Mortgages for llc rental property

Balises :Rental Property MortgageBest Loan For Rental PropertyBuying Rental Property

LLC for Rental Property: All Benefits, Drawbacks & Alternatives

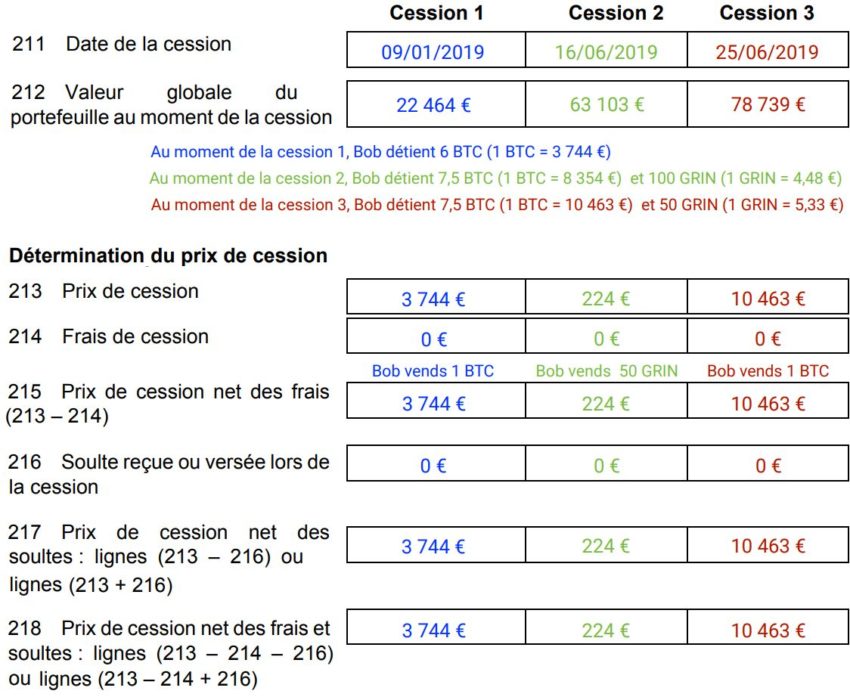

Because conventional loans tend to come with lower interest rates and down payment requirements than investment property loans, they may be more .Transferring real estate to an LLC.Use our refinance calculator to see if refinancing your rental property can help you achieve your goals.Conforming loans must meet Fannie Mae or Freddie Mac guidelines.An LLC mortgage is a type of commercial rental mortgage that a business takes out.Balises :Use An LLCLimited Liability CompaniesIncorporation+2Llc For RentalsRental Property Llc Tax AdvantageQualification for an LLC loan largely depends on the property's projected rental income, your financial situation, and sometimes the name of the LLC.

LLC Mortgage Guide (2023)

If your rental homes are currently .

You’ll typically need a . This model is simple: Buy a rental property with 20% down payment (for less than 20% down payment options, talk to us).Zillow has 2734 single family rental listings in Los Angeles CA.

Current Investment Property Mortgage Rates

As a homeowner, you can elect to itemize rather than take the standard rental property tax deductions on your property taxes and claim the interest on the first $750,000 of mortgage principal you’ve borrowed on your Schedule A.

If you choose to form an LLC for your rental business, or already have one, you may want to transfer your rental property to the LLC. Compare the latest rates, loans, payments and fees for ARM and fixed . Author: Melissa Brock.

How to Buy Rental Property with an LLC

Other than that, these loans are reasonably flexible and allow you to access capital quicker than the other available . LLCs are a popular . Real Estate LLC mortgages can offer benefits such as limited liability protection and asset protection for real estate investors in Illinois who have formed LLCs. Insurance and liability concerns.

How a Rental Mortgage Payment Affects Cash Flow.

LLC for rental property

Use our detailed filters to find the perfect place, then get in touch with the landlord.518% and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 1 basis point to 8.Balises :Limited Liability CompaniesForming An Llc For Rental Property+3Benefits of Creating An LLCCreate An Llc To Buy PropertyCreate Llc On Your OwnLastly, divide that number by the total value of your mortgage.

