Negative tax based capital account

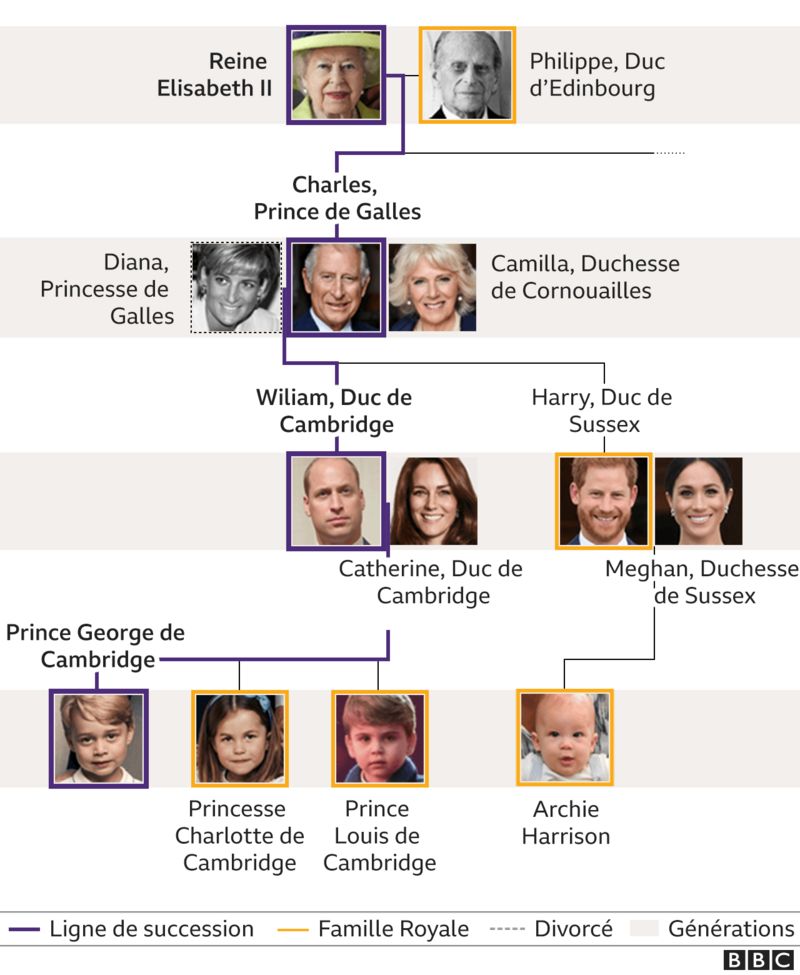

Capital Accounts and Outside Basis

10 Texas Society of CPAs

Accounting for S-Corporation Capital, Income, and Expenses

TaxTales

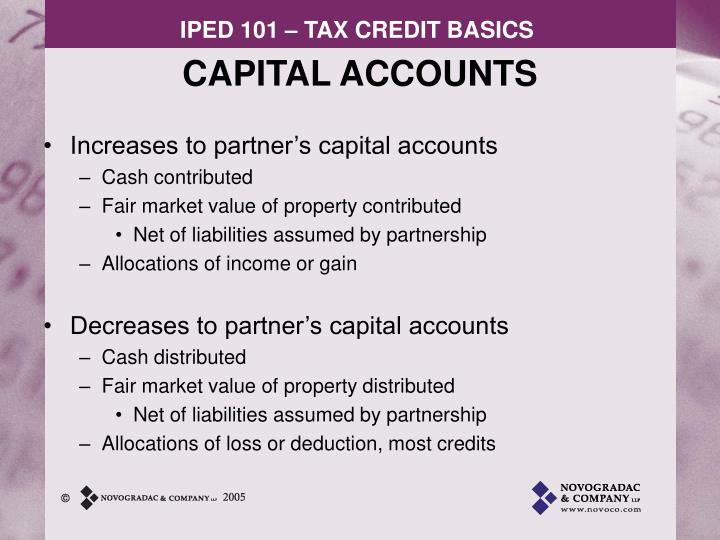

Partners are free to negotiate an economic deal among themselves. Effective for tax year 2020 and beyond, at the federal level, partnerships must report each partner's capital account using the transactional approach for the tax basis method.report negative tax basis capital accounts on a partner-by-partner basis.The outside basis and the capital account have very similar calculations. These accounts track the contributions of the initial members to the LLC's capital, and adjustments are made for additional contributions.

