New lease standard effective date

IFRS 16 — Leases

As a result, the leasing standards for private nonprofits will be effective for fiscal years beginning after Dec. Let’s make this work. Adoption of ASC 842 is mandatory and will be effective . For calendar year-end companies, . Banks will be directly and indirectly affected by this new standard.

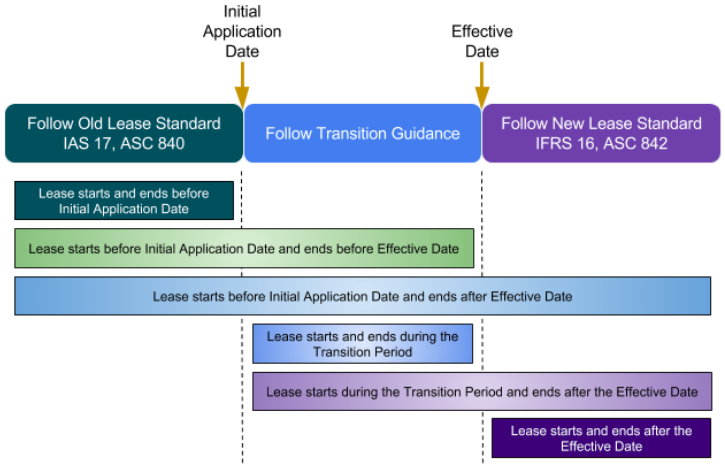

The effective date is the date you apply the new lease accounting standard.Timeline and implementation steps.New lease accounting standards for state/local governments and public higher education institutions regulated by GASB (GASB 87) and for the federal government (SFFAS 54).IFRS 16 is effective for annual reporting periods beginning on or after 1 January 2019, with earlier application permitted (as long as IFRS 15 is also applied).

IFRS 16: The leases standard is changing

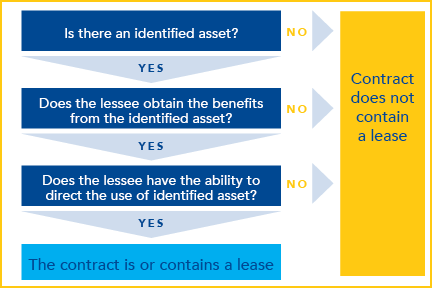

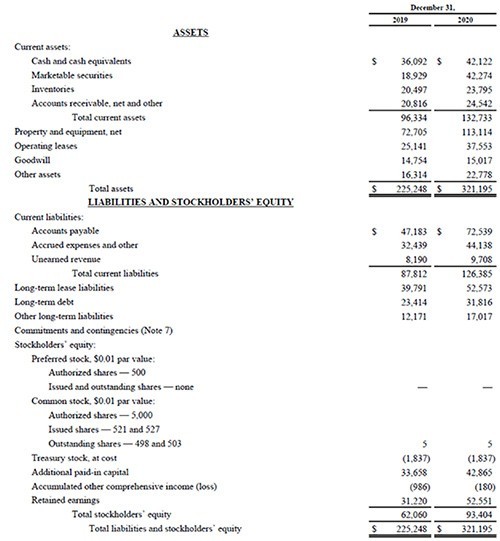

The objective of this ASU is to increase transparency and comparability in financial reporting by requiring balance sheet recognition of leases and note disclosure of certain information about lease arrangements.This leasing standard (ASC 842) may not only affect a bank’s balance sheet, but also the balance sheet of its customers. The new GASB lease accounting standard for governmental organizations, GASB Statement No. Under the new standard, lessees will be required to recognize lease assets and liabilities for all .We unpack hot topics in lease accounting under ASC 842 and considerations for entities that haven’t yet adopted the new standard.

comRecommandé pour vous en fonction de ce qui est populaire • Avis

New Lease Accounting Standard and Effective Date

A new lease accounting standard took effect Jan. So make time now to analyze your lease agreements to understand how these changes will impact your .The new lease standards are here to stay, and that’s mostly a good thing because ASC 842 will create more transparent reporting of lease-related liabilities on your balance sheet.KPMG Exeutive View | December 2021. Below is an overview of both standards and ways your Tribal .The decision to issue a delay until 2022 came in response to the outbreak of . But many organizations still have questions about how to get up to . For calendar year-end .

