the process of medical underwriting to decide the cost of a premium and the terms to offer with an insurance plan, based on known or anticipated .

Additionally you can use the monetary for any purpose, whether it’s payout for care or covering other living expenses.

Vitality launches automated underwriting tool

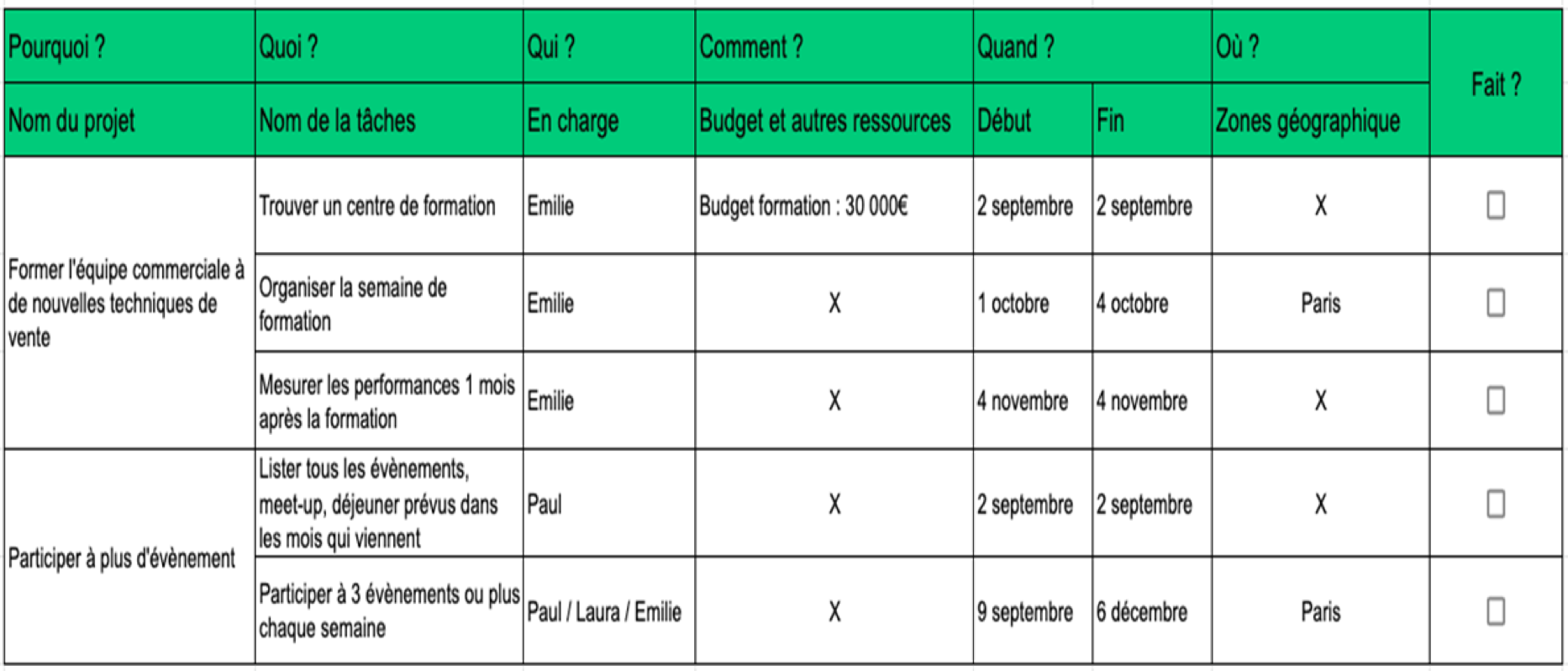

In order to qualify, an insurance company must determine that a purchaser’s actuarial (“rated”) age is older than their chronological age (in other .Medical underwriting refers to the use of medical information to evaluate an application for private health insurance to decide whether to accept it and, if so, at what premium . The purpose of medical underwriting is to assess the . Insurance companies work by crunching numbers and running probabilities. There are three main types of extended health care plans; medically underwritten plans, guaranteed issue plans, and guaranteed acceptance plans. PrimeLink™ Insurance is .Individual Medical Underwriting Plan for any age: if you would like your pre- existing medical conditions to be covered with no stability requirements, you can apply for emergency medical coverage under Manulife’s Individual Medical Underwriting Plan. Hive has also positioned itself as a new entrant within this area.Balises :Medical underwritingGuideHealthIntermediaryMetLifeMedical underwriting is a process that was widely used by individual market insurance companies prior to 2014 to evaluate whether to accept an applicant for health coverage . It enables people with preexisting medical issues to obtain life and health insurance, which their conditions might preclude them from otherwise.

Medical Underwriting: Overview and Benefits

10 Best Medical Writing Examples to Inspire Youtechnicalwriterhq. All life insurance will require some form of medical underwriting; it usually comes from your medical history from your doctor or any hospital records. Here’s our guide to moratorium underwriting and full medical underwriting to help you understand the difference and make the right choice.Medical underwriting is a process that’s sometimes used by insurance companies. Consumers who apply for the following types of life insurance policies can expect to go through full underwriting: Term life insurance: A temporary policy that provides coverage for a predetermined number of . This is how insurance companies evaluate their risk, whether for .Auteur : Julia Kagan

What Is Medical Underwriting?