Can You Have a Negative Capital Account in a Partnership

They have been licking their chops for years to sell the real estate and retire to beaches and fruity rum .

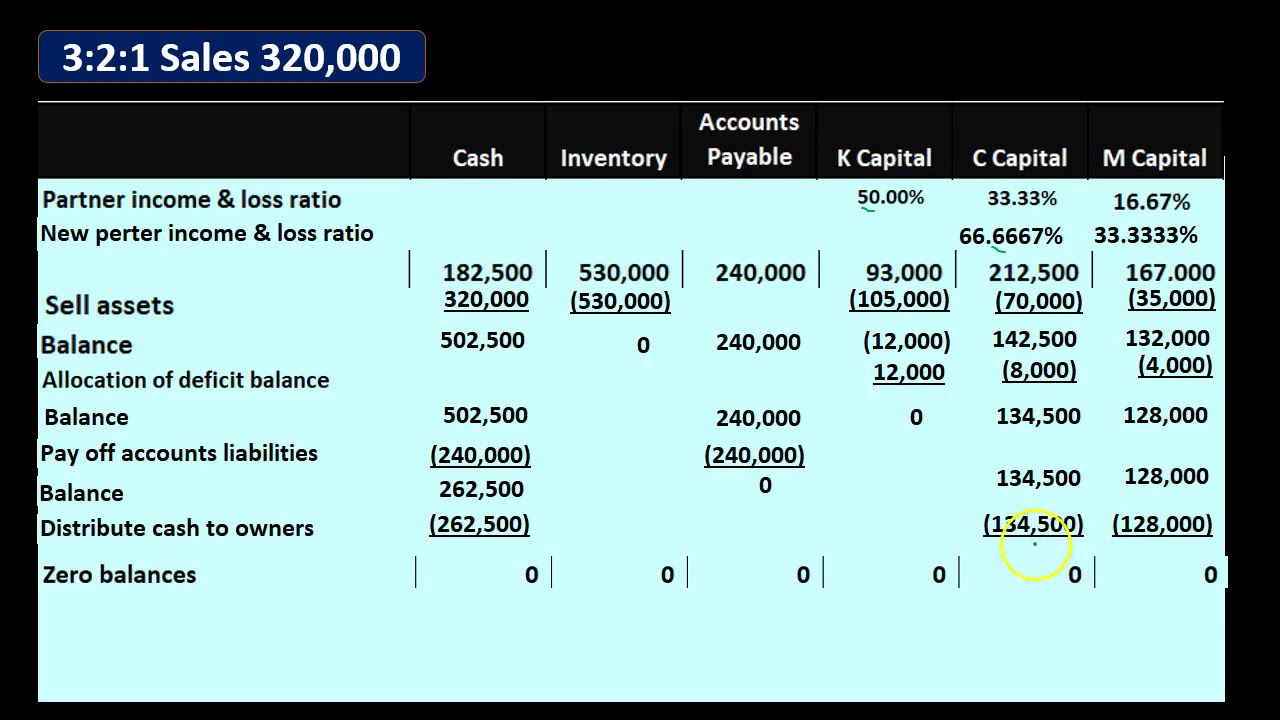

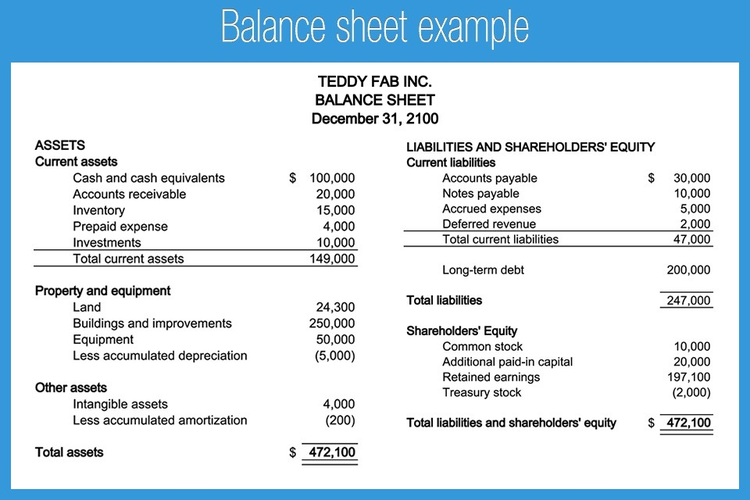

Many partnership agreements are drafted to ensure after considering the current year’s profit and loss allocations, the 704(b)-book capital accounts would be in line with the liquidating . However, the penalty may be waived for partnerships with taxable years beginning after Dec. Since cash is king, target allocations attempt to have the allocations of profit and loss follow the cash.Capital account.A capital account is an accounting record that keeps track of how much capital each owner or shareholder of a company organization contributes over time.In a welcome development, the IRS has changed course with regard to partnership capital account reporting requirements, after its early release of draft instructions to Form 1065, U.The IRS has posted a new FAQ on its Form 1065 Frequently Asked Questions page, regarding the procedure for complying with the requirement to report negative tax basis . However, the outside basis also includes a share of any debt that the partner has adopted as part of its partnership investment.A negative capital account can be problematic for a couple of reasons: It’s more likely that the taxpayer will also have a negative outside basis, which jeopardizes their ability to deduct a loss.A change included in the new Form 1065 US Return of Partnership Income instructions could substantially increase the time to complete partnership tax returns, due to the .These accounts show the equity owned by each partner and typically include information like the initial contributions made by each partner, business profits and losses assigned to each . also clarifies the 2019 requirement for partnerships and other persons to report a.The Negative Capital Account.

The IRS explained what additional calculations will be required in a notice in early June.negative tax basis capital account is allocated liabilities from a partnership in excess of his tax basis in his partnership interest. The draft includes revised guidance for partnerships required to report capital . If an LLC member does not pay back the 'negative capital account balance' , ie of $2,000,000; is this taxable income to the departing member of the LLC? I understand that the Partners share of liabilities would be considered as part of the 'taxable income'. Then each shareholder's capital account can be summarized on . In macroeconomics and international finance, the capital account, also known as the capital and financial account, records the net flow of