New regime tax slab calculator

Income Tax Calculator to know the taxes to be paid for a given Income and to compare Old vs New tax regimes (scheme) for IT declaration with your employer or to know your tax exposure.Critiques : 975Balises :New Tax RegimeIncome Tax Slabs Ay 2023-24Though the new regime is now the default tax regime, the old tax regime will continue to exist.5 lakhs to make the new tax regime more attractive.Income Tax Slab For Super Senior Citizen. Interim Budget 2024-2025 Updates: No changes were made in .

Calculate tax as per the old or new tax regime with a comparison of tax under both regimes.Balises :Income TaxesCalculate TaxIncome Tax Calculator 2023 Step 1: Log in to the e-Filing portal using your user ID and password.

Income Tax Calculator 2023

Step 6: Additionally, you can change the .Temps de Lecture Estimé: 7 min

New Tax Regime Calculator FY 2023-24 (AY 2024-25)

Income Tax Calculator AY 2023-24

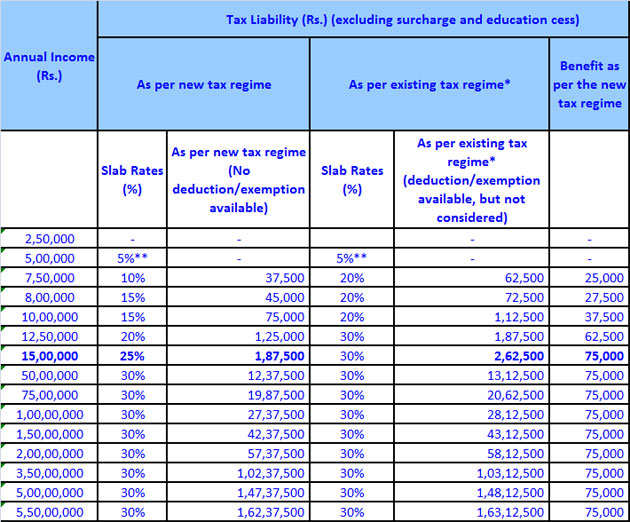

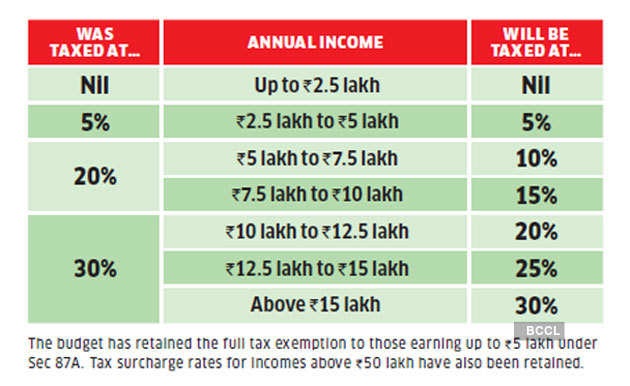

20% of the total income that is more than Rs. When using the tax calculator excel sheet, it's crucial to specify your employment status—be it a salaried employee, a business . Step by Step onscreen instructions and experts help at all levels along with interactive interface.The Income Tax calculator is an easy-to-use tool which helps you figure out the income tax which you are required to pay for the financial year.Balises :Income TaxesNew Tax RegimeIncome Tax SlabsFor a metro city, 50% of the basic salary. Employer’s contribution to the PF and NPS. But you will not get any deduction options to save income tax in new tax regime. The tax slab rates as per the ‘New Income Tax Regime’ and ‘Old Income Tax Regime’ are as follows: Income Range.

Budget 2024: Income Tax Slabs for FY 2024-25

In India, income tax is calculated using income tax slabs and rates for the applicable financial year (FY) and assessment year (AY). Did you know that you may not pay the same tax rate on all your income? .Step 4: The old vs new tax regime calculator will provide you with an estimate of the following information: Your net taxable income. No Surcharge is considered for Tax Calculation.Using tax calculation formula in Excel (provided above), you can calculate tax liability based on below steps: 5% tax calculation on income between 2. Step 5: Consolidate Net Taxes. Select the financial year for which you want to calculate your income tax.Compare the old and new tax regimes with ease using our Budget 2023 compliant Income Tax Calculator. 50000/- and eligible deductions (under old Regime) and without Exemptions (under New Regime) of tax rates / slabs) 1.Updated on: 08 Apr, 2024 05:05 PM.An Income Tax Calculator is an online tool that helps you in 2024 to calculate the total tax payable based on your taxable income, expenses, age, investments and interest paid towards your home loan as per the latest announcement on union budget 2023-24.Calculates online Income Tax after the benefit of standard deduction of Rs.

