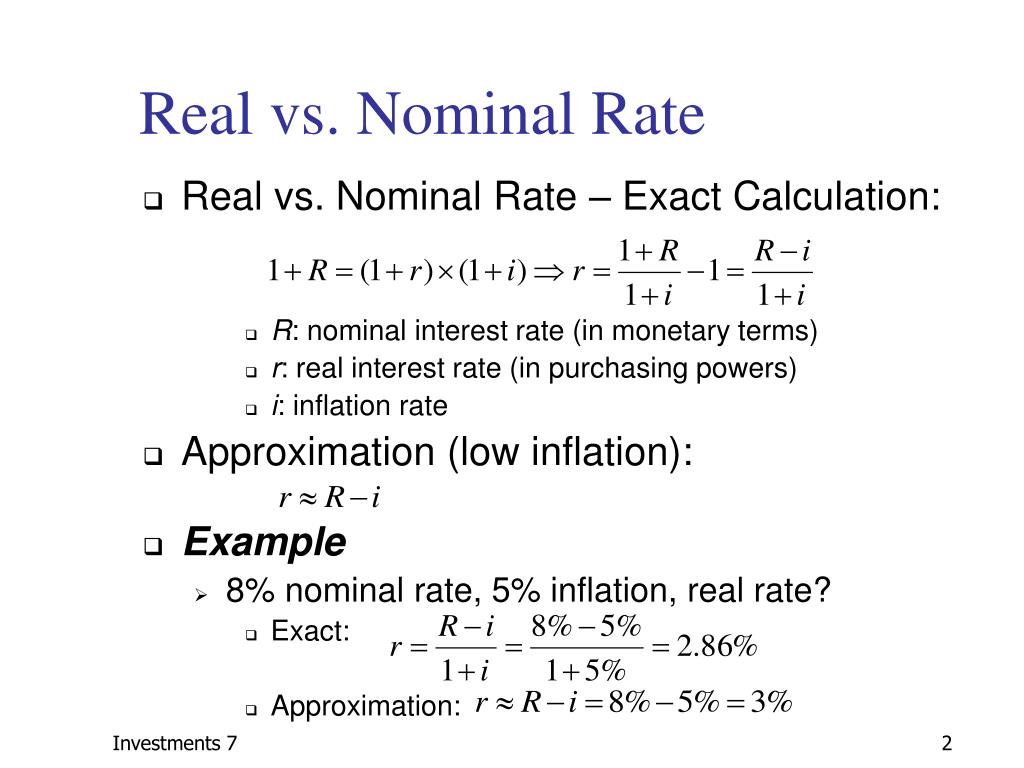

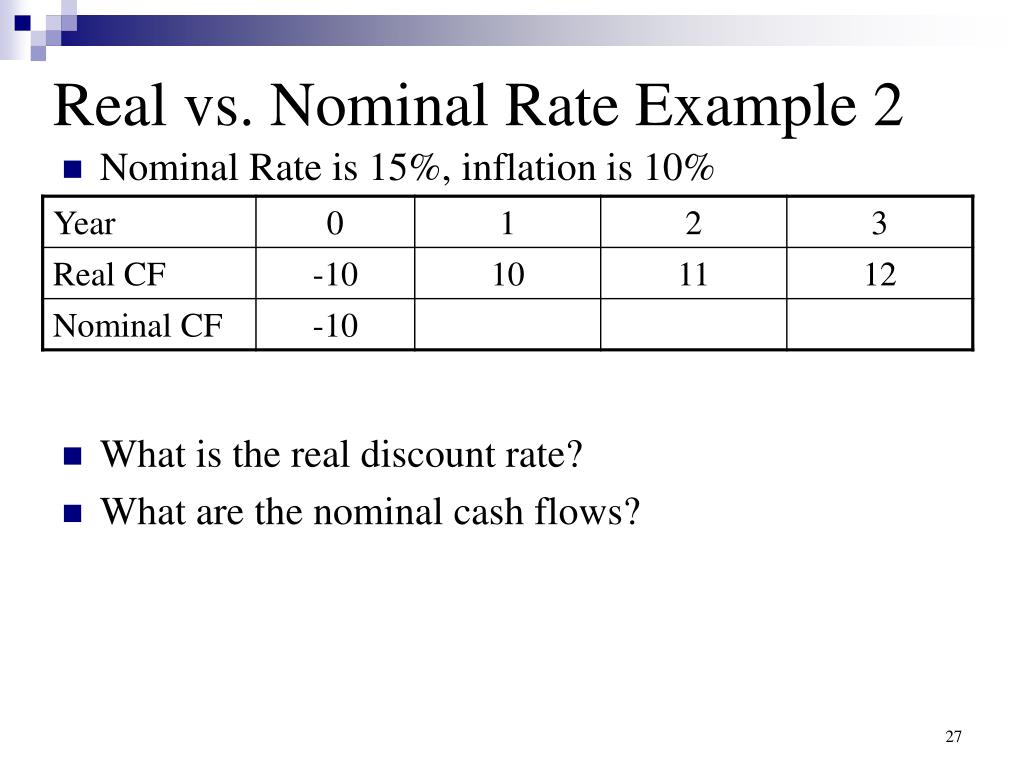

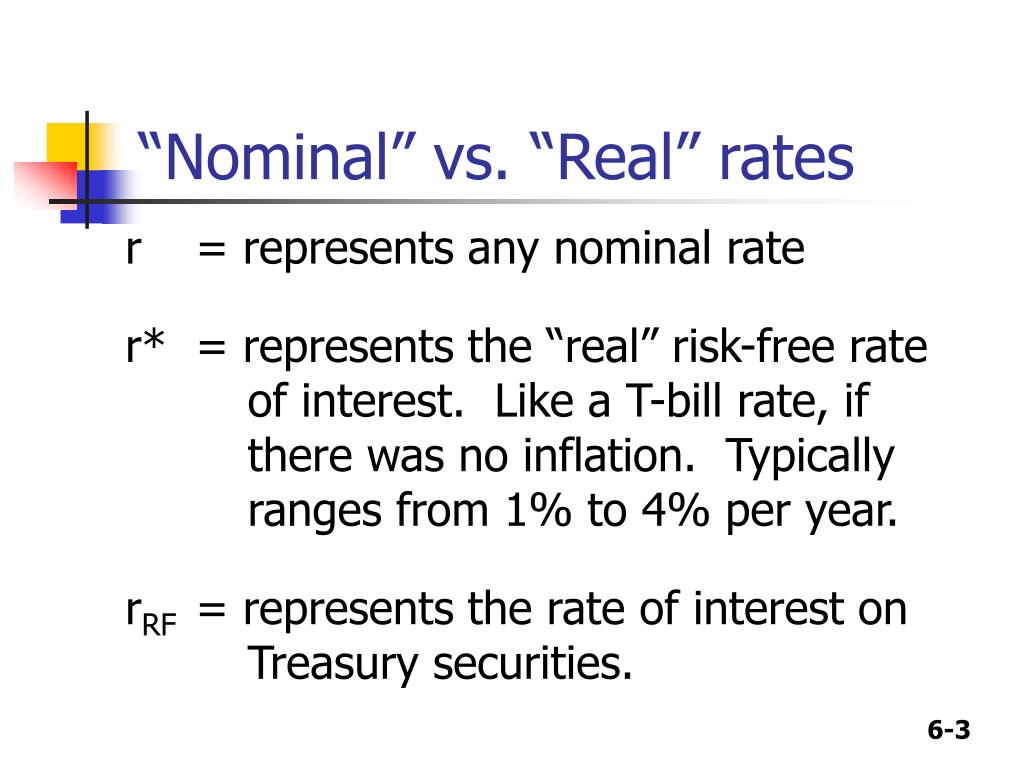

Nominal rate vs real rate

In this case, real interest rates are actually higher than nominal interest rates.75 * 180)/ 80 = 1.

