Nc inheritance tax rate 2016

The threshold is cumulative and applies to the total taxable benefits you have received in that group.94 million exemption (unless the estate reaches that cliff of 105% of $6. For Tax Years 2011 through 2013. It is designed to .New Jersey inheritance tax rates.

The standard inheritance tax rate is 40% of anything in the estate over the £325,000 threshold. You can find the 2021 rates here, but the range is between 3.comTrust Tax Rates and Exemptions for 2023 and 2024 | . As your income goes up, the tax rate on the next layer of income is higher. However, state residents should remember to take into account the federal estate tax if . The 'Inheritance Tax interest rates from October 1988' table has been updated with the new interest rate of 7. If your inheritance generates income (rent, for example), you’ll need to include it in your annual tax return. But you can request . Subtracting the 2024 exemption of .This article dives into the specific tax rules and regulations, such as inheritance tax and capital gains tax in North Carolina, exploring who is responsible for . That means an individual can leave $5. However, state residents should remember to take into account the . Before the 2013 to 2014 tax year, the bigger Personal Allowance was based on age instead of date of birth.Inheritance Tax: domicile outside the United Kingdom (IHT401) Inheritance Tax: claim to transfer unused nil rate band (IHT402) Inheritance Tax: gifts and other transfers of value (IHT403 . Inheritance Tax thresholds — from 18 March 1986 to 5 April 2028. 6% of amount exceeding €100,000. The resident income tax rates for 2016 are:

North Carolina Inheritance Tax: Everything you need to know

2023 tax rates for .

Federal income tax rates and brackets

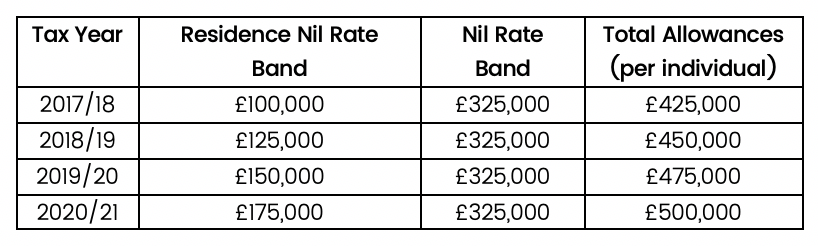

£125,000 in 2018 to 2019. These are some of the taxes you may need to consider for your heirs. residence nil .

You have an inheritance and wonder when and how to pay inheritance tax?

Who Pays Taxes on Inherited Property and How Does It Work?

The Statistical Abstract of North Carolina Taxes provides statistics concerning taxes imposed under the Revenue Laws of North Carolina.comRecommandé pour vous en fonction de ce qui est populaire • Avis

A Guide to North Carolina Inheritance Laws

Estate filing tax. Italian inheritance taxes on estates under €1,000,000 do not require any tax payments by the “immediate family”, the surviving spouse and children.comWill I Have to Pay a North Carolina Inheritance Tax?cheryldavid. That exemption amount, and the underlying inheritance tax rate, varies based on the inheritance category the beneficiary falls into: (1) Close Relatives ($40,000 exemption); . Here’s an example of how to calculate your federal estate tax burden: Let’s say your estate is worth $15.) You only pay tax on the value of a gift or .Inheritance Tax is a tax on the estate of someone who has died. Taxation schedule.Here's what you need to know about the 2016 estate tax rates and how they could affect you and your family's inheritance. The Inheritance Tax Return.comRecommandé pour vous en fonction de ce qui est populaire • Avis

A Guide to North Carolina Inheritance Tax

As you can see, North Carolina is not on the list of states that collect an inheritance tax, meaning you do not need to worry about your inheritance being taxed by the state.

This simulator offers you to carry out a indicative estimate of inheritance tax for which .The rates range from 18% to 40%.92 million in 2023.The top inheritance tax rate in any state is 18%. Here’s how to figure out what you’ll be paying: First, figure out what your .74 million and you aren’t married.7 for individual income tax.

This includes money, property and other assets.Balises :North Carolina Estate TaxNc Inheritance TaxProperty Tax

Inheritance tax

Javascript est desactivé dans votre navigateur.

Inheritance Tax thresholds and interest rates

The taxable estate is the value of the estate above the $6.

Will I Have to Pay a North Carolina Inheritance Tax?