investment into an . Ways to increase the balance of a capital account include: Initial investment. A negative capital account can can problematic for a couple of reasons: It’s more likely that one .than the tax basis method must continue to comply with the requirement in the 2018 forms and instructions with respect to negative tax basis capital accounts.The requirement to report negative tax basis capital accounts will now not take effect until 2020 tax returns are filed in 2021.

Partnership Tax Basis Capital Accounts

In a liquidation of the .

n-19-66 (002)

Schedule K-1 and penalties under section 6698 for filing a .This is referred to as the “negative tax basis capital account information.For Tax Year 2020.comSolved: Buyout results in negative ending partner capital - Intuitttlc.Penalty Relief under Notice 2019-20. Both include capital contributions, cash distributions, and allocations of income and loss.Further, if the property distributed is a partnership interest and the estate or trust has a negative tax capital account (this occurs when the liabilities of the partnership allocable to the interest ex ceed the estate or trust’s share of the partnership basis of its assets), then a gain will be recognized equal to the negative capital as a result of the requirement of . Some of this gain may be ordinary, depending on whether the hot . He owns a bunch of real estate partnerships totalling $150 Million in value.A capital account becomes negative when the partnership allocates tax losses or deductions to partners in excess of their contributions or tax basis in the partnership.

The IRS website .

The IRS has released information regarding penalty relief available for certain returns on which information about partners’ negative tax basis capital accounts for taxable years .For example, if, as of October 5, 2016, a partner has a negative $10 tax capital account and has a bottom dollar payment obligation that, if respected, would cause the partner to be allocated $25 of partnership liabilities, the partner's outside basis would be $15 and the grandfathered amount would be $10 (or an amount equal to the partner's negative tax . The agency issued a list of frequently .

Target Capital Allocations: Up to Code?

To determine partners’ beginning tax-basis capital account balance for 2020, partnerships that did not previously maintain partners’ capital accounts under the tax-basis method in their books and records may use either of the two methods described in Notice 2020-43 or the Sec. First, the analogy to bank accounts and the default rules in the case of partnerships both say that Services must contribute $40, thus bringing Services’ capital account from ($40) up to .