Even if a nominal rate sounds good, it’s still subject to inflation which can eat up the profits of investing based on the rate of inflation. The nominal rate is the advertised rate — for example, a savings account with a 2% yield has a nominal interest rate of 2%.名义利率(Nominal Interest Rate):是央行所公布的未调整通货膨胀因素的利率,即利息(报酬)的货币额与本金的货币额的比率。---货币量 ---货币量 例如,小明同学在银行存入100元的一年期存款,一年到期时获得5元利息,利率则为 \frac{5}{100}\ =5%,这个利率就是 . It is the amount of interest a person would pay in a year for borrowing funds .Nominal interest rate = Real interest rate + Inflation expectations.The nominal rate is the interest you see advertised, not taking inflation into account.

Real interest rate = nominal interest rate - rate of inflation (expected or actual)., credit scores and credit reports exist to provide information about each borrower so that lenders can assess risk. And so we get our calculator out.有效利率 vs 名目利率? 名目利率(Nominal Interest Rate):單利計算的利率,通常期間為一年。 有效利率(Effective Rate):考慮利息可能一年多次,名目利率經過幾次複利後,所得到的年化報酬率,才是真實的報酬率。 名目利率是指一年計息一次的年利率,以單利計算,一般的金融機構都是標示名目利率。 How does it work in practice? Here’s an example. Real Exchange Rate.

Adjusting nominal values to real values (article)

When the inflation rate is changing rapidly, . Putting the values in the formula for real exchange rate: Real exchange rate = (0. If inflation is 3% and the nominal rate on an investment is 5%, the real rate would be: 5% - 3% = 2%.

Real vs Nominal Exchange Rate

In economics, we distinguish between two types of interest rates: the nominal interest rate and the .Depending on the rate of inflation, the real interest rate can be significantly different from the nominal interest rate.

Nominal vs Real Interest Rate

Real vs nominal explained

Once you find out the nominal return vs real return, it can be disheartening to realize your investment may not have as much profit potential as you thought. The real rate accounts for inflation and is usually lower than the nominal rate. Real interest rates describe the growth in the real value of the interest on a loan or deposit, adjusted for .

Nominal interest, real interest, and inflation calculations

The real rate is what your interest looks like after considering how inflation affects your .The real interest rate is the nominal interest rate – inflation rate.

For instance, imagine that you borrowed $100 from your bank one year ago at 8% interest on your loan. A real interest rate equals the observed market interest rate .The formula connecting nominal and real interest rates is simple: nominal rate = real interest rate + inflation rate.The nominal interest rate is stable over time and adjusted only at the end of the loan, while the real interest rate, due to its flexibility, changes by market inflation. Say the initial interest rate on a bond was 9. In contrast, in the 1990s, although nominal interest rates were relatively low, inflation was even lower, and real interest rates were positive much of the time. For example, if somebody lends $1,000 for a year at 10%, and receives $1,100 back at the end of the . The real value refers to the same statistic after it has been adjusted for . An increase in real GDP indicates economic growth in a country.The real rate can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate: , where = nominal interest rate; = real interest rate; = expected inflation rate. So, if the rate of inflation is -2% (2% deflation), a bank that loans money out for a 3% rate of . For example, if the Bank of England set base rates of 0.

The core equation is RER = eP*/P, where, in our example, e is the nominal dollar/euro exchange rate, P* is the average price of a good in the euro area, and P .From those two assumptions, we’ll enter them into the formula to calculate the nominal risk-free rate: Nominal rf Rate = (1 + 5. Next, we’ll calculate the real risk-free rate using the same assumptions to confirm our calculation is correct.If an investor made a fixed deposit of $10,000 with an annual interest rate of 3% but the rate of inflation for that year is 3%, the calculation of the real interest rate would be like this.Real Rate Of Return: A real rate of return is the annual percentage return realized on an investment, which is adjusted for changes in prices due to inflation or other external effects. nominal interest rate of a $10,000 loan where you have to pay 5% back every year is 5% which is $500 interest per month) Real rate is adjusted for inflation.Explication du taux d'intérêt nominal : . One example of a nominal interest rate is an interest rate quoted at a bank on any given day.