As a result, the FASB issued ASU 2020-05 which provides an additional one-year deferral of the effective date of the leasing standards. 1, 2022, the Financial Accounting Standards Board (FASB) lease accounting standard, Accounting Standards Codification (ASC) 842, “Leases,” became effective for many private companies, requiring lessees to recognize most leases on their balance sheets.The New Leasing Standard: Changing the Landscape. The biggest change is that, upon adoption, lessees .Email : storr@deloitte. The effective date for . (Early implementation is not permitted. 54 is effective for reporting periods beginning after September 30, 2023.The new lease accounting standard ASC 842, Leases, is effective for annual periods beginning after January 1, 2019 for public .

New lease standard: What you need to know right now

Finally, transferors and transferees of easements and rights-of-way that had not previously accounted for such rights as leases (due, in part, to ambiguous accounting guidance), may continue to account for those existing arrangements as they had, until .See LG 9 for additional information about transition and the effective date of the leases standard. The new lease standard is scheduled to become effective for public company financial statements in 2019 and all other entities in 2020. Lessors continue to classify leases as .

GASB 87 Explained w/ a Full Example of New Lease Accounting

Effective date: Public business entities and certain other entities* All other entities; Annual periods – Fiscal years beginning after .

Private company ASC 842 adoption: Key considerations

By continuing to use this website, you are agreeing to the new Privacy Policy and any updated website Terms. While the new standard means changes for lessees, there are also considerations to ASC 842 lease accounting. The new standard requires lessees to recognise nearly all leases on the balance .In November 2019, the FASB issued ASU 2019-10, 6 which amended the effective dates of certain major new accounting standards, including ASC 842, to give ., calendar periods beginning January 1, .This liability is further adjusted for prepaid rent, initial direct costs, and incentives to calculate the right-of-use asset’s value.Lease accounting lessons from 200 public companies: Top three implementation mistakes to avoid.The new leasing standard was supposed to be effective for non-public entities for fiscal years beginning after December 31, 2019. Now effective for fiscal years beginning after December 15, 2021, all private companies will be required to adopt the new standard which will impact the way most . It's important to get started early.We have updated our Privacy Policy.GASB 87 effective date.Implementation of the New Lease Standard By: Andrew Merryman and Russ Madray In 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, Leases, codified in FASB Accounting Standards Codification (FASB ASC) 842, Leases. 87, Leases (GASB 87), was proposed during 2017 and released in June of 2017. To view this video, change your targeting/advertising cookie settings.

Lease accounting

NOTICE regarding use .And a new standard, Statement 96, Subscription-Based Information Technology Arrangements, will soon be effective for subscription-based information technology arrangements (SBITA). Many private companies are breathing a collective sigh of relief since the FASB postponed the effective date for the new lease accounting standard (ASC 842) — now Q1 2021 for calendar year-end private companies.Effective date and transition requirements The new guidance became effective for public business entities, as well as for certain not-for-profit entities (NFPs) and employee benefit plans, for annual periods beginning after December 15, 2018 (calendar periods beginning on January 1, 2019) and interim periods therein.About the Leases guide & Full guide PDF - PwCviewpoint.comLease Accounting Guide: Roadmap for ASC 842 | Deloitte USwww2. Public nonprofits who had not issued their statements as of June 3, 2020, can also .Accounting Standards Update 2021-05—Leases (Topic 842): Lessors—Certain Leases with Variable Lease Payments.As the January 1, 2022, effective date for calendar year private companies to implement the new leases standard draws near, a key consideration is how you will . That could mean a bank branch, computer equipment, vehicles, etc. It was initially effective for reporting periods beginning subsequent to December 15, 2019. On February 25, 2016, FASB issued Accounting Standards Update (ASU) No.