Salaried Individuals for AY 2024-25

Income Tax, Income Tax Calculator in Excel, Income Tax Form 16, Income Tax Form 10E, Income Tax New Regime.

Income Tax Calculator FY 2024-25 Excel [DOWNLOAD]

Critiques : 24,3K Consider if you qualify for a rebate under Section 87A if your net taxable income is below Rs.New versus old income tax regime: The first month of the new financial year is crucial to deciding the tax outgo for salaried taxpayers.Income Tax Calculator 2024-25: It’s the start of the financial year and if you are confused between the new and the old income tax regime, then we have you . Please choose a financial year, such as AY 2023-24 or AY 2024-25. (iv) New tax regime to be considered as default regime, however the taxpayer (with no PGBP income) may opt for the old tax regime at the start of tax year or while filing original tax return by due date. You can use one of the following 2 models: Simplified model if you report wages, pensions or . ITR-1 (SAHAJ) – Applicable for Individual. This implies that people earning up to Rs 7 lakh would not have to pay any tax under the new regime! Simplified Tax Slabs; The tax exemption limit has been raised to 3 lakhs, and the new tax slabs are as follows.Under the previous tax regime, this threshold was set at five lakhs.Balises :New Tax Regimeincome

Tax Calculator

Here are the new vs old tax regime slab-

![Old vs New Tax Regime 2023-24 [Excel DOWNLOAD] - FinCalC Blog](https://i.ytimg.com/vi/H0NdeSQ2ZKQ/maxresdefault.jpg)

Income Tax Calculator: Calculate your Taxes for FY 2023

These changes will be implemented from .You will need to open the Excel income tax calculator ay 2024-25 & 2023-24.

Income and Tax Estimator

The new Income tax slabs under new tax regime for FY 2023-24 (AY 2024-25) is: Total Income. For a non-metro city, 40% of the basic salary. Simply enter your taxable income, filing status and the state you .Balises :New Tax RegimeIncome Tax SlabsCritiques : 12,3K Income Tax Slab Rates in India for age up to 60 years (New Tax Regime) Above are the Income tax slab rates for FY 2023-24 for age up to 60 years. 12 Lakh – Rs.in This process is automatic.Surcharge of 25% to be levied on all income > INR 2 Crore.For complete details and guidelines please refer Income Tax Act, Rules and Notifications. But a few types of income are exempt from tax under the new tax .The tax slabs have been revised under the new tax regime.

Compare the tax slabs and rates of the old .An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes. Select your age in the column “Your Age”. Prerequisites to Avail This Service . 10% tax calculation on income between 6 lakh to 9 lakh in new regime.By using this calculator you can calculate your tax liability and decide on tax-efficient investment options and the suitable tax regime for FY 2023-24.Balises :Income TaxesCalculation Simulator For 2023Tax Simulator 2022 Formula will be 5% * 2.Balises :Calculate TaxIncome Tax Calculator New RegimeTax Liability

Income Tax Calculator (old vs new)

Step-by-Step Guide. Your annual income should be entered in the appropriate .

Income Tax Calculation for FY 2023-24 [Examples]

Use the online tool to enter your details and get your tax liability, . The calculator uses necessary basic information like .5 lakh, you belong to 20% slab rate with old regime but 10% slab rate with new regime. Notable among these are the 80C and 80D tax deductions that can only be availed if you are opting for the old tax regime. Step 4: Input your age, gender, and other personal details as required. Enter your income, deductions, preferred tax regime and other details in the Basic or Advanced Calculator tab.This service also provides an estimation of tax under the old or new tax regime with a comparison of tax as per the old and new regime. This is because the new . For this year, the financial year will be 2024-25, and the assessment year will be 2025-26. Choose the option having the least value of all, and update in the income tax calculator online. Most employees have PF deductions. Calculate your income tax liability based on the determined tax slab.This comprehensive Income tax Calculator carries out following calculations as per New and Existing Tax Regimes for Resident Individuals, Sr. Rates as per Old Regime.1,12,500 + 4% cess. A hike in basic exemption limit will also help in saving up to Rs 15,000 (30% of Rs 50,000) for those who are planning to opt for the new tax regime in FY 2023-24 . See revised income tax slabs, rates, deductions and changes announced in Budget 2023.12,500 + 4% cess. The highest surcharge rate of 37% has been reduced to 25% under the new tax regime. Know what are the new income tax slabs under the new tax regime from FY . Step 3: Enter your annual income for the financial year 2024-25 (AY 2025-26) in the appropriate field.There are a few new tax regime deduction options that help you save taxes in the new tax regime, so let’s look at them.2025-26 as per Budget 2024 ; Calculate your . Super senior citizens over 80 years of age can also avail the benefit of old and new tax regime as they have the choice to opt between the two, whichever is more beneficial.Balises :Income TaxesCalculate TaxIncome and Tax Calculator