Nominal Interest Rate

If inflation is 2% then the real interest rate of that loan from above is 3%.Real GDP = ($100 billion / 125) x 100 = $80 billion.Monthly real vs. Interest rates help us evaluate and compare different investments or loans over time. In economics, nominal .75% and the CPI inflation rate is 1. is what is said to be the interest rate. This chart displays the nominal interest rate of a 1-year US Treasury . The commercial bank liability curve starts in November 1990 and is estimated to a maturity of 10 years. Real vs Nominal Exchange Rate – Differences.Updated on May 7, 2023. Understanding interest rates are important as they will help evaluate and compare different investments and loans over time. Nominal GDP is calculated by using current-year prices, while real GDP is calculated by using base-year prices. Here, the nominal risk-free rate comes out to 8.

Getting Real about Interest Rates

Recommandé pour vous en fonction de ce qui est populaire • Avis

What is the difference between nominal and real interest rates?

Nominal interest rates can never be of a negative value, while real interest rates can become a negative value if inflation occurs in the market, which makes the prices go . The 2% real rate reflects the actual return after factoring for the devaluing effect of inflation.Regarder la vidéo3:34While the nominal interest rate is the agreed upon percentage that someone will pay back on a loan, the real interest rate accounts for inflation and gives a more accurate representation of the actual value of the loan over time. This means that for the same amount of money, you can spend almost twice as many nights in Europe as in the .The real interest rate is calculated as the difference between the nominal interest rate and the inflation rate. Nominal Rate of Return.apprendre-gestion.A nominal interest rate is one that does not adjust for inflation, while a real interest rate is one that has been adjusted for inflation. Tel est donc le taux d’intérêt réel, que l’on calcule en déduisant le taux d’inflation (3 %) du taux d’intérêt . This tells the true investment return.Nominal rates are the stated rate of something (e.

Real Interest Rate: Definition, Formula, and Example

= real interest rate. Nominal Interest Rate vs.This video provides a brief explanation of Nominal and Real rates of Interest, and the strengths and weaknesses of each. Say the initial interest rate .Don’t Forget Inflation! The nominal interest rate (or money interest rate) is the percentage increase in money you pay the lender for the use of the money you borrowed. A saver who deposits €1,000 in an account for one .Real Interest Rate = Nominal Interest Rate - Inflation Rate.#interestrates #macroeconomics #ThinkEconIn this video we look at the real vs nominal interest rates.

To understand the logic behind the real interest rate, let's consider a case when you took a loan with a 6% interest rate (i = 6%), and you expect the price level to rise by 2% over the course of the year (πe = 2%).Real Rate of Return vs.The nominal value of any economic statistic is measured in terms of actual prices that exist at the time.

Real Rate of Return: Definition, How It's Used, and Example

The real interest rate is .

Risk Free Rate (rf)

If a bank advertises an annual interest rate of 2.Table of Contents. Real interest is nominal interest after .

Real Interest Rate.Based on the nominal exchange rate from the example above, we know that the nominal exchange rate is EUR 0.This is how it is calculated: Real interest rate = nominal interest rate - inflation. Actual or anticipated rate of inflation = 3%.To find the nominal interest rate, add the inflation to the real interest rate: 6% + 2% = 8% nominal interest rate Example 3: A time deposit at the bank offers a 4% nominal interest rate, while . The nominal interest rate in finance and economics represents the interest rate without accounting for inflation, compounding effects, .And maybe I'll do it the previous way in the next video. This is because the inflation has reduced the value of .Real and nominal interest rates.As a result, at the end of the year, you expect to pay back 4% in real terms – that is, in terms of real goods and services that money is . We consider the formula for the real interest rate, as .Since implied inflation rates are calculated as the difference of the nominal and real curves, an absence of either real or nominal interest rate data at a given maturity implies an absence of corresponding implied inflation rate data at that maturity. But the real return is we made $8 over the course of the year in today's money. While both are measures of the cost of borrowing or the return on investment, they differ in their underlying factors and implications. nominal interest rate.Dans ce cas, le rendement réel de cette épargne est en fait négatif : -0,5 %. And what we originally invested in today's money was $102. Written by Mark Henricks. Prudent financial decision-making often involves .59% on a car loan, this is the nominal interest rate. Nominal Exchange Rate.