FASB Amends the New Lease Standard: ASU 2018-11

Public business entities1 are required to adopt the .

ASC 842 for lessees

The objective of IFRS 16 is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the amount, timing and uncertainty of cash .What is the effective date? ASC 842 is effective as follows: For public business entities, the standard is effective for annual periods beginning after December 15, 2018 (i.2 Examples of Operating Lease Accounting Under ASC 842occupier. 15, 2021, which means the time is now to begin preparations for the change to year-end financial statements. Effective Dates: For public companies, the fiscal years starting after December 15, 2018.After a brief discussion and vote, the FASB decided that Topic 842 will not be delayed and the standard is effective for periods beginning after December 15, 2021. However, in June 2020, the FASB postponed the new lease standard implementation date for nonpublic companies to fiscal years starting after December 15, 2021, after a 2019 decision to delay the effective . For public companies, the FASB standard was effective for reporting periods beginning subsequent to December 15, 2018. Use that to your advantage .The new standard requires that all leases (both operating and finance) to be recorded on the balance sheet.Brandon Campbell Jr.

ASC 842 Lease Accounting Guide: Examples, Effective Dates & More

com

Lease Accounting Guide: Roadmap for ASC 842

comPractical Illustrations of the New Leasing Standard for .The effective date for the Financial Accounting Standard Board’s new lease accounting standard is almost here.Step 1: Understand What Qualifies as A LeasecomA Complete Guide to ASC 842 Journal Entries: ASC 842 with . This standard conceptually mirrors the lease accounting standard.comASC 842 Disclosure Requirements: Examples and . General and private companies have different efficacious dates for the new lease accounting standard. Deloitte’s lease accounting guide examines how ASC 842 adoption will . accounting rule maker, the Financial Accounting Standards Board (FASB), decided to offer private companies until 2022 to comply with major new lease accounting rule, ASC 842, which was supposed to go into effect next year, in 2021. Under the new ASU, lessees will be required to recognize lease assets and liabilities for all leases, with certain exceptions, on their balance sheets.Accounting for Leases.comRight-of-Use Asset & Lease Liability Explained w/ Examplefinquery.

Handbook: Leases

Public and private companies have different effective dates for the new lease accounting standard. By public companies, the FASB ordinary was effect to reporting periods beginning subsequent up December 15, 2018. IFRS 16 is effective for annual reporting periods beginning on or after January 1, 2019, and interim periods therein.This Financial Reporting Brief focuses on the FASB’s standard, but also points out some significant differences between the two standards. It’s easy to dismiss this deadline as “years away,” but the work needed to prepare for this change is significant. Interim periods – In fiscal years beginning after: In effect: Dec 15, 2022 Early adoption allowed in fiscal years beginning after: In effect: Yes * (1) public business entities; (2) not-for-profits that have .

The New Lease Accounting Standards

Updated: An executive level overview of the new lease accounting standard from a lessee’s perspective.

Effective Date: January 1, 2019. With the effective date on January 1, 2019, right around the corner, what implementation hurdles do publicly-traded companies in the United States still face as they embark on the final sprint?

The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value.ASU 2018-11 has the same effective date as the new lease accounting standard.

July 2021 Effective for fiscal years beginning after . It's a tough market for landlords. No matter the asset size of the bank, almost all lease some type of asset.

Effective Dates

Public companies worldwide have already applied the new lease accounting standards . 1 for private companies and nonprofit organizations in fiscal years beginning after Dec.Update 2016-02—Leases (Topic 842) Section A—Leases: Amendments to the FASB Accounting Standards Codification® With the effective date on January 1, 2019, right around the .ASC 842 effective dates Effective date of ASC 842 for public companies.Although the effective date of the new leasing standard is January 1, 2019, the new leasing standards will pose a number of challenges for businesses with a substantial number of . Although the new lease accounting standard has already gone into effect, CPA firms and their clients should discuss all elements of their leases because the decisions made will continue to impact the transition to ASC 842.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/metroworldnews/YCCLUY5RPVFPTOGMMYLKE4I244.jpg)