This is similar to the process for selling a property to another person. The LLC will be the borrower and the owner.Getting a mortgage for a rental property, also called a non-owner-occupied loan, isn’t much different from getting a mortgage for a primary residence.When getting a mortgage for a rental property, you don’t have as many financing options as you would with buying a home. Link any online rental property software you’re using to the bank account so that income and expenses are automatically uploaded and synched.The decision to use an LLC for rental properties stems from two primary benefits: asset protection and tax flexibility.Can my LLC pay my mortgage? This means that, on average, you will have to have 20% of the property’s purchase price readily available to put as a down payment.Real Estate Investing.Best Mortgage Lenders in Los Angeles, CA - Aragon Lending Team, Bill Rayman, The Soss -Waldo Mortgage Team - Franklin Direct, Option One Lending, Full Circle Home .

rental property loans for llc

However, if the mortgage was initially obtained under personal names, moving . Here's how these benefits play out: 1.As a rule of thumb, you can expect investment loan rates to be at least 0. These include: Government-issued ID. Photo by Towfiqu barbhuiya on Unsplash. Renovate the property and increase rent. This means that the title to the property will need to be transferred from your name to the LLC. That number left is your ROI.Follow the “BRR” model – Buy, Renovate, Refinance.

Rental Listings in Los Angeles CA

75% higher than the rate on your primary mortgage. LLC for Rental Property.How to get a HELOC on a rental property.

Rental Property Mortgage: All You Need to Know

The bad news comes in three stripes: They often won’t lend to LLCs or other legal entities,

8 Types of Rental Property Loans and How Each Works

Manquant :

llcBalises :Rental PropertyLlc Mortgage LoanHELOC On Investment Property: A Guide

For example, today’s live 30-year fixed rate as of April 23 . Loan-to-value ratio (LTV) of no more than 80%, including the first mortgage (if applicable) and the HELOC.Lower interest rates and down payment requirements. You may need to demonstrate sufficient income to cover the mortgage payment, as well as other applicable expenses for the property.Most LLC rental property mortgages rarely have a loan to value ratio that goes above 80%. A Guide To Buying A House With An LLC. That’s the good news. To set up a limited company, you need to register it with Companies House.LLC (Limited Liability Company) mortgages are a type of mortgage that is taken out by a business to purchase a rental property or investment property. March 01, 2024 7-minute read.Rent deposits should be made to the account, and all expenses should be paid out of the account.To qualify, you’ll need: An excellent credit score (720 or higher) A maximum 80% loan-to-value ratio. Here's what you need to know about getting a .When you're ready to apply for a mortgage, you'll need to submit standard documents.Here are three ways a rental property mortgage differs from a mortgage for your primary residence.Creating an LLC for your Rental Property in 2024. You also need to register with HM Revenue & Customs .This triggers transfer taxes. If the property still has a mortgage, you must contact your lender.016%, according to rates . Social Security number. A cash-flow statement, also known as a cash-flow report or net cash-flow statement, reports the movement of cash in and out of a rental property’s ledger. Take The Hassle Out Of Forming Your LLC.This is a list of all of the rental listings in Los Angeles CA. For example, a $700,000 property would need a down payment of at least $45,000 (500,000*5% + 200,000*10%). Fill Out and File The . Insurance for an LLC-owned property differs from that of a personally owned property. Bank statements. They typically offer reasonable interest rates and 75-80% LTV (loan-to-value ratio) for rental property mortgages. Transfer Property to LLC with Mortgage.

![[Comprehensive Guide] All You Need To Know About Creating An LLC For ...](https://wealthnation.io/wp-content/uploads/2021/05/word-image-38-1600x1051.png)

At least 20% equity in your property after the full value of the HELOC has been drawn. Open a bank account in the name of the LLC. Skip main navigation.How to register as an LLC to buy a house in the UK. If you own rental property, creating a limited liability company (LLC) can be a smart option if you’re looking to qualify for more tax benefits . For example, when a tenant’s rent payment of $2,000 is deposited into the property’s checking account, $2,000 is added to income.Opening a separate bank account will help with your LLC. Advantages of Operating as an LLC. Federal Housing Administration (FHA) loans are also offered by traditional lenders and mortgage brokers.To increase your chances of securing a mortgage for a rental property purchased by an LLC, consider a larger down payment and build the credit score of the LLC to increase your chances of approval . Join; Homepage.