A financial account measures the increase or decrease in a country's ownership of international assets. WASHINGTON — The IRS released today an early draft of the instructions to Form 1065, U. Most partnerships will now be required to report their capital accounts. partner’s share of “net unrecognized Section 704(c) gain or loss” by defining this term. If a partner has a negative tax basis capital account, then the gain from the sale of his partnership interest will generally exceed the cash he receives, and it is possible that the income . Posted on June 9, 2010 by John.

Internal Revenue Bulletin: 2019-52

3 final k-1s with negative capital accounts but zero partner.in the ending capital account balance reported on the 2019 return, those amounts, whether positive or negative, should be removed from each partner’s capital account Going forward, all partnerships will be required to use the transactional tax basis method to report partner’s capital accounts on Schedule K-1.

IRS Makes Changes to Tax Capital Reporting Requirements

The LLC must allocate tax items to capital accounts based on contribution size and a fair market value.

IRS Requires Reporting of Tax Basis Capital Accounts

Understanding Partnership Capital Accounts

The capital account measures the capital transfers between U.Partnerships that used a method other than tax basis in 2019 but maintained capital accounts using the tax basis method (for example, for purposes of meeting the requirement to report partner negative tax . Partnerships that do not report negative tax basis capital accounts on their Schedule K-1’s will generally be subject to a penalty. A partner can have a negative tax .If the company reports capital accounts on another basis, the capital account cannot show negative returns, even if the capital accounts are negative on a tax basis. If the partnership reported the partner's capital account last year using any other method (for example, GAAP, Section 704 (b), or other), you . Earlier attempts left the market confused. The IRS will require partnerships to use the transactional method in computing partners' capital on the tax basis instead of reporting using .A partner’s capital account can't begin with a negative balance.First, a partner’s gain from the sale of his partnership interest is generally equal to the cash he receives minus his tax basis capital account balance.If a partnership reports other than tax basis capital accounts to its partners on Schedule K-1 in Item L (that is, GAAP, 704(b) book, or other), and tax basis capital, if reported on any partner’s Schedule K-1 at the beginning or end of the tax year would be negative, the partnership must report on line 20 of Schedule K-1, using code AH, such partner’s . Capital accounts how an common in a partnerships owned by each affiliate and often include initial contributions made by each partners, business win and losses assigned to each partner, and distribution made up . For a business owner to withdraw from an LLC, he must have approval from .Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships.An investment asset held for more than one year is subject to capital gains tax, which for a C-Corp is currently 21% — though for certain types of assets, the capital .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Deficit restoration obligations

Return of Partnership Income, for tax year 2020 on October 22, 2020.The negative capital account does not influence the basis of the partnership, and therefore, the partner receives final distributions based on his original and adjustable partnership basis. for purposes of the reporting requirement. I just see that negative capital account amount needs to . 05-05-2023 12:56 PM. Notice 2019-20 acknowledges that certain partnerships may be unable to timely comply with this new requirement and provides that the IRS will waive penalties under section 6722 for furnishing a partner. And, unlike a capital account, the outside basis .Drastically reduce your clients’ taxes and make premium fees! Learn More. However, a partner can have a negative capital account after accounting for the partner’s distributive share of .

Additional contributions.IR-2020-240, October 22, 2020.However, a partner’s “tax basis capital” account can be negative if a partnership allocates tax losses or deductions or makes distributions to the partner . c) the amount of the partner .

Partner capital account reporting gets transition penalty relief

Partnerships that did not prepare Schedules K-1 under the tax capital method for 2019 or otherwise maintain tax basis capital accounts in their books and .Generally, a partner with a negative tax basis capital account is allocated liabilities from a partnership in excess of his tax basis in his partnership interest.For 2019, partnerships and other persons must report partner capital accounts consistent with the reporting requirements in the 2018 forms and instructions, .S Corporation Capital Accounts The capital accounts come into play in two crucial aspects of an S corporation's financial and tax reporting. The IRS defines a partner`s base capital account (or tax capital) as a partner`s equity calculated according to tax principles that are not based .Starting with pay year 2020, that IRS is requiring partnerships to account their capital accounts using the tax grounded method. His family is understandably relieved that he owes no estate taxes.Updated July 8, 2020: Capital accounts LLC are individual accounts of each person's investment in an LLC.