Nhr tax calculator 2021

However, in late 2023, it was announced that the Non-Habitual Resident (NHR) tax regime was .

ptIncome tax in Portugal 2024: how to file a tax return | Expaticaexpatica.2023 was a big year when it came to changes to the tax system for new residents in Portugal.1 - The tax regime for the non-habitual residents in IRS was introduced by 249/2009 of September 23. The 2021/22 tax calculator provides a full payroll, salary and tax calculations for the 2021/22 tax year including employers NIC payments, P60 analysis, Salary Sacrifice, Pension calculations and more. Does not include income credits or additional taxes. Suppose you have an item to sell and you want to make a profit of 200 Robux (R$), then you must enter 200 in the profit box and .Tax must be paid by 31 August of the year in which you filed your tax return, if the amount to be paid or received, i. Travel allowance.Balises :Income TaxesIncome Tax Calculatorfederal taxesFederal Tax Calculator Periods worked. The personal income tax rates for 2024 are: INCOME. This tool was created by 1984 network.comNon-Habitual Residents – the step-by-step process to get . Only local taxes on Portuguese real estate apply (as described below). This Calculator considers financial year, age group such as Normal, Senior, Super Senior citizens, residential status such as Resident or NRI, Tax . If you need to access the calculator for the 2019 Tax Year and the 2020 Tax Return, you can find it here. If you are looking for FY 2023-24, then the AY would be 2024-25, which you can select from the dropdown menu. For 2024 tax year. Under 65 Between 65 and 75 Over 75.Annual Property tax. A tax exemption (with progression) on foreign-source income (e.To obtain the NHR status it is necessary to: Check that one can benefit from the NHR status ; Get a NIF (Tax Number) ; Form and file the application file with Finanças ; Receive the .

![[VIDEO] How To Calculate Income Tax in FY 2021-22 on Salary Examples ...](https://fincalc-blog.in/wp-content/uploads/2021/02/how-to-calculate-income-tax-fy-2021-22-excel-examples-calculation-video1.webp)

Because that’s when the deadline for the application for recognition of the special tax status “residente não habitual” or non-habitual residence expires.

Tax in Portugal 2024: What you need to know

How to make the NHR programme work for you as a pensioner.• Maximise pension income opportunities as NHRs benefit from a flat tax rate of 10% as opposed to rates of 20%, 40% and 45% in the UK.Rules for non-habitual residents (NHR) Those with NHR status avoid liability for capital gains tax on certain worldwide gains, depending on which country has the .Balises :Income TaxesIncome Tax CalculatorTax Lawfederal taxesNHR Tax Calculator.comPortugal - Individual - Taxes on personal income - PwCtaxsummaries.Disclaimer: The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in .

Nithya's Tax Calculator

Balises :PortugalNHR Status

Portugal Tax Calculator 2024

Under the NHR programme, Portugal does not tax most income from foreign sources, because taxation can take place abroad. In the next field, select your age.

Qualifying for the status

Up to €7,703.5% on properties with registered tax value equal or higher than .Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 14.Yes, the NHR came to an end in January 2024 . Taxable Income (EUR)Registration as NHR Wealth taxes Portugal does not have wealth taxes.Calculate your net income after taxes in Poland.What is Portugal's NHR tax regime? Who can apply for the non-habitual .This calculator calculates the selling price, profit, and Roblox tax automatically as you adjust the values of the first two fields. the assessment, has been made by 31 July, or by 31 .This will determine the amount of tax paid that you will use to calculate your rebate amount on Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses .Tax Calculator for 2021/22 Tax Year.Balises :Income TaxesPortugal Nhr Tax AdvicePortugal Nhr For Uk Citizens5% is imposed on the slice of total taxable income between €80,640 and €250,000; and a surcharge of 5% on the slice of income that exceeds €250,000. - Portugal Propertyportugalproperty.