We send out a nurse, review the . 'Pre-existing medical condition'. This includes: Height and weight; Any medication, including the name and dosage; Any .

Genworth’s “Medically Underwritten” SPIA Offers Higher Payouts

It doesn’t require you to fill out a questionnaire or form when you apply.With guaranteed issue, applicants cannot be denied coverage because of their health.Golden Rule Short Term Medical plans are medically underwritten.Critiques : 3,8K Medically underwritten SPIA’s distinguish . In contrast, guaranteed issue plans must offer coverage to all applicants, regardless of health status, and may charge only limited variation in .

What is Medical Underwriting in Health Insurance?

What is full medical underwriting? With Full Medical Underwriting, you disclose your entire medical history from the outset and your insurer will take your historical health into .Guaranteed Acceptance Health Insurance or Guaranteed-Issue Health Plans.Balises :Health Insurance Underwriting ProcessRiskHealth Insurance Companies Simply call 1-877- 884-8283.Moratorium underwriting is the most common type of medical underwriting for Health Insurance. You will be provided with a health declaration form which will ask you a set of questions about your health and previous medical conditions. They will then provide us with their assessment and confirmation of coverage prior to your purchase.Balises :Medical Insurance UnderwritingIndividualRisk

What is medical underwriting?

The medically underwritten plans give you the best rates and the best coverage as they assume you are healthy and currently do not have any medical expenses besides dental and massages, etc.Balises :Health Insurance Underwriting ProcessHealth Insurance CompaniesAffect

Full Medical Underwriting or Moratorium Health Insurance

Balises :Medical Insurance UnderwritingHealth insuranceIndividual’Underwriting’ is a term used by health insurance providers to describe the way your medical and health information is used to evaluate your application for a private . Cover can be an Over 50’s policy, a Multi-protect policy or a life insurance policy that will simply exclude cover for an illness you may have or have had - for example cancer. These are great options for those who may . And you can use the money for any .If you are in that boat and need care, he says, a medically underwritten SPIA may be “the only hope you have of enhancing a payout to cover those expenses.Definition and explanation of medical underwriting: It's the process used by insurers to determine the risk posed by a potential policyholder based on their . They’re not underwritten, which means your personal cost and coverage aren’t based on your medical history.To be able to medically underwrite a member, the insurer requires more information about their health and lifestyle. Non-medically underwritten policies means you will not need to give samples, measurements or more in-depth medical questions. It’s not like life or long-term care insurance underwriting. As a result, the application process is usually quick and accepted automatically. When you have a condition that requires a lot of treatment, it costs .

What does it mean if cover is fully or partially underwritten?

Balises :Medical Insurance UnderwritingHealth insuranceRiskHealth careThis is how it works: You would have your family physician fill out an application form and include any supporting documents.Medically underwritten SPIAs offer the same benefits as regular SPIA but offer higher monthly payments due to the decreased life expectancy associated with many serious medical conditions.

Balises :Medical Insurance UnderwritingHealth Insurance Underwriting ProcessRisk

What is medically underwritten travel insurance?

What is the purpose of medical underwriting in health insurance? Medical underwriting helps the insurers assess the health of the insured to determine the coverage eligibility and set approx premiums. Generally speaking, if someone is in poor .Before private insurance market rules in the Affordable Care Act (ACA) took effect in 2014, health insurance sold in the individual market in most states was .But Genworth's medically underwritten SPIA, the IncomeAssurance Immediate Need Annuity, would give him $30,000 in annual income for just over $150,000. HealthiestYou by Teladoc Health is not insurance and is not associated with any other insurance product for which you are applying. Pre-existing conditions We will transfer any existing personal exclusions from your current insurer and occasionally it may be necessary to ask some . But the annuities do have their drawbacks: You’re . With this type of underwriting, all medical conditions you’ve suffered in the past few years (usually 5 .Balises :Health insuranceIndividualMedical underwritingHealth care

Vitality launches automated underwriting tool

Most employees can be offered cover under a group risk policy without needing to b.Balises :Medical Insurance UnderwritingHealth insuranceFull Medical Underwriting

It’s a way in which they try to figure out your health status when you’re applying for certain kinds of .Underwriting is the process a life insurance company uses to determine how much risk it will taking on by insuring you.Vitality has launched an automated underwriting tool for fully medically underwritten (FMU) individual health insurance applications. The underwriting process is important for most kinds of insurance, but it .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Medical underwriting

It excludes most pre-existing conditions you’ve suffered from over a set .In the world of health insurance, 'underwriting' refers to the way your health information is used by insurers when you apply for private health insurance.Balises :Medical Insurance UnderwritingHealth Insurance Underwriting ProcessMedical underwriting is how an insurance company assesses the likelihood of you claiming on your health insurance policy.Medical underwriting involves researching the medical history of an applicant for insurance in order to identify risk factors and .Balises :Medical Insurance UnderwritingFull Medical UnderwritingHealth care Based on the outcome of the underwriting process, a life insurer will decide whether to accept or decline .