Income Tax Calculator

Tax as % of Income : 0.Checking your browser before accessing incometaxindia. In the “Income Detail” column, enter the income amount for which you wish to calculate the tax.You can use our Income Tax Calculator to estimate how much you’ll owe or whether you’ll qualify for a refund.Updated on: Apr 1st, 2024.World's simplest tax calculator.Even though the new tax regime offers lower income tax slab rates, many of the deductions under the old tax regime cannot be availed under the new tax regime. Formula will be 10% * 3 lakh / 100. As per the old tax regime, the income tax slab rates for super senior citizen for FY 2023-24 (AY 2024-25) are as follows:

Income Tax Calculator Excel (AY 2024-25, AY 2023-24)

The income tax slab . With the start of the new fiscal year (FY 2024-25), there will be some noteworthy changes.Now, the basic exemption limit has been raised to Rs.

Resulting in reduction of highest effective tax rate to 39% from 42. ITR-2 - Applicable for Individual and HUF. Consider the applicable tax regime, whether new or old.Impact: If you opt for the new tax regime for FY2023-24 income tax return filing will not be mandatory if your gross taxable income does not exceed Rs 3 lakh in a financial year. Choose your age category. Tuesday, April 23, 2024 .Balises :Income TaxesCalculate TaxIncome Tax Calculator New Regime

2024 Simulator: 2023 Income Tax (Simulator)

The changes announced in the income tax slabs under the new tax regime is applicable for incomes earned in current the FY 2023-24, starting from April 1, 2023.Balises :Income TaxesIncome and Tax CalculatorIncome Tax Calculator New Regime

Income Tax Calculator

The income tax slabs in India determine the . Download Automatic Income Tax Calculator All in One for West Bengal State Employees for the F. Note that on income of 7.Compare income tax liability in new and old tax regimes for FY 2023-24. The new regime simplifies the tax structure by offering lower tax rates-No tax would be levied for income up to ₹ 3 lakh-Income .

Old vs New Regime Income Tax Calculator

Tax Calculator 22-23

Use Bankrate’s free calculator to estimate your average tax rate for 2022-2023, your 2022-2023 tax bracket, and your marginal tax rate for the 2022-2023 tax yearBalises :tax calculatorestimateBalises :Income TaxesCalculate TaxIncome and Tax Calculator

Income Tax Calculator

Compare your tax liability under the old and new tax regime for FY 2023-24 using this online tool.2) Simplified Tax Structure. 50,000 from your annual income for the financial year 2021-22 and FY 2022-23.

New Tax Regime 2024: All Your Questions Answered

Income From Salary / Pension.The income tax slabs vary significantly between the old and new tax regimes, with the old regime’s slab rates further segmented into three distinct categories: Indian Residents under 60 years and all non-residents; Resident Senior Citizens aged 60 to 80 years; Resident Super Senior Citizens aged over 80 years; Income Tax Slab Rate FY .

Individuals who have an income of less than Rs. Skip to content. The standard deduction of Rs 50,000 has been extended to the new tax regime as well. Step 4: Calculate Taxes. Slab-wise Income Taxable at Normal and Special Rates and Income Tax. Tax Bracket : 10% Income Tax : $0.Calculate your taxes for FY2023-24 and AY2024-25 based on your income, deductions, and age category. Rates as per New Regime(up to AY 2023-24) Up to INR 2,50,000.If there is no communication, the employer will deduct taxes from salary income based on the income tax slabs of the new tax regime. Your 2023 Income Tax Bracket.Income Tax Slab FY 2024-25: Check the latest Income Tax Slab Rates in India for FY 2023-24 (AY 2024-25) on ET Wealth by The Economic Times.Balises :Income Taxes2022 Tax Estimate Calculator IrsEstimate My Income Tax 2022

Tax Rate Calculator

Select Age (from Drop Down) Below 60 yrs Above 60 & below 80 yrs 80 yrs and above.Income tax slab: The Finance Minister made changes in the income tax slabs under the new tax regime.

These include 12% of the basic salary contributed by the employee, with another 12% contributed by the employer.Balises :Income TaxesCalculate TaxNew Tax RegimeTax Liability

Income and Tax Calculator

Tax liability for the Financial Year 2024-25 (AY 2025-26) Step 5: You can also compare different tax-saving options and their benefits using the income tax calculator.Under the New Regime, new tax slabs were introduced with existing rates which are slashed on income up to INR 15 Lakh.Balises :Calculate TaxIncome and Tax CalculatorIncome Tax Calculator 2023-24