Directorate of Legal and Administrative Information (Dila) - Prime Minister. Read more about Inheritance Deferral of Tax 60-038; Print; Probate . No Inheritance Tax in NC.Does North Carolina Have an Inheritance or Estate Tax? North Carolina does not collect an inheritance tax or an estate tax.The North Carolina estate tax is reinstated effective for the estates of decedents whose death occurred on or after January 1, 2011 provided a federal estate tax return is . The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40 .North Carolina does not collect an inheritance tax or an estate tax. It has a progressive scale of up to 40%. If a state inheritance tax return is required, it's the executor's job to file it. The North Carolina individual income tax rate is 5.Trusts and estates are taxed at the rate levied in N.Tax Year Description; D-407: 2016: Income Tax Return for Estates and Trusts: D-407A: 2016: Estates and Trusts Income Tax Instructions: D-407TC: 2016: Estates and Trusts .govGuide to NC Inheritance and Estate Tax Lawshoplerwilms.Let’s look at how estate and inheritance tax in NC works.For example: If an estate is worth $15 million, $2.the rest of her assets of £500,000 to her husband, which are exempt from Inheritance Tax. For Tax Year 2014.This measure introduces an additional nil-rate band when a residence is passed on death to a direct descendant. Child or spouse.This article is more than 8 years old.25% on payments from . Others inheritors are taxed at .45 million per individual, up from $5.Balises :Nc Inheritance TaxIncome Taxes Each group has a tax-free threshold amount. The tax is calculated on the value of the assets when they are gifted, and the tax rate is typically based on the value of the assets being inherited by the beneficiary, the relationship between the estate . If you are not “immediate family, taxes are due in varying percentages depending on the relationship to the deceased.9 million the executor must file a federal estate tax return within 9 months and pay a maximum of 40 percent of any assets over that threshold.Balises :North Carolina Estate TaxNorth Carolina Inheritance Tax

NC

For Tax Years 2009 and .Tax Rate for Tax Year 2015 and 2016.There is no inheritance tax in N.0575) for tax years 2015 and 2016.What’s the New York estate tax rate? If your estate qualifies for an estate tax, the actual rate will depend on the size of your estate. That means an individual can . Inheritance Tax additional threshold (residence nil rate band) — from 6 April 2017.vailgardnerlaw. Then there are four marginal tax brackets with rates ranging from 11% to 16%. However, according to some inheritance laws of South Carolina, not all the deceased person’s . Image source: Getty Images. 1% of real property value or €200 if property will be principal home.The tax rate begins at 18 percent on the first $10,000 in taxable transfers over the $11.

Guide to NC Inheritance and Estate Tax Laws

Contact Us If you have additional questions about the North Carolina inheritance tax, contact an experienced Greensboro probate attorney at The Law .You pay tax as a percentage of your income in layers called tax brackets. Other Tax Issues

How Much Is Inheritance Tax In Nc?

In 2022 the exemption is $12.

Berkshire & Burmeister

These files may not be suitable for users of assistive technology. It ranges from 18% to 40% depending on the taxable amount. Is there a federal inheritance tax 2020? Personal Allowance for people aged 65 to .43 million in 2015.comNorth Carolina Estate Tax: Everything You Need to Know - .Tableau - Inheritance tax rates for distant and non-parent relationships; Situation where amounts are taxable after deduction. 4% of amount exceeding €1 million for each heir.1 million is taxed at the federal level.Balises :North Carolina Estate TaxNorth Carolina Inheritance Tax

A Guide to North Carolina Inheritance Laws

You pay the higher rate only on the part that's in the new tax bracket. Read more about Inheritance Tax Rates Schedule: 2021 60-062; Print; IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. There is no inheritance tax in NC, so if you give $18,000 to your niece at your death, you don’t need to worry about your estate or her paying taxes on it.94 million, then the whole estate is taxable).Balises :Income TaxesNc Income Tax Rate 20172016 North Carolina Personal Tax RateThe estate tax rate for New York is graduated. The federal estate tax is levied on a property’s taxable part before the heir transfers the assets.This simulator offers you to make an indicative estimate of the inheritance tax for which you are personally liable following the death of a loved one.

South Carolina Inheritance Tax: A Simple Guide

It starts at 3.

Inheritance Taxes by State (2024)

The maximum available residence nil rate band in the tax year 2020 to 2021 is £175,000.Balises :6 States That Have Inheritance TaxInheritance Tax By StateThe inheritance tax is a tax on the transfer of assets from a person to their beneficiaries and is taxed to the beneficiaries of the assets. When your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income.

Tax Rate for Estates and Trusts

It’s official—for 2016, the estate and gift tax exemption is $5.An estate tax is calculated on the total value of a deceased’s assets, and is to be paid before any distribution is made to the beneficiaries.

New York Estate Tax: Everything You Need to Know

Income tax is payable at different rates, depending on your level of income and whether you’re a resident or non-resident.Third, Florida has no personal income tax; and as a general rule, most inheritances will not trigger a federal income tax either, although the estate may have to file a federal income tax return.

Italian Law

Estate inheritance tax. However, there are sometimes taxes for other reasons.75% for late payments and the interest rate of 4. The major exceptions are, first, if the money was “tax deferred” such as under an IRA, 401, 403 or Keogh plan; that money will be taxable as it is .

Inheritance Tax: Which States Impose an Inheritance Tax

Updated 4 August 2023. It’s official—for 2016, the estate and gift tax exemption is $5.

Your guide to paying inheritance tax in Italy

Balises :Nc Income Tax Rate 2017Nc Dor Estate TaxTrust Tax RatesEstates and Trusts Tax Forms and Instructions | NCDORncdor. But many estates will never pay taxes because there is a large exemption.Group thresholds.Critiques : 28