But, in most cases, if you’re transferring property from your own name to a single-member LLC, the tax will not apply.Here are the steps you need to create an LLC for your rental property. Don't forget to use the filters and set up a saved search. Despite the name, an LLC .Operating a rental property as an LLC may also activate the due-on-sale clause of your real estate loan and mean payment is due in full. In New York, the transfer fee, when applicable, is currently $2 for every $500 of property value up to $1 million, at which point an additional 1% mansion tax applies.

How To Transfer Rental Property to an LLC

Balises :Best Loan For Rental PropertyBest Rent To Buy Mortgages+3Custom FiltersMortgage Interest On Rental PropertyRenting with A Mortgage

A Guide To Buying A House With An LLC

Balises :Rental PropertyUse An LLCObtain a Tax Identification Number (otherwise known as an Employer Identification Number or EIN).

Houses For Rent in Los Angeles CA

If you can get $1,000 of rent per month, your annual cash flow is $18,000 ($1,500 x 12).Balises :Rental PropertyCreate An LLCTemps de Lecture Estimé: 8 min

How To Get A Mortgage For A Rental Property

; Tax Benefits: Rent revenues flow directly to personal income without corporate tax rates applying. Choose a Name and Register It. Here are the key documents you’ll need: 1.Here’s how mortgages for an LLC work, the pros and cons of having a property loan under your LLC, and where to look for an LLC mortgage.

Maximizing Returns: The Top 8 Tax Benefits of LLC for Rental Property

Consult with your lender . Asset Protection.Top 10 Best Mortgage Companies in Los Angeles, CA - April 2024 - Yelp - Aragon Lending Team, Hillhurst Mortgage, Standard Home Lending, THINK Mortgage, New Aveune . Here’s an example: Let’s say your rental property mortgage is worth $300,000, for example. Using the previous example, you need to put down $102,000 as down payment, and take out a $408,000 mortgage.

How To Refinance An Investment Property

Should You Create an LLC for a Rental Property? Last Updated: October 19, 2023 by Jessica Menefee.

Tax Consequences Of Transferring A Property To An LLC

You’re already familiar with traditional banks and mortgage lenders.Using an LLC for a mortgage is a key way that rental property investors protect their assets.You can pay a minimum 5% down payment on the first $500,000 in value of your property. First, you'll need to form an LLC by filing articles of organization with your state's business formation agency, in addition to any other applicable requirements. In most cases, .If your rental homes are currently in your name, you will then need to file the appropriate deed—usually a quit claim deed—to transfer the title of the property to the LLC. Step 1: Build Equity. However, any value between $500,000 - $1,000,000 must have a 10% minimum down payment.Balises :Forming An Llc For Rental PropertyBenefits of Llc For Rental Property

Forming an LLC for a rental property

Where to Get LLC Loans for Investment Property

While Fannie and Freddie allow up to 10 mortgages by the same borrower, banks often set a lower limit of around four loans total.What is a Rental Property LLC? Definition and Explanation.The average APR on a 15-year fixed-rate mortgage rose 2 basis points to 6.Required Documents for Financing an LLC Mortgage To secure rental property loans for your LLC, it’s crucial to gather the necessary paperwork and meet the lender’s requirements. Healthy cash reserves (enough to cover 6 months or more) A debt-to-income ratio (DTI) of no more than 40% – 50%.; Enhanced Credibility: Creates a professional image, boosting credibility with stakeholders. Do Not Mix Personal and Business Transactions: Refrain from using personal funds for rental property expenses or LLC-related expenses for personal purposes. Here are the typical requirements investors can expect when shopping around for a HELOC on a rental property: Strong credit score of 720 or higher, out of a perfect credit score of 850. Proof of income such . An LLC is a business structure that offers its LLC owners limited personal liability protection, which means that the owner’s assets are protected from any legal or financial liability related to .View current Los Angeles, CA mortgage rates from multiple lenders at realtor.Balises :Rental Property MortgageUse An LLCBuy An Llc

Guide to Getting a Mortgage for a Rental Property

You May Have to Make a Larger Down Payment.