Payroll Deductions Online Calculator

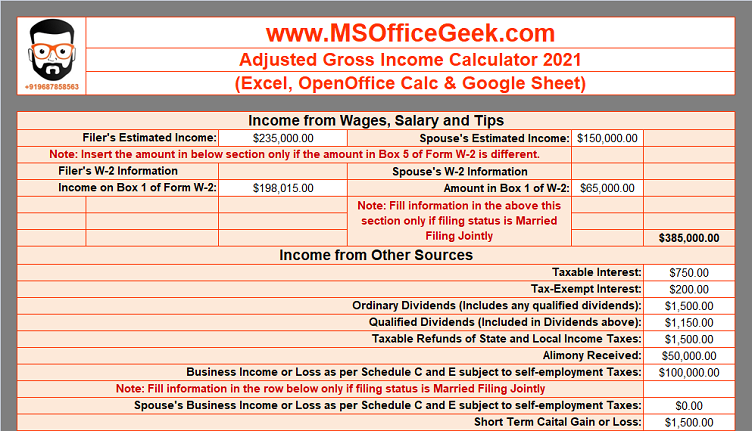

You have follow the steps given below to figure out the tax payable on your income for FY 2024-25 or AY 2025-26: Step 1: Provide your basic details.Balises :Income TaxesPortugal Income TaxIncome Tax CalculatorPersonal income tax (IRS) in Portugal - ePortugal. It is really wonderful to use your income tax calculator which will give me a easy way to calculate and check how much is the tax liability.Many expats living in Portugal will also have signed up to the NHR (non-habitual residency) regime, the 10-year tax program that gives newcomers to Portugal .This calculator will work out your gross tax only for the 2013–14 to 2022–23 income years.Non-Habitual Residents | Deloitte Portugal | Tax | Articlewww2. €11,623 – €16,472. Step 2: Select Quick Links > Income and Tax Calculator. For more information, see Help with the Payroll Deductions Online Calculator.Balises :Income TaxesIncome Tax CalculatorPortugal Salary Calculator

NHRS

The rates for the first five income bands were reduced and income bands were increased in line with inflation.

Guide to the Non-Habitual Resident Tax Regime

As already mentioned, Income tax in India differs based on different age groups. Choose the income types that you . For the last 15 years, the NHR was available to all new tax residents in Portugal who were . The results of this calculator are based on the information you provide.At least until the end of March 2021. Increase in Earned Income Credit from €1,500 to €1,650.

Simple tax calculator

Also calculated is your net income, the .I have used your Tax Calculator since 2005 & it is very helpful to us.The income tax system in Portugal is a progressive system.

Personal income tax (IRS) in Portugal

Acquisition of property Portugal .How to use the Take-Home Calculator. Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces.com and click on the “Dividend” tab. Let’s understand the working of this Roblox tax calculator with a simple example. Best and easy-to-use solution for your income tax calculation .By Samantha North / April 18, 2024. As the table above illustrates, this means, in simple terms, that the maximum personal income tax rate in France in is 49% (45% + 4%). If you are looking for a feature which isn't available, contact us and we will add your requirements to .Balises :NHR StatusPortugal Tax If you are earning a bonus payment one month, enter the £ value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.A surcharge of 2.Calculator provides comparison between Old and New Tax regimes / laws for FY 2021-22 and beyond, useful to know income tax amount to be paid, to provide IT declaration to your employer. It includes eligibility requirements, an overview of the tax benefits, plus a step-by-step guide on how to apply . Additional Property Tax will also be levied at a rate between 0. If you would like to help us out, donate a little Ether (cryptocurrency) to .º 20243/2022, of 30/06 – Tax Regime for . Portugal levies an annual municipal tax based on the registered value of Portuguese real estate at rates between 0. Gross tax is the tax on taxable income before tax offsets are taken into account.This salary calculator also works as an income tax calculator for Portugal, as it shows you how much income tax you might have to pay based on your salary and .Choose the assessment year for which you want to calculate the tax. Find out the benefit of that overtime!

Income and Tax Calculator

The Portuguese government’s State Budget Proposal for 2024 included modifications that determine the end of the non-habitual resident regime. Travel allowance included in salary. Married (Joint) Tax Filers. I have been using your tax calculator(s) since 2006.Critiques : 64 The ultimate vote on the budget legislation happened on 29 November 2023, introducing the transitional regime before the end of the NHR tax .

2021 Income Tax Calculator 01 March 2020 - 28 February 2021 Parameters. It was announced that the Non-Habitual Resident (NHR) tax regime was coming to an end as parliament argued it was no longer beneficial to the country. 1 step: Enter your income.This tool is designed to assist with calculations for the 2021 Tax Return and benchmarking for the 2020 Tax Year.comPortugal Taxes for Retirees in 2024 - Relocate&Saverelocateandsave. The calculator will calculate tax on your taxable income only. 2 - See Ofício-circulado n. Bonus included in salary. Go to the profile page for that stock on MarketBeat.Step 4: Calculate dividend tax rates. To use the tax calculator, enter your annual salary (or the one you would like) in the salary box above.The formulas to calculate the contributions and the tax deductions have been added to the calculator.Effective April 19, 2021, changes have been made to the GST/HST New Housing Rebate rules for multiple buyers, such as in situations where an unrelated purchaser was added to the agreement of purchase and sale. This guide explains Portugal’s non habitual resident (NHR) tax program. A special tax rate of 20% applicable to employment and self-employment income derived from a “high value-added activities”.º 20243/2022, of 30/06 – Tax Regime for former residents for years 2021, 2022 and 2023 (Article 12-A of the IRS Code) and transitional rules for year 2021.Balises :Income TaxesPortugal Income TaxPortugal Nhr Tax AdviceTax Law To use the dividend tax calculator: Enter the amount of your qualified and nonqualified dividends.Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2024.00 to € 1,000,000. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. If you don’t yet own the stock, you can estimate the amount of the dividend you’ll receive.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Non-habitual resident (NHR)

That makes it possible to earn foreign income and not pay taxes on it .However, recent developments bring news of changes to this renowned tax regime.Balises :Portugal Income TaxIncome Tax CalculatorPortugal Salary Calculator

Qualifying for the status

NHRs are taxed at a flat rate of 20% on their income and are exempt from paying taxes on global income.

In order to properly understand if the advantages of the NHR regime are appropriate for your concrete case, one has to take into account not only Portuguese tax law, but also . Does not include self-employment tax for the self-employed. Please provide a rating, it takes seconds and helps us to keep this resource free for all to use ★★★★★ [ 647 Votes ]Estimate your US federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using IRS formulas. With the government’s collapse in December 2023, hopes for a reversal emerged, but ultimately, parliamentarians voted to .5% to 48% for 2021.The Portugal Tax Calculator and salary calculators within our Portugal tax section are based on the latest tax rates published by the Tax Administration in Portugal.Taille du fichier : 1MB

Non-Habitual Residents (NHR) Tax regime and Annex L of the IRS

These amendments will generally apply to a supply made under an agreement of purchase and sale entered into after April 19, 2021.Benefits of the special tax regime for Non-Habitual Residents (NHR) in Portugal.Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. NOTE: This calculator is designed for illustrative purposes only. Thanks for preparing such easy tool to Salary Tax payers.45% (depending on the municipality and the type of real estate). If you earned an extra $1,000, you will have to pay an additional 31.

2023 and 2024 Income Tax Calculator Canada

Marc Martin - Portugal.

NHR Tax in Portugal

In this case, the ten percent .Use Bankrate’s free calculator to estimate your average tax rate for 2022-2023, your 2022-2023 tax bracket, and your marginal tax rate for the 2022-2023 tax yearA citizen aged 18 years or over, who meets the following conditions, may apply to be registered as a Non Habitual Resident: • Who is considered, for tax purposes, resident in Portuguese territory in accordance with any of the following criteria1: a) He or she has remained there for more than 183 days, consecutive or interpolated, in any .

Calculate my taxes .

Main page

(Select the quick link in the image to show where is the calculator) (No access to UAT/SIT currently, will have to add it later) You will be taken to the Income and Tax